HOUSE_OVERSIGHT_020824 - HOUSE_OVERSIGHT_021089

USA Inc.

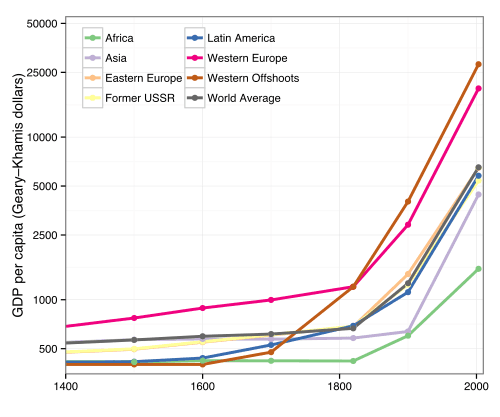

Document HOUSE_OVERSIGHT_020824 is a report titled "About USA Inc.," created by Mary Meeker and compiled in February 2011. It analyzes the federal government's financial situation as if it were a business.

This House Oversight Committee document, consisting of 266 pages, presents a detailed examination of the United States' financial standing in 2011, framing it as "USA Inc.". The report includes a text summary and a large PowerPoint presentation with data-rich observations, aiming to provide relevant context for discussions about America's financials. It analyzes federal revenue drivers, expense growth history, and potential scenarios for achieving positive cash flow.

Key Highlights

- •The document analyzes the U.S. federal government's financials as if it were a business, referred to as "USA Inc."

- •Key individuals involved or providing inspiration include Mary Meeker, Al Gore, and Barack Obama.

- •The report includes a comprehensive slide presentation with data-driven observations about America's financial present and future.

Frequently Asked Questions

Books for Further Reading

Perversion of Justice: The Jeffrey Epstein Story

Julie K. Brown

Investigative journalism that broke the Epstein case open

Filthy Rich: The Jeffrey Epstein Story

James Patterson

Bestselling account of Epstein's crimes and network

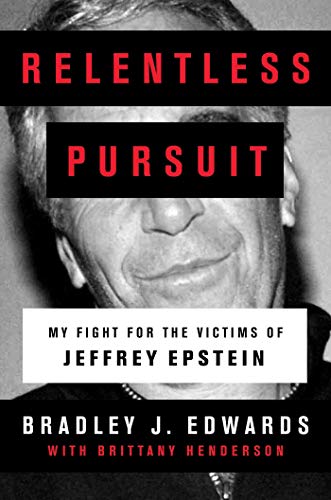

Relentless Pursuit: My Fight for the Victims of Jeffrey Epstein

Bradley J. Edwards

Victims' attorney's firsthand account

Document Information

Bates Range

HOUSE_OVERSIGHT_020824 - HOUSE_OVERSIGHT_021089

Pages

266

Source

House Oversight Committee

Date

February 24, 2011

Original Filename

USA_Inc.pdf

File Size

4.45 MB

Document Content

Page 1 - HOUSE_OVERSIGHT_020824

No text available for this page

Page 2 - HOUSE_OVERSIGHT_020825

About USA Inc. Created and Compiled by Mary Meeker February 2011 This report looks at the federal government as if it were a business, with the goal of informing the debate about our nation’s financial situation and outlook. In it, we examine USA Inc.’s income statement and balance sheet. We aim to interpret the underlying data and facts and illustrate patterns and trends in easy-to-understand ways. We analyze the drivers of federal revenue and the history of expense growth, and we examine basic scenarios for how America might move toward positive cash flow. Thanks go out to Liang Wu and Fred Miller and former Morgan Stanley colleagues whose contributions to this report were invaluable. In addition, Richard Ravitch, Emil Henry, Laura Tyson, Al Gore, Meg Whitman, John Cogan, Peter Orszag and Chris Liddell provided inspiration and insights as the report developed. It includes a 2-page foreword; a 12-page text summary; and 460 PowerPoint slides containing data-rich observations. There’s a lot of material — think of it as a book that happens to be a slide presentation. We hope the slides in particular provide relevant context for the debate about America’s financials. To kick-start the dialogue, we are making the entire slide portion of the report available as a single work for non-commercial distribution (but not for excerpting, or modifying or creating derivatives) under the Creative Commons license. The spirit of connectivity and sharing has become the essence of the Internet, and we encourage interested parties to use the slides to advance the discussion of America’s financial present and future. If you would like to add your own data-driven observations, contribute your insights, improve or clarify ours, please contact us to request permission and provide your suggestions. This document is only a starting point for discussion; the information in it will benefit greatly from your thoughtful input. This report is available online and on iPad at www.kpcb.com/usainc In addition, print copies are available at www.amazon.com CB www.kpcb.com USA Inc. _ ii HOUSE_OVERSIGHT_020825

Page 3 - HOUSE_OVERSIGHT_020826

Foreword George P. Shultz, Paul Volcker, Michael Bloomberg, Richard Ravitch and John Doerr February 2011 Our country is in deep financial trouble. Federal, state and local governments are deep in debt yet continue to spend beyond their means, seemingly unable to stop. Our current path is simply unsustainable. What to do? A lot of people have offered suggestions and proposed solutions. Few follow the four key guideposts to success that we see for setting our country back on the right path: 1) create a deep and widely held perception of the reality of the problem and the stakes involved; 2) reassure citizens that there are practical solutions; 3) develop support in key constituencies; and 4) determine the right timing to deliver the solutions. USA Inc. uses each of these guideposts, and more; it is full of ideas that can help us build a better future for our children and our country. First, Mary Meeker and her co-contributors describe America’s problems in an imaginative way that should allow anyone to grasp them both intellectually and emotionally. By imagining the federal government as a company, they provide a simple framework for understanding our current situation. They show how deficits are piling up on our income statement as spending outstrips income and how our liabilities far exceed nominal assets on our balance sheet. USA Inc. also considers additional assets — hard to value physical assets and our intangible wealth — our creativity and energy and our tradition of an open, competitive society. Additionally, the report considers important trends, pointing specifically to an intolerable failure to educate many in the K-12 grades, despite our knowledge of how to do so. And all these important emotional arguments help drive a gut reaction to add to data provided to reinforce the intellectual reasons we already have. Second, USA Inc. provides a productive way to think about solving our challenges. Once we have created an emotional and intellectual connection to the problem, we want people to act and drive the solution, not to throw up their hands in frustration. The authors’ ingenious indirect approach is to ask what a turnaround expert would do and what questions he or she would ask. The report describes how we first stumbled into this mess, by failing to predict the magnitude of program costs, by creating perverse incentives for excessive behavior, and by missing important trends. By pointing to the impact of individual responsibility, USA /nc. gives us reason to believe that a practical solution exists and can be realized. CB www.kpcb.com USA Inc. © iii HOUSE_OVERSIGHT_020826

Sponsored

Page 4 - HOUSE_OVERSIGHT_020827

Third, the report highlights how powerful bipartisan constituencies have emerged in the past to tackle great issues for the betterment of our nation, including tax reform, civil liberties, healthcare, education and national defense. Just as presidents of both parties rose to the occasion to preside over the difficult process of containment during the half-century cold war, we know we can still find leaders who are willing to step up and overcome political or philosophical differences for a good cause, even in these difficult times. Finally, the report makes an important contribution to the question of timing. Momentum will follow once the process begins to gain support, and USA Inc. should help by stimulating broad recognition and understanding of the challenges, by providing ways to think about solutions, and by helping constituencies of action to emerge. As the old saying goes, “If not now, when? If not us, who?” With this pioneering report, we have a refreshing, business-minded approach to understanding and addressing our nation’s future. Read on...you may be surprised by how much you learn. We hope you will be motivated to help solve the problem! CB www.kpcb.com USA Inc. — iv HOUSE_OVERSIGHT_020827

Page 5 - HOUSE_OVERSIGHT_020828

Table of Contents About USA ING. ee ii Foreword Ce ee ee ee ee ee eee ee ee ee ee ee ee ee iii Summary Ce 2 ee ee ee ee ee ee eee eee ee ee eee ee ee ee ee ee ee Vii Introduction Pe ee ee ee ee ee ee ee ee ee ee ee ee 5 High-Level Thoughts on Income Statement/Balance Sheet -------:-::-: 25 Income Statement Drilldown ee 53 Entitlement Spending Pe ee 72 Medicaid « - 0 tt tte 94 Medicare « * 0 tt ttt ee 100 Unemployment Benefits Pe ee 121 Social Security Se ee 129 Rising Debt Level and Interest Payments +--+ - sss tt ttt tt tts 142 Debt Level Se 145 Effective Interest Rates Pe ee 161 Debt Composition Pe ee er 168 Periodic Large One-Time Charges +++ +s ttt ttt ttt tt ts 177 TARP = ft tt 188 Fannie Mae/ Freddie Mac =: * : tt tt tt tt ee ee 193 ARRA 2 ot ttt 200 Balance Sheet Drilldown += - st tt ttt 209 CB www.kpcb.com USA Inc. Vv HOUSE_OVERSIGHT_020828

Page 6 - HOUSE_OVERSIGHT_020829

What Might a Turnaround Expert Consider?: ----s- sess sees eee 221 High-Level Thoughts on How to Turn Around USA Inc.’s Financial Outlook - --- 237 Focus onExpenses - ++ ttt ttt ee 953 Reform Entitlement Programs «++ ss ttt ttt tt tt te 255 Restructure Social Security - + - tt ttt ttt es 256 Restructure Medicare & Medicaid --- +--+ +--+ rrr eter eee 268 Focus on Operating Efficiency - + ss ttt ttt tt tt ee 329 Review Wages & Benefits ---- str es 335 Review Government Pension Plans -- +--+ +++ + +r rrr tree 338 Review Role of Unions ---: +: ct ttt ttt ee 342 Review Cost Structure & Headcount ---- +++ etree 345 Review Non-Core 'Business' for Out-Sourcing ----- +--+ rrr 349 Focus on Revenues «+++ ttt ee 355 Drive Sustainable Economic Growth -- +--+ tr rt ttt ee 356 Invest in Technology / Infrastructure / Education --- +s sss: 366 Increase /Improve Employment ---- +s sett t ttre 383 Improve Competitiveness -- +s ttt ttt ttt es 389 Consider Changing Tax Policies «+++ ttt tt tt tt tt ee 395 Review TaxRateS -- ttt e e 396 Reduce Subsidies / Tax Expenditures /Broaden Tax Base -:-::::: 400 Consequences of Inaction: ------ ett ttt 413 Short-Term, Long-Term «st ttt ttt ee 415 Public Debt, Net Worth vs. Peers = st ttt tt ttt 416 Lessons Learned From Historical Debt Crisis - -- +--+ +++ eet etree 422 General Motors -- tt tt 431 Summary «ct ee 437 Appendix -- ss ttt 453 Glossary «tt ee xix Index + # © #e eee we eee ew Ew ww ew ew ew ew ee ee Xxvii CB www.kpcb.com USA Inc. _ vi HOUSE_OVERSIGHT_020829

Sponsored

Page 7 - HOUSE_OVERSIGHT_020830

Summary Imagine for a moment that the United States government is a public corporation. Imagine that its management structure, fiscal performance, and budget are all up for review. Now imagine that you’re a shareholder in USA Inc. How do you feel about your investment? Because 45% of us own shares in publicly traded companies, nearly half the country expects quarterly updates on our investments. But although 100% of us are stakeholders in the United States, very few of us look closely at Washington’s financials. If we were long-term investors, how would we evaluate the federal government’s business model, strategic plans, and operating efficiency? How would we react to its earnings reports? Nearly two-thirds of all American households pay federal income taxes, but very few of us take the time to dig into the numbers of the entity that, on average, collects 13% of our annual gross income (not counting another 15- 30% for payroll and various state and local taxes). We believe it’s especially important to pay closer attention to one of our most important investments. As American citizens and taxpayers, we care about the future of our country. As investors, we’re in an on-going search for data and insights that will help us make more informed investment decisions. It’s easier to predict the future if one has a keen understanding of the past, but we found ourselves struggling to find good information about America’s financials. So we decided to assemble — in one place and in a user-friendly format — some of the best data about the world’s biggest “business.” We also provide some historical context for how USA Inc.’s financial model has evolved over decades. And, as investors, we look at trend lines which help us understand the patterns (and often future directions) of key financial drivers like revenue and expenses. The complexity of USA Inc.’s challenges is well Known, and our presentation is just a starting point; it’s far from perfect or complete. But we are convinced that citizens — and investors — should understand the business of their government. Thomas Jefferson and Alexis de Tocqueville knew that — armed with the right information — the enlightened citizenry of America would make the right decisions. It is our humble hope that a transparent financial framework can help inform future debates. In the conviction that every citizen should understand the finances of USA Inc. and the plans of its “management team,” we examine USA Inc.’s income statement and balance sheet and present them in a basic, easy-to-use format. We summarize our thoughts in PowerPoint form and in this brief text summary at www.kpcb.com/usainc. We encourage people to take our data and thoughts and study them, critique them, augment them, share them, and make them better. There’s a lot of material — think of it as a book that happens to be a slide presentation. CB www.kpcb.com USA Inc. _ vii HOUSE_OVERSIGHT_020830

Page 8 - HOUSE_OVERSIGHT_020831

There are two caveats. First, we do not make policy recommendations. We try to help clarify some of the issues in a straightforward, analytical way. We aim to present data, trends, and facts about USA Inc.’s key revenue and expense drivers to provide context for how its financials have reached their present state. Our observations come from publicly available information, and we use the tools of basic financial analysis to interpret it. Forecasts generally come from 3rd-party agencies like the Congressional Budget Office (CBO), the nonpartisan federal agency charged with reviewing the financial impact of legislation. Second, the ‘devil is in the details.’ For US policy makers, the timing of material changes will be especially difficult, given the current economic environment. By the standards of any public corporation, USA Inc.’s financials are discouraging. True, USA Inc. has many fundamental strengths. On an operating basis (excluding Medicare and Medicaid spending and one-time charges), the federal government’s profit & loss statement is solid, with a 4% median net margin over the last 15 years. But cash flow is deep in the red (by almost $1.3 trillion last year, or -$11,000 per household), and USA Inc.’s net worth is negative and deteriorating. That net worth figure includes the present value of unfunded entitlement liabilities but not hard-to-value assets such as natural resources, the power to tax or mint currency, or what Treasury calls “heritage” or “stewardship assets” like national parks. Nevertheless, the trends are clear, and critical warning signs are evident in nearly every data point we examine. F2010 Cash Flow = -$1.3 Trillion; Net Worth = -$44 Trillion With a Negative Trend Line Over Past 15 Years USA Inc. Annual Cash Flow & Year-End Net Worth, F1996 — F2010 GOOD nnn ee eee eee cece reece eet ce cece ence nentete eae cneeceenacaeaeaneatateneaneatateneaeeataseaeasenctatastaenseseacnseasnscesnaness $15,000 0 go = | a 1 $0 = _ =< 8 = 8 A TF GAOO Rape ee MB ~-- «-$15,000 - 2 £ xo} ° it = = = % 2 (OME CU) Bee eee ee ncaa, Cee a ~-- -$30,000 > 7 <4 2 mi One-Time Expenses* ul $1,200 mmm Cash Flow (left axis) SR -— f -$45,000 =—O= Net Worth (right axis) BA COD -$60,000 F1996 F1998 F2000 F2002 F2004 F2006 F2008 F2010 Note: USA federal fiscal year ends in September; Cash flow = total revenue — total spending on a cash basis; net worth includes unfunded future liabilities from Social Security and Medicare on an accrual basis over the next 75 years. *One-time expenses in F2008 include $14B payments to Freddie Mac; F2009 includes $2798 net TARP payouts, $97B payment to Fannie Mae & Freddie Mac and $40B stimulus spending on discretionary items; F2010E includes $26B net TARP income, $1378 stimulus spending and $41B payment to Fannie Mae & Freddie Mac. F2010 net worth improved dramatically owing to revised actuarial estimates for Medicare program resulted from the Healthcare reform legisiation. For mare definitions, see next slide. Source: cash flow per White ke House Office of Management and Budget; net worth per Dept. of Treasury, “2010 Financial Report of the U.S. Government.” hs www.kpcb.com USA Inc. | Summary CB www.kpcb.com USA Inc. _ viii HOUSE_OVERSIGHT_020831

Page 9 - HOUSE_OVERSIGHT_020832

Underfunded entitlements are among the most severe financial burdens USA Inc. faces. And because some of the most underfunded programs are intended to help the nation’s poorest, the electorate must understand the full dimensions of the challenges. Unfunded Entitlement (Medicare + Social Security) + Underfunded F2010 USA Inc. Revenues + Expenses At A Glance Entitlement Expenditures (Medicaid) = Among Largest Long-Term Liabilities on USA Inc.'s Balance Sheet F2010 F2010 USA Inc. Expenses = USA Balance Sheet Liabilities Composition, F2010 Revenues = $3.5T Entitlement Programs $2.2T Net Interest Payment Discretionary S496p One-Time Items Unfunded Medicaid* $152B Social "Wadicare. Other Security Medicare c ' $707B $35.3T ‘orporate ivi Income Tax Income Tax Non-Defense Unfunded $22.8T $191B % $8998 Discretionary 12% S431B deral Veteran Federal ‘ai ‘edera Employee zi Debt Other Benefits Benefits $1.6T $2.1T $3.7T $9.1T Social . Defense Medicare + Federal es Medicaid wssiraoe Tax ease 2 2 ) Unemployment Insurance + Other Entitlements $553B Social Security $7.9T Note: USA federal fiscal year ends in September; tinalividux defense discretionary induces federal spending on edi KP KP EE www kpcb. com USA Inc. | Summary 1H worn. kpc. com Some consider defense outlays — which have nearly doubled in the last decade, to 5% of GDP — a principal cause of USA Inc.’s financial dilemma. But defense spending is still below its 7% share of GDP from 1948 to 2000; it accounted for 20% of the budget in 2010, compared with 41% of all government spending between 1789 and 1930. The principal challenges lie elsewhere. Since the Great Depression, USA Inc. has steadily added “business lines” and, with the best of intentions, created various entitlement programs. They serve many of the nation’s poorest, whose struggles have been made worse by the recent financial crisis. Apart from Social Security and unemployment insurance, however, funding for these programs has been woefully inadequate — and getting worse. Entitlement expenses amount to $16,000 per household per year, and entitlement spending far outstrips funding, by more than $1 trillion (or $9,000 per household) in 2010. More than 35% of the US population receives entitlement dollars or is on the government payroll, up from ~20% in 1966. Given the high correlation of rising entitlement income with declining savings, do Americans feel less compelled to save if they depend on the government for their future savings? It is interesting to note that in China the household savings rate is ~36%, per our estimates based on CEIC data, in part due to a higher degree of self-reliance — and far fewer established pension plans. In the USA, the personal savings rate (defined as savings as percent of disposable income) was 6% in 2010 and only 3% from 2000 to 2008. CB www.kpcb.com USA Inc. ix HOUSE_OVERSIGHT_020832

Sponsored

Page 10 - HOUSE_OVERSIGHT_020833

Millions of Americans have come to rely on Medicare and Medicaid — and spending has skyrocketed, to 21% of USA Inc.’s total expenses (or $724B) in F2010, up from 5% forty years ago. Together, Medicaid and Medicare — the programs providing health insurance to low-income households and the elderly, respectively — now account for 35% of total healthcare spending in the USA. Since their creation in 1965, both programs have expanded markedly. Medicaid now serves 16% of all Americans, compared with 2% at its inception; Medicare now serves 15% of the population, up from 10% in 1966. As more Americans receive benefits and as healthcare costs continue to outstrip GDP growth, total spending for the two entitlement programs is accelerating. Over the last decade alone, Medicaid spending has doubled in real terms, with total program costs running at $273 billion in F2010. Over the last 43 years, real Medicare spending per beneficiary has risen 25 times, driving program costs well (10x) above original projections. In fact, Medicare spending exceeded related revenues by $272 billion last year. Amid the rancor about government’s role in healthcare spending, one fact is undeniable: government spending on healthcare now consumes 8.2% of GDP, compared with just 1.3% fifty years ago. Total Government* Healthcare Spending Increases are Staggering — Up 7x as % of GDP Over Five Decades vs. Education Spending Only Up 0.6x USA Total Government Healthcare vs. Education Spending as % of GDP, 1960 — 2009 erms 8% 65 enema neeinnumuoninenienison ng Al gece 6 gpa Ermer Spending as % of GDP ——Total Government (Federal + State + Local} Spending on Healthcare \ ’ ——Total Government (Federal + State + Local} Spending on Education Yo oot 1960 1964 1968 1972 1976 1980 1984 1988 1992 1996 2000 2004 2008 Note: “Total government spending on heaithcare includes Medicare, Medicaid and other programs such as federa/ employee and veteran health benefits, total government spending on education includes spending on pre-primary through KP tertiary education programs. Source: Dept. of Education, Dept. of Heaith & Human Services. EI www. kpcb.com USA Inc, | Summary The overall healthcare funding mix in the US is skewed toward private health insurance due to the predominance of employer-sponsored funding (which covers 157MM working Americans and their families, or 58% of the total population in 2008 vs. 64% in 1999). This mixed private-public funding scheme has resulted in implicit cross-subsidies, whereby healthcare providers push KP CB www.kpcb.com USA Inc. =X HOUSE_OVERSIGHT_020833

Page 11 - HOUSE_OVERSIGHT_020834

costs onto the private market to help subsidize lower payments from public programs. This tends to help drive a cycle of higher private market costs causing higher insurance premiums, leading to the slow erosion of private market coverage and a greater enrollment burden for government programs. The Patient Protection and Affordable Care Act, enacted in early 2010, includes the biggest changes to healthcare since 1965 and will eventually expand health insurance coverage by ~10%, to 32 million new lives. Increased access likely means higher spending if healthcare costs continue to grow 2 percentage points faster than per capita income (as they have over the past 40 years). The CBO sees a potential $143B reduction in the deficit over the next 10 years, but this assumes that growth in Medicare costs will slow — an assumption the CBO admits is highly uncertain. Unemployment Insurance and Social Security are adequately funded...for now. Their future, unfortunately, isn’t so clear. Unemployment Insurance is cyclical and, apart from the 2007-09 recession, generally operates with a surplus. Payroll taxes kept Social Security mainly at break-even until 1975-81 when expenses began to exceed revenue. Reforms that cut average benefits by 5%, raised tax rates by 2.3%, and increased the full retirement age by 3% (to 67) restored the system’s stability for the next 25 years, but the demographic outlook is poor for its pay-as-you-go funding structure. In 1950, 100 workers supported six beneficiaries; today, 100 workers support 33 beneficiaries. Since Social Security began in 1935, American life expectancy has risen 26% (to 78), but the “retirement age’ for full benefits has increased only 3%. Regardless of the emotional debate about entitlements, fiscal reality can’t be ignored — if these programs aren’t reformed, one way or another, USA Inc.’s balance sheet will go from bad to worse. Federal Government Spending Had Risen to 24% of GDP in 2010, Up From an Average of 3% From 1790 to 1930 Federal Government Spending as % of GDP, 1790 — 2010 ee sssceeeeeentennes 24% in 2010 eS aE 3% Trendline Average 15% - 1790-1930 Federal Spending as % of GDP saree UneeeeneenenneUeeeeeccecnecccncenn | REE VW tes eee OY 1790 1810 1830 1850 1870 1890 1910 1930 1950 1970 1990 2010 Source: Federal spending per Series Y 457-465 in "Historical Statistics of the United States, Colonial Times to 1970, Part il and per White House OMB. GDP prior to 1930 per Louis Johnston and Samuel H. Williamson, “What Was the U.S. GDP Then?" KP MeasuringWorth, 2010. GDP post 1930 per White House OMB. Neither federai spending nor GDP data are adjusted for inflation. (aE wew. kpcb.com USA Inc. | Summary KP CB www.kpcb.com USA Inc. xi HOUSE_OVERSIGHT_020834

Page 12 - HOUSE_OVERSIGHT_020835

Entitlement Spending Increased 11x While Real GDP Grew 3x Over Past 45 Years USA Real Federal Expenses, Entitlement Spending, Real GDP % Change, 1965 — 2010 OT ° Entitlement Expenses Total Expenses 1000% -- ~~ +10.6x Entitlement Programs — =Real GDP BOO sserresccsascsesnancsensaran-sansnansnnamneraat 0st SASEG SAIN ASSES E ROBERT ES SERIES EES EASES OPO gMMNSO Total ce _ Aien Expenses +3.3X % Change From 1965 CO ee Real GDP —_ —_ oo oe QV oot 1965 1969 1973 1977 1981 1985 1989 1993 1997 2001 2005 2009 iD Note: Data adjusted for inflation. Source: White House Office of Management and Budget. a PS sacs rpeo com USA Inc. | Summary Take a step back, and imagine what the founding fathers would think if they saw how our country’s finances have changed. From 1790 to 1930, government spending on average accounted for just 3% of American GDP. Today, government spending absorbs closer to 24% of GDP. It’s likely that they would be even more surprised by the debt we have taken on to pay for this expansion. As a percentage of GDP, the federal government’s public debt has doubled over the last 30 years, to 53% of GDP. This figure does not include claims on future resources from underfunded entitlements and potential liabilities from Fannie Mae and Freddie Mac, the Government Sponsored Enterprises (GSEs). If it did include these claims, gross federal debt accounted for 94% of GDP in 2010. The public debt to GDP ratio is likely to triple to 146% over the next 20 years, per CBO. The main reason is entitlement expense. Since 1970, these costs have grown 5.5 times faster than GDP, while revenues have lagged, especially corporate tax revenues. By 2037, cumulative deficits from Social Security could add another $11.6 trillion to the public debt. The problem gets worse. Even as USA Inc.’s debt has been rising for decades, plunging interest rates have kept the cost of supporting it relatively steady. Last year’s interest bill would have been 155% (or $290 billion) higher if rates had been at their 30-year average of 6% (vs. 2% in 2010). As debt levels rise and interest rates normalize, net interest payments could grow 20% or more annually. Below-average debt maturities in recent years have also kept the Treasury’s borrowing costs down, but this trend, too, will drive up interest payments once interest rates rise. CB www.kpcb.com USA Inc. — xii HOUSE_OVERSIGHT_020835

Sponsored

Page 13 - HOUSE_OVERSIGHT_020836

Can we afford to wait until the turning point comes? By 2025, entitlements plus net interest payments will absorb all — yes, all — of USA Inc.'s revenue, per CBO. Entitlement Spending + Interest Payments Alone Should Exceed USA Inc. Total Revenue by 2025E, per CBO Entitlement Spending + Interest Payments vs. Revenue as % of GDP, 1980 — 2050E a —— Revenue 30% . —o—Entitlement Spending + Net fo pr. Interest Payments 20% eager 10% — poo Total Revenue & Entitlement + Net Interest Payments as % of GDP 0% 1 1 T T T T T T 1980 1990 2000 2010E 2020E 2030E 2040E 2050E Source: Congressional Budget Office (CBO) Long-Term Budget Outlook (6/10). Note that entitlement spending includes federal government expenditures on Social Security, Medicare and Medicaid. Data in our chart is based on CBO’s ‘alternative fisca/ scenario’ forecast, which assumes a continuation of today’s underlying fiscal policy. Note that CBO aiso maintains an ‘extended-baseline’ scenario, which adheres closely to current law. The ailternative fiscal scenario deviates from CBO’s baseline because it incorporates some policy changes that are widely expected fo occur (such as extending the 2001-2003 tax cuts rather than letting them expire as scheduled by current law and adjusting physician payment rates to be in line with the Medicare economic index rather than at fower scheduled rates) and that policymakers have requiarly made in the past. www.kpcb.com USA Inc. | Summary Less than 15 years from now, in other words, USA Inc. — based on current forecasts for revenue and expenses - would have nothing left over to spend on defense, education, infrastructure, and R&D, which today account for only 32% of USA Inc. spending, down from 69% forty years ago. This critical juncture is getting ever closer. Just ten years ago, the CBO thought federal revenue would support entitlement spending and interest payments until 2060 — 35 years beyond its current projection. This dramatic forecast change over the past ten years helps illustrate, in our view, how important it is to focus on the here-and-now trend lines and take actions based on those trends. How would a turnaround expert determine ‘normal’ revenue and expenses? The first step would be to examine the main drivers of revenue and expenses. It’s not a pretty picture. While revenue — mainly taxes on individual and corporate income — is highly correlated (83%) with GDP growth, expenses — mostly entitlement spending — are less correlated (73%) with GDP. With that as backdrop, our turnaround expert might try to help management and shareholders (citizens) achieve a long-term balance by determining “normal” levels of revenue and expenses: CB www.kpcb.com USA Inc. xiii HOUSE_OVERSIGHT_020836

Page 14 - HOUSE_OVERSIGHT_020837

* From 1965 to 2005 (a period chosen to exclude abnormal trends related to the recent recession), annual revenue growth (3%) has been roughly in line with GDP growth, but corporate income taxes have grown 2% a year. Social insurance taxes grew 5% annually and represented 37% of USA Inc. revenue, compared with 19% in 1965. An expert might ask: o What level of social insurance or entitlement taxes can USA Inc. support without reducing job creation? o Are low corporate income taxes important to global competitive advantage and stimulating growth? * Entitlement spending has risen 5% a year on average since 1965, well above average annual GDP growth of 3%, and now absorbs 51% of all expenses, more than twice its share in 1965. Defense and non-defense discretionary spending (including infrastructure, education, and law enforcement) is up just 1-2% annually over that period. Questions for shareholders: o Do USA Inc.’s operations run at maximum efficiency? Where are the opportunities for cost savings? o Should all expense categories be benchmarked against GDP growth? Should some grow faster or slower than GDP? If so, what are the key determinants? o Would greater investment in infrastructure, education, and global competitiveness yield more long-term security for the elderly and disadvantaged? With expenses outstripping revenues by a large (and growing) margin, a turnaround expert would develop an analytical framework for readjusting USA Inc.’s business model and strategic plans. Prudence would dictate that our expert assume below-trend GDP growth and above-trend unemployment, plus rising interest rates — all of which would make the base case operating scenario fairly gloomy. This analysis can’t ignore our dependence on entitlements. Almost one-third of all Americans have grown up in an environment of lean savings and heavy reliance on government healthcare subsidies. It’s not just a question of numbers — it’s a question of our responsibilities as citizens...and what kind of society we want to be. Some 90 million Americans (out of a total population of 307 million) have grown accustomed to support from entitlement programs; so, too, have 14 million workers in the healthcare industry who, directly or indirectly, benefit from government subsidies via Medicare and Medicaid. Low personal savings and high unemployment make radical change difficult. Political will can be difficult to summon, especially during election campaigns. B GB www.kpcb.com USA Inc. xiv HOUSE_OVERSIGHT_020837

Page 15 - HOUSE_OVERSIGHT_020838

At the same time, however, these numbers don’t lie. With our demographics and our debts, we’re on a collision course with the future. The good news: Although time is growing short, we still have the capacity to create positive outcomes. Even though USA Inc. can print money and raise taxes, USA Inc. cannot sustain its financial imbalance indefinitely — especially as the Baby Boomer generation nears retirement age. Net debt levels are approaching warning levels, and some polls suggest that Americans consider reducing debt a national priority. Change is legally possible. Unlike underfunded pension liabilities that can bankrupt companies, USA Inc.’s underfunded liabilities are not legal contracts. Congress has the authority to change the level and conditions for Social Security and Medicare benefits; the federal government, together with the states, can also alter eligibility and benefit levels for Medicaid. Options for entitlement reform, operating efficiency, and stronger long-term GDP growth. As analysts, not public policy experts, we can offer mathematical illustrations as a framework for discussion (not necessarily as actual solutions). We also present policy options from third-party organizations such as the CBO. Reforming entitlement programs — Social Security. The underfunding could be addressed through some or all of the following mechanical changes: increasing the full retirement age to as high as 73 (from the current level of 67); and/or reducing average annual social security benefits by up to 12% (from $13,010 to $11,489); and/or increasing the social security tax rate from 12.4% to 14.2%. Options proposed by the CBO include similar measures, as well as adjustments to initial benefits and index levels. Of course, the low personal savings rates of average Americans — 3% of disposable income, compared with a 10% average from 1965 to 1985 — limit flexibility, at least in the early years of any reform. Reforming entitlement programs — Medicare and Medicaid. Mathematical illustrations for these programs, the most underfunded, seem draconian: Reducing average Medicare benefits by 53%, to $5,588 per year, or increasing the Medicare tax rate by 3.9 percentage points, to 6.8%, or some combination of these changes would address the underfunding of Medicare. As for Medicaid, the lack of a dedicated funding stream (i.e., a tax similar to the Medicare payroll tax) makes the math even more difficult. But by one measure from the Kaiser Family Foundation, 60% of the Medicaid budget in 2001 was spent on so-called optional recipients (such as mid- to low-income population above poverty level) or on optional services (such as dental services and prescription drug benefits). Reducing or controlling these benefits could help control Medicaid spending — but increase the burden on some poor and disabled groups. Ultimately, the primary issue facing the US healthcare system is ever-rising costs, historically driven by increases in price and utilization. Beneath sustained medical cost inflation is an entitlement mentality bolted onto a volume-based reimbursement scheme. All else being equal, the outcome is an incentive to spend: Underlying societal, financial, and liability factors combine to fuel an inefficient, expensive healthcare system. B GB www.kpcb.com USA Inc. Xv HOUSE_OVERSIGHT_020838

Sponsored

Page 16 - HOUSE_OVERSIGHT_020839

Improving operating efficiency. With nearly one government civilian worker (federal, state and local) for every six households, efficiency gains seem possible. A 20-year trend line of declining federal civilian headcount was reversed in the late 1990s. Resuming that trend would imply a 15% potential headcount reduction over five years and save nearly $300 billion over the next ten years. USA Inc. could also focus intensively on local private company outsourcing, where state and local governments are finding real productivity gains. Improving long-term GDP growth — productivity and employment. Fundamentally, federal revenues depend on GDP growth and related tax levies on consumers and businesses. Higher GDP growth won't be easy to achieve as households rebuild savings in the aftermath of a recession. To break even without changing expense levels or tax policies, USA Inc. would need real GDP growth of 6-7% in F2012-14 and 4-5% in F2015-20, according to our estimates based on CBO data — highly unlikely, given 40-year average GDP growth of 3%. While USA Inc. could temporarily increase government spending and investment to make up for lower private demand in the near term, the country needs policies that foster productivity and employment gains for sustainable long-term economic growth. How Much Would Real GDP Need to Grow to Drive USA Inc. to Break-Even Without Policy Changes? 6-7% in F2012E-F2014E & 4-5% in F2015- F2020E...Well Above 40-Year Average of 3% CBO’s Baseline Real GDP Growth vs. Required Real GDP Growth for a Balanced Budget Between F2011E and F2020E A% Real GDP Y/Y Growth (%) N sz 200: 2011E 2013E 2015E 2017E 2019E Real GDP Annual Growth (CBO Baseline Forecast) = Real GDP Annual Growth Needed to Eliminate Fiscal Deficit — -1970-2009 Average Real GDP Growth KP Source: CBO, “The Budget and Economic Outlook: Fiscal Years 2010 to 2020,” 8/10. §@S) www kpcb.com USA Inc. | Summary Productivity gains and increased employment each contributed roughly half of the long-term GDP growth between 1970 and 2009, per the National Bureau of Economic Research. Since the 1960s, as more resources have gone to entitlements and interest payments, USA Inc. has scaled back its investment in technology R&D and infrastructure as percentages of GDP. Competitors are making these investments. India plans to double infrastructure spending as a percent of GDP by 2013, and its tertiary (college) educated population will double over the next ten years, according to Morgan Stanley analysts, enabling its GDP growth to accelerate to 9- 10% annually by 2015 (China’s annual GDP growth is forecast to remain near 8% by 2015). USA Inc. can’t match India’s demographic advantage, but technology can help. KP CB www.kpcb.com USA Inc. xvi HOUSE_OVERSIGHT_020839

Page 17 - HOUSE_OVERSIGHT_020840

For employment gains, USA Inc. should minimize tax and regulatory uncertainties and encourage businesses to add workers. While hiring and R&D-related tax credits may add to near-term deficits, over time, they should drive job and GDP growth. Immigration reform could also help: A Federal Reserve study in 2010 shows that immigration does not take jobs from U.S.-born workers but boosts productivity and income per worker. Changing tax policies. Using another simple mechanical illustration, covering the 2010 budget deficit (excluding one- time charges) by taxes alone would mean doubling individual income tax rates across the board, to roughly 26-30% of gross income, we estimate. Such major tax increases would ultimately be self-defeating if they reduce private income and consumption. However, reducing tax expenditures and subsidies such as mortgage interest deductions would broaden the tax base and net up to $1.7 trillion in additional revenue over the next decade, per CBO. A tax based on consumption - like a value added tax (VAT) - could also redirect the economy toward savings and investment, though there would be drawbacks. These issues are undoubtedly complex, and difficult decisions must be made. But inaction may be the greatest risk of all. The time to act is now, and our first responsibility as investors in USA Inc. is to understand the task at hand. Our review finds serious challenges in USA Inc.’s financials. The ‘management team’ has created incentives to spend on healthcare, housing, and current consumption. At the margin, investing in productive capital, education, and technology — the very tools needed to compete in the global marketplace — has stagnated. America’s Resources Allocated to Housing + Healthcare Nearly Doubled as a Percent of GDP Since 1965, While Household and Government Savings Fell Dramatically Healthcare + Housing Spending vs. Net Household + Government Savings as % of GDP, 1965-2009 — Housing + Healthcare Spending as % of GDP —oO=Net Household + Government Savings as % of GDP As % of GDP 1970 1975 1980 1985 1990 1995 Note: Housing includes purchase, rent and home improvement. Government savings occur when government runs a surplus. Ta Source: BEA, CMS via Haver Analytics. < kpcb.com USA Inc. | Summary CB www.kpcb.com USA Inc. xvii HOUSE_OVERSIGHT_020840

Page 18 - HOUSE_OVERSIGHT_020841

With these trends, USA Inc. will not be immune to the sudden crises that have afflicted others with similar unfunded liabilities, leverage, and productivity trends. The sovereign credit issues in Europe suggest what might lie ahead for USA Inc. shareholders — and our children. In effect, USA Inc. is maxing out its credit card. It has fallen into a pattern of spending more than it earns and is issuing debt at nearly every turn. Common principles for overcoming this kind of burden include the following: 1) Acknowledge the problem — some 80% of Americans believe ‘dealing with our growing budget deficit and national debt’ is a national priority, according to a Peter G. Peterson Foundation survey in 11/09; 2) Examine past errors — People need clear descriptions and analysis to understand how the US arrived at its current financial condition — a ‘turnaround CEO’ would certainly initiate a ‘no holds barred’ analysis of the purpose, success and operating efficiency of all of USA Inc.’s spending; 3) | Make amends for past errors — Most Americans today at least acknowledge the problems at personal levels and say they rarely or never spend more than what they can afford (63% according to a 2007 Pew Research study). The average American knows the importance of managing a budget. Perhaps more would be willing to sacrifice for the greater good with an understandable plan to serve the country’s long-term best interests; 4) Develop a new code of behavior — Policymakers, businesses (including investment firms), and citizens need to share responsibility for past failures and develop a plan for future successes. Past generations of Americans have responded to major challenges with collective sacrifice and hard work. Will ours also rise to the occasion? CB www.kpcb.com USA Inc. xviii HOUSE_OVERSIGHT_020841

Sponsored

Page 19 - HOUSE_OVERSIGHT_020842

A —=} USA Inc. February 2011 USA Inc. — Outline Introduction High-Level Thoughts on Income Statement/Balance Sheet Income Statement Drilldown What Might a Turnaround Expert — Empowered to Improve USA Inc.’s Financials — Consider? Consequences of Inaction Summary Appendix KP (@E) www.kpcb.com USAInc. 2 HOUSE_OVERSIGHT_020842

Page 20 - HOUSE_OVERSIGHT_020843

This work is licensed for non-commercial distribution (but NOT for excerpting, or modifying or creating derivatives) under the Creative Commons Attribution-NonCommercial-NoDerivs 3.0 Unported CC BY-NC-ND license. You can find this license at http://creativecommons.org/licenses/by-nc- nd/3.0/legalcode or send a letter to Creative Commons, 171 Second Street, Suite 300, San Francisco, CA, 94105, USA. HOUSE_OVERSIGHT_020843

Page 21 - HOUSE_OVERSIGHT_020844

Introduction if Dp i USA Ince. | Introduction 5 About This Report CB www.kpcb.com USA Ine. | Introduction 6 HOUSE_OVERSIGHT_020844

Sponsored

Page 22 - HOUSE_OVERSIGHT_020845

Presentation Premise For America to remain the great country it has been for the past 235 years, it must determine the best ways to honor the government’s fundamental mission derived from the Constitution: ...to form a more perfect union, establish justice, insure domestic tranquility, provide for the common defense, promote the general welfare and secure the blessings of liberty to ourselves and our posterity. To this end, government should aim to help create a vibrant environment for economic growth and productive employment. It should manage its operations and programs as effectively and efficiently as possible, improve its financial position by driving the federal government's income statement to long-term break-even, and reduce the unsustainable level of debt on its balance sheet. KP i USA Inc. | Introduction 7 USA Inc. Concept Healthy financials and compelling growth prospects are key to success for businesses (and countries). So if the US federal government — which we call USA Inc. — were a business, how would public shareholders view it? How would long-term investors evaluate the federal government's business model, strategic plans, and operating efficiency? How would analysts react to its earnings reports? Although some 45%1 of American households own shares in publicly traded companies and receive related quarterly financial statements, not many “stakeholders” look closely at Washington’s financials. Nearly two-thirds of all American households? pay federal income taxes, but very few take the time to dig into the numbers of the entity that, on average, collects 13%? of all Americans’ annual gross income (not counting another 15-30% for payroll and various state and local taxes). We drill down on USA Inc.’s past, present, and (in some cases) future financial dynamics and focus on the country’s income statement and balance sheet and related trends. We isolate and review key expense and revenue drivers. On the expense side, we examine the major entitlement programs (Medicare, Medicaid and Social Security) as well as defense and other major discretionary programs. On the revenue side, we focus on GDP growth (driven by labor productivity and employment in the long run) and tax policies. We present basic numbers-driven scenarios for addressing USA Inc.'s financial challenges. In addition, we lay out the type of basic checklists that corporate turnaround experts might use as starting points when looking at some of USA Inc.’s business model challenges. Source: 1) 2008 ICI (Investment Company Institute) / SIFMA (Securities Industry and Financial Markets Association) Equity and Bond Owners Survey; 2) Number of tax returns with positive tax liability (91MM) divided by total number of returns filed (142MM), per Tax Foundation calculations based on IRS data; 3) Total federal income taxes (ex. payroll taxes) paid divided by total adjusted gross income, per IRS 2007 data. www.kpcb.com USA Inc. | Introduction 8 HOUSE_OVERSIGHT_020845

Page 23 - HOUSE_OVERSIGHT_020846

Why We Wrote This Report As American citizens / tax payers, we care about the future of our country. As investors, we search for data and insights to help us make better investment decisions. (It’s easier to predict the future with a keen understanding of the past.) We found ourselves searching for better information about the state of America’s financials, and we decided to assemble — in one place and in a user-friendly format — some of the best data about the world’s biggest “business.” In addition, we have attempted to provide some historical context for how USA Inc.’s financial model has evolved over decades. The complexity of USA Inc.’s challenges is well Known, and our presentation is just a starting point; it’s far from perfect or complete. But we are convinced that citizens — and investors — should understand the business of their government. Thomas Jefferson and Alexis de Tocqueville knew that — armed with the right information — the enlightened citizenry of America would make the right decisions. It is our humble hope that a transparent financial framework can help inform future debates. KP i USA Inc. | Introduction 9 What You'll Find Here... In the conviction that every citizen should understand the finances of USA Inc. and the plans of its “management team,” we examine USA Inc.’s income statement and balance sheet and present them in a basic, easy-to- use format. In this document, a broad group of people helped us drill into our federal government's basic financial metrics. We summarize our thoughts in PowerPoint form here and also have provided a brief text summary at www.kpcb.com/usainc. We encourage people to take our data and thoughts and study them, critique them, augment them, share them, and make them better. There’s a lot of material — think of it as a book that happens to be a slide presentation. KP a USA Inc. | Introduction 10 HOUSE_OVERSIGHT_020846

Page 24 - HOUSE_OVERSIGHT_020847

...And What You Won't We do not make policy recommendations. We try to help clarify some of the issues in a simple, analytically-based way. We aim to present data, trends, and facts about USA Inc.’s key revenue and expense drivers to provide context for how its financials have reached their present state. We did not base this analysis on proprietary data. Our observations come from publicly available information, and we use the tools of basic financial analysis to interpret it. Forecasts generally come from 3rd-party agencies like the Congressional Budget Office (CBO). For US policy makers, the timing of material changes will be especially difficult, given the current economic environment. No doubt, there will be compliments and criticism of things in the presentation (or missing from it). We hope that this report helps advance the discussion and we welcome others to opine with views (backed up by data). KP i USA Inc. | Introduction 11 We Focus on Federal, Not State & Local Government Data e Federal / State & Local Governments Share Different Responsibilities — Federal government is financially responsible for all or the majority of Defense, Social Security, Medicare and Interest Payments on federal debt and coordinates / shares funding for public investment in education / infrastructure. — State & local governments are financially responsible for all or the majority of Education, Transportation (Road Construction & Maintenance), Public Safety (Police / Fire Protection / Law Courts / Prisons) and Environment & Housing (Parks & Recreation / Community Development / Sewerage & Waste Management). — Federal / state & local governments share financial responsibility in Medicaid and Unemployment Insurance. e We Focus on the Federal Government — State and local governments face many similar long-term financial challenges and may ultimately require federal assistance. To be sure, the size of state & local government budget deficits ($70 billion’ in aggregate in F2009) and debt-to-GDP ratio (7%? on average in F2008) pales by comparison to the federal government's ($1.3 trillion budget deficit, 62% debt-to-GDP ratio in F2010). But these metrics may understate state & local governments’ financial challenges by 50% or more® because they exclude the long-term cost of public pension and other post employment benefit (OPEB) liabilities. Note: 1) Per National Conference of State Legislatures, State fiscal years ends in June. $70B aggregate excludes deficits from Puerto Rico ($3B deficits in F2009). 2) Debt-to-GDP ratio per Census Bureau State & Local Government Finance; 3) Calculation based on the claim that $1T of collective short fall in State & local government pension and OPEB funding KP would be $2.5T using corporate accounting rules, per Orin S. Kramer, “How to Cheat a Retirement Fund,” 9/10. (@E) www.kpcb.com USA Inc. | Introduction 12 HOUSE_OVERSIGHT_020847

Sponsored

Page 25 - HOUSE_OVERSIGHT_020848

Summary KP i USA Inc. | Introduction 13 Highlights from F2010 USA Inc. Financials e Summary — USA Inc. has challenges. e Cash Flow — While recession depressed F2008-F2010 results, cash flow has been negative for 9 consecutive years ($4.8 trillion, cumulative), with no end to losses in sight. Negative cash flow implies that USA Inc. can't afford the services it is providing to 'customers,’ many of whom are people with few alternatives. e Balance Sheet — Net worth is negative and deteriorating. e Off-Balance Sheet Liabilities — Off-balance sheet liabilities of at least $31 trillion (primarily unfunded Medicare and Social Security obligations) amount to nearly $3 for every $1 of debt on the books. Just as unfunded corporate pensions and other post-employment benefits (OPEB) weigh on public corporations, unfunded entitlements, over time, may increase USA Inc.’s cost of capital. And today’s off-balance sheet liabilities will be tomorrow’s on-balance sheet debt. e Conclusion — Publicly traded companies with similar financial trends would be pressed by shareholders to pursue a turnaround. The good news: USA Inc.’s underlying asset base and entrepreneurial culture are strong. The financial trends can shift toward a positive direction, but both ‘management’ and ‘shareholders’ will need collective focus, willpower, commitment, and sacrifice. Note: USA federal fiscal year ends in September, Cash flow = total revenue — total spending on a cash basis; net worth includes unfunded future liabilities from Social Security and Medicare on an accrual basis over the next 75 years. Source: cash flow per White House Office of Management and Budget; net worth per Dept. of Treasury, “2010 Financial Report of the U.S. KP Government,” adjusted to include unfunded liabilities of Social Security and Medicare. (@E) www.kpcb.com USA inc. | Introduction 14 HOUSE_OVERSIGHT_020848

Page 26 - HOUSE_OVERSIGHT_020849

Drilldown on USA Inc. Financials... e To analysts looking at USA Inc. as a public corporation, the financials are challenged - Excluding Medicare / Medicaid spending and one-time charges, USA Inc. has supported a 4% average net margin’ over 15 years, but cash flow is deep in the red by negative $1.3 trillion last year (or -$11,000 per household), and net worth2 is negative $44 trillion (or -$371,000 per household). e The main culprits: entitlement programs, mounting debt, and one-time charges — Since the Great Depression, USA Inc. has steadily added “business lines” and, with the best of intentions, created various entitlement programs. Some of these serve the nation’s poorest, whose struggles have been made worse by the financial crisis. Apart from Social Security and unemployment insurance, however, funding for these programs has been woefully inadequate — and getting worse. - Entitlement expenses (adjusted for inflation) rose 70% over the last 15 years, and USA Inc. entitlement spending now equals $16,600 per household per year; annual spending exceeds dedicated funding by more than $71 trillion (and rising). Net debt levels are approaching warning levels, and one-time charges only compound the problem. - Some consider defense spending a major cause of USA Inc.'s financial dilemma. Re-setting priorities and streamlining could yield savings — $788 billion by 2018, according to one recent study*® — perhaps without damaging security. But entitlement spending has a bigger impact on USA Inc. financials. Although defense nearly doubled in the last decade, to 5% of GDP, it is still below its 7% share of GDP from 1948 to 2000. It accounted for 20% of the budget in 2010, but 41% of all government spending between 1789 and 1930. Note: 1) Net margin defined as net income divided by total revenue; 2) net worth defined as assets (ex. stewardship assets like national parks and heritage assets like the Washington Monument) minus liabilities minus the net present value of unfunded entitlements (such as Social Security and Medicare), data per Treasury Dept.'s “2010 Annual Report on the U.S. Government’, 3) Gordon Adams and Matthew Leatherman, “A Leaner and Meaner National Defense,” Foreign Affairs, Jan/Feb 2011) www.kpcb.com USA Inc. | Introduction 15 ...Drilldown on USA Inc. Financials... e Medicare and Medicaid, largely underfunded (based on ‘dedicated’ revenue) and growing rapidly, accounted for 21% (or $724B) of USA Inc.’s total expenses in F2010, up from 5% forty years ago - Together, these two programs represent 35% of all (annual) US healthcare spending; Federal Medicaid spending has doubled in real terms over the last decade, to $273 billion annually. e Total government healthcare spending consumes 8.2% of GDP compared with just 1.3% fifty years ago; the new health reform law could increase USA Inc.’s budget deficit - As government healthcare spending expands, USA Inc.’s red ink will get much worse if healthcare costs continue growing 2 percentage points faster than per capita income (as they have for 40 years). e Unemployment Insurance and Social Security are adequately funded...for now. The future, not so bright - Demographic trends have exacerbated the funding problems for Medicare and Social Security — of the 102 million increased enrollment between 1965 and 2009, 42 million (or 41%) is due to an aging population. With a 26% longer life expectancy but a 3% increase in retirement age (since Social Security was created in 1935), deficits from Social Security could add $11.6 trillion (or 140%) to the public debt by 2037E, per Congressional Budget Office (CBO). KP a USA Inc. | Introduction 16 HOUSE_OVERSIGHT_020849

Page 27 - HOUSE_OVERSIGHT_020850

...Drilldown on USA Inc. Financials e If entitlement programs are not reformed, USA Inc.’s balance sheet will go from bad to worse - Public debt has doubled over the last 30 years, to 62% of GDP. This ratio is expected to surpass the 90% threshold* — above which real GDP growth could slow considerably — in 10 years and could near 150% of GDP in 20 years if entitlement expenses continue to soar, per CBO. - As government healthcare spending expands, USA Inc.’s red ink will get much worse if healthcare costs continue growing 2 percentage points faster than per capita income (as they have for 40 years). e The turning point: Within 15 years (by 2025), entitlements plus net interest expenses will absorb all — yes, all — of USA Inc.’s annual revenue, per CBO - That would require USA Inc. to borrow funds for defense, education, infrastructure, and R&D spending, which today account for 32% of USA Inc. spending (excluding one-time items), down dramatically from 69% forty years ago. - It's notable that CBO’s projection from 10 years ago (in 1999) showed Federal revenue sufficient to support entitlement spending + interest payments until ZOG0E — 35 years later than current projection. Note: *Carmen Reinhart and Kenneth Rogoff observed from 3,700 historical annual data points from 44 countries that the relationship between government debt and real GDP growth is weak for debt/GDP ratios below a threshold of 90 percent of GDP. Above 90 percent, median growth rates fall by one percent, and average growth falls considerably more. We note that while Reinhart and Rogoff’s observations are based on ‘gross debt’ data, in the U.S., debt held by the public is closer to the European KP countries’ definition of government gross debt. For more information, see Reinhart and Rogoff, “Growth in a Time of Debt,” 1/10. (@)E) www.kpcb.com USA Inc. | Introduction 17 How Might One Think About Turning Around USA Inc.?... e Key focus areas would likely be reducing USA Inc.’s budget deficit and improving / restructuring the ‘business model’... — One would likely drill down on USA Inc.’s key revenue and expense drivers, then develop a basic analytical framework for ‘normal’ revenue / expenses, then compare options. Looking at history... — Annual growth in revenue of 3% has been roughly in line with GDP for 40 years* while corporate income taxes grew at 2%. Social insurance taxes (for Social Security / Medicare) grew 5% annually and now represent 37% of USA Inc. revenue, compared with 19% in 1965. — Annual growth in expenses of 3% has been roughly in line with revenue, but entitlements are up 5% per annum - and now absorb 51% of all USA Inc.’s expense - more than twice their share in 1965; defense and other discretionary spending growth has been just 1-2%. One might ask... — Should expense and revenue levels be re-thought and re-set so USA Inc. operates near break-even and expense growth (with needed puts and takes) matches GDP growth, thus adopting a ‘don’t spend more than you earn’ approach to managing USA Inc.'s financials? Note: *We chose a 40-year period from 1965 to 2005 to examine ‘normal’ levels of revenue and expenses. We did not choose the most recent 40-year period (1969 to 2009) as USA was in deep recession in 2008 / 2009 and underwent significant tax policy fluctuations in 1968 /1969, so KP many metrics (like individual income and corporate profit) varied significantly from ‘normal’ levels. (@E) www.kpcb.com USA Inc. | Introduction 18 HOUSE_OVERSIGHT_020850

Sponsored

Page 28 - HOUSE_OVERSIGHT_020851

... How Might One Think About Turning Around USA Inc.? One might consider... e Options for reducing expenses by focusing on entitlement reform and operating efficiency — Formula changes could help Social Security's underfunding, but look too draconian for Medicare/Medicaid; the underlying healthcare cost dilemma requires business process restructuring and realigned incentives. - Resuming the 20-year trend line for lower Federal civilian employment, plus more flexible compensation systems and selective local outsourcing, could help streamline USA Inc.’s operations. e Options for increasing revenue by focusing on driving long-term GDP growth and changing tax policies - USA Inc. should examine ways to invest in growth that provides a high return (ROI) via new investment in technology, education, and infrastructure and could stimulate productivity gains and employment growth. — Reducing tax subsidies (like exemptions on mortgage interest payments or healthcare benefits) and changing the tax system in other ways could increase USA Inc.’s revenue without raising income taxes to punitive — and self-defeating — levels. Such tax policy changes could help re-balance USA’s economy between consumption and savings and re-orient business lines towards investment-led growth, though there are potential risks and drawbacks. e History suggests the long-term consequences of inaction could be severe - USA Inc. has many assets, but it must start addressing its spending/debt challenges now. KP i USA Inc. | Introduction 19 Sizing Costs Related to USA Inc.’s Key Financial Challenges & Potential AND / OR Solutions e To create frameworks for discussion, the next slide summarizes USA Inc.’s various financial challenges and the projected future cost of each main expense driver. — The estimated future cost is calculated as the net present value of expected ‘dedicated’ future income (such as payroll taxes) minus expected future expenses (such as benefits paid) over the next 75 years. e Then we ask the question: ‘What can we do to solve these financial challenges?’ — The potential solutions include a range of simple mathematical illustrations (such as changing program characteristics or increasing tax rates) and/or program-specific policy solutions proposed or considered by lawmakers and agencies like the CBO (such as indexing Social Security initial benefits to growth in cost of living). e These mathematical illustrations are only a mechanical answer to key financial challenges and not realistic solutions. In reality, a combination of detailed policy changes will likely be required to bridge the future funding gap. KP a USA Inc. | Introduction 20 HOUSE_OVERSIGHT_020851

Page 29 - HOUSE_OVERSIGHT_020852

Overview of USA Inc.’s Key Financial Challenges & Potential and/or Solutions Financial Net Present Cost! Mathematical Illustrations Rank Challenge ($T / % of 2010 GDP) and/or Potential Policy Solutions? * Isolate and address the drivers of medical cost inflation 1 Medicaid $35 Trillion / 239% + Improve efficiency / productivity of healthcare system ¢ Reduce coverage for optional benefits & optional enrollees ¢ Reduce benefits « Increase Medicare tax rate : Metis pe SOMUUESLE SES L Isolate and address the drivers of medical cost inflation * Improve efficiency / productivity of healthcare system * Raise retirement age * Reduce benefits Social ah 5 * Increase Social Security tax rate : Security Gemalion ¢ Reduce future initial benefits by indexing to cost of living growth rather than wage growth * Subject benefits to means test to determine eligibility von GDP / * Invest in technology / infrastructure / education 4 -- * Remove tax & regulatory uncertainties to stimulate employment growth Revenue ai F * Reduce subsidies and tax expenditures & broaden tax base Growth * Resume the 20-year trend line for lower Federal civilian employment Government : ‘ 5 mer -- * Implement more flexible compensation systems Inefficiencies ; ; f ; * Consolidate / selectively local outsource certain functions Note: 1) Net Present Cost is calculated as the present value of expected future net liabilities (expected revenue minus expected costs) for each program / issue over the next 75 years, Medicare estimate per Dept. of Treasury, “2010 Financial Report of the U.S. Government,” Social Security estimate per Social Security Trustees’ Report (8/10). 2) For more details on potential solutions, see slides 252-410 or full USA Inc. presentation. 3) Medicaid does not have dedicated revenue source and its $35T net KP present cost excludes funding from general tax revenue, NPV analysis based on 3% discount rate applied to CBO’s projection for annual inflation-adjusted expenses. (@)E) www.kpcb.com USA Inc. | Introduction 21 The Essence of America’s Financial Conundrum & Math Problem? While a hefty 80% of Americans indicate balancing the budget should be one of the country’s top priorities, per a Peter G. Peterson Foundation survey in 11/09... ...only 12% of Americans support cutting spending on Medicare or Social Security, per a Pew Research Center survey, 2/11. Some might call this ‘having your cake and eating it too...’ KP a USA Inc. | Introduction 22 HOUSE_OVERSIGHT_020852

Page 30 - HOUSE_OVERSIGHT_020853

The Challenge Before Us Policymakers, businesses and citizens need to share responsibility for past failures and develop a plan for future successes. Past generations of Americans have responded to major challenges with collective sacrifice and hard work. Will ours also rise to the occasion? (@)E) www.kpcb.com USA Inc. | Introduction 23 HOUSE_OVERSIGHT_020853

Sponsored

Page 31 - HOUSE_OVERSIGHT_020854

High-Level Thoughts on Income Statement/Balance Sheet KP CC —— USA Inc. | High Level Thoughts 25 How Would You Feel if... ...your Cash Flow was NEGATIVE for each of the past 9 years... ... your Net Worth* has been NEGATIVE for as long as you can remember... ... t would take 20 years of your income at the current level to pay off your existing debt — assuming you don't take on any more debt. KP Note: *See slide 30 for net worth qualifier. Ce USA Inc. | High Level Thoughts 26 HOUSE_OVERSIGHT_020854

Page 32 - HOUSE_OVERSIGHT_020855

Welcome to the Financial Reality (& Negative Trend) of USA Inc. F2010 Cash Flow = -$1.3 Trillion; Net Worth = -$44 Trillion USA Inc. Annual Cash Flow & Year-End Net Worth, F1996 — F2010 BAGS 6 m2 ce me — mn ae oc ms mn = a ws — a HS $15,000 $0 oe = < 8 s z al 3 -$15,000 <= £ 2 ° a = = ‘ _ a Q = CE) De oe er -- $30,000 F 3 7 2 mm One-Time Expenses* ul < ty] $ " ‘ a A $1,200 mmm Cash Flow (leftaxis) = - A -$45,000 >= Net Worth (right axis) ¥ $1600 oo -$60,000 F1996 F1998 F2000 F2002 F2004 F2006 F2008 F2010 Note: USA federal fiscal year ends in September; Cash flow = total revenue — total spending on a cash basis; net worth includes unfunded future liabilities from Social Security and Medicare on an accrual basis over the next 75 years. *One-time expenses in F2008 include $14B payments to Freddie Mac; F2009 includes $279B net TARP payouts, $97B payment to Fannie Mae & Freddie Mac and $40B stimulus spending on discretionary items; F2010 includes $26B net TARP income, $137B stimulus spending and $41B payment to Fannie Mae & Freddie Mac. F2010 net worth improved dramatically owing to revised actuarial estimates for Medicare program resulted from the Healthcare reform legislation. For more definitions, see next slide. Source: cash flow per White House Office KP of Management and Budget; net worth per Dept. of Treasury, “2010 Financial Report of the U.S. Government.” www.kpcb.com USA Inc. | High Level Thoughts 27 Think About That... The previous chart is in TRILLIONS of dollars. Just because million, billion and trillion rhyme, doesn't mean that they are even close to the same quantity. KP a USA Inc. | High Level Thoughts 28 HOUSE_OVERSIGHT_020855

Page 33 - HOUSE_OVERSIGHT_020856

Only Politicians Work in Trillions of Dollars— Here’s How Much That Is *™ 1 Pallet x 1 Football Field and $41 Million (MM) 217 Football Fields $1 Billion (B) = Le. Trillion (T) ae aa (@E www.kpcb.com USA Inc. | High Level Thoughts 29 Net Worth Qualifier ¢ The balance sheet / net worth calculation does not include the power to tax — the net present value of the sovereign power to tax and the ability to print the world’s reserve currency would clearly bolster USA Inc.’s assets — if they could be accurately calculated. * Plant, Property & Equipment (PP&E) on USA Inc.’s balance sheet is valued at $829B' (or 29% of USA Inc.’s total stated assets) — this includes tangible assets such as buildings, internal use software and civilian and military equipment. * The PP&E calculation DOES NOT include the value of USA Inc.’s holdings in the likes of public land (estimated to be worth $408B per OMB)’, highways, natural gas, oil reserves, mineral rights (estimated to be worth $345B per OMB), forest, air space, radio frequency spectrum, national parks and other heritage and stewardship assets which USA Inc. does not anticipate to use for general government operations. The good news for USA Inc. is that the aggregate value of these heritage and stewardship assets could be significant. Note: 1) USA Inc.’s holding of land is measured in non-financial units such as acres of land and lakes, and number of National Parks and National Marine Sanctuaries. Land under USA Inc.’s stewardship accounts for 28% of the total U.S. landmass as of 9/10. Dept. of Interior reported 552 national wildlife refuges, 378 park units, 134 geographic management areas, 67 fish hatcheries under their management as of 9/10. Dept. of Defense reported 203,000 acres of public land and 16,140,000 acres withdrawn public land, the USDA’s Forest Service managed an estimated 155 national forests, while the Dept. of Commerce had 13 National Pp Marine Sanctuaries, which included near—shore coral reefs and open ocean, as of 9/10. Dept. of Treasury, “2010 Financial Report of the U.S. Government.” FSA wearer com USA Inc. | High Level Thoughts 30 HOUSE_OVERSIGHT_020856

Sponsored

Page 34 - HOUSE_OVERSIGHT_020857

A Word of Warning About Comparing Corporate & Government Accounting... e Government accounting standards do not report the present value of future entitlement payments (such as Social Security or Medicare) as liabilities. Instead, entitlement payments are recognized only when they are paid. Our analysis takes a different view: governments create liabilities when they enact entitlements and do not provide for revenues adequate to fund them. e We measure the entitlement liability as the present value of estimated entitlement payments in excess of expected revenues for citizens of working age based on Social Security and Medicare Trust Funds’ actuarial analysis. e Government accounting standards also do not recognize the value of internally- generated intangible assets (such as the sovereign power to tax). We do not recognize those assets either, as we have no basis to measure them. But the US government has substantial intangible assets that should provide future economic benefits. Note: For more discussion on alternatives to corporate and official government accounting methods, see Laurence J. Kotlikoff, Alan J. Auerbach, and Jagadeesh okhale, “Generational Accounting: A Meaningful Way to Assess Generational Policy,” published on 12/94 in The Journal of Economic Perspectives. KP Source: Greg Jonas, Morgan Stanley Research. i USA Inc. | High Level Thoughts 31 ...and About Government Budgeting e Federal government budgeting follows arcane practices that are very different from corporate budgeting — and can neglect solutions to structural problems in favor of short-term expediency. e Federal government does not distinguish capital budget (for long-term investment) from operating budget (for day-to-day operations). As a result, when funding is limited, government may choose to reduce investments for the future to preserve resources for day-to-day operations. e Budget “scoring” rules give Congress incentives to hide the true costs...and help Congressional committees defend their turf.” Note: *For more detail, refer to slide 116 on congressional budget scoring rules related to recent Healthcare reform. a USA Inc. | High Level Thoughts 32 HOUSE_OVERSIGHT_020857

Page 35 - HOUSE_OVERSIGHT_020858

Metric Definitions & Qualifiers e Cash Flow = ‘Cash In’ Minus ‘Cash Out’ — Calculated on a cash basis (which excludes changes in non-cash accrual of future liabilities) for simplicity. e One-Time Expenses = ‘Spending Minus Repayments’ for Non-Recurring Programs — Net costs of programs such as TARP, ARRA, and GSE bailouts. e Net Worth = Assets Minus Liabilities Minus Unfunded Entitlement Liabilities — Assets include cash & investments, taxes receivable, property, plant & equipment (as defined by Department of Treasury). — Liabilities include accounts payable, accrued payroll & benefits, federal debt, federal employee & veteran benefits payable... — Unfunded Entitlement Liabilities include the present value of future expenditures in excess of dedicated future revenues in Medicare and Social Security over the next 75 years. Note: USA Inc. accounts do not follow the same GAAP as corporations. i USA Inc. | High Level Thoughts 33 Common Financial Metrics Applied to USA Inc. in F2010 e Cash Flow Per Share = -$4,171 — USA Inc.’s F2010 cash flow -$1.3 trillion, divided by population of ~310 million (assuming each citizen holds one share of USA Inc.). e Net Debt to EBITDA Ratio = -8x — USA Inc. net debt held by public ($9.1 trillion) divided by USA Inc. F2010 EBITDA (-$1.1 trillion). It’s notable that the ratio compares with S8&P500 average of 1.4x in 2010. Note: USA Inc. accounts do not follow the same GAAP as corporations. Refer to slide 31 for a word of warning about comparing corporate and government accounting. EBITDA is Earnings Before Interest, Tax, Depreciation & Amortization. Source: Dept. of Treasury, White House Office of Management and Budget, Congressional Budget Office, BEA, BLS. www.kpcb.com USA Inc. | High Level Thoughts 34 HOUSE_OVERSIGHT_020858

Page 36 - HOUSE_OVERSIGHT_020859

Even Adjusting For Cyclical Impact of Recessions, USA Inc.’s 2010 Structural Operating Loss = -$817 Billion vs. -$78 Billion 15 Years Ago USA Inc. Annual Operating Surplus / Deficit, Structural vs. Cyclical’, F1996 — F2010 GAGE) a eee en es ns cn a a a nn mT aT A EC aT 2 al | ri 1 1 1 $400 ------------------ 5252225252222 | I er ck ta it a ; — a & “$Q00 ce see ee ence = Structural aCyclical ----_-_--_--_ ee Leal - SEA ZOB = <= ae oo ee ce ee ee em ee rem me em ae SER RE ea eR ee eee — » “$1,800 ~~ ~~ = =~ <= 2-2 2-2-2 ee ee ne ee ee ee ee ee F1996 F1998 F2000 F2002 F2004 F2006 F2008 F2010 Note: 1) Congressional Budget Office defines a structural surplus or deficit as the budget surplus or deficit that would occur under current law if the influences of the business cycle on the budget — the automatic stabilizers — were removed, and cyclical surplus or deficit as the automatic net changes in revenues and outlays that are attributable to cyclical movements in real (inflation-adjusted) output and unemployment. CBO compiled this data from Dept. of Commerce’s Bureau of Economic Analysis (BEA), which maintains the national income and product accounts (NIPA). An important difference between the official budget deficit and the NIPA measure of net federal government saving is that the latter excludes such purely financial transactions as the sale of government assets, and most transactions under the Troubled Asset Relief Program, because those transactions do not help to measure current production and income. In addition, historical NIPA data are subject to significant revision; historical budget data, by contrast, are rarely revised significantly. Source: 1996-2006 data per CBO, “The Effects of KP Automatic Stabilizers on the Federal Budget,” 5/10, 2007-2010 data per White House OMB F2012 Budget Analytical Perspective. (@)E) www.kpcb.com USA Inc. | High Level Thoughts 35 Annual Federal Government Surplus / Deficit ($ Billion) Understanding Differences Between Economist Language vs. Equity Investor Translation Economist Language Equity Investor Approximate Translation* e Budget Deficit — The amount by which a e Cash Flow — ‘Cash in’ minus ‘cash out.’ government's expenditures exceed its receipts over a particular period of time. e Structural Deficit = The portion of the e Cash Flow (ex. One-Time Items)* _— budget deficit that results from a ‘Cash in’ minus ‘cash out’ excluding fundamental imbalance in government expenditures that are one-time in nature receipts and expenditures, as opposed to (such as economic stimulus spending). one based on the business cycle or one- time factors. e One-Time Expenses* — TARP / GSE / e Cyclical Deficit — The portion of the stimulus spending related to economic budget deficit that results from cyclical factors such as economic recessions prsevernells rather than from underlying fiscal policy. e Federal Debt Held By the Public — The e Debt — Cumulative negative cash flow accumulation of all previous fiscal years’ financed by borrowing. d fi it Note: *We acknowledge that while the concept of ‘cash flow ex. one-time items’ and ‘one-time expenses’ is similar to ‘structural deficit’ and erlcits. ‘cyclical deficit,’ respectively, these terms are not interchangeable and have different definitions. Congressional Budget Office defines a structural surplus or deficit as the budget surplus or deficit that would occur under current law if the influences of the business cycle on the budget — the automatic stabilizers — were removed, and cyclical surplus or deficit as the automatic net changes in revenues and outlays that KP are attributable to cyclical movements in real (inflation-adjusted) output and unemployment. (@E) www.kpcb.com USA Inc. | High Level Thoughts 36 HOUSE_OVERSIGHT_020859

Sponsored

Page 37 - HOUSE_OVERSIGHT_020860