HOUSE_OVERSIGHT_024432 - HOUSE_OVERSIGHT_024591

Document HOUSE_OVERSIGHT_024432 is a Private Placement Memorandum from September 27, 2006, concerning Knowledge Universe Education L.P. (KUE).

This document outlines a confidential offering of investment units in Knowledge Universe Education L.P. (KUE), seeking to raise $1,000,000,000. The offering, managed by Goldman, Sachs & Co. and Credit Suisse, aims to expand KUE's operations through strategic acquisitions and to repay existing debt. KUE is the indirect controlling stockholder of Knowledge Learning Corporation (KLC), a large for-profit early childhood care and education company.

Key Highlights

- •Confidential private placement offering of $1,000,000,000 in investment units of Knowledge Universe Education L.P. (KUE)

- •Knowledge Universe Education L.P. (KUE) is the indirect controlling stockholder of Knowledge Learning Corporation (KLC)

- •Goldman, Sachs & Co. and Credit Suisse are acting as placement agents for the offering

Frequently Asked Questions

Document Information

Bates Range

HOUSE_OVERSIGHT_024432 - HOUSE_OVERSIGHT_024591

Pages

160

Source

House Oversight Committee

Date

March 1, 2013

Original Filename

img-301175525-0001.pdf

File Size

16.05 MB

Document Content

Page 1 - HOUSE_OVERSIGHT_024432

No. Copy: Recipient: Private Placement Memorandum Dated September 27, 2006 CONFIDENTIAL $1,000,000,000 KNOWLEDGE UNIVERSE EDUCATION L.P. KUE Management Inc. Investment Units consisting of Common Limited Partner Units of Knowledge Universe Education LP and Class A Ordinary Shares of KUE Management Inc. Knowledge Universe Education L.P. (“KUE," and, together with its subsidiaries, the “Company’) is a Cayman Islands exempted limited partnership. KUE Management Inc. is a Cayman Islands exempted company and the sole general partner of KUE (the “General Partner"). KUE is the indirect controlling stockholder of Knowledge Learning Corporation ("KLC"), the largest for-profit early childhood care and education company in the U.S., which operates approximately 2,500 locations in 39 states. We are offering investment units (the “Units’}, each comprised of one Cammon limited partner unit (“Common LP Unit’) in KUE and one Class A ordinary share of the General Partner (“Class A Share’), for $1,000 per Unit. We are offering the Units on a strictly confidential basis pursuant to a private placement with Goldman, Sachs & Co. and Credit Suisse acting as placement agents (the “Agents"), subject to various conditions, exclusively to accredited investors. We intend to use the net proceeds from the sale of the Units to expand operations, including through strategic acquisitions in the U.S. and internationally, to develop new products and services, to repay certain existing indebtedness and for other corporate purposes. We reserve the right to withdraw, cancel or modify the offer and to reject orders in whole or in part. The offering is expected to be completed in one or more closings on or prior to March 31, 2007. The Units and the underlying Common LP Units and Class A Shares have not been, nor will they be, registered under the U.S. Securities Act of 1933, as amended (the “Securities Act”), or qualified under any applicable U.S. state statutes or laws of any non-U.S. jurisdiction. The Units will be offered and sold under the exemption from registration provided by Section 4(2} of the Securities Act and Regulation D and Regulation S promulgated under the Securities Act, and other similar exemptions available pursuant to the laws of the states and other jurisdictions where the offering will be made. There is no public market for the Units and no such market is expected to develop in the future. There is no obligation on the part of any person to register the Units or the underlying Common LP Units or Class A Shares under the Securities Act or any state or nen-U.S. securities laws other than in the limited circumstances described in this Private Placement Memorandum. Investing in the Units involves risks. You should read the section entitled “Risk Factors” beginning on page 44 for a discussion of certain risk factors that you should consider before investing in the Units. Placement Agents Goldman, Sachs & Co. Credit Suisse Private Placement Memorandum dated September 27, 2006. HOUSE_OVERSIGHT_024432

Page 2 - HOUSE_OVERSIGHT_024433

Table of Contents 1. EXECUTIVE SUMMARY 19 2. SUMMARY TERMS OF THE TRANSACTION 27 3. USE OF PROCEEDS 39 4. CAPITALIZATION 40 5. SUMMARY FINANCIAL DATA ~ 42 6. RISK FACTORS 44 7. DISTRIBUTION POLICY 60 8. INDUSTRY OVERVIEW 61 9. KNOWLEDGE UNIVERSE EDUCATION (“KUE”) 73 10. MANAGEMENT’S DISCUSSION AND ANALYSIS OF KLC’s PRO FORMA RESULTS OF OPERATIONS 75 11. THE OPERATING COMPANY (“KLC OPCO”) 82 12. THE REAL ESTATE COMPANY (“KLC PROPCO”) 100 13. k12 INC. (“k12”) 106 14. THE STRUCTURE OF KUE AND THE GENERAL PARTNER 115 15. MANAGEMENT INCENTIVE PLANS AND EMPLOYMENT AGREEMENTS 131 16. RELATED PARTY TRANSACTIONS 133 17. ELIGIBLE INVESTORS 136 18. CERTAIN INCOME TAX CONSEQUENCES 140 19. APPENDICES 146 HOUSE_OVERSIGHT_024433

Page 3 - HOUSE_OVERSIGHT_024434

You should rely only on the information contained in this Private Placement Memorandum (this “Memorandum”) or to which we have referred you. We have not authorized anyone to provide you with information that is different. This Memorandum may only be used where it is legal to sell the Units. The information in this Memorandum may only be accurate on the date of this Memorandum. No person has any obligation to update the statements and information contained in this Memorandum. NOTICE TO INVESTORS THIS CONFIDENTIAL MEMORANDUM iS BEING FURNISHED ON A STRICTLY CONFIDENTIAL BASIS SOLELY TO A LIMITED NUMBER OF SOPHISTICATED PROSPECTIVE INVESTORS FOR THE PURPOSE OF PROVIDING CERTAIN INFORMATION REGARDING THE OFFERING OF THE UNITS. A PROSPECTIVE INVESTOR MAY NOT DISTRIBUTE OR REPRODUCE THIS MEMORANDUM, OR DISCLOSE ITS CONTENTS, TO ANY PERSON OTHER THAN PROFESSIONAL REPRESENTATIVES OF THE INVESTOR IN CONNECTION WITH ITS CONSIDERATION OF THIS INVESTMENT, AS CONTEMPLATED BY THE CONFIDENTIALITY AGREEMENTS BETWEEN THE INVESTORS AND KUE, THIS MEMORANDUM AND ANY INFORMATION FURNISHED IN CONNECTION HEREWITH (COLLECTIVELY, THE “COMPANY INFORMATION"), YOU ACKNOWLEDGE AND AGREE THAT (1) ALL COMPANY INFORMATION IS CONFIDENTIAL; (If) YOU WILL NOT DISTRIBUTE OR REPRODUCE THE COMPANY INFORMATION IN WHOLE OR IN PART AND WILL USE THE COMPANY INFORMATION SOLELY TO EVALUATE AN INVESTMENT IN THE UNITS AND NOT FOR ANY OTHER PURPOSE; (Ill) IN THE EVENT THAT YOU HAVE NO FURTHER INTEREST IN PARTICIPATING IN THIS OFFERING, OR IF AT ANY TIME THE COMPANY SO REQUESTS (AT ITS DISCRETION), YOU WILL PROMPTLY RETURN, DESTROY OR DELETE ALL COMPANY INFORMATION THAT YOU HAVE RECEIVED AT THE EARLIEST OPPORTUNITY AS REQUESTED BY THE COMPANY; AND (IV) YOU WILL NOT DISCLOSE TO ANY THIRD PARTY THE COMPANY INFORMATION THAT HAS BEEN PROVIDED TO YOU. EACH PROSPECTIVE INVESTOR IS RESPONSIBLE FOR THE FEES OF ITS OWN COUNSEL, ACCOUNTANTS AND OTHER ADVISORS. THE UNITS OFFERED HEREBY AND THE COMMON LP UNITS AND CLASS A SHARES REPRESENTED THEREBY ARE SUBJECT TO RESTRICTIONS ON TRANSFERABILITY AND RESALE AND MAY NOT BE TRANSFERRED OR RESOLD EXCEPT AS PERMITTED UNDER THE SECURITIES ACT AND THE APPLICABLE STATE AND NON-US. SECURITIES LAWS PURSUANT TO REGISTRATION OR AN EXEMPTION THEREFROM, AND THEN ONLY TO THE EXTENT PERMITTED BY THE LIMITED PARTNERSHIP AGREEMENT OF KUE AND THE GOVERNING DOCUMENTS AND AGREEMENT AMONG MEMBERS OF THE GENERAL PARTNER. ACCORDINGLY, INVESTORS SHOULD BE AWARE THAT THEY WILL BE REQUIRED TO BEAR THE FINANCIAL RISKS OF AN INVESTMENT IN THE UNITS OFFERED HEREBY FOR AN INDEFINITE PERIOD OF TIME. THE STATEMENTS AND INFORMATION CONTAINED IN THIS MEMORANDUM HAVE BEEN COMPILED AS OF THE DATE HEREOF (UNLESS OTHERWISE STATED HEREIN) FROM THE COMPANY AND FROM OTHER SOURCES. NEITHER THE DELIVERY OF THIS MEMORANDUM NOR ANY SALE MADE HEREUNDER SHALL UNDER ANY CIRCUMSTANCES IMPLY THAT THERE HAS BEEN NO CHANGE IN THE AFFAIRS OF THE COMPANY OR THAT THE INFORMATION SET FORTH HEREIN IS CORRECT AS OF ANY TIME SUBSEQUENT TO THE DATE HEREOF. NO PERSON HAS ANY OBLIGATION TO UPDATE THE STATEMENTS AND INFORMATION CONTAINED HEREIN, IN MAKING AN INVESTMENT DECISION, INVESTORS MUST RELY ON THEIR OWN EXAMINATION OF THE COMPANY, THE GENERAL PARTNER AND THE TERMS OF THE OFFERING, INCLUDING THE MERITS AND RISKS INVOLVED. YOU ACKNOWLEDGE THAT (A) YOU HAVE NOT RELIED ON THE AGENTS OR ANY PERSON AFFILIATED WITH THE AGENTS IN CONNECTION WITH YOUR INVESTIGATION OF THE ACCURACY OF THE INFORMATION PROVIDED HEREIN OR YOUR INVESTMENT DECISION AND (B) NO PERSON HAS BEEN AUTHORIZED TO GIVE ANY INFORMATION OR TO MAKE ANY REPRESENTATION CONCERNING THE COMPANY, THE GENERAL PARTNER OR THE OFFERING OTHER THAN AS CONTAINED IN THIS MEMORANDUM AND INFORMATION GIVEN BY DULY AUTHORIZED OFFICERS AND EMPLOYEES OF THE COMPANY IN CONNECTION WITH HOUSE_OVERSIGHT_024434

Sponsored

Page 4 - HOUSE_OVERSIGHT_024435

YOUR EXAMINATION OF THE COMPANY, THE GENERAL PARTNER AND THE TERMS OF THIS OFFERING, AND, IF GIVEN OR MADE, SUCH OTHER INFORMATION OR REPRESENTATIONS SHOULD NOT BE RELIED UPON AS HAVING BEEN AUTHORIZED BY THE COMPANY, THE GENERAL PARTNER OR THE AGENTS. THIS MEMORANDUM DOES NOT CONSTITUTE AN OFFER BY ANY PERSON TO SELL, OR A SOLICITATION OF AN OFFER TO BUY, ANY UNITS OR COMPONENTS THEREOF IN ANY JURISDICTION IN WHICH IT IS UNLAWFUL FOR SUCH PERSON TO MAKE SUCH AN OFFER OR SOLICITATION. THE UNITS AND COMPONENT SECURITIES OFFERED HEREBY HAVE NOT BEEN REGISTERED UNDER THE SECURITIES ACT OR THE SECURITIES LAWS OF THE STATES OR ANY NON-US. JURISDICTION AND ARE BEING OFFERED AND SOLD IN RELIANCE ON EXEMPTIONS FROM THE REGISTRATION REQUIREMENTS OF THE SECURITIES ACT AND SUCH STATE AND NON-US. LAWS. THE UNITS HAVE NOT BEEN RECOMMENDED, APPROVED OR DISAPPROVED BY THE U.S. SECURITIES AND EXCHANGE COMMISSION OR ANY OTHER FEDERAL, STATE OR NON-U.S. SECURITIES COMMISSION OR REGULATORY AUTHORITY, NOR HAVE ANY OF THE FOREGOING AUTHORITIES PASSED UPON OR ENDORSED THE MERITS OF THIS OFFERING OR THE ACCURACY OR ADEQUACY OF THIS MEMORANDUM. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE. NEITHER THE GENERAL PARTNER NOR THE COMPANY IS REQUIRED TO REGISTER OR BE REGULATED AS A MUTUAL FUND UNDER THE MUTUAL FUNDS LAW (2003 REVISION) OF THE CAYMAN ISLANDS. NEITHER THE CAYMAN ISLANDS MONETARY AUTHORITY NOR ANY OTHER GOVERNMENTAL AUTHORITY IN THE CAYMAN ISLANDS HAS PASSED JUDGMENT UPON OR APPROVED THE TERMS OR MERITS OF THIS DOCUMENT. THERE IS NO INVESTMENT COMPENSATION SCHEME AVAILABLE TO INVESTORS IN THE CAYMAN ISLANDS. PROSPECTIVE INVESTORS SHOULD READ THIS ENTIRE MEMORANDUM CAREFULLY BEFORE DECIDING WHETHER TO PURCHASE THE UNITS, AND PROSPECTIVE INVESTORS SHOULD MAKE THEIR OWN INVESTIGATION OF THE INVESTMENT DESCRIBED HEREIN, INCLUDING THE MERITS AND RISKS INVOLVED AND THE LEGALITY AND TAX CONSEQUENCES OF SUCH AN INVESTMENT. PROSPECTIVE INVESTORS ARE NOT TO CONSTRUE THIS MEMORANDUM OR ITS CONTENTS AS LEGAL, TAX, INVESTMENT OR OTHER ADVICE. PROSPECTIVE INVESTORS WILL HAVE THE OPPORTUNITY TO ASK QUESTIONS AND RECEIVE ANSWERS AND ADDITIONAL INFORMATION ABOUT THE COMPANY, THE GENERAL PARTNER AND THE UNITS TO VERIFY THE INFORMATION CONTAINED HEREIN TO THE EXTENT REPRESENTATIVES OF THE COMPANY POSSESS SUCH INFORMATION. EACH INVESTOR SHOULD MAKE ITS OWN INQUIRIES AND CONSULT ITS OWN ADVISORS CONCERNING THE VARIOUS LEGAL, TAX AND ECONOMIC CONSIDERATIONS RELATING TO ITS INVESTMENT. THIS MEMORANDUM DOES NOT CONTAIN THE INFORMATION, INCLUDING FINANCIAL STATEMENTS, THAT WOULD BE INCLUDED IN A REGISTRATION STATEMENT FILED WITH THE U.S. SECURITIES AND EXCHANGE COMMISSION. THIS MEMORANDUM CONTAINS PROJECTIONS FOR KLC AND A?2 INC. THAT ARE BASED UPON A NUMBER OF ASSUMPTIONS AND ESTIMATES THAT, WHILE PRESENTED WITH NUMERICAL SPECIFICITY AND CONSIDERED REASONABLE BY MANAGEMENT WHEN TAKEN AS A WHOLE, INHERENTLY ARE SUBJECT TO SIGNIFICANT BUSINESS, ECONOMIC, COMPETITIVE AND OTHER RISKS, UNCERTAINTIES AND CONTINGENCIES, MANY OF WHICH ARE BEYOND THE CONTROL OF THE COMPANY, AND ARE BASED UPON SPECIFIC ASSUMPTIONS WITH RESPECT TO FUTURE BUSINESS DECISIONS, SOME OR ALL OF WHICH WILL CHANGE. PROJECTIONS ARE NECESSARILY SPECULATIVE IN NATURE AND IT CAN BE EXPECTED THAT ASSUMPTIONS UNDERLYING THE PROJECTIONS WILL NOT PROVE TO BE VALID OR WILL VARY FROM ACTUAL RESULTS. ACCORDINGLY, THE PROJECTIONS ARE ONLY AN ESTIMATE. ACTUAL RESULTS WILL VARY FROM THE PROJECTIONS AND THE VARIATIONS MAY BE MATERIAL. CONSEQUENTLY, YOUR RECEIPT OF THE PROJECTIONS SHOULD NOT BE REGARDED AS A REPRESENTATION BY HOUSE_OVERSIGHT_024435

Page 5 - HOUSE_OVERSIGHT_024436

THE COMPANY, ITS ADVISORS, THE AGENTS, OR ANY OTHER PERSON OF RESULTS THAT WILL ACTUALLY BE ACHIEVED. PROSPECTIVE PURCHASERS OF THE UNITS ARE CAUTIONED NOT TO PLACE UNDUE RELIANCE ON THESE PROJECTIONS. THE INFORMATION PRESENTED HEREIN WAS PREPARED OR OBTAINED BY KUE AND IS BEING FURNISHED SOLELY FOR USE BY PROSPECTIVE INVESTORS IN CONNECTION WITH THE OFFERING. THE AGENTS HAVE NOT ASSUMED ANY RESPONSIBILITY FOR INDEPENDENT VERIFICATION OF THE INFORMATION CONTAINED HEREIN OR OTHERWISE MADE AVAILABLE IN CONNECTION WITH THE OFFERING OF SECURITIES AND MAKE NOC REPRESENTATIONS OR WARRANTIES AS TO THE ACCURACY OR COMPLETENESS OF SUCH INFORMATION. NOTHING CONTAINED HEREIN IS, OR SHOULD BE RELIED ON AS, APROMISE OR REPRESENTATION AS TO THE FUTURE PERFORMANCE OF KUE. NOTICE TO NON-U.S. INVESTORS NOTICE TO RESIDENTS OF ARGENTINA THIS MEMORANDUM HAS NOT BEEN APPROVED BY ANY SECURITIES REGULATOR IN ARGENTINA AND DOES NOT ENABLE KUE, THE GENERAL PARTNER, OR ANY OTHER PARTY TO MAKE A PUBLIC OFFERING OF THE UNITS. THIS MEMORANDUM HAS ONLY BEEN ADDRESSED DIRECTLY TO THE PROSPECTIVE INVESTORS DESIGNATED AND IS INTENDED TO PROVIDE INFORMATION AT THEIR REQUEST. THIS MEMORANDUM SHOULD NOT BE CIRCULATED OR MADE PUBLIC IN ANY WAY. INVESTORS PARTICIPATING IN THIS ISSUANCE FULLY ACKNOWLEDGE THAT THEY HAVE BEEN INVITED PERSONALLY AND IN CONSIDERATION OF THEIR SPECIAL POSITION AS SOPHISTICATED INVESTORS AND THAT THEY HAVE HAD ALL PROPER AND DUE PERSONAL COUNSELING TO ADOPT ANY DECISION RELATED TO THIS ISSUANCE. THE UNITS ARE NOT AUTHORIZED TO BE OFFERED PUBLICLY IN THE ARGENTINEAN MARKET OR TO BE SOLD TO ANY INVESTOR IN ARGENTINA. NOTICE TO RESIDENTS OF AUSTRALIA THIS MEMORANDUM HAS NOT BEEN AND WILL NOT BE LODGED WITH THE AUSTRALIAN SECURITIES AND INVESTMENTS COMMISSION. THE OFFER [IS ONLY MADE TO THOSE PERSONS TO WHOM DISCLOSURE IS NOT REQUIRED UNDER DIVISION 2 OF PART 6D.2 OR PART 7.9 OF THE CORPORATIONS ACT 2001 AND DOES NOT PURPORT TO BE AN OFFER OF INTERESTS FOR WHICH DISCLOSURE IS REQUIRED. IN ADDITION, KUE IS NOT A REGISTERED SCHEME AS DEFINED IN THE CORPORATIONS ACT 2001. RESALE OF THE UNITS IN AUSTRALIA WITHIN 12 MONTHS OF THE DATE OF ISSUE MAY REQUIRE THE SELLER TO COMPLY WITH THE DISCLOSURE REQUIREMENTS OF DIVISION 2 OF PART 6D.2 OR PART 7.9 OF THE CORPORATIONS ACT 2001. NOTICE TO RESIDENTS OF BRAZIL KUE IS NOT A PUBLICLY-HELD CORPORATION AND IS NOT LISTED WITH ANY STOCK EXCHANGE, ORGANIZED OVER THE COUNTER MARKET OR ELECTRONIC SYSTEM OF SECURITIES TRADING. LIKEWISE, THE UNITS HAVE NOT BEEN AND WILL NOT BE REGISTERED WITH ANY SECURITIES EXCHANGE COMMISSION OR OTHER SIMILAR AUTHORITY, INCLUDING THE BRAZILIAN SECURITIES AND EXCHANGE COMMISSION (COMISSAO DE VALORES MOBILARIOS-"CVM"). ANY PUBLIC OFFERING, AS DEFINED UNDER BRAZILIAN LAWS AND REGULATIONS, OF THE UNITS IN BRAZIL IS NOT LEGAL WITHOUT SUCH PRIOR REGISTRATION UNDER LAW NR. 6.385/76. SUBSEQUENT TRADING OF THE UNITS IN BRAZIL IS ALLOWED ONLY BY MEANS OF PRIVATE TRANSACTIONS AND IS NOT SUBJECT TO REGISTRATION WITH THE CVM TO THE EXTENT THAT SUCH TRADING DOES NOT QUALIFY AS A PUBLIC OFFERING, IT SHOULD BE NOTED THAT A SELLER OF THE UNITS, HOWEVER, MAY BE ASKED BY THE PURCHASER TO COMPLY WITH PROCEDURAL REQUIREMENTS TO EVIDENCE PREVIOUS TITLE TO THE UNITS, AND MAY BE SUBJECT TO BRAZILIAN TAX ON CAPITAL GAINS WHICH MAY BE WITHHELD FROM THE SALE PRICE. PERSONS WISHING TO OFFER OR ACQUIRE THE UNITS HOUSE_OVERSIGHT_024436

Page 6 - HOUSE_OVERSIGHT_024437

WITHIN BRAZIL SHOULD CONSULT WITH THEIR OWN COUNSEL AS TO THE APPLICABILITY OF THESE REGISTRATION REQUIREMENTS OR ANY EXEMPTION THEREFROM, THIS MEMORANDUM IS CONFIDENTIAL AND INTENDED SOLELY FOR THE USE OF THE ADDRESSEE AND CANNOT BE DELIVERED OR DISCLOSED IN ANY MANNER WHATSOEVER TO ANY PERSON OR ENTITY OTHER THAN THE ADDRESSEE. NOTICE TO RESIDENTS OF CANADA THIS MEMORANDUM CONSTITUTES AN OFFERING OF THE UNITS DESCRIBED HEREIN ONLY IN THOSE JURISDICTIONS IN CANADA AND TO THOSE PERSONS WHERE AND TO WHOM THEY MAY BE LAWFULLY OFFERED FOR SALE AND THEREIN ONLY BY PERSONS PERMITTED TO SELL SUCH SECURITIES. THIS MEMORANDUM IS NOT, AND UNDER NO CIRCUMSTANCES IS TO BE CONSTRUED AS, AN ADVERTISEMENT OR A PUBLIC OFFERING OF THE UNITS IN CANADA. NO SECURITIES COMMISSION OR SIMILAR REGULATORY AUTHORITY IN CANADA HAS REVIEWED OR IN ANY WAY PASSED UPON THIS MEMORANDUM OR THE MERIT OF THE UNITS AND ANY REPRESENTATION TO THE CONTRARY IS AN OFFENCE UNDER APPLICABLE SECURITIES LAWS, No dealer, salespersons or other individual has been authorized to give any information or to make any representations not contained in this Memorandum in connection with the offer made by this Memorandum and, if given or made, such information or representations must not be relied upon as having been authorized by KUE or by the Generai Partner or by any placement agent. Neither fhe delivery of this Memorandum nor any sale made hereunder shall, under any circumstances, create an implication that there has not been any change in the facts as set forth in this Memorandum or in the affairs of KUE or the General Partner since the date hereof. Resale Restrictions in Canada. THE DISTRIBUTION OF THE UNITS IN CANADA IS BEING MADE ON A PRIVATE PLACEMENT BASIS. ACCORDINGLY, ANY RESALE OF THE UNITS MUST BE MADE IN ACCORDANCE WITH AN EXEMPTION FROM THE REGISTRATION AND PROSPECTUS REQUIREMENTS OF APPLICABLE SECURITIES LAWS. NEITHER KUE NOR THE GENERAL PARTNER iS A REPORTING ISSUER IN ANY PROVINCE OR TERRITORY OF CANADA. PURCHASERS OF THE UNITS ARE ADVISED TO SEEK LEGAL ADVICE PRIOR TO ANY RESALE OF THE UNITS. Enforcement of Legal Rights. THE GENERAL PARTNER IS A CAYMAN ISLANDS EXEMPTED COMPANY AND KUE IS A CAYMAN ISLANDS EXEMPTED LIMITED PARTNERSHIP, THE DIRECTORS, OFFICERS AND REPRESENTATIVES OF THE GENERAL PARTNER AND KUE MAY BE LOCATED OUTSIDE CANADA AND, AS A RESULT, IT MAY NOT BE POSSIBLE FOR CANADIAN PURCHASERS TO EFFECT SERVICE OF PROCESS WITHIN CANADA UPON THE GENERAL PARTNER, KUE, OR THEIR DIRECTORS, OFFICERS OR REPRESENTATIVES. ALL OR A SUBSTANTIAL PORTION OF THE ASSETS OF KUE, THE GENERAL PARTNER AND THEIR DIRECTORS, OFFICERS OR REPRESENTATIVES MAY BE LOCATED OUTSIDE OF CANADA AND, AS A RESULT, IT MAY NOT BE POSSIBLE TO SATISFY A JUDGMENT AGAINST SUCH PERSONS IN CANADA OR TO ENFORCE A JUDGMENT OBTAINED IN CANADIAN COURTS AGAINST SUCH PERSONS OUTSIDE OF CANADA. Right _of Action for Damages or Rescission. THE FOLLOWING SUMMARY IS SUBJECT TO THE EXPRESS PROVISIONS OF THE SECURITIES ACT (ONTARIO), THE SECURITIES ACT (NEW BRUNSWICK) AND THE SECURITIES ACT (NOVA SCOTIA) AND THE RULES AND REGULATIONS THEREUNDER AND REFERENCE IS MADE THERETO FOR THE COMPLETE TEXT OF SUCH PROVISIONS. THE SECURITIES ACT (ONTARIO) AND THE SECURITIES ACT (NEW BRUNSWICK) PROVIDE CERTAIN PURCHASERS IN ONTARIO AND NEW BRUNSWICK, RESPECTIVELY, WITH A STATUTORY RIGHT OF ACTION FOR DAMAGES OR RESCISSION AGAINST THE ISSUER WHERE AN OFFERING MEMORANDUM CONTAINS A MISREPRESENTATION, THE SECURITIES ACT (NOVA SCOTIA) PROVIDES PURCHASERS IN NOVA SCOTIA WITH A STATUTORY RIGHT OF ACTION FOR DAMAGES AGAINST EVERY SELLER, EVERY DIRECTOR OF THE SELLER AT THE DATE OF THiS HOUSE_OVERSIGHT_024437

Sponsored

Page 7 - HOUSE_OVERSIGHT_024438

MEMORANDUM AND EVERY PERSON WHO SIGNED THE OFFERING MEMORANDUM OR A RIGHT OF RESCISSION AGAINST EVERY SELLER WHERE AN OFFERING MEMORANDUM CONTAINS A MISREPRESENTATION. SUCH PURCHASERS WHO PURCHASE A SECURITY OFFERED BY THE OFFERING MEMORANDUM DURING THE PERIOD OF DISTRIBUTION ARE DEEMED TO HAVE RELIED ON SUCH MISREPRESENTATION IF IT WAS A MISREPRESENTATION AT THE TIME OF PURCHASE. FOR PURCHASERS IN ONTARIO AND NOVA SCOTIA, THESE STATUTORY RIGHTS ARE EXERCISABLE, IN THE CASE OF AN ACTION FOR RESCISSION, 180 DAYS AFTER THE DATE OF THE TRANSACTION THAT GAVE RISE TO THE CAUSE OF ACTION OR, IN THE CASE OF ANY ACTION, OTHER THAN AN ACTION FOR RESCISSION, THE EARLIER OF (1) 180 DAYS AFTER THE PLAINTIFF FIRST HAD KNOWLEDGE OF THE FACTS GIVING RISE TO THE CAUSE OF ACTION AND (I} THREE YEARS AFTER THE DATE OF THE TRANSACTION THAT GAVE RISE TO THE CAUSE OF ACTION. NOTWITHSTANDING THE FOREGOING, IN NOVA SCOTIA, NO ACTION MAY BE COMMENCED MORE THAN 120 DAYS AFTER THE DATE ON WHICH PAYMENT WAS MADE FOR THE SECURITIES OR AFTER THE DATE ON WHICH THE INITIAL PAYMENT FOR THE SECURITIES WAS MADE WHERE PAYMENTS SUBSEQUENT TO THE INITIAL PAYMENT ARE MADE PURSUANT TO A CONTRACTUAL COMMITMENT ASSUMED PRIOR TO, OR CONCURRENTLY WITH, THE INITIAL. PAYMENT. FOR PURCHASERS IN NEW BRUNSWICK, THESE STATUTORY RIGHTS ARE EXERCISABLE, IN THE CASE OF AN ACTION FOR RESCISSION, 180 DAYS AFTER THE DATE OF THE TRANSACTION THAT GAVE RISE TO THE CAUSE OF ACTION OR, IN THE CASE OF ANY ACTION, OTHER THAN AN ACTION FOR RESCISSION, THE EARLIER OF (I) ONE YEAR AFTER THE PLAINTIFF FIRST HAD KNOWLEDGE OF THE FACTS GIVING RISE TO THE CAUSE OF ACTION AND (II) 6 YEARS AFTER THE DATE OF THE TRANSACTION THAT GAVE RISE TO THE CAUSE OF THE ACTION. THE RIGHTS DISCUSSED ABOVE ARE IN ADDITION TO AND WITHOUT DEROGATION FROM ANY OTHER RIGHT OR REMEDY WHICH PURCHASERS MAY HAVE AT LAW AND ARE INTENDED TO CORRESPOND TO THE PROVISIONS OF THE RELEVANT SECURITIES LEGISLATION AND ARE SUBJECT TO THE DEFENCES CONTAINED THEREIN. Canadian Federal income Tax Considerations. THIS MEMORANDUM DOES NOT DISCUSS THE CANADIAN FEDERAL INCOME TAX CONSIDERATIONS RELEVANT TO A HOLDER OF THE UNITS RESIDENT IN CANADA FOR PURPOSES OF THE INCOME TAX ACT (CANADA) (THE “ITA"). THE RULES FOR THE TAXATION OF PARTNERS AND PARTNERSHIPS UNDER THE ITA ARE EXTREMELY COMPLEX AND, ACCORDINGLY, PROSPECTIVE PURCHASERS OF THE UNITS WHO ARE RESIDENT IN CANADA ARE STRONGLY ADVISED TO CONSULT WITH THEIR OWN TAX ADVISORS PRIOR TO PURCHASING ANY UNITS. Forward Looking Statements, CERTAIN STATEMENTS IN THIS MEMORANDUM CONSTITUTE “FORWARD-LOOKING STATEMENTS.” FORWARD-LOOKING STATEMENTS = INCLUDE STATEMENTS CONCERNING THE PLANS, OBJECTIVES, GOALS, STRATEGIES AND FUTURE OPERATIONS AND PERFORMANCE OF KUE AND THE GENERAL PARTNER AND THE ASSUMPTIONS UNDERLYING THESE FORWARD-LOOKING STATEMENTS. KUE AND THE GENERAL PARTNER USE THE WORDS “ANTICIPATES,” “ESTIMATES,” EXPECTS,” “BELIEVES,” “INTENDS,” "PLANS," “MAY,” “WILL,” “SHOULD,” AND ANY SIMILAR EXPRESSIONS TO IDENTIFY FORWARD-LOOKING STATEMENTS. THESE FORWARD-LOOKING STATEMENTS INVOLVE KNOWN AND UNKNOWN RISKS, UNCERTAINTIES AND OTHER IMPORTANT FACTORS THAT COULD CAUSE ACTUAL RESULTS, PERFORMANCE AND ACHIEVEMENTS FO BE MATERIALLY DIFFERENT FROM ANY FUTURE RESULTS, PERFORMANCE OR ACHIEVEMENTS EXPRESSED OR IMPLIED BY SUCH FORWARD-LOOKING STATEMENTS. SUCH FORWARD-LOOKING STATEMENTS ARE BASED ON NUMEROUS ASSUMPTIONS REGARDING PRESENT AND FUTURE BUSINESS STRATEGIES AND THE ENVIRONMENT IN WHICH KUE AND THE GENERAL PARTNER WILL OPERATE IN THE FUTURE. AS A RESULT OF THESE RISK, UNCERTAINTIES AND HOUSE_OVERSIGHT_024438

Page 8 - HOUSE_OVERSIGHT_024439

ASSUMPTIONS, A PROSPECTIVE INVESTOR SHOULD NOT PLACE UNDUE RELIANCE ON THESE FORWARD-LOOKING STATEMENTS. SEE "RISK FACTORS” IN THIS MEMORANDUM. THESE FORWARD-LOOKING STATEMENTS SPEAK ONLY AS OF THE DATE OF THIS MEMORANDUM. NEITHER KUE NOR THE GENERAL PARTNER |S OBLIGED, AND DOES NOT INTEND, TO UPDATE OR REVISE ANY FORWARD-LOOKING STATEMENTS, WHETHER AS A RESULT OF NEW INFORMATION, FUTURE EVENTS OR OTHERWISE. ALL SUBSEQUENT WRITTEN AND ORAL FORWARD-LOOKING STATEMENTS ATTRIBUTABLE TO KUE, THE GENERAL PARTNER, OR PERSONS ACTING ON THEIR BEHALF, ARE EXPRESSLY QUALIFIED IN THEIR ENTIRETY BY THE CAUTIONARY STATEMENTS CONTAINED THROUGHOUT THIS MEMORANDUM. Financial information. FINANCIAL INFORMATION CONTAINED IN THIS MEMORANDUM RAVE NOT BEEN PREPARED IN ACCORDANCE WITH U.S. GENERALLY ACCEPTED ACCOUNTING PRACTICES, AND MAY DIFFER IN CERTAIN RESPECTS FROM THOSE ACCOUNTING PRINCIPLES USED IN OTHER JURISDICTIONS, INCLUDING CANADA. PROSPECTIVE PURCHASERS SHOULD CONDUCT THEIR OWN INVESTIGATION AND ANALYSIS OF THE BUSINESS, DATA AND TRANSACTION DESCRIBED HEREIN AND CONSULT THEIR OWN FINANCIAL ADVISORS. SEE “NON-GAAP FINANCIAL MEASURES” BELOW IN THIS MEMORANDUM. Representations of Canadian Purchasers. EACH PURCHASER OF THE UNITS RESIDENT IN A CANADIAN JURISDICTION WILL BE DEEMED TO HAVE REPRESENTED TO KUE AND THE GENERAL PARTNER AND THE AGENTS WHO SELLS THE UNITS TO SUCH PURCHASER THAT: (A) THE OFFER AND SALE OF THE UNITS WAS MADE EXCLUSIVELY THROUGH THIS MEMORANDUM AND WAS NOT MADE THROUGH AN ADVERTISEMENT OF THE UNITS IN ANY PRINTED MEDIA OF GENERAL AND REGULAR PAID CIRCULATION, RADIO, TELEVISION OR TELECOMMUNICATIONS, INCLUDING ELECTRONIC DISPLAY, OR ANY OTHER FORM OF ADVERTISING IN CANADA; (B) SUCH PURCHASER HAS REVIEWED AND ACKNOWLEDGES THE TERMS REFERRED TO ABOVE UNDER “RESALE RESTRICTIONS IN CANADA"; (C}) WHERE REQUIRED BY LAW, SUCH PURCHASER IS PURCHASING AS PRINCIPAL FOR ITS OWN ACCOUNT AND NOT AS AGENT; AND (D)} SUCH PURCHASER OR ANY ULTIMATE PURCHASER FOR WHICH SUCH PURCHASER IS ACTING AS AGENT [IS ENTITLED UNDER APPLICABLE CANADIAN SECURITIES LAWS TO PURCHASE SUCH UNITS WITHOUT THE BENEFIT OF A PROSPECTUS QUALIFIED UNDER SUCH SECURITIES LAWS, AND WITHOUT LIMITING THE GENERALITY OF THE FOREGOING: (I) SUCH PURCHASER IS AN “ACCREDITED INVESTOR” AS DEFINED iN SECTION 1.1 OF NATIONAL INSTRUMENT 45-106 ("Ni 45-106"), OR FULFILLS THE REQUIREMENTS OF SECTION 2.10 OF NI 45- 106 (A “$150K PURCHASER”) AND (Il) IN THE CASE OF A PURCHASER RESIDENT IN ONTARIO, SUCH PURCHASER, OR ANY ULTIMATE PURCHASER FOR WHICH SUCH PURCHASER IS ACTING AS AGENT, IS AN “ACCREDITED INVESTOR’ AS DEFINED IN Ni 45-106, OR A $150K PURCHASER WHO IS PURCHASING THE UNITS FROM A REGISTERED INVESTMENT DEALER WITHIN THE MEANING OF SECTION 98 OF THE REGULATION TO THE SECURITIES ACT (ONTARIO}. IN ADDITION, EACH PURCHASER OF THE UNITS RESIDENT IN CANADA WILL BE DEEMED TO HAVE REPRESENTED TO KUE, THE GENERAL PARTNER AND THE AGENTS FROM WHOM A PURCHASE CONFIRMATION WAS RECEIVED, THAT SUCH PURCHASER: (A) HAS BEEN NOTIFIED BY KUE AND THE GENERAL PARTNER (|) THAT KUE AND THE GENERAL PARTNER ARE REQUIRED TO PROVIDE INFORMATION (“PERSONAL INFORMATION") PERTAINING TO THE PURCHASER AS REQUIRED TO BE DISCLOSED IN SCHEDULE ! OF FORM 45-106F1 UNDER NI 45- 106 (INCLUDING ITS NAME, ADDRESS, TELEPHONE NUMBER AND THE NUMBER AND VALUE OF ANY UNITS PURCHASED), WHICH FORM 45-106F1 IS REQUIRED TO BE FILED BY KUE AND THE GENERAL PARTNER UNDER NI 45-106; (II) THAT SUCH PERSONAL INFORMATION WILL BE DELIVERED TO THE ONTARIO SECURITIES COMMISSION (THE "OSC”) IN ACCORDANCE WITH NI 45-106; (lil) THAT SUCH PERSONAL INFORMATION IS BEING COLLECTED INDIRECTLY BY THE OSC UNDER THE AUTHORITY GRANTED TO iT UNDER THE SECURITIES LEGISLATION OF ONTARIO; (IV) THAT SUCH PERSONAL INFORMATION IS BEING COLLECTED FOR THE PURPOSES OF THE ADMINISTRATION AND ENFORCEMENT OF THE SECURITIES LEGISLATION OF ONTARIO; AND (V) THAT THE PUBLIC OFFICIAL IN ONTARIO WHO CAN ANSWER QUESTIONS HOUSE_OVERSIGHT_024439

Page 9 - HOUSE_OVERSIGHT_024440

ABOUT THE OSC'S INDIRECT COLLECTION OF SUCH PERSONAL INFORMATION IS THE ADMINISTRATIVE ASSISTANT TO THE DIRECTOR OF CORPORATE FINANCE AT THE OSC, SUITE 1903, BOX 5520 QUEEN STREET WEST, TORONTO, ONTARIO M5H 388, TELEPHONE: (416) 593- 8086; AND (B) HAS AUTHORIZED THE INDIRECT COLLECTION OF THE PERSONAL INFORMATION BY THE OSC. FURTHER, THE PURCHASER ACKNOWLEDGES THAT ITS NAME, ADDRESS, TELEPHONE NUMBER AND OTHER SPECIFIED INFORMATION, INCLUDING THE NUMBER OF UNITS IT HAS PURCHASED AND THE AGGREGATE PURCHASE PRICE PAID BY PURCHASER, MAY BE DISCLOSED TO OTHER CANADIAN SECURITIES REGULATORY AUTHORITIES AND MAY BECOME AVAILABLE TO THE PUBLIC IN ACCORDANCE WITH THE REQUIREMENTS OF APPLICABLE LAWS. BY PURCHASING UNITS, THE PURCHASER CONSENTS TO THE DISCLOSURE OF SUCH INFORMATION. Language of documents in Canada. UPON RECEIPT OF THIS MEMORANDUM, EACH INVESTOR IN CANADA HEREBY CONFIRMS THAT IT HAS EXPRESSLY REQUESTED THAT ALL DOCUMENTS EVIDENCING OR RELATING IN ANY WAY TO THE SALE OF THE UNITS (INCLUDING FOR GREATER CERTAINTY ANY PURCHASE CONFIRMATION OR ANY NOTICE) BE DRAWN UP IN THE ENGLISH LANGUAGE ONLY. PAR LA RECEPTION DE CE DOCUMENT, CHAQUE INVESTISSEUR CANADIEN CONFIRME PAR LES PRESENTES QU'L A EXPRESSEMENT EXIGE QUE TOUS LES DOCUMENTS FAISANT FOI OU SE RAPPORTANT DE QUELQUE MANIERE QUE CE SOIT A LA VENTE DES VALEURS MOBILIERES DECRITES AUX PRESENTES (INCLUANT, POUR PLUS DE CERTITUDE, TOUTE CONFIRMATION D'ACHAT OU TOUT AVIS) SOIENT REDIGES EN ANGLAIS SEULEMENT. NOTICE TO RESIDENTS OF THE CAYMAN ISLANDS CLASS A SHARES IN THE GENERAL PARTNER AND COMMON LP UNITS IN KUE MAY BE BENEFICIALLY OWNED BY PERSONS RESIDENT, DOMICILED, ESTABLISHED, INCORPORATED OR REGISTERED IN THE CAYMAN ISLANDS PURSUANT TO THE LAWS OF THE CAYMAN ISLANDS. THE GENERAL PARTNER AND KUE, HOWEVER, WILL NOT UNDERTAKE BUSINESS WITH THE PUBLIC IN THE CAYMAN ISLANDS OTHER THAN SO FAR AS MAY BE NECESSARY FOR THE CARRYING ON OF THE BUSINESS OF, AS APPLICABLE, THE GENERAL PARTNER OR KUE EXTERIOR TO THE ISLANDS. "PUBLIC" FOR THESE PURPOSES DOES NOT INCLUDE ANY EXEMPTED OR ORDINARY NON-RESIDENT COMPANY REGISTERED UNDER THE COMPANIES LAW OR A FOREIGN COMPANY REGISTERED PURSUANT TO PART IX OF THE COMPANIES LAW OR ANY SUCH COMPANY ACTING AS GENERAL PARTNER OF A PARTNERSHIP REGISTERED PURSUANT TO SECTION 9(1) OF THE EXEMPTED LIMITED PARTNERSHIP LAW (2003 REVISION) OR ANY DIRECTOR OR OFFICER OF SUCH PARTNERSHIP ACTING IN SUCH CAPACITY OR THE TRUSTEE OF ANY TRUST REGISTERED OR CAPABLE OF REGISTRATION PURSUANT TO SECTION 74 OF THE TRUSTS LAW (2001 REVISION). NOTICE TO RESIDENTS OF CHINA THE INFORMATION CONTAINED IN THIS MEMORANDUM WILL NOT CONSTITUTE AN OFFER TO SELL ANY SECURITIES WITHIN THE PEOPLE'S REPUBLIC OF CHINA (WHICH, FOR SUCH PURPOSES, DOES NOT INCLUDE THE HONG KONG OR MACAU SPECIAL ADMINISTRATIVE REGIONS OR TAIWAN) (THE “PRC"). THIS MEMORANDUM AND THE INFORMATION CONTAINED HEREIN HAVE NOT BEEN APPROVED BY ANY RELEVANT GOVERNMENTAL AUTHORITIES IN THE PRC AND THE UNITS MAY NOT BE OFFERED FOR SALE IN THE PRC. PRC INVESTORS ARE RESPONSIBLE FOR OBTAINING ALL RELEVANT GOVERNMENT REGULATORY APPROVALS/LICENSES THEMSELVES, INCLUDING, BUT NOT LIMITED TO, ANY WHICH MAY BE REQUIRED FROM THE STATE ADMINISTRATION OF FOREIGN EXCHANGE, THE CHINA BANKING REGULATORY COMMISSION, AND/OR THE CHINA SECURITIES REGULATORY COMMISSION, AND COMPLYING WITH ALL RELEVANT PRG REGULATIONS, INCLUDING, BUT NOT LIMITED TO, ANY RELEVANT FOREIGN EXCHANGE REGULATIONS AND/OR FOREIGN INVESTMENT REGULATIONS. HOUSE_OVERSIGHT_024440

Sponsored

Page 10 - HOUSE_OVERSIGHT_024441

NOTICE TO RESIDENTS OF FRANCE THE COMPANY AND THE AGENTS HAVE NOT OFFERED OR SOLD AND WILL NOT OFFER OR SELL, DIRECTLY OR INDIRECTLY, THE UNITS TO THE PUBLIC IN FRANCE, AND HAVE NOT DISTRIBUTED OR CAUSED TO BE DISTRIBUTED AND WILL NOT DISTRIBUTE OR CAUSE TO BE DISTRIBUTED TO THE PUBLIC IN FRANCE, THIS MEMORANDUM OR ANY OTHER OFFERING MATERIAL RELATING TO THE UNITS. SUCH OFFERS, SALES AND DISTRIBUTIONS HAVE BEEN AND SHALL ONLY BE MADE IN FRANCE TO {I} PROVIDERS OF INVESTMENT SERVICES RELATING TO PORTFOLIO MANAGEMENT FOR THE ACCOUNT OF THIRD PARTIES, AND/OR (11) QUALIFIED INVESTORS (INVESTISSEURS QUALIFIES), AND/OR (Ill) A RESTRICTED GROUP OF INVESTORS (CERCLE RESTREINT D'INVESTISSEURS), ALL AS DEFINED IN, AND IN ACCORDANCE WITH, ARTICLES L.471-1, L.411-2, D.411-1 AND D.411-2 OF THE FRENCH CODE MONETAIRE ET FINANCIER. NOTICE TO RESIDENTS OF GERMANY THE UNITS HAVE NOT BEEN AND WILL NOT BE REGISTERED OR APPROVED FOR PUBLIC OFFERING UNDER THE SECURITIES LAWS OF GERMANY. THIS MEMORANDUM HAS NOT BEEN AND WILL NOT BE SUBMITTED TO THE FEDERAL FINANCIAL SERVICES SUPERVISORY AUTHORITY (BUNDESANSTALT FUR FINANZDIENSTLEISTUNGSAUFSICHT) FOR APPROVAL AS A PROSPECTUS AND NO PROSPECTUS HAS BEEN OR WILL BE PUBLISHED IN GERMANY. THEREFORE, THE UNITS MAY BE OFFERED AND SOLD IN THE TERRITORY OF THE FEDERAL REPUBLIC OF GERMANY ONLY IF (1) LESS THAN 20 UNITS ARE OFFERED IN GERMANY, (Il) THE PRICE PER OFFERED UNIT IS AT LEAST €200,000 FOR EACH OFFEREE, (Ill) THE OFFER IS TO A "RESTRICTED CIRCLE OF PERSONS’ AS THIS TERM IS INTERPRETED BY THE BAFIN AND THE GERMAN COURTS, OR (IV) THE OFFER IS TO INVESTORS WHO PURCHASE OR SELL SECURITIES OR INVESTMENTS (VERMOGENSANLAGEN) AS DEFINED IN THE GERMAN SALES PROSPECTUS ACT (VERKAUFSPROSPEKTGESETZ) FOR THEIR OWN ACCOUNT OR THE ACCOUNT OF THIRD PARTIES AS PART OF THEIR PROFESSION OR TRADE. THIS MEMORANDUM AND ANY OTHER DOCUMENT RELATING TO THE UNITS, AS WELL AS INFORMATION CONTAINED THEREIN, MAY NOT BE SUPPLIED TO THE PUBLIC IN GERMANY OR USED IN CONNECTION WITH ANY OFFER FOR SUBSCRIPTION OR SALE OF THE UNITS TO THE PUBLIC IN GERMANY. TRIS MEMORANDUM AND OTHER OFFERING MATERIALS RELATING TO THE OFFER OF THE UNITS ARE STRICTLY CONFIDENTIAL AND MAY NOT BE DISTRIBUTED TO ANY PERSON OR ENTITY OTHER THAN THE RECIPIENTS HEREOF. NOTICE TO RESIDENTS OF HONG KONG WARNING THE CONTENTS GF THIS MEMORANDUM HAVE NOT BEEN REVIEWED BY ANY REGULATORY AUTHORITY IN HONG KONG. YOU ARE ADVISED TO EXERCISE CAUTION IN RELATION TO THE OFFER. IF YOU ARE IN ANY DOUBT ABOUT ANY OF THE CONTENTS OF THIS MEMORANDUM, YOU SHOULD OBTAIN INDEPENDENT PROFESSIONAL ADVICE. NOTICE TO RESIDENTS OF ICELAND THIS MEMORANDUM HAS BEEN ISSUED TG YOU FOR YOUR PERSONAL USE ONLY AND EXCLUSIVELY FOR THE PURPOSES OF THE INVESTMENT SCHEME. ACCORDINGLY, THIS MEMORANDUM MAY NOT BE USED FOR ANY OTHER PURPOSE NOR PASSED ON TO ANY OTHER PERSON IN ICELAND. THE SECURITIES OFFERING DESCRIBED IN THIS MEMORANDUM IS AN UNREGULATED INVESTMENT SCHEME. THE SECURITIES WHICH ARE THE OBJECT OF THIS MEMORANDUM ARE NOT REGISTERED FOR PUBLIC DISTRIBUTION IN ICELAND WITH THE FINANCIAL SUPERVISORY AUTHORITY PURSUANT TO THE ICELANDIC ACT ON SECURITIES TRANSACTIONS NO. 33/2003 OR THE ICELANDIC ACT ON UCITS-FUNDS AND OTHER INVESTMENT FUNDS NO. 30/2003 AND SUPPLEMENTARY REGULATIONS. THE UNITS MAY NOT BE OFFERED OR SOLD BY MEANS OF THIS MEMORANDUM OR ANYWAY LATER RESOLD TO HOUSE_OVERSIGHT_024441

Page 11 - HOUSE_OVERSIGHT_024442

OTHER THAN ENTITIES OR PERSONS DEFINED AS INSTITUTIONAL INVESTORS IN THE MEANING OF ITEM NO. 7. IN ARTICLE 2 OF THE ICELANDIC ACT ON SECURITIES TRANSACTIONS AND THE REGULATION OF THE TRANSACTIONS OF SECURITIES NO. 233/2003. ANY RESALE OF THE UNITS IN ICELAND WILL NEED TO TAKE PLACE IN ACCORDANCE WITH THE PROVISIONS OF THE ICELANDIC ACT ON SECURITIES TRANSACTIONS No. 33/2003 AS AMENDED AND ANY APPLICABLE LAWS OR REGULATIONS OF ICELAND. NOTICE TO RESIDENTS OF INDIA THE ISSUANCE OF THE UNITS IS BEING MADE STRICTLY ON A PRIVATE PLACEMENT BASIS. THIS MEMORANDUM IS NOT A PROSPECTUS OR A STATEMENT IN LIEU OF A PROSPECTUS. IT IS NOT, AND SHOULD NOT BE DEEMED TO CONSTITUTE AN OFFER TO THE PUBLIC IN GENERAL. THE INFORMATION CONTAINED IN THIS MEMORANDUM IS BELIEVED BY THE COMPANY TO BE ACCURATE IN ALL MATERIAL RESPECTS AS OF THE DATE HEREOF, THE COMPANY DOES NOT UNDERTAKE TO UPDATE THIS MEMORANDUM TO REFLECT SUBSEQUENT EVENTS. THIS MEMORANDUM HAS BEEN PREPARED TO PROVIDE GENERAL INFORMATION ON THE COMPANY TO POTENTIAL INVESTORS EVALUATING THE PROPOSAL TO SUBSCRIBE FOR THE UNITS COVERED BY THIS MEMORANDUM AND iT DOES NOT PURPORT TO CONTAIN ALL THE INFORMATION THAT ANY SUCH POTENTIAL INVESTOR MAY REQUIRE. POTENTIAL INVESTORS SHOULD CONDUCT THEIR OWN DUE DILIGENCE, INVESTIGATION AND ANALYSIS OF THE COMPANY. PRIOR TO APPLYING FOR THE UNITS, INVESTORS SHOULD VERIFY IF THEY HAVE THE NECESSARY POWER AND COMPETENCE TO APPLY FOR THE UNITS UNDER THEIR CONSTITUTIONAL DOCUMENTS AS WELL AS ALL RELEVANT LAWS AND REGULATIONS IN FORCE IN INDIA. THEY SHOULD ALSO CONSULT THEIR OWN TAX ADVISORS ON THE TAX IMPLICATIONS OF THE ACQUISITION, OWNERSHIP AND SALE OF THE UNITS, AND INCOME ARISING THEREON. ALTHOUGH THE INFORMATION CONTAINED HEREIN HAS BEEN OBTAINED FROM SOURCES THAT ARE RELIABLE TO THE BEST OF THE AGENTS’ KNOWLEDGE AND BELIEF, THE AGENTS MAKES NO REPRESENTATION AS TO THE ACCURACY OR COMPLETENESS OF ANY INFORMATION CONTAINED HEREIN OR OTHERWISE PROVIDED BY THE AGENT. NEITHER THE AGENTS NOR ANY OFFICER OR EMPLOYEE OF THE AGENTS ACCEPT ANY LIABILITY WHATSOEVER FOR ANY DIRECT OR CONSEQUENTIAL LOSS ARISING FROM ANY USE OF THIS MEMORANDUM OR ITS CONTENTS. NOTICE TO RESIDENTS OF ITALY THE OFFERING OF THE UNITS IN THE REPUBLIC OF ITALY (“ITALY”) HAS NOT BEEN AUTHORISED BY THE COMMISSIONE NAZIONALE PER LE SOCIETA E LA BORSA ("CONSOB”) PURSUANT TO THE ITALIAN SECURITIES LEGISLATION AND, ACCORDINGLY: (l) THE UNITS CANNOT BE OFFERED, SOLD OR DELIVERED IN ITALY IN AN INVESTMENT SOLICITATION (“SOLLECITAZIONE ALL'INVESTIMENTO”) WITHIN THE MEANING OF ARTICLE 1, PARAGRAPH 1, LETTER (T) OF LEGISLATIVE DECREE NO. 58 OF 24 FEBRUARY 1998, AS AMENDED (“DECREE 58/98”), (1) THE UNITS CANNOT BE OFFERED, SOLD AND/OR DELIVERED, NOR ANY DOCUMENT RELATING TO THE UNITS CAN BE DISTRIBUTED, EITHER IN THE PRIMARY OR SECONDARY MARKET, TO INDIVIDUALS RESIDENT IN ITALY, AND (Ill) ANY OFFER, SALE AND/OR DELIVERY OF THE UNITS AND DISTRIBUTION OF COPIES OF ANY DOCUMENT RELATING TO THE UNITS IN ITALY WILL ONLY BE: HOUSE_OVERSIGHT_024442

Page 12 - HOUSE_OVERSIGHT_024443

(A) MADE TO ITALIAN INSTITUTIONAL INVESTORS (INVESTITORI ISTITUZIONALP), AS DEFINED IN ARTICLE 100 OF DECREE 58/98 BY REFERENCE TO ARTICLE 31.2 OF CONSOB REGULATION NO. 11522 OF 71 JULY 1998, AS AMENDED (“REGULATION 11522/98"}; (B) MADE IN COMPLIANCE WITH ARTICLE 129 OF THE LEGISLATIVE DECREE NO. 385 OF 1 SEPTEMBER 1993, AS AMENDED ("DECREE 385/93”), AND THE IMPLEMENTING INSTRUCTIONS OF THE BANK OF ITALY, IF APPLICABLE, PURSUANT TO WHICH THE ISSUE OR PLACEMENT OF SECURITIES IN ITALY 1S SUBJECT TO PRIOR NOTIFICATION TO THE BANK OF ITALY, UNLESS AN EXEMPTION, DEPENDING, INTER ALIA, ON THE AMOUNT OF THE ISSUE AND THE CHARACTERISTICS OF THE SECURITIES, APPLIES; (C) MADE IN COMPLIANCE WITH ANY OTHER ITALIAN SECURITIES, TAX AND EXCHANGE CONTROL AND OTHER APPLICABLE LAWS AND REGULATIONS AND ANY OTHER APPLICABLE REQUIREMENT OR LIMITATION WHICH MAY BE IMPOSED BY CONSOB, THE BANK OF ITALY OR ANY OTHER COMPETENT ITALIAN AUTHORITY; AND (D) MADE BY AN INVESTMENT FIRM, BANK OR FINANCIAL INTERMEDIARY PERMITTED TO CONDUCT SUCH ACTIVITIES IN ITALY IN ACCORDANCE WITH DECREE 58/98, DECREE 385/83, REGULATION 11522/98 AND ANY OTHER APPLICABLE LAWS AND REGULATIONS. NOTICE TO RESIDENTS OF JAPAN THE OFFERING OF THE UNITS HEREUNDER HAS NOT BEEN AND WILL NOT BE REGISTERED UNDER THE SECURITIES AND EXCHANGE LAW OF JAPAN. CONSEQUENTLY, THE UNITS MAY NOT BE OFFERED, SOLD, RESOLD OR OTHERWISE TRANSFERRED, DIRECTLY OR INDIRECTLY, IN JAPAN OR TO OR FOR THE ACCOUNT OF ANY RESIDENT OF JAPAN, EXCEPT PURSUANT TO AND IN COMPLIANCE WITH APPLICABLE JAPANESE LAWS AND REGULATIONS. THE INVESTORS SHOULD FURTHER NOTE THAT PURSUANT TO THE PARTNERSHIP AGREEMENT THE UNITS MAY ONLY BE TRANSFERRED IN WHOLE AND NOT IN PART AND THAT ANY SUCH TRANSFER WILL REQUIRE A PRIOR WRITTEN CONSENT OF THE GENERAL PARTNER. NOTICE TO RESIDENTS OF JERSEY NOTHING IN THIS MEMORANDUM, NOR ANYTHING COMMUNICATED TO HOLDERS OR POTENTIAL HOLDERS OF SECURITIES BY THE COMPANY OR THE AGENTS [8 INTENDED TO CONSTITUTE OR SHOULD BE CONSTRUED AS ADVICE ON THE MERITS OF THE PURCHASE OF OR SUBSCRIPTION FOR THE UNITS OR THE EXERCISE OF ANY RIGHTS ATTACHED THERETO FOR THE PURPOSES OF THE FINANCIAL SERVICES (JERSEY) LAW 1998, AS AMENDED. NOTICE TO RESIDENTS OF KUWAIT THIS OFFERING HAS NOT BEEN APPROVED BY THE KUWAIT CENTRAL BANK OR THE KUWAIT MINISTRY OF COMMERCE AND INDUSTRY, NOR HAS THE COMPANY RECEIVED AUTHORIZATION OR LICENSING FROM THE KUWAIT CENTRAL BANK OR THE KUWAIT MINISTRY OF COMMERCE AND INDUSTRY TO MARKET OR SELL THE UNITS WITHIN KUWAIT. FURTHERMORE, THIS MEMORANDUM DOES NOT CONSTITUTE THE MARKETING OR OFFERING OF SECURITIES IN KUWAIT PURSUANT TO THE KUWAITI SECURITIES LAW (LAW NO. 31 OF 1990, AS AMENDED). NOTICE TO RESIDENTS OF MEXICO THE UNITS HAVE NOT BEEN REGISTERED WITH THE NATIONAL REGISTRY OF SECURITIES (REGISTRO NACIONAL DE VALORES) MAINTAINED BY THE MEXICAN NATIONAL BANKING AND SECURITIES COMMISSION (COMISION NACIONAL BANCARIA Y DE VALORES) AND MAY NOT BE OFFERED OR SOLD PUBLICLY IN MEXICO. THIS OFFER DOES NOT CONSTITUTE A PUBLIC OFFER UNDER THE MEXICAN SECURITIES MARKET LAW (LEY DEL MERCADO DE VALORES). THIS PRIVATE OFFER AND ALL OTHER INFORMATION AS CONTAINED IN THIS MEMORANDUM ARE EXCLUSIVELY FOR THE BENEFIT OF AND DISTRIBUTION TO INSTITUTIONAL OR HIGH NET 10 HOUSE_OVERSIGHT_024443

Sponsored

Page 13 - HOUSE_OVERSIGHT_024444

WORTH INVESTORS. THIS MEMORANDUM AND OTHER OFFERING MATERIALS MAY NOT BE PUBLICLY DISTRIBUTED IN MEXICO. NOTICE TO RESIDENTS OF MONACO NEITHER THIS MEMORANDUM NOR ANY OTHER OFFERING MATERIAL RELATING TO THE UNITS MAY BE AVAILABLE TO THE PUBLIC OR USED IN CONNECTION WITH ANY OTHER OFFER FOR SUBSCRIPTION OR SALE OF THE UNITS IN THE PRINCIPALITY OF MONACO, AND THE UNITS MAY NOT BE ISSUED, OFFERED OR OTHERWISE SOLD IN THE PRINCIPALITY OF MONACO. NOTICE TO RESIDENTS OF THE NETHERLANDS THE UNITS MAY ONLY BE OFFERED, DIRECTLY OR INDIRECTLY, IN THE NETHERLANDS TO ENTITIES WHICH (]} ARE PROFESSIONAL MARKET PARTIES AS DEFINED IN ARTICLE |-C, 1ST PARAGRAPH, UNDER A OF THE EXEMPTION REGULATION ISSUED PURSUANT TO ARTICLE 4 OF THE ACT ON THE SUPERVISION OF SECURITIES TRADE (WET TOEZICHT EFFECTENVERKEER 4995) AND (ii) WHICH TRADE OR INVEST IN INVESTMENT OBJECTS IN THE CONDUCT OF A PROFESSION OR BUSINESS WITHIN THE MEANING OF ARTICLE | OF THE EXEMPTION REGULATION OF 9 OCTOBER 1990 ISSUED PURSUANT TO ARTICLE 14 OF THE INVESTMENT INSTITUTION SUPERVISION ACT (WET TOEZICHT BELEGGINGSINSTELLINGEN OF JUNE 27, 1990). THE UNITS MAY NOT OTHERWISE BE OFFERED, DIRECTLY OR INDIRECTLY, IN THE NETHERLANDS. NOTICE TO RESIDENTS OF QATAR THE UNITS HAVE NOT BEEN OFFERED, SOLD OR DELIVERED, AND WILL NOT BE OFFERED, SOLD OR DELIVERED AT ANY TIME, DIRECTLY OR INDIRECTLY, IN THE STATE OF GATAR IN A MANNER THAT WOULD CONSTITUTE A PUBLIC OFFERING. THIS MEMORANDUM HAS NOT BEEN REVIEWED OR REGISTERED WITH QATARI GOVERNMENT AUTHORITIES, WHETHER UNDER LAW. NO. 25 (2002) CONCERNING INVESTMENT FUNDS, CENTRAL BANK RESOLUTION NO. 15 (1997), AS AMENDED, OR ANY ASSOCIATED REGULATIONS. THEREFORE, THIS MEMORANDUM IS STRICTLY PRIVATE AND CONFIDENTIAL, AND IS BEING ISSUED TO A LIMITED NUMBER OF ’ SOPHISTICATED INVESTORS, AND MAY NOT BE REPRODUCED OR USED FOR ANY OTHER PURPOSE, NOR PROVIDED TO ANY PERSON OTHER THAN RECIPIENT THEREOF. NOTICE TO RESIDENTS OF RUSSIA UNDER RUSSIAN LAW, THE UNITS ARE SECURITIES OF A FOREIGN ISSUER. NEITHER THE [ISSUE OF THE UNITS NOR A SECURITIES PROSPECTUS IN RESPECT OF THE UNITS HAS BEEN, OR IS INTENDED TO BE, REGISTERED WITH THE FEDERAL SERVICE FOR FINANCIAL MARKETS OF THE RUSSIAN FEDERATION, AND HENCE THE UNITS ARE NOT ELIGIBLE FOR [INITIAL OFFERING OR PUBLIC CIRCULATION IN THE RUSSIAN FEDERATION. THE INFORMATION PROVIDED IN THIS MEMORANDUM IS NCT AN OFFER, OR AN INVITATION TO MAKE OFFERS, TO SELL, EXCHANGE OR OTHERWISE TRANSFER THE UNITS IN THE RUSSIAN FEDERATION OR TO OR FOR THE BENEFIT OF ANY RUSSIAN PERSON OR ENTITY. EACH OF THE AGENTS HAS REPRESENTED AND AGREED THAT IT HAS NOT OFFERED OR SOLD AND WILL NOT OFFER OR SELL ANY UNITS TO OR FOR THE BENEFIT OF ANY PERSONS RESIDENT, INCORPORATED, ESTABLISHED OR HAVING THEIR USUAL RESIDENCE IN RUSSIA OR TO ANY PERSON LOCATED WITHIN THE TERRITORY OF RUSSIA UNLESS AND TO THE EXTENT OTHERWISE PERMITTED UNDER RUSSIAN LAW. NOTICE TO RESIDENTS OF SAUDI ARABIA THIS MEMORANDUM MAY NOT BE DISTRIBUTED IN THE KINGDOM EXCEPT TO THE EXTENT PERMITTED UNDER THE RULES GOVERNING EXEMPT OFFERS AS SET FORTH IN THE OFFERS HOUSE_OVERSIGHT_024444

Page 14 - HOUSE_OVERSIGHT_024445

OF SECURITIES REGULATIONS (THE "REGULATIONS’). IT SHOULD NOT BE DISTRIBUTED TO ANY OTHER PERSON, OR RELIED UPON BY ANY OTHER PERSON. THE CAPITAL MARKET AUTHORITY DOES NOT TAKE ANY RESPONSIBILITY FOR THE CONTENTS OF THIS MEMORANDUM, DOES NOT MAKE ANY REPRESENTATION AS TO ITS ACCURACY OR COMPLETENESS, AND EXPRESSLY DISCLAIMS ANY LIABILITY WHATSOEVER FOR ANY LOSS ARISING FROM, OR INCURRED IN RELIANCE UPON, ANY PART OF THIS MEMORANDUM. PROSPECTIVE PURCHASERS OF THE SECURITIES OFFERED HEREBY SHOULD CONDUCT THEIR OWN DUE DILIGENCE ON THE ACCURACY OF THE INFORMATION RELATING TO THE SECURITIES. IF YOU DO NOT UNDERSTAND THE CONTENTS OF THIS DOCUMENT YOU SHOULD CONSULT AN AUTHORIZED FINANCIAL ADVISER. NOTICE TO RESIDENTS OF SINGAPORE As io the Class A Shares THIS MEMORANDUM HAS NOT BEEN REGISTERED AS A PROSPECTUS WITH THE MONETARY AUTHORITY OF SINGAPORE. ACCORDINGLY, THIS MEMORANDUM AND ANY OTHER DOCUMENT OR MATERIAL IN CONNECTION WITH THE OFFER OR SALE, OR INVITATION FOR SUBSCRIPTION OR PURCHASE, OF CLASS A SHARES MAY NOT BE CIRCULATED OR DISTRIBUTED, NOR MAY SUCH CLASS A SHARES BE OFFERED OR SOLD, OR BE MADE THE SUBJECT OF AN INVITATION FOR SUBSCRIPTION OR PURCHASE, WHETHER DIRECTLY OR INDIRECTLY, TO PERSONS IN SINGAPORE OTHER THAN (1) TO AN INSTITUTIONAL INVESTOR UNDER SECTION 274 OF THE SECURITIES AND FUTURES ACT, CHAPTER 289 OF SINGAPORE (THE “SFA"), (II} TO A RELEVANT PERSON, OR ANY PERSON PURSUANT TO SECTION 275(1A}, AND IN ACCORDANCE WITH THE CONDITIONS, SPECIFIED IN SECTION 275 OF THE SFA OR (Ill) OTHERWISE PURSUANT TO, AND IN ACCORDANCE WITH THE CONDITIONS OF, ANY OTHER APPLICABLE PROVISION OF THE SFA, WHERE SUCH CLASS A SHARES ARE SUBSCRIBED OR PURCHASED UNDER SECTION 275 BYA RELEVANT PERSON WHICH IS: (A) A CORPORATION (WHICH IS NOT AN ACCREDITED INVESTOR (AS DEFINED IN SECTION 4A OF THE SFA)) THE SOLE BUSINESS OF WHICH IS TO HOLD INVESTMENTS AND THE ENTIRE SHARE CAPITAL OF WHICH IS OWNED BY ONE OR MORE INDIVIDUALS, EACH OF WHOM IS AN ACCREDITED INVESTOR; OR (B) A TRUST (WHERE THE TRUSTEE iS NOT AN ACCREDITED INVESTOR) WHOSE SOLE PURPOSE IS TO HOLD INVESTMENTS AND EACH BENEFICIARY OF THE TRUST IS AN INDIVIDUAL WHO IS AN ACCREDITED INVESTOR, SHARES, DEBENTURES AND UNITS OF SHARES AND DEBENTURES OF THAT CORPORATION OR THE BENEFICIARIES’ RIGHTS AND INTEREST (HOWSOEVER DESCRIBED) IN THAT TRUST SHALL NOT BE TRANSFERRED WITHIN 6 MONTHS AFTER THAT CORPORATION OR THAT TRUST HAS ACQUIRED SUCH CLASS A SHARES PURSUANT TO AN OFFER MADE UNDER SECTION 275 EXCEPT: {1} TO AN INSTITUTIONAL INVESTOR (FOR CORPORATIONS, UNDER SECTION 274 OF THE SFA) OR TO A RELEVANT PERSON DEFINED IN SECTION 275(2) OF THE SFA, OR TO ANY PERSON PURSUANT TO AN OFFER THAT IS MADE ON TERMS THAT SUCH SHARES, DEBENTURES AND UNITS OF SHARES AND DEBENTURES OF THAT CORPORATION OR SUCH RIGHTS AND INTEREST IN THAT TRUST ARE ACQUIRED AT A CONSIDERATION OF NOT LESS THAN $$200,000 {OR ITS EQUIVALENT IN A FOREIGN CURRENCY) FOR EACH TRANSACTION, WHETHER SUCH AMOUNT IS TO BE PAID FOR iN CASH OR BY EXCHANGE OF SECURITIES OR OTHER ASSETS, AND FURTHER FOR CORPORATIONS, IN ACCORDANCE WITH THE CONDITIONS SPECIFIED IN SECTION 275 OF THE SFA; (2) WHERE NO CONSIDERATION IS OR WILL BE GIVEN FOR THE TRANSFER; OR HOUSE_OVERSIGHT_024445

Page 15 - HOUSE_OVERSIGHT_024446

(3) WHERE THE TRANSFER IS BY OPERATION OF LAW. As fo fhe Common LP Units THIS MEMORANDUM HAS NOT BEEN REGISTERED AS A PROSPECTUS WITH THE MONETARY AUTHORITY OF SINGAPORE AND THIS OFFERING IS NOT REGULATED BY ANY FINANCIAL SUPERVISORY AUTHORITY PURSUANT TO ANY LEGISLATION IN SINGAPORE. YOU SHOULD ACCORDINGLY CONSIDER CAREFULLY WHETHER THE INVESTMENT IS SUITABLE FOR YOU. EACH INVESTOR AGREES THAT THIS MEMORANDUM AND ANY OTHER DOCUMENT OR MATERIAL IN CONNECTION WITH THE OFFER OR SALE, OR INVITATION FOR SUBSCRIPTION OR PURCHASE, OF COMMON LP UNITS MAY NOT BE CIRCULATED OR DISTRIBUTED, NOR MAY SUCH COMMON LP UNITS BE OFFERED OR SOLD, OR BE MADE THE SUBJECT OF AN INVITATION FOR SUBSCRIPTION OR PURCHASE, WHETHER DIRECTLY OR INDIRECTLY, TO PERSONS IN SINGAPORE OTHER THAN INSTITUTIONAL INVESTORS (AS DEFINED IN SECTION 4A OF THE SECURITIES AND FUTURES ACT, CHAPTER 289 OF SINGAPORE ('SFA’)), ACCREDITED INVESTORS (AS DEFINED IN SECTION 4A OF THE SFA) OR ANY PERSON PURSUANT TO AN OFFER THAT IS MADE ON TERMS THAT SUCH COMMON LP UNITS ARE ACQUIRED AT A CONSIDERATION OF NOT LESS THAN S$200,000 (OR ITS EQUIVALENT IN A FOREIGN CURRENCY) FOR EACH TRANSACTION, WHETHER SUCH AMOUNT IS TO BE PAID FOR IN CASH OR BY EXCHANGE OF SECURITIES OR OTHER ASSETS. NOTICE TO RESIDENTS OF SPAIN NO PUBLIC OFFERING OF THE COMMON LP UNITS WILL BE CARRIED OUT IN THE SPANISH TERRITORY, PURSUANT TO THE DEFINITION OF PUBLIC OFFER CONTAINED iN ARTICLE 30 BIS OF THE SECURITIES MARKET LAW 24/1988, OF JULY 28. CONSEQUENTLY, THIS MEMORANDUM HAS NOT BEEN AND WILL NOT BE VERIFIED OR REGISTERED WITH THE SPANISH SECURITIES MARKET COMMISSION (COMISION NACIONAL DEL MERCADO DE VALORES, “CNMV"). NOTICE TO RESIDENTS OF SWITZERLAND THE UNITS ARE BEING OFFERED BY WAY OF A PRIVATE PLACEMENT TO A LIMITED NUMBER OF INVESTORS WITHOUT ANY PUBLIC OFFERING IN OR FROM SWITZERLAND. THIS MEMORANDUM AND ANY OTHER OFFERING MATERIAL RELATING TO THE UNITS ARE INTENDED SOLELY FOR THE RECIPIENT, THE INFORMATION THEREIN !S STRICTLY CONFIDENTIAL AND THEREFORE MAY NOT BE DISTRIBUTED TO ANY THIRD PARTY OR THE PUBLIC IN GENERAL. NOTICE TO RESIDENTS OF THE UNITED ARAB EMIRATES (“UAE”) BY RECEIVING THIS MEMORANDUM, THE PERSON OR ENTITY TO WHOM IT HAS BEEN ISSUED UNDERSTANDS, ACKNOWLEDGES AND AGREES THAT THIS MEMORANDUM HAS NOT BEEN APPROVED BY THE UAE CENTRAL BANK, THE UAE MINISTRY OF ECONOMY OR ANY OTHER AUTHORITY IN THE UAE, NOR ARE THE AGENTS AUTHORIZED OR LICENSED BY THE UAE CENTRAL BANK, THE UAE MINISTRY OF ECONOMY OR ANY OTHER AUTHORITY IN THE UAE TO MARKET OR SELL THE UNITS IN THE COMPANY WITHIN THE UAE. NO MARKETING OF ANY FINANCIAL PRODUCTS OR SERVICES HAVE BEEN OR WILL BE MADE FROM WITHIN THE UAE AND NO SUBSCRIPTION TO ANY SECURITIES, PRODUCTS OR FINANCIAL SERVICES MAY OR WILL BE CONSUMMATED WITHIN THE UAE. THE AGENTS ARE NOT LICENSED BROKERS, DEALERS, FINANCIAL ADVISORS OR INVESTMENT ADVISORS UNDER THE LAWS APPLICABLE IN THE UAE, AND DO NOT ADVISE INDIVIDUALS RESIDENT IN THE UAE AS TO THE APPROPRIATENESS OF INVESTING IN OR PURCHASING OR SELLING SECURITIES OR OTHER FINANCIAL PRODUCTS. NOTHING CONTAINED IN THIS MEMORANDUM IS INTENDED TO CONSTITUTE INVESTMENT, LEGAL, TAX, ACCOUNTING OR OTHER PROFESSIONAL ADVICE IN, OR IN RESPECT OF, THE UAE, HOUSE_OVERSIGHT_024446

Sponsored

Page 16 - HOUSE_OVERSIGHT_024447

THIS MEMORANDUM IS FOR YOUR INFORMATION ONLY AND NOTHING IN THIS MEMORANDUM IS INTENDED TG ENDORSE OR RECOMMEND A PARTICULAR COURSE OF ACTION. YOU SHOULD CONSULT WITH AN APPROPRIATE PROFESSIONAL FOR SPECIFIC ADVICE RENDERED ON THE BASIS OF YOUR SITUATION. NOTICE TO RESIDENTS OF THE UNITED KINGDOM THE COMPANY IS AN UNREGULATED COLLECTIVE INVESTMENT SCHEME FOR THE PURPOSES OF THE FINANCIAL SERVICES AND MARKETS ACT 2000 ("FSMA"), THE PROMOTION OF WHICH IN THE UNITED KINGDOM IS RESTRICTED BY THE FSMA. IF MADE BY A PERSON WHO IS NOT AN AUTHORISED PERSON UNDER FSMA, THE ISSUE OR DISTRIBUTION OF THIS DOCUMENT IN THE UNITED KINGDOM MAY ONLY BE MADE TO AND DIRECTED AT PERSONS WHO {1} ARE INVESTMENT FROFESSIONALS FALLING WITHIN ARTICLE 19 OF THE FINANCIAL SERVICES AND MARKETS ACT 2000 (FINANCIAL PROMOTION) ORDER 2005; OR (Il) ARE PERSONS TO WHOM THE PROMOTION MAY OTHERWISE BE LAWFULLY MADE. IF MADE BY A PERSON WHO IS AN AUTHORISED PERSON UNDER FSMA, THE ISSUE OR DISTRIBUTION OF THIS DOCUMENT !N THE UNITED KINGDOM MAY ONLY BE MADE TO AND DIRECTED AT PERSONS WHO (lI) ARE INVESTMENT PROFESSIONALS WITHIN ARTICLE 14 OF THE FINANCIAL SERVICES AND MARKETS ACT 2000 (PROMOTION OF COLLECTIVE INVESTMENT SCHEMES) (EXEMPTIONS) ORDER 2001; OR (I}} ARE PERSONS TO WHOM THE PROMOTION MAY OTHERWISE BE LAWFULLY MADE. TRANSMISSION OF THIS DOCUMENT TO ANY OTHER PERSON IN THE UNITED KINGDOM iS UNAUTHORISED AND MAY CONTRAVENE THE FSMA. IN THE UNITED KINGDOM, PARTICIPATION IN THE COMPANY !S AVAILABLE ONLY TO SUCH PERSONS AND PERSONS OF ANY OTHER DESCRIPTION SHOULD NOT RELY ON THIS DOCUMENT. HOUSE_OVERSIGHT_024447

Page 17 - HOUSE_OVERSIGHT_024448

NON-GAAP FINANCIAL MEASURES EBITDA, Adjusted EBITDA and Adjusted EBITDAR (including pro forma presentations thereof) and the related ratios presented in this Memorandum are supplemental measures of our performance that are not required by, or presented in accordance with, generally accepted accounting principles in the U.S. (“GAAP”). EBITDA, Adjusted EBITDA and Adjusted EBITDAR are not measurements of our financial performance under GAAP and should not be considered as alternatives to net income, operating income or any other performance measures derived in accordance with GAAP, or as an alternative to cash flow from operating activities as a measure of our liquidity. EBITDA represents net income before net interest expense, income tax expense, depreciation (including impairment charges) and amortization. Pro forma presentations of EBITDA have also added back KinderCare Learning Centers, Inc.'s (“KinderCare”) discontinued operations, consistent with KLC’s treatment of center closures and sales and KinderCare’s historical presentation of EBITDA. Adjusted EBITDA represents EBITDA plus (i) expenses (minus gains) that we do not consider reflective of our ongoing operations after the KinderCare acquisition, as further described in this Memeorandum and (ii) management fees which are subordinated to our obligations on our 7%% senior subordinated notes (the “Notes") and which are added back in measuring our performance for purposes of our ability to incur debt under our indenture. Our actual and projected Adjusted EBITDA, where applicable, also exclude non- cash stock-based compensation expense, which is also excluded under our indenture; accruals under our stock appreciation rights (“SAR”) plan; and accruals under our long term incentive plan, which are non- cash at the time of award and vest and become payabie in three years subject to continued employment (with certain exceptions). Our pro forma Adjusted EBITDA for 2005 excludes restructuring and integration charges associated with the KinderCare acquisition and the cost of operating parallel organizations during the integration process, which management does not consider reflective of ongoing operations. Adjusted EBITDAR Is Adjusted EBITDA plus rent expense. We present EBITDA, Adjusted EBITDA and Adjusted EBITDAR because we consider them to be important supplemental measures of our perfermance and believe they are frequently used by securities analysts, investors and other interested parties in the evaluation of issuers, many of which present EBITDA and/or Adjusted EBITDA and/or Adjusted EBITDAR when reporting their results. We are basing our executive incentive compensation payments in part on our performance measured using Adjusted EBITDA including adjustments described herein. We also use financial measures similar to Adjusted EBITDA, though subject to certain different adjustments, in the senior credit facility that we entered into in connection with the KinderCare acquisition and the indenture governing the Notes to measure our compliance with covenants such as interest coverage and debt incurrence. Measures similar to Adjusted EBITDA are alsc widely used by us and others in our industry to evaluate and price potential acquisition candidates. For example, we evaluated the KinderCare acquisition and our 2003 acquisition of ARAMARK Educational Resources to a significant degree based on their historical and potential EBITDA, as adjusted for items we did not consider representative of post-acquisition operations. We believe EBITDA and Adjusted EBITDA facilitate operating performance comparisons from period to period and company to company by backing out potential differences caused by variations in capital structures (affecting relative interest expense), tax positions (such as the impact on periods or companies of changes in effective tax rates or net operating losses) and the age and beok depreciation of facilities and equipment (affecting relative depreciation expense}. We believe Adjusted EBITDAR is a useful measure of performance independent of occupancy costs. We calculate Adjusted EBITDA by adjusting EBITDA to eliminate the impact of a number of items we do not consider indicative of our ongoing operations and for the other reasons noted above. For the reasons indicated herein, you are encouraged to evaluate each adjustment and whether you consider it appropriate. In addition, in evaluating Adjusted EBITDA and Adjusted EBITDAR, you should be aware that in the future we may incur expenses similar to the adjustments in the presentation of Adjusted EBITDA and Adjusted EBITDAR. Our presentation of Adjusted EBITDA and Adjusted EBITDAR should not be construed as an inference that our future results will be unaffected by unusual or non-recurring items. HOUSE_OVERSIGHT_024448

Page 18 - HOUSE_OVERSIGHT_024449

EBITDA, Adjusted EBITDA and Adjusted EBITDAR have limitations as analytical tools, and you should not consider them in isolation, or as a substitute for analysis of our results as reported under GAAP. Some of these limitations are: @ they do not reflect our cash expenditures for capital expenditures or contractual commitments; @ they do not reflect the cost of our non-cash stock-based compensation or our SAR plan or long term incentive plan or the expense associated with allocating Profits Participation LP Units (as defined below) to employees; & they do not reflect changes in, or cash requirements for, our working capital; M@ they do not reflect the significant interest expense, or the cash requirements necessary to service interest or principal payments, on our indebtedness: B they do not reflect management fees; HB although depreciation and amortization are non-cash charges, the assets being depreciated and amortized will offen have to be replaced in the future, and our non-GAAP measures do not reflect cash requirements for such replacements or the related expense; @ they do not reflect the impact of earnings or charges resulting from the significant costs we have incurred in integrating KinderCare, and we are likely to incur significant integration costs in future acquisitions; @ other companies, including other companies in our industry, may calculate these measures differently than we do, limiting their usefulness as a comparative measure; and @ they do not comply with the requirements of Item 10(e) of Regulation S-K or Regulation G of the Securities and Exchange Commission (“SEC"). Because of these limitations, EBITDA, Adjusted EBITDA and Adjusted EBITDAR should not be considered as measures of discretionary cash available to us to invest in the growth of our business or reduce our indebtedness. We compensate for these limitations by relying on our GAAP results as well as these non-GAAP measures. For more information, see our consolidated financial statements and the notes io those statements included elsewhere in this Memorandum. FORWARD-LOOKING STATEMENTS This Memorandum contains forward-looking statements, which involve risks and uncertainties. You can identify forward-lcoking statements because they contain words such as “anticipates,” “expects,” "should," ‘intends,” “plans,” “believes,” “seeks,” “estimates,” "will," "may," “approximately" and similar expressions which concern, among other things, the Company's results of operations, financial condition, liquidity, prospects, growth, strategies and the industry in which the Company cperates. Examples include statements regarding anticipated growth in revenue, net income and EBITDA, expectations regarding the likelihood of recurrence of certain charges and gains, expectations regarding capital investments, and expectations regarding future cash generated from operations. These forward-looking statements are based on our management's current expectations, assumptions, estimates and projections about us and our industry. You are cautioned that actual results could differ from those 16 HOUSE_OVERSIGHT_024449

Sponsored

Page 19 - HOUSE_OVERSIGHT_024450

anticipated by the forward-looking statements. Investors are cautioned not to place undue reliance on the projections contained in this Memorandum or other models and forecasts they may receive or discuss in connection with this offering. Important factors that could cause our actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by those statements include, but are not limited to, those discussed under “Risk Factors,” elsewhere in this Memorandum. The following list represents some, but not necessarily all, of the factors that could cause actual results to differ from historical results or those anticipated or predicted by any forward-looking statements: E we may be unable to identify, consummate or obtain favorable terms on acquisitions of businesses or interests therein, which is a principal component of our growth strategy; @ our international expansion strategy is untested, and our acquisition and development of non-U.S. businesses may not be successful; @ the loss of any of our key management employees could adversely affect our business; @ we have a substantial level of indebtedness and plan to incur additional debt; H we face intense competition in the early childhood care and education services industry from numerous other types of providers; & we may acquire companies that are not well-established or experiencing financial difficulties; @ we rely on the management teams of our subsidiaries, who may not be able to operate them in accordance with our plans; @ we may acquire minority interests in various companies (such as k12 Inc. ("k12")) and we may not be able to protect our interests adequately in respect of such investments; @ we or our subsidiaries may be unable to raise additional financing which may be needed to satisfy certain of our subsidiaries’ working capital requirements; @ failure to comply with present or future applicable U.S. or foreign governmental regulation and licensing requirements could have a material adverse effect on our operations; @ activities of Knowledge Universe Learning Group LLC ("KULG”, the parent entity of the General Pariner and/or its Principals may be competitive with the Company; conflicts of interest may arise with the Principals and their affiliates; the Company may not engage in certain businesses; f litigation and adverse publicity concerning incidents at child care centers could hurt our reputation; @ our insurance policies may prove inadequate to cover claims, and we may be unable to maintain our existing coverage in the future at reasonable prices; @ factors beyond our control, such as economic conditions, could affect demand for our child care services; HOUSE_OVERSIGHT_024450

Page 20 - HOUSE_OVERSIGHT_024451

@ a loss or reduction of government funding for child care assistance programs or food reimbursement programs could adversely affect us; @ a termination or reduction of tax credits for child care could have a material adverse effect on our business; @ if we (or our subsidiaries) are unable to attract and retain sufficient qualified employees, if minimum wage rates increase or if our employees (cr our subsidiaries’ employees) unionize, our results of operations may be adversely affected; & our results of operations could be adversely affected if environmental contamination is discovered on any of our properties; and B material weaknesses in KLC’s internal controls discovered during KLC’s fiscal year 2005 audit. BACKGROUND DATA Industry and market data used throughout this Memorandum is based on independent industry publications, government publications, reports by market research firms and other published independent sources. Some data is also based on our good faith estimates, which are derived from our review of internal surveys and independent sources. Such information necessarily incorporates significant assumptions as to factual or other matters. Although we believe these sources are reliable, we have not independently verified the information from third party-sources or the assumptions on which such information is based and cannot guarantee its accuracy or completeness. Some of the industry data contained in this Memorandum has not been updated because we have been unable to obtain more recent data. Although we are not aware of trends contrary to those reflected in such data (except as otherwise stated), we cannot assure you that such data are indicative of current trends. TRADEMARKS The intellectual property portfolio of the Company includes registered and unregistered trademarks and service marks and collective trademarks that distinguish the services and products that it offers from those services and products offered by other companies. In addition, the Company has applied to register certain other trademarks, service marks and collective trademarks in the U.S. and other countries, and likely will seek to register additional marks in the future. A federal registration in the U.S. is effective for ten years and may be renewed for ten-year periods perpetually, subject only to required filings based on continued use of the mark by a registrant. It is possible that some of these applications to register additional marks will not result in registrations. KLC’s primary trademarks are “Knowledge Learning Corporation,” “Children's World,” “Knowledge Beginnings,” “Children's Discovery Centers” and “Medallion School Partnerships.” KinderCare owns and uses various registered and unregistered trademarks and service marks covering the name “KinderCare,” its schocihouse logo and a number of other names, siogans and designs, including “KinderCare at Work” and “Mulberry.” k12’s primary trademarks are the k12 star logo, the word mark and design, which are licensed from an entity controlled by the Principals. All other product and company names referred to in this Memorandum are trademarks and registered trademarks of their respective companies. HOUSE_OVERSIGHT_024451

Page 21 - HOUSE_OVERSIGHT_024452

1. EXECUTIVE SUMMARY The following summary is qualified in its entirety by the more detailed information appearing elsewhere in this Memorandum. You should carefully consider the information set forth under “Risk Factors”. The term “KUE” refers only to Knowledge Universe Education L.P, a Cayman Islands exempted limited partnership. The terms “Knowledge Universe Education”, the “Company”, “we”, “us” and “our” refer to KUE and, where applicable, its subsidiaries, and do not refer to the Agents. In November 2005, KLC separated its education operations (“KLC OpCo”) from its real estate assets (“KLC PropCo’). 1.1. Company Overview KUE is the third largest for-profit education company in the world and the largest for-profit education company in the pre-school to 12th grade segment (“pre-K-12”) in the world. While the Company's operations are currently based within the U.S., the proceeds from this transaction will be used primarily to expand KUE’s education platform both globally and across the pre-K-12 education continuum. KUE's existing portfolio of assets consists of: (i) KLC OpCo, the leading early childhood education (“ECE”) company with 2,507 locations in 39 states Knowledge Universe KUE Management Inc. and the District of Columbia and nearly two and a SCedo mae (General Partner) half times larger than its next closest competitor in 17.9% to 40.0%" terms of revenue; Knowledge Learning K42 Inc. (ii) KLC PropCo, one of the largest education based cool on tele real estate portfolios in the U.S. consisting of 845 early childhood centers located in 37 states; and (iii) A significant interest in k12, an online curriculum provider and kindergarten through 12th grade management company, currently serving over 25,000 students as the largest operator of online virtual schools in the U.S. The principal owners of KUE are Michael Milken, Lowell Milken and Steven Green (collectively the “Principals”). Michael Milken and Lowell Milken each has more than two decades of experience in the education sector through involvement in several for-profit and not-for-profit initiatives. Steven Green, former U.S. ambassador to Singapore, has more than two decades of experience as an international industrialist leading major corporate restructurings and expansions in manufacturing, housing, consumer products, retail and real estate enterprises. The Company represents the Principals’ sole vehicle for equity investment opportunities in the pre-K-12 sector going forward. The Principals founded the Company and its affiliated companies over the past decade based on their vision of a world where competition for human capital? is becoming the driving force of economic prosperity. To remain competitive in the world economy, countries will be forced to invest heavily in the development of their human capital. The Principals believe that an investment made in an individual's education, especially at a young age, is the most effective way to build human capital and thereby increase that individual’s lifelong productivity. As the largest for-profit provider of ECE in the world, the Company is well positioned to capitalize on these trends. ’ The 12.4% minority position is held by various investors. ? KUE’s ownership varies depending on the liquidation value or sale value of k12 and according to the preference of the various securities KUE owns, At higher valuations, KUE's percentage ownership is lower, See “k12 Inc, (k12) — k12 Equity.” * The economic theory of Human Capital Policy was first published by University of Chicago professor James Heckman in Human Capital Policy, dated August 2002, 19 HOUSE_OVERSIGHT_024452

Sponsored

Page 22 - HOUSE_OVERSIGHT_024453

Education is one of the largest sectors in the world, representing approximately 5% of global gross national income of $48 trillion.* In 2005 in the U.S. alone, education was a $1 trillion market.” Education is still predominantly provided by public / governmental eniities in most countries including the U.S. KUE believes that the industry will converge towards a more balanced public / private system, similar to the evolution observed in the 20th century in other major industries such as healthcare, infrastructure and telecommunications. The Company's strategy is to grow its existing platforms both damestically and internationally and to expand its assets globally across the pre-K-12 education continuum. In addition to its current investments in ECE and online curriculum, KUE will seek to expand by acquiring education companies offering services or products that can complement its current offering. KUE believes that owning a diversified porticlio of assets in the pre-K-12 education space will allow it to leverage content and best practices across multiple constituencies and to multiple markets. KUE’s strategy in U.S. ECE is to expand its existing platform through the opening of new centers, opportunistic acquisitions of smaller competitors and the sale of education-related products and services through existing channels. Internationally, KUE has identified several near-term opportunities fo expand into Europe, the Middle-East and Asia, with some of these opportunities in advanced stages of preparation. Management has a history of successfully growing through acquisitions. In May 2003, KLC acquired Aramark Educational Resources ("AER"), a company three times its size in terms of revenue. Management completed the integration of AER in approximately 12 months, realizing approximately $10 million in net annual synergies and improving operational performance. In January 2005, the Company acquired KinderCare, the largest provider of ECE services in the U.S. at the time. Management achieved approximately $25 million in net annualized synergies through the closing of under-performing centers and the rationalization cf corporate overhead. In November 2005, KLC separated its education operations (KLC OpCo) from its real estate assets (KLC PropCo}. Management believes this division allows KLC OpCo management fo focus on the core business of operating and growing the ECE business while the maximization of the valuable educational real estate portfolio is managed and expanded by a professional real estate firm, Greenstreet Real Estate Partners (formerly Greenstreet Realty Partners, L.P.}, and also represents management's view of KLC’s component businesses. Management believes that KUE presents an attractive financial profile with its combination of businesses: {i} KLC OpCo, which generated $1.48 billion in pro forma revenue and $150 million in pro forma Adjusted EBITDA’ in 2005, is projected to grow organically to $2.3 billion and $320 million by 2011, respectively and to generate operating cash flow growing from $72 million in 2005 to $214 million in 2011; (i) a real estate portfolio in KLC PropCo that generated an additional $88 million in pro forma EBITDA in 2005; and (iii) an investment in k12, which continues to deliver top line growth in excess of 25% and has seen its revenue grow at a 133% compounded annual growth rate over the last three fiscal years (from $6.7 million in 2002 to $85.1 million in 2005). 1.2. Investment Rationale 1.2.1 Attractive Industry Characteristics H The global for-profit education market is large and growing * Source: UNESCO institute for Statistics database. ® Source: US Department of Education National Center for Education Statistics and Training Magazine and Harris Nesbitt research. ° Pro forma for the acquisition of KinderCare and the separation of KLC into KLC OpCo and KLC PrapCo. 20 HOUSE_OVERSIGHT_024453

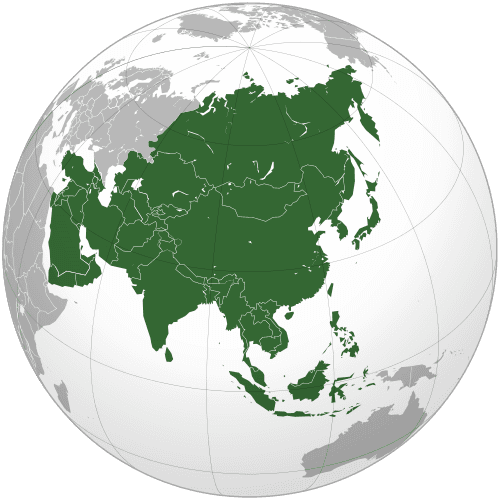

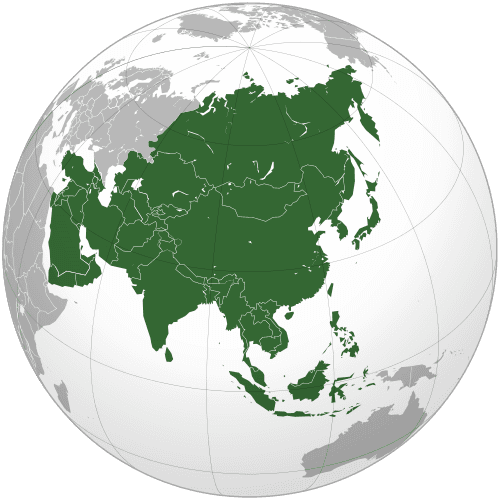

Page 23 - HOUSE_OVERSIGHT_024454

Education is one of the largest sectors in the world and represents a large portion of a country's investmenis — Represents approximately 5% of global gross national income of $48 trillion. In the U.S. alone, education represents a $1 trillion market with for-profit education accounting for approximately $81 billion or 7.8% of the overall market. — The pre-K-12 segment of the education market is approximately a $610 billion market, with for- profit pre-K-12 education accounting for approximately $37.4 billion, over 6.1% of the pre-K-12 market. The for-profit education secter is growing at an attractive rate — U.S. education spending has grown at a stable compound annual growth rate ("CAGR”) of 5.7% since 1993. The for-profit component of this industry (pre-K-12, post secondary and corporate training) is projected to grow faster than the overall historical industry growth rate, at a 7.4% annual rate, reflecting the increasing importance of for-profit operations in the sector, to reach a market size of $116 billion by 2010.’ — In addition, these estimates do not refiect the growing segment of direct to consumer educational materials such as supplemental tutoring, which represented an estimated $20 billion of additional spending in 2004. EZ Increasing competition for human capital To remain competitive in the global economy, countries are investing heavily in the development of their human capital, especially at young ages — According to the World Bank's Worid Education Indicators, worldwide enrollment rates in pre- primary education increased by 37% from 1995 to 2003." — KUE believes that education companies will become significantly more valuable as countries become increasingly aware of the competitive advantages afforded by education. Of the top 100 global companies by market cap, not a single education company is represented on the list. As globalization of the economy and improving technologies flatten the playing field, demand for more standardized education across regions increases — KUE believes that increasingly global education standards, enhanced workforce mobility and new technologies are catalysts of worid competition for human capital. mM Several international growth opportunities 1 The Company ts starting to execute on its international development strateqy — In the near term, the Company is focusing on opportunities identified in the United Kingdom, Saudi Arabia, the United Arab Emirates and China. Depending on the state and organization of each country’s education sector, KUE’s development will be executed through cooperation with government authorities, outright acquisitions and/or the establishment of partnerships with key local players. ” Source: Harris Nesbitt, Education and Training, September 20085. ® Source: Education Trends in Perspective: Analysis of the World Education Indicators, 2005. 21 HOUSE_OVERSIGHT_024454

Page 24 - HOUSE_OVERSIGHT_024455

— These initiatives could provide three key regional platiorms for further development and consolidation. In the medium term, numerous opportunities for KUE should be generated by the increasing demand for quality for-profit educational offerings by governments and citizens around the world — Competitive pressures for development of human capital, deficiencies of national education systems, growth of a middle-class in China, India and the Middle East, demand for English language offerings and changing demographics are some of the primary drivers of increased demand internationally. — In China alone, 274 million children are under the age of 15, and 100 million are single-children under the age of 25, as a result of the one-child policy. These demographics result in large demand for education and increased spending capacity per child. @ Favorable demographic trends and customer behavior in the U.S. Growing number of working mothers — According to the Bureau of Labor Statistics (BLS) estimates, women are expected to represent nearly 48% of the total U.S. workforce by 2012, up from 46.6% in 2002.9 — Inthe ULS., approximately 60% of mothers with children under the age of six are employed. Increasing birth rate -— There are approximately 24 million children under the age of five in the U.S. today. According to the U.S. Census Bureau, absolute birth rates are going to continue to increase, and the population of children in the U.S. five and under is expected to increase to approximately 27 million by 2015.° Essential nature of the service to fhe consumer — As with healthcare, parents are primarily focused on the quality of the service that their child receives and the proximity of the center to their home or work; price is typically a secondary consideration. By relieving parents of the requirement fo stay at home with their children, ECE allows both men and women to participate in the workforce and generate income for the household. 1.2.2 Compelling Business Prefile @ KUE presents an attractive financial profile For the fiscal year ended December 31, 2005, KLC OpCo had operations in 39 states and Washington D.C. and generated pro forma revenue of $1.48 billion — With organic growth projected to be in excess of 5% per annum through 2011, geographic diversity and double-digit Adjusted EBITDA margins, KLC OpCo can generate attractive returns. — KLC OpCo generates strong operating cash flow (48% of 2005 pro forma Adjusted EBITDA) which provides significant resources to fund Investment and support equity return-enhancing leverage, a * Source: Harris Nesbitt, Education and Training, September 2005, * Source: Population Projections Branch, U.S. Census Bureau, "U.S. interim Projections by Age, Sex, Race and Hispanic Origin,” May 2004. 22 HOUSE_OVERSIGHT_024455

Sponsored