EFTA00018441 - EFTA00018465

Document EFTA00018441 is a collection of SDNY (Southern District of New York) news clips from July 31, 2019, focusing on topics like public corruption and the Jeffrey Epstein case.

This document is a compilation of news articles related to legal matters handled by the SDNY, including coverage of Jeffrey Epstein's case. A featured New York Times article discusses Epstein's aspiration to use his DNA to seed the human race through artificial insemination at his New Mexico ranch, reflecting his interest in transhumanism. The document also contains mentions of other legal cases and topics of interest from that period.

Key Highlights

- •The document includes news clips related to Jeffrey Epstein's case and other SDNY matters from July 31, 2019.

- •Jeffrey Epstein reportedly wanted to use his New Mexico ranch to impregnate women with his DNA, aiming to improve the human race.

- •The news compilation covers various topics, including public corruption and securities fraud.

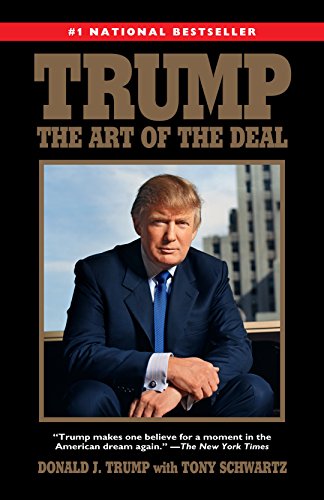

- •Key figures mentioned in the document include Donald Trump, Ghislaine Maxwell, and several scientists and legal professionals.

Frequently Asked Questions

Related Links

Document Information

Bates Range

EFTA00018441 - EFTA00018465

Pages

25

Document Content

Page 1 - EFTA00018441

From: To: Subject: FW: SDNY News Clips Wednesday, July 31, 2019 Date: Wed, 31 Jul 2019 21:13:52 +0000 Attachments: 2019 7-31.pdf It looks like NICIGa just filed something in the CVRA litigation — do you have a copy by any chance? From: Sent: Wednesday, July 31, 2019 5:12 PM Cc: Smolar, Subject: SDNY News Clips Wednesday, July 31, 2019 SDNY News Clips Wednesday, July 31, 2019 Contents Public Corruption. 2 Epstein. 2 Collins. 18 Securities and Commodities Fraud. 20 Stewart 20 Thompson. 22 Pinto-Thomaz. 24 Narcotics. 26 Castro. 26 Rochester Drug Company. 28 Civil 30 Life Spine. 30 Matters of Interest 32 The U.S. said a California cherry-picker went to Pakistan for terrorist training. Now the case has collapsed. 32 Fed Cuts Interest Rates for First Time Since 2008 Crisis. 35 Public Corruption Epstein EFTA00018441

Page 2 - EFTA00018442

Jeffrey Epstein Hoped to Seed Human Race With His DNA New York Times By James B. Stewart, Matthew Goldstein and Jessica Silver-Greenberg 7/31/19 Jeffrey E. Epstein, the wealthy financier who is accused of sex trafficking, had an unusual dream: He hoped to seed the human race with his DNA by impregnating women at his vast New Mexico ranch. Mr. Epstein over the years confided to scientists and others about his scheme, according to four people familiar with his thinking, although there is no evidence that it ever came to fruition. Mr. Epstein's vision reflected his longstanding fascination with what has become known as transhumanism: the science of improving the human population through technologies like genetic engineering and artificial intelligence. Critics have likened transhumanism to a modern-day version of eugenics, the discredited field of improving the human race through controlled breeding. Mr. Epstein, who was charged in July with the sexual trafficking of girls as young as 14, was a serial illusionist: He lied about the identities of his clients, his wealth, his financial prowess, his personal achievements. But he managed to use connections and charisma to cultivate valuable relationships with business and political leaders. Interviews with more than a dozen of his acquaintances, as well as public documents, show that he used the same tactics to insinuate himself into an elite scientific community, thus allowing him to pursue his interests in eugenics and other fringe fields like cryonics. Lawyers for Mr. Epstein, who has pleaded not guilty to the sex-trafficking charges, did not respond to requests for comment. Mr. Epstein attracted a glittering array of prominent scientists. They included the Nobel Prize-winning physicist Murray Gell-Mann, who discovered the quark; the theoretical physicist and best-selling author Stephen Hawking; the paleontologist and evolutionary biologist Stephen Jay Gould; Oliver Sacks, the neurologist and best-selling author; George M. Church, a molecular engineer who has worked to identify genes that could be altered to create superior humans; and the M.I.T. theoretical physicist Frank Wilczek, a Nobel laureate. The lure for some of the scientists was Mr. Epstein's money. He dangled financing for their pet projects. Some of the scientists said that the prospect of financing blinded them to the seriousness of his sexual transgressions, and even led them to give credence to some of Mr. Epstein's half-baked scientific musings. Scientists gathered at dinner parties at Mr. Epstein's Manhattan mansion, where Dom Perignon and expensive wines flowed freely, even though Mr. Epstein did not drink. He hosted buffet lunches at Harvard's Program for Evolutionary Dynamics, which he had helped start with a $6.5 million donation. Others flew to conferences sponsored by Mr. Epstein in the United States Virgin Islands and were feted on his private island there. Once, the scientists — including Mr. Hawking — crowded on board a submarine that Mr. Epstein had chartered. The Harvard cognitive psychologist Steven Pinker said he was invited by colleagues — including Martin Nowak, a Harvard professor of mathematics and biology, and the theoretical physicist Lawrence Krauss — to "salons and coffee klatsches" at which Mr. Epstein would hold court. While some of Mr. Pinker's peers hailed Mr. Epstein as brilliant, Mr. Pinker described him as an "intellectual impostor." EFTA00018442

Page 3 - EFTA00018443

"He would abruptly change the subject, A.D.D.-style, dismiss an observation with an adolescent wisecrack," Mr. Pinker said. Another scientist cultivated by Mr. Epstein, Jaron Lanier, a prolific author who is a founding father of virtual reality, said that Mr. Epstein's ideas did not amount to science, in that they did not lend themselves to rigorous proof. Mr. Lanier said Mr. Epstein had once hypothesized that atoms behaved like investors in a marketplace. Mr. Lanier said he had declined any funding from Mr. Epstein and that he had met with him only once after Mr. Epstein in 2008 pleaded guilty to charges of soliciting prostitution from a minor. Mr. Epstein was willing to finance research that others viewed as bizarre. He told one scientist that he was bankrolling efforts to identify a mysterious particle that might trigger the feeling that someone is watching you. At one session at Harvard, Mr. Epstein criticized efforts to reduce starvation and provide health care to the poor because doing so increased the risk of overpopulation, said Mr. Pinker, who was there. Mr. Pinker said he had rebutted the argument, citing research showing that high rates of infant mortality simply caused people to have more children. Mr. Epstein seemed annoyed, and a Harvard colleague later told Mr. Pinker that he had been "voted off the island" and was no longer welcome at Mr. Epstein's gatherings. Then there was Mr. Epstein's interest in eugenics. On multiple occasions starting in the early 2000s, Mr. Epstein told scientists and businessmen about his ambitions to use his New Mexico ranch as a base where women would be inseminated with his sperm and would give birth to his babies, according to two award-winning scientists and an adviser to large companies and wealthy individuals, all of whom Mr. Epstein told about it. It was not a secret. The adviser, for example, said he was told about the plans not only by Mr. Epstein, at a gathering at his Manhattan townhouse, but also by at least one prominent member of the business community. One of the scientists said Mr. Epstein divulged his idea in 2001 at a dinner at the same townhouse; the other recalled Mr. Epstein discussing it with him at a 2006 conference that he hosted in St. Thomas in the Virgin Islands. The idea struck all three as far-fetched and disturbing. There is no indication that it would have been against the law. Once, at a dinner at Mr. Epstein's mansion on Manhattan's Upper East Side, Mr. Lanier said he talked to a scientist who told him that Mr. Epstein's goal was to have 20 women at a time impregnated at his 33,000-square- foot Zorro Ranch in a tiny town outside Santa Fe. Mr. Lanier said the scientist identified herself as working at NASA, but he did not remember her name. According to Mr. Lanier, the NASA scientist said Mr. Epstein had based his idea for a baby ranch on accounts of the Repository for Germinal Choice, which was to be stocked with the sperm of Nobel laureates who wanted to strengthen the human gene pool. (Only one Nobel Prize winner has acknowledged contributing sperm to it. The repository discontinued operations in 1999.) Mr. Lanier, the virtual-reality creator and author, said he had the impression that Mr. Epstein was using the dinner parties — where some guests were attractive women with impressive academic credentials — to screen candidates to bear Mr. Epstein's children. Mr. Epstein did not hide his interest in tinkering with genes — and in perpetuating his own DNA. One adherent of transhumanism said that he and Mr. Epstein discussed the financier's interest in cryonics, an unproven science in which people's bodies are frozen to be brought back to life in the future. Mr. Epstein told this person that he wanted his head and penis to be frozen. EFTA00018443

Sponsored

Page 4 - EFTA00018444

Southern Trust Company, Mr. Epstein's Virgin Island-incorporated business, disclosed in a local filing that it was engaged in DNA analysis. Calls to Southern Trust, which sponsored a science and math fair for school children in the Virgin Islands in 2014, were not returned. In 2011, a charity established by Mr. Epstein gave $20,000 to the Worldwide Transhumanist Association, which now operates under the name Humanity Plus. The group's website says that its goal is "to deeply influence a new generation of thinkers who dare to envision humanity's next steps." Mr. Epstein's foundation, which is now defunct, also gave $100,000 to pay the salary of Ben Goertzel, vice chairman of Humanity Plus, according to Mr. Goertzel's résumé. "I have no desire to talk about Epstein right now," Mr. Goertzel said in an email to The New York Times. "The stuff I'm reading about him in the papers is pretty disturbing and goes way beyond what I thought his misdoings and kinks were. Yecch." Alan M. Dershowitz, a professor emeritus of law at Harvard, recalled that at a lunch Mr. Epstein hosted in Cambridge, Mass., he steered the conversation toward the question of how humans could be improved genetically. Mr. Dershowitz said he was appalled, given the Nazis' use of eugenics to justify their genocidal effort to purify the Aryan race. Yet the lunches persisted. "Everyone speculated about whether these scientists were more interested in his views or more interested in his money," said Mr. Dershowitz, who was one of Mr. Epstein's defense lawyers in the 2008 case. Luminaries at Mr. Epstein's St. Thomas conference in 2006 included Mr. Hawking and the Caltech theoretical physicist Kip S. Thorne. One participant at that conference, which was ostensibly on the subject of gravity, recalled that Mr. Epstein wanted to talk about perfecting the human genome. Mr. Epstein said he was fascinated with how certain traits were passed on, and how that could result in superior humans. Mr. Epstein appears to have gained entree into the scientific community through John Brockman, a literary agent whose best-selling science writers include Richard Dawkins, Daniel Goleman and Jared Diamond. Mr. Brockman did not respond to requests for comment. For two decades, Mr. Brockman presided over a series of salons that matched his scientist-authors with potential benefactors. (The so-called "billionaires' dinners" apparently became a model for the gatherings at Mr. Epstein's East 71st Street townhouse, which included some of the same guests.) In 2004, Mr. Brockman hosted a dinner at the Indian Summer restaurant in Monterey, Calif, where Mr. Epstein was introduced to scientists, including Seth Lloyd, the M.I.T. physicist. Mr. Lloyd said that he found Mr. Epstein to be "charming" and to have "interesting ideas," although they "turned out to be quite vague." Also at the Indian Summer dinner, according to an account on the website of Mr. Brockman's Edge Foundation, were the Google founders Sergey Brim and Larry Page and Jeff Bezos, who was accompanied by his mother. "All the good-looking women were sitting with the physicists' table," Daniel Dubno, who was a CBS producer at the time and attended the dinner, was quoted as saying. Mr. Dubno told The Times that he did not recall the dinner or having said those words. Mr. Brockman was Mr. Gell-Mann's agent, and Mr. Gell-Mann, in the acknowledgments section of his 1995 book "The Quark and the Jaguar," thanked Mr. Epstein for his financial support. EFTA00018444

Page 5 - EFTA00018445

However impressive his roster of scientific contacts, Mr. Epstein could not resist embellishing it. He claimed on one of his websites to have had "the privilege of sponsoring many prominent scientists," including Mr. Pinker, Mr. Thorne and the M.I.T. mathematician and geneticist Eric S. Lander. Mr. Pinker said he had never taken any financial or other support from Mr. Epstein. "Needless to say, I find Epstein's behavior reprehensible," he said. Mr. Thorne, who recently won a Nobel Prize, said he attended Mr. Epstein's 2006 conference, believing it to be co-sponsored by a reputable research center. Other than that, "I have had no contact with, relationship with, affiliation with or funding from Epstein," he said. "I unequivocally condemn his abhorrent actions involving minors." Lee McGuire, a spokesman for Mr. Lander, said he has had no relationship with Mr. Epstein. "Mr. Epstein appears to have made up lots of things," Mr. McGuire said, "and this seems to be among them." Some of Jeffrey Epstein's victims don't want new charges in South Florida South Florida Sun Sentinel By Marc Freeman 7/30/19 Financier Jeffrey Epstein has been branded a pervert and an abuser, but not all of his victims want to see him prosecuted further in South Florida. Some of the girls Epstein assaulted at his Palm Beach mansion before 2008 have already reached financial settlements with him and fear they'll lose their anonymity. Federal prosecutors — the ones who approved his lenient plea deal to begin with — say they fully support that position. Epstein faces separate federal sex trafficking charges in New York, but the debate about prosecuting him in South Florida will be resolved soon enough. A federal judge in West Palm Beach is considering whether to strike down parts of a controversial 2007 deal that gave him and unnamed co-conspirators immunity from federal charges. U.S. District Judge Kenneth Marra ruled in February that Epstein's non-prosecution agreement violated the federal Crime Victims' Rights Act. Dozens of victims were improperly kept in the dark about it until after it had been finalized. Marra must decide how to rectify this violation 12 years later, after receiving arguments from lawyers for two of Epstein's victims, prosecutors and Epstein. The victims in the case, cited as Jane Does, say the necessary remedy is for Epstein to face what they say are long overdue charges in Florida. "To be sure, Jane Doe 1 and 2 very much appreciate the laudable efforts of the diligent prosecutors in New York," their lawyers wrote. "But those New York charges, important though they are, still leave Epstein's crimes in Florida uncharged and all of his co-conspirators at large." Lawyers for the U.S. government disagree. They concede that prosecutors back then "fell short" of treating victims properly as they reached a settlement with Epstein. But the attorneys now contend "the past cannot be undone" and the deal must be upheld under the law. Among their arguments is that many victims clearly want to let it go, because they are content with financial settlements they obtained from Epstein, and his 2008 guilty plea to two state prostitution charges. That plea EFTA00018445

Page 6 - EFTA00018446

resulted in 13 months in Palm Beach County Jail and registering as a sex offender. The prosecutors say they reached this position based on "conversations" with the victims and their lawyers, without giving a specific number. Attorney Spencer Kuvin of West Palm Beach said he represents one victim who met with the U.S. Attorney's Office in April. "She said she'd like to see him prosecuted and put in jail," Kuvin said. "She said, `I don't know if that's a realistic possibility, but that's what I want.'" He said it's not surprising that other victims are less inclined to participate. "When you have so many victims, you're going to have just as many different opinions as to how it should be handled," Kuvin said. "But that shouldn't stop the prosecution of a predator. One victim that wants to come forward ... is enough to put him away." The federal prosecutors explained that while some victims "would like to see Epstein prosecuted for his crimes, they valued anonymity above all and were not willing to speak with law enforcement or otherwise participate in any criminal or civil litigation due to the risk that their involvement may become known to family, friends, or the public." This is not to say there aren't many victims who are eager to see Epstein face new charges in South Florida, wrote Byung J. Pak, U.S. Attorney for the Northern District of Georgia, and Jill E. Steinberg and Nathan P. Kitchens, special attorneys for the Southern District of Florida. But they conclude that reopening their cases against Epstein in South Florida still "exacerbates the harm to victims who have attempted to readjust their lives in the interim." Kuvin said he agrees, "It's a valid concern for some of the victims." Attorneys for two victims in the pending Crime Victims' Right Act litigation blasted the government's reasoning to leave Epstein's non-prosecution agreement in place. Lawyers Bradley Edwards, Paul Cassell and Jack Scarola say any South Florida victims who are not willing to prosecute Epstein because of privacy concerns can simply decline to do so and remain anonymous. The lawyers say there's no way that prosecuting Epstein for some victims would harm other victims unless the prosecutors somehow disclose their identities in the process. "The Government's argument thus boils down to a stop-us-before-we-do-something-bad claim that deserves no credence from the Court," wrote Edwards and his co-counsel on behalf of the two women, identified as Jane Doe I and Jane Doe 2. They also pointed out that the prosecutors weren't asserting the alleged "risk" to some victims outweighs obtaining justice for their clients. "But in any event, on closer examination, the Government's argument turns out to be vaporous," they wrote this month. Epstein's lawyers told the judge they support the South Florida prosecutors' arguments that the once-secret deal shouldn't be blown up to allow new charges. Jeffrey Epstein faces 'a million pages' of evidence: defense lawyer EFTA00018446

Sponsored

Page 7 - EFTA00018447

New York Post By Andrew Denney and Bruce Golding 7/31/19 Prosecutors have 1 million pages of evidence against Jeffrey Epstein, his lawyer revealed in court Monday — without shedding any new light on the jailhouse incident that left the convicted pedophile with bruises on his neck. No marks were visible on Epstein's neck, and he never appeared to be in pain during the 15-minute hearing in Manhattan federal court. The judge overseeing the case tentatively scheduled Epstein's trial for June 2020 after a prosecutor said the child sex-trafficking charges against him should be resolved as "swiftly as possible." "We don't think any delay in this is in the public interest," Manhattan Assistant US Attorney said. Epstein's trial is expected to last four to six weeks, and the defense will have all the prosecution's evidence against the multimillionaire financier by Oct. 31, she said. Defense lawyer Martin Weinberg objected to starting the trial before September 2020, saying, "We need time to review a million pages of discovery." But Judge Richard Berman said he was blocking out time in June 2020 on the presumption that the defense would be ready by then. Weinberg didn't make any mention of the July 23 incident in which law enforcement sources have said Epstein, 66, was found sprawled on the floor of his cell in the Metropolitan Correctional Center, where he's being held without bail. Weinberg declined to answer questions about the incident outside court. Epstein, who wore dark blue jail scrubs over a brown T-shirt, didn't speak during the hearing. He's pleaded not guilty to accusations he sexually abused dozens of underage girls - some as young as 14 — in his Upper East Side townhouse and his waterfront mansion in Palm Beach, Florida, between 2002 and 2005. Berman set a Sept. 13 deadline for defense motions in the case, and Weinberg said he planned to seek dismissal of a conspiracy charge on grounds of double jeopardy tied to allegations that underpinned a non-prosecution agreement that Epstein struck in 2008 with then-Miami US Attorney Alex Acosta. That deal was exposed last year in an award-winning series of stories by the Miami Herald, and controversy that erupted following Epstein's July 6 arrest forced Acosta to resign as President Trump's labor secretary. Jeffrey Epstein appears in court for first time since reported jail injuries The Guardian By Victoria Bekiempis 7/31/19 Financier Jeffrey Epstein looked physically healthy when he appeared in court in New York on Wednesday in his sex trafficking case, about a week after reportedly being found unconscious in his jail cell with neck injuries. He wore dark blue jail scrubs during his brief appearance in Manhattan federal criminal court on Wednesday morning, in a proceeding scheduled before the apparent incident behind bars last week. There were no signs of injuries that had been reported at the time and he appeared well and more neatly presented than at some previous hearings. EFTA00018447

Page 8 - EFTA00018448

The Jeffrey Epstein scandal His lawyers did not bring up the incident in court and refused to comment on the topic following the hearing, which focused on scheduling issues. Prosecutor asked for a June 2020 trial date to be set, telling the judge: "We don't think that any delay in this case is in the public interest." The Manhattan US attorney's office alleged earlier in July that Epstein "sexually exploited and abused dozens of minor girls" from 2002 to 2005. Some of his victims were just 14 years old, prosecutors alleged. The disgraced financier, who was arrested on 6 July, pleaded not guilty several weeks ago. Epstein has long been accused of sexually abusing underage girls. He also has purported connections to Donald Trump, Bill Clinton and Prince Andrew, and moved in elite circles, including for several years in a relationship with Ghislaine Maxwell, daughter of the late British media tycoon Robert Maxwell. Epstein and the Miami US attorney's office, headed at the time by Alexander Acosta, brokered a plea deal in 2008 that closed a federal inquiry involving at least 40 teenage girls. Under this arrangement, Epstein pleaded guilty to state charges, which presented far less potential jail time than if he had faced federal charges. The Miami Herald reporter Julie K Brown exposed the secretive nature of this agreement. Acosta resigned from his post as Trump's labor secretary following extensive criticism of the deal. Epstein has unsuccessfully requested bail while awaiting trial. The 66-year-old, who registered as a sex offender following the Florida case, had maintained through lawyers that he neither posed a danger nor risk of flight. In rejecting Epstein's request, Judge Richard Berman said, "the government has established danger to others and to the community by clear and convincing evidence", adding: "I doubt that any bail package can overcome a danger to the community." Epstein's lawyers are appealing against the decision, according to court filings. Late last week, Judge Berman also ruled in favor of prosecutors' proposed protective order, which will keep case materials relating to "the government's ongoing investigation of uncharged individuals" under wraps. Judge sets tentative date for Jeffrey Epstein's trial Associated Press By Larry Neumeister and Jim Mustian 7/31/19 A subdued Jeffrey Epstein listened passively in court Wednesday as a judge said he won't face trial on sex trafficking charges before June 2020, and more likely a few months afterward. There was no mention at the Manhattan federal court appearance or any visible sign of injuries after the 66-year- old financier was found on the floor of his cell last week with neck bruises. Epstein's lawyer, Martin Weinberg, refused to say what might have left his client with neck bruises after the court hearing. Assistant U.S. Attorney urged a June trial date for the man accused of arranging to have sex with girls as young as age 14, saying there is "a public interest in bringing this case to trial as swiftly as possible." But Weinberg said the case is far from "ordinary," adding the defense team won't be ready before Labor Day 2020. He said prosecutors delayed bringing charges that relate to alleged crimes that occurred in the early 2000s at Epstein's residences in Manhattan and Florida. EFTA00018448

Page 9 - EFTA00018449

U.S. District Judge Richard M. Berman said a trial projected to last four to six weeks could tentatively begin June 8, but he'll likely defer to defense lawyers' needs if they are not ready. Epstein's demeanor in court was noticeably different from previous appearances, when he was actively engaged with his lawyers and looking through papers. On Wednesday, he sat quietly, his hands folded in front of his face through much of the 20-minute proceeding. Occasionally, he looked toward courtroom artists and reporters seated in a jury box. Epstein has remained at the Metropolitan Correction Center, which is adjacent to the downtown Manhattan courthouse. He has pleaded not guilty to sex trafficking charges that carry the potential for up to 45 years in prison. Berman refused bail after concluding he is a danger to the community and a flight risk. Prosecutors have said they fear he might try to influence a growing number of witnesses who support charges that he recruited and abused dozens of girls in New York and Florida in the early 2000s. His lawyers had argued he should be allowed to stay under house arrest in his Manhattan mansion. His lawyers say an agreement reached with federal prosecutors a dozen years ago disallows the charges and they say he has committed no new crimes. The lawyers agreed to file written arguments about the agreement and double jeopardy claims by Sept. 13. Oral arguments will occur in October. The non-prosecution deal was reached before he pleaded guilty in state court in Florida to prostitution-related charges involving underage girls. Afterward, he was required to register as a sex offender and pay restitution to many victims. While he served a 13-month jail term, he was permitted to leave jail to work for 12 hours a day, six days a week. Epstein was arrested July 6 when he arrived at a New Jersey airport on a private jet from Paris, where he has a home. Did Jeffrey Epstein try to kill himself? He and his lawyer, back in court, aren't saying Miami Herald By Miami Herald Staff 7/31/19 Victims of Jeffrey Epstein share the emotional toll that sexual abuse has taken on them — even years after the abuse occurred. Miami Herald reporter Julie K. Brown interviewed the young women, most speaking for the first time about Epstein. BY EMILY MICHOT I JULIE K. BROWN For the first time since he was found semi-conscious in his jail cell with telltale bruise marks on his neck, accused sex trafficker Jeffrey Epstein appeared in a Manhattan court room. Epstein — onetime friend of the rich and powerful, including current President Donald Trump and past President Bill Clinton — learned Wednesday that he will not face trial until at least next June. The multimillionaire part-time resident of Palm Beach sat subdued in front of U.S. District Court Judge Richard M. Berman. The 66-year-old defendant wore dark blue jail scrubs and glasses. His lawyer, Martin Weinberg, declined to reveal any details about the incident at the Metropolitan Correctional Center, which occurred July 23, including whether it was a suicide attempt, an attack by a fellow detainee or something else. His client is being held without bond. Wednesday's hearing in New York City lasted just 15 minutes. EFTA00018449

Sponsored

Page 10 - EFTA00018450

Epstein, a financier who owns homes around the world, including a waterfront estate in Palm Beach, was arrested July 6, nearly eight months after the Miami Herald published Perversion of Justice, a two-year investigation of a much-reviled secret plea deal in 2007-2008 that spared Epstein a sweeping federal indictment despite allegations of sexual abuse by nearly three dozen underage girls. He had just arrived from France at New Jersey's Teterboro airport on his private jet when authorities met him and took him into custody. During the early- and mid-2000s, Epstein allegedly ran what amounted to a sexual pyramid scheme, using recruiters to lure girls as young as 14 to his lavish Palm Beach and Manhattan mansions with the promise that they would receive $200 to give a man a massage. The girls have alleged that they were coerced into sex. The girls were paid additional money if they would recruit others girls, police and court records allege. Epstein had assistants schedule as many as three visits a day. Rather than face federal charges that could have put him away for life, Epstein pleaded guilty in state court to minor prostitution charges and served just a year in the county stockade — which permitted him to leave the lockup for his luxurious downtown West Palm Beach office for 12 hours a day, six days a week. This "work release" arrangement, highly unusual for a sex offender, is now under criminal investigation by order of the Palm Beach sheriff, Ric Bradshaw, who oversees the stockade and approved the work release. Although Assistant U.S. Attorney said it is important to move swiftly ahead with Epstein's court case, his defense attorney said he needs time in light of the approximately one million pages of documents that that comprise the evidence collected against his client. Labor Secretary Alex Acosta held a press conference to defend his role in handling the Jeffrey Epstein sexual abuse case. Acosta was a U.S. Attorney who approved the Epstein plea deal in 2008. By CSPAN In the meantime, Epstein will be given a chance to argue that the non-prosecution agreement, executed in 2008, gave him, his schedulers, his alleged madam and others immunity from federal charges and that the new charges constitute impermissible double jeopardy. In its series of articles, the Herald highlighted the role of Alexander Acosta, then-U.S. attorney for the Southern District of Florida, in approving the immunity agreement, including a controversial stipulation that Epstein's accusers not be told of the arrangement. Facing searing criticism after Epstein's arrest, Acosta resigned his post as President Trump's labor secretary. Jeffrey Epstein could face sex trafficking trial next June Reuters 7/31/19 Financier Jeffrey Epstein could go to trial on charges of sex trafficking involving dozens of underage girls as early as next June, though his lawyers told a court on Wednesday they may need more time. At a hearing in Manhattan federal court, prosecutors sought a June 2020 trial date, while a lawyer for Epstein asked that it wait another three months. The lawyer, Martin Weinberg, said Epstein and his legal team needed more time to review evidence, expected to total more than 1 million pages. U.S. District Judge Richard Berman said he would tentatively set aside time for a trial beginning June 8, but revisit the issue later. He said he normally allowed defendants more time to prepare if they wished. Assistant U.S. Attorney said a trial is expected to last four to six weeks. EFTA00018450

Page 11 - EFTA00018451

Prosecutors have accused Epstein of arranging for girls under the age of 18 to perform nude "massages" and other sex acts, and of paying some girls to recruit others. Epstein has pleaded not guilty. Wednesday's hearing occurred one week after Epstein was reportedly found unconscious and with neck injuries in his jail cell at the Metropolitan Correctional Center in downtown Manhattan. Epstein, dressed in blue jail scrubs, had no visible injuries on Wednesday. His lawyers declined to comment on the reports after the hearing. Epstein is appealing Berman's July 18 denial of his request to remain under house arrest in his $77 million mansion on Manhattan's Upper East Side while awaiting trial. The charges against Epstein focus on alleged misconduct from at least 2002 to 2005. They followed Epstein's 2008 guilty plea to state prostitution charges in Florida, in exchange for the Justice Department's agreement not to prosecute him on similar charges. Epstein served 13 months in jail and agreed to register as a sex offender under the 2008 agreement, which is now widely considered too lenient. His lawyers have argued this month that the agreement barred federal prosecutors in Manhattan from pursuing the current case over the same conduct. Weinberg said at Wednesday's hearing that they intended to file motions on the issue. U.S. Attorney Geoffrey Berman, whose office is overseeing the current case, has said there is no such bar. Epstein Lawyers Ask for a Year to Review a Million Pages Bloomberg By Chris Dolmetsch , Bob Van Voris , and Patricia Hurtado 7/31/19 Jeffrey Epstein's lawyers say they need at least a year to review a blizzard of documents prosecutors have gathered against the fund manager as they prepare to defend him against charges of sex trafficking in minors and conspiracy. Prosecutors asked a judge to schedule Epstein's trial for next June, but defense attorney Martin Weinberg said his team wanted to wait until September 2020, because they haven't yet begun to receive documents from the government. "We need time to receive a million pages of discovery and prepare to defend a four- to six-week trial," Weinberg said during a brief hearing in Manhattan on Wednesday. "We need time to assess events that occurred 14 to 17 years ago." The judge set a tentative trial date of June 8 and asked the parties to keep him updated on their progress. Epstein, who didn't speak in court, was arrested on July 6 after stepping off his private plane in New Jersey from a trip to Paris. He has pleaded not guilty and said he has fully complied with the law for more than 14 years. Marks on Neck Epstein is accused of molesting teenage girls from 2002 to 2005. He pleaded guilty in 2008 to Florida state charges of soliciting prostitution, after striking a non-prosecution agreement with the U.S. Federal prosecutors in New York say they are not bound by the deal as they now pursue their own charges. EFTA00018451

Page 12 - EFTA00018452

In court Wednesday, there was no discussion of what happened to the 66-year-old Epstein last week at New York's Metropolitan Correctional Center, where he has been held since his arrest. People familiar with the matter said he was found injured and unresponsive in his cell, with marks on his neck. Authorities are investigating whether he was assaulted, possibly by another inmate, or whether the injuries were self-inflicted. Weinberg declined to respond to questions about the incident outside court. Also in court was Gloria Allred, the activist lawyer who has represented women accusing Roy Moore, Bill Cosby and President Donald Trump of sexual assault. After the hearing, she said she was representing other Epstein accusers who "were not in the Florida case." She said other women have approached her about their experiences with Epstein but were reluctant to discuss them for fear of retaliation. The U.S. attorney in Manhattan, Geoffrey Berman, has urged others who may be victims to come forward and cooperate with the government. Allred declined to say whether her clients have spoken to prosecutors. The case is U.S. v. Epstein, 19-cr-490, U.S. District Court, Southern District of New York (Manhattan). Collins Editorial: Failures of ethics Buffalo News By News Editorial Board 7/29/19 The ethics specialists are right and so are the members of a special ethics panel, including both Democrats and Republicans, who are paying attention. Good for them. The conduct of Rep. Chris Collins, R-Clarence, exposed a range of issues Congress needs to treat as tumors, and cut them out. Collins was indicted last year on allegations of insider trading. But he was routinely smashing ethical standards — of both formal and common sense varieties — before he was ever charged with a crime. A year before Collins was indicted, the Office of Congressional Ethics reported that it found "a substantial reason to believe" that Collins violated federal law by touting the stock of Innate Immunotherapeutics, an Australian biotech firm, based on inside information. The office also said Collins may have broken House ethics rules by persuading National Institutes of Health officials to meet with a staffer from that company. At least as troubling are the actions Collins took that were not deemed to be ethical violations. Speaking to a bipartisan House task force charged with drawing up new ethics rules based on Collins' arrest, ethics experts worried about lawmakers who sit on the boards of privately owned companies, or who serve as partners in other businesses or who are directors of nonprofit organizations. Collins still does all three. Earlier this year, in response to Collins' arrest, the House barred lawmakers from serving on the boards of publicly traded companies. Collins did that, too, as a board member — and leading stockholder — of Innate Immunotherapeutics. It's how prosecutors say he obtained the insider information that led to his arrest. There was more. Collins authored a provision of the 2016 "21st Century Cures Act" that sped drug approval for companies like Innate. Collins, with a straight face, claimed there was no conflict because Innate had no business before U.S. regulators. But in 2017, the company practically beamed that it had "received clearance from the U.S. Food and Drug Administration for the Company's Investigational New Drug (IND) application lodged last month." EFTA00018452

Sponsored

Page 13 - EFTA00018453

The fact that Collins' role in the legislation could also have benefited other companies — and may even have been worthy of passage — does nothing to change the associated fact that he was pushing for legislation whose adoption could have lined his pockets. It was classic self-dealing. The drug in question was meant to treat multiple sclerosis. It failed in clinical trials in 2017 and prosecutors say Collins illegally spread the word to family and others who were able to sell their stock before its price collapsed on the bad news. Collins has pleaded not guilty to the charges. His trial is scheduled for February. But regardless of what a judge or jury ultimately decides about Collins, he has shown himself to be indifferent to the need for a member of Congress to conduct himself in a way that reflects well on the institution and on the voters who entrust him with public office. In that, he has shown Congress that it needs to act. It can't count on its members using good judgment, especially when millions of dollars are at stake. The good news is that it seems ready to meet that public obligation. It is considering measures that would prohibit lawmakers from serving as partners in limited liability corporations, joining committees that oversee their business interests and serving on the boards of nonprofit organizations. Staff members would also be barred. Sadly, some Republican members have defended Collins, despite the clear conflicts of interest. But the Republican on the ethics task force, Rep. Van Taylor of Texas, expressed no disagreement with the panel's Democrat, Pennsylvania Rep. Susan Wild, who said she expected to move "rather quickly" on writing new rules. Taylor sees the tasks as "very narrow," focused on preventing lawmakers from serving in outside positions that could pose conflicts. The remarkable thing is that those restrictions need to be put in writing. Thank Collins for that. Securities and Commodities Fraud Stewart Southern District Will Pursue A Retrial Of "Silver Platter" Case Forbes By Walter Pavlo 7/30/19 Sean Stewart was indicted on insider trading charges back in May 2015 during U.S. Attorney Preet Bharara's reign over the Southern District of New York. Now, over four years since his indictment, Sean can reflect back on a wild journey of being convicted, sentenced to 3 years prison, having that conviction overturned, being released from prison halfway through his term and, now, having a new date to go back to trial to face the charges again. Sean Stewart was indicted on insider trading for passing material non-public information on potential deals to his father, Robert, who then passed it on to his former friend and trader, Richard Cunniffe. Sean, a Yale graduate who had worked in investment banking at JPMorgan Chase and Perella Weinberg, mentioned some details about his work while talking to Robert. Sean's information made it to Cunniffe who made over a million dollars on the trades, sharing a small amount (less $100,000) with Robert. How much did Sean make on the trades? ZERO dollars. He had no idea that Cunniffe traded because he did not even know who Cunniffe was. It was a clear case of misappropriation where information was used without Sean's knowledge, so it was not a "classical" insider trading case. However, Bharara's team of U.S. attorneys was looking for cases that targeted EFTA00018453

Page 14 - EFTA00018454

wealthy Wall Street traders who seemed to have an advantage over the average trader. Sean's case was a good fit. Cunniffe was busted by the FBI and soon became a government informant, taping calls and other meetings with Robert. In one of those calls, Robert stated that Sean said of the information he had passed on to Cunniffe, "I can't believe it. I handed you this on a silver platter and you didn't invest." So the primary evidence in the case, the case that came to be known as the "silver platter" case, was based on a statement that was attributed to Sean. It's a phrase that Sean's new defense team wants to be excluded from the proceedings. When Robert was arrested, under duress of FBI questioning, he said nine (9) times that Sean was not in on his scheme with Cunniffe (here is entire tape transcript here). Robert also admitted his own role and that of Cunniffe's during the interrogation. When it came to trial, neither that tape nor Robert's testimony was allowed because of legal maneuvering by prosecutors. The video tape was suppressed and Robert did not testify due to threats from prosecutors that he would be charged for perjury due to his conflicting accounts. Here is what the jury missed from that tape: FBI AGENT: Tell me about the first time that Sean gave you information on a deal. ROBERT STEWART: Well, uh, I wouldn't characterize any of these as — I mean Sean would mention stuff. I don't think he had any idea that I would trade on any of this stuff Uh, I've never mentioned that I did, to him. Ummm AGENT: If that's true, how do you explain the comment you made to Rick [Cunniffe] that Sean got angry with you when he gave you this information on a silver platter and you didn't invest. ROBERT: Uhh, I think I was just saying that to Rick because Sean said, oh, you know, ahh, all these deals, you know, you — if you were trading you could make like millions of dollars. And I said, you know, Sean, no one's going to trade and make millions of dollars on this stuff. That wasn't his intention. Robert took the 5th but did submit an affidavit that if he were to testify he would have said Sean did not know about the trades by Cunniffe. Looking back at the trial, there was not a single email, document, or text message that suggested that Sean was a knowingly participated in the trading scheme. This is interesting since there were so many incriminating documents between Cunniffe and Robert. There were no witnesses who gave testimony on Sean's knowledge and intent, including Cunniffe, the cooperator, who on the stand acknowledged that he never knew Sean. Furtnermore, trading records and actions undertaken by Sean suggest he did not know trading had taken place. Last fall, the 2nd Circuit overturned Sean's conviction, something rare in most cases, especially a reversal on an evidentiary ruling, which suggests the 2nd Circuit felt that Sean may be innocent and the judge's mistakes resulted in an unfair trial. The appellate court ruled that Robert's post-arrest video interrogation should have been allowed. Sean was released from prison and has been in legal limbo until the SDNY decided that they would move to move forward with another trial on the same charges. Stewart will have a new judge this time around. U.S. District Judge Laura Taylor Swain was replaced by Judge Rakoff, a man who seems to be on a mission to define insider trading laws himself. He also has new attorneys Steven M. Witzel, Lawrence Gerschwer, R. David Gallo and Leigh G. Rome of Fried Frank Harris Shriver & Jacobson LLP. If Sean is found guilty, he would face the prospect of being sentenced to prison and returning to prison to complete a term. On the other hand, it would not be out of the question for Judge Rakoff to give him "time served" in prison even if Sean is found guilty. Rakoff, not a fan of the Federal Sentencing Guidelines, seems to be one of those judges that uses common sense in his approach to sentencing. Earlier this week, Rakoff EFTA00018454

Page 15 - EFTA00018455

sentenced a man to 14 months in prison for knowingly leaking insider information on Sherwin Williams' acquisition of Valspar. While Sean may have made some mistakes, these could have been handled by the companies he worked for and, at the most severe, an enforcement action by the Securities and Exchange Commission. The SDNY seems intent on trying to interpret insider trading laws by putting on elaborate trials with the threat of putting people in prison for years. It is a waste of resources. It looks like the ghost of Bharara still haunts the SDNY. Thompson Easton man accused of stealing $7M via fake Bitcoin transactions Lehigh Valley Live By Sarah Cassi 7/30/19 An Easton man who headed a cryptocurrency escrow company was arrested last week on federal charges he allegedly stole $7 million from two companies by lying about Bitcoin transactions. Jon Barry Thompson, also known as J. Barry Thompson, was the principal of Volantis, which included a cryptocurrency escrow company called Volantis Escrow Platform LLC and a related company, Volantis Market Making LCC. The 48-year-old Thompson was arrested in Easton, and was charged with two counts each of commodities fraud and wire fraud. Easton police assisted in serving the arrest warrant at 6:15 a.m. Thursday at Thompson's West Burke Street home on College Hill. What happens to the money when a criminal's stash is in bitcoin? When a criminal's stash is in bitcoin, the stakes are now much higher in forfeiture cases with the soaring value of the virtual currency. Thompson was released after posting $500,000 bond. Messages left for comment at a phone number listed for Thompson and for his defense attorney, Matthew Siembieda, were not immediately returned. Prosecutors said Thompson stole $7 million from two companies after lying about transactions of the peer-to- peer digital currency Bitcoin — $3 million from one company and $4 million from a second. Thompson offered minimized settlement default risk in cryptocurrency transactions, and claimed there was no risk of default, prosecutors allege. In June and July 2018, Thompson convinced the first company to send Volantis more than $3 million for a Bitcoin purchase, prosecutors allege. Thompson allegedly assured the company he had the Bitcoin in hand and that money could not be lost. Thompson took the money, but never provided the company the promised Bitcoin or returned its money, prosecutors said. Thompson allegedly gave the company a fake account statement showing he had the company's money but in reality sent the more than $3 million to a third-party entity purportedly in exchange for Bitcoin without first receiving any of the Bitcoin in hand. EFTA00018455

Sponsored

Page 16 - EFTA00018456

In July 2018, Thompson allegedly convinced a second company to send Volantis more than $4 million for Bitcoin purchases. Again, Thompson is accused of sending a substantial portion of the money to a third party without first receiving any Bitcoin in return, prosecutors allege. Thompson never gave the second company any Bitcoin and did not return its money, prosecutors said. "Jon Thompson induced investors to engage in cryptocurrency transactions through his company, Volantis Market Making, by touting a transaction structure that would eliminate any risk of loss during the purchase," Manhattan U.S. Attorney Geoffrey S. Berman said in a news release. "As his clients soon realized, however, Thompson's representations were false, and these cryptocurrency investors ultimately lost all of the money they had entrusted with him because of his lies." FBI Assistant Director-in-Charge Sweeney said Thompson used phrases and terminology that the victimized companies didn't understand, and he "allegedly preyed on their ignorance of the emerging cryptocurrency." "Thompson allegedly thought no one would ask where their actual money went when they trusted him to invest in Bitcoin," Sweeney said. The complaint doesn't identify the companies allegedly victimized by Thompson. Forbes previously reported Symphony, an Irish investment company that specializes in trading cryptocurrencies, gave Thompson 3.6 million Euros to purchase Bitcoin on its behalf. Symphony never received any Bitcoin and its money was never returned. In that case, the plaintiff withdrew the complaint it had brought in federal court in Pennsylvania and, instead, reached a private settlement with Thompson. Thompson then breached the agreement by failing to make the first settlement payment, Forbes reported. Pinto-Thomaz Popular Paint Brand Insider Trading Results In Prison Term: Feds Patch By Chris Dehnel 7/30/19 A former analyst for a major financial ratings agency is to spend more than a year in prison for an insider trading scheme involving his hairdresser, a jeweler and two major paint brands sold prominently in Connecticut. Geoffrey S. Berman, the United States Attorney for the southern district of New York, announced that Sebastian Pinto-Thomaz, 34, a former credit ratings analyst at Standard & Poor's, was sentenced in Manhattan federal court to 14 months in prison for participating in two schemes to trade on material, nonpublic information in advance of the Sherwin-Williams Company's acquisition of the Valspar Corporation. Valspar is the brand sold by Lowe's. Pinto-Thomaz was convicted on April 26, following a jury trial before U.S. District Judge Jed S. Rakoff, who also imposed Monday's sentence. In summarizing the case, Berman said, "As an employee of Standard & Poor's, Sebastian Pinto-Thomaz was privy to potentially lucrative information about business acquisition plans. Instead of protecting that information, EFTA00018456

Page 17 - EFTA00018457

as he had sworn to do, he shared it with a friend and with his hairdresser. In turn, they bet on a stock that they knew to be a sure thing, and raked in nearly $300,000 in profits. Pinto-Thomaz painted himself into a corner when he and his co-defendants exploited insider information to reap illegal profits. Now they all face time in prison for their misdeeds." When a company announces an acquisition, the acquiring company often seeks the opinion of a credit rating agency regarding the potential impact that the acquisition could have on the acquiring company's creditworthiness, Berman said. Therefore, companies often contact rating agencies before an acquisition is publicly announced in order to secure the rating agency's views on how a possible acquisition could impact a company's credit rating, he said. All major rating agencies offer a service — sometimes known as a Rating Evaluation Service, or RES — that provides the company with a rating committee decision with respect to a proposed acquisition. In March 2016, Standard and Poor's, a credit rating agency in New York, assigned Pinto-Thomazto work on a RES for the Sherwin-Williams Company in advance of its contemplated but unannounced acquisition of the Valspar Corporation, according to casae records. In connection with the assignment, Pinto-Thomaz received material, nonpublic or "inside" information the deal about Sherwin-Williams's planned acquisition of Valspar prior to the public announcement of the acquisition. S&P's written policies prohibited the unauthorized disclosure of confidential information, which included the inside information, Berman said. During his tenure at S&P, Pinto-Thomaz reviewed and certified his duties of loyalty and confidentiality to S&P and its clients, according to case records. In March 2016, Pinto-Thomaz passed the inside information about the paint merger to Jeremy Millul, a friend, and to Abell Oujaddou, his hairdresser, so that they could "use it to make profitable trades in Valspar stock and options.," Berman said. On March 21, 2016, the first trading day after the public announcement of the acquisition, the price of Valspar stock increased approximately 23 percent over the prior day's close. Millul, a Manhattan jeweler opened a brokerage account on March 13, 2016, and shortly thereafter purchased 480 shares of Valspar common stock, case records show. On March 18, 2016, the last trading day before the acquisition was publicly announced, Millul also purchased 75 out-of-the-money Valspar call options, according to case records. After the acquisition was publicly announced, Millul sold his Valspar stock and options for approximately $106,806 in profits, Berman said. Oujaddou, a Manhattan hairstylist and salon owner who has known Pinto-Thomaz for years and is a close friend with his mother, was given inside information during a haircut on March 8 or 9, 2016, according to case records. On March 10 through March 18, 2016, Oujaddou, who had never previously purchased Valspar or Sherwin- Williams purchased 8,630 shares of Valspar stock, case records show. After the acquisition was publicly announced, Oujaddou sold his Valspar shares for approximately $192,080 in profits, according to case records. Following the trading, Oujaddou met Pinto-Thomaz in the paint aisle of a hardware store and paid him a kickback, Berman said. Pinto-Thomaz denied having a relationship with anyone on the list of pre-merger trading. EFTA00018457

Page 18 - EFTA00018458

In addition to his prison term, Pinto-Thomaz was sentenced to three years of supervised release and ordered to pay a fine of $15,000 and a forfeiture money judgment in the amount of $7,500. Millul and Oujaddou each previously pled guilty and were to be sentenced on July 30. Narcotics Castro Drug Dealer Forfeits Over $4M in Bitcoin as Part of a Guilty Plea All Stocks By Ravi Rd 7/31/19 According to a July 25 press release from the United States Attorney's Office of the Southern District of New York, the very active Bitcoin drug dealer Richard Castro has pleaded guilty of committing illicit activities such as money laundering and distributing three controlled substances through the dark web and encrypted emails. Castro was charged by the US Department of Justice (DoJ) and agreed to forfeit more than $4 million including cryptocurrency funds available in his seven different Bitcoin wallets. Castro, 36-year-old based in Windermere, Florida, operated under multiple badges, such as "Chems_usa," "Chemical_usa" and "Jagger109" to distribute three controlled opioid substances namely carfentanil, fentanyl, and phenyl fentanyl. Dream Market and AlphaBay were two of his primary market places on the dark web, where he sold drugs in exchange for cryptocurrency. The three controlled opioid substances were sold from November 2015 to 2019 by Castro and another co- conspirator, Luis Fernandez. Fentanyl, the first of these three is considered to be significantly stronger than heroin while Carfentanil is believed to be 100 times stronger than fentanyl. Castro sold these substances under the three aforementioned monikers which ultimately used to prove that he is indeed the leader of this conspiracy. On Dream Market, Castro once boasted about 3,200 transactions that he had completed on various dark web marketplaces. Out of these 3,200 transactions, 1,800 transactions were successfully completed on AlphaBay alone. The conspirators apparently also received many positive reviews for the quality of synthetic opioid substance they were selling. In June 218, Castro informed his clients that he would only accept orders received by encrypted emails and declared the organization is getting the business off from the dark web. Customers who wanted to buy narcotics had to acquire the address of the encrypted email from "Chems_usa" by paying certain fees. Unfortunately for Castro, an undercover law enforcement officer also obtained the encrypted email and placed an order, which ultimately led to his arrest. Castro was accepting the payments in Bitcoin which were later distributed in seven different BTC wallets. Manhattan U.S. Attorney Geoffrey S. Berman said: "As he admitted today, for years, Richard Castro used the dark web to distribute prolific quantities of powerful opioids, including fentanyl and carfentanil. Castro thought he could hide behind the anonymity of the interne, and use online pseudonyms to deal drugs — like `Chems_usa' and `Chemical_usa.' Thanks to our law enforcement partners, `Chems_usa' is now in U.S. prison." Castro has agreed to forfeit $4,156,198.18 including the funds on those seven Bitcoin wallets. EFTA00018458

Sponsored

Page 19 - EFTA00018459

Rochester Drug Company Distributor Has Been Shipping Excess Opioids to Small Towns Legal Reader By Sara E. Teller 7/31/19 Miami-Luken Inc., an Ohio drug wholesale distributor, and four people including two former executives have been charged with selling millions of pills amid the opioid epidemic despite knowing the dangers. The indictment charged the Springboro, Ohio-based company; Anthony Rattini, the company's former president; James Barlay, former compliance officer, and two pharmacists with "conspiring to distribute controlled substances." Prosecutors have alleged "Miami-Luken ignored obvious signs that drugs were being diverted to illegal users and dealers between 2011 and 2015." The company was shipping 4.9 million pills to Miller-West's drugstore in Oceana, W.Va., where the population is just under 1,400. "Miami-Luken and the executives failed to guard against the dangerous drugs it was shipping to pharmacies in five states from being diverted for illegal uses or to report suspicious orders to the U.S. Drug Enforcement Administration," they added. The distributor shipped millions of pills to desolate and rural areas of Appalachia which was hit especially hard by the epidemic. "Records show Miami-Luken also distributed 3.7 million hydrocodone pills from 2008 to 2011 to a pharmacy in Kermit, West Virginia, a town of just 400 people," prosecutors said. The pharmacists charged were Devonna Miller-West, the owner of Oceana, West Virginia's Westside Pharmacy, and Samuel Ballengee, owner of Williamson, West Virginia's Tug Valley Pharmacy. The company was also shipping some to other "unnamed pharmacists and physicians," the indictment alleged. "There's a need, in my opinion, to devote sufficient charges right here and now to stop the dying," United States Attorney Benjamin C. Glassman said, adding investigators found "many overdose deaths that could arguably be linked to the conduct of people accused in the conspiracy." In April of this year, criminal charges were brought against Rochester Drug Co-operative. Geoffrey S. Berman, the United States Attorney for the Southern District of New York, and Ray Donovan, the Special Agent in Charge of the New York Division of the U.S. Drug Enforcement Administration (DEA), announced the charges. Rochester Drug Co-Operative is one of the 10 largest pharmaceutical distributors in the United States. Charges were also filed against Laurence F. Doud III, the company's former chief executive officer; and William Pietruszewski, the company's former chief compliance officer. The indictment was specifically for "unlawfully distributing oxycodone and fentanyl, and conspiring to defraud the DEA," according to court documents. Berman said at the time, "This prosecution is the first of its kind: executives of a pharmaceutical distributor and the distributor itself have been charged with drug trafficking, trafficking the same drugs that are fueling the opioid epidemic that is ravaging this country. Our Office will do everything in its power to combat this epidemic, from street-level dealers to the executives who illegally distribute drugs from their boardrooms." The company paid $20 million to resolve the charges. DEA Special Agent in Charge Ray Donovan said, "Today's charges should send shock waves throughout the pharmaceutical industry reminding them of their role as gatekeepers of prescription medication. The distribution of life-saving medication is paramount to public health; similarly, so is identifying rogue members of the pharmaceutical and medical fields whose diversion contributes to the record-breaking drug overdoses in America. DEA investigates DEA Registrants who divert controlled pharmaceutical medication into the wrong hands for the wrong reason. This historic investigation unveiled a criminal element of denial in RDC's compliance practices and holds them accountable for their egregious non-compliance according to the law." EFTA00018459

Page 20 - EFTA00018460

Civil Life Spine Lawsuit against Huntley-based medical device company alleges kickback scheme Northwest Herald By Drew Zimmerman 7/30/19 Life Spine, a medical technology manufacturer in Huntley, is the defendant in a federal lawsuit alleging violations of the False Claims Act by offering lucrative incentives to surgeons in exchange for their use of Life Spine products. The suit, which was filed last week by the U.S. Attorney's Office in the Southern District of New York, alleges that the company entered into agreements with dozens of surgeons as a means to pay more than $7 million in illegal kickbacks — including consulting fees, royalties and intellectual acquisition payments - for the surgeon's use of Life Spine's equipment. The suit also alleges that these agreements, spanning an estimated seven-year period, were done with the knowledge, involvement and participation of Life Spine President and CEO Michael Butler and Vice President of Business Development Richard Greiber, who also are being charged. "Defendants are liable for damages based on the payment of claims submitted to Medicare and Medicaid for medical services and procedures involving Life Spine Products that were tainted by illegal kickbacks," the suit reads. About half of Life Spine's total domestic sales of spinal products between January 2012 and at least December 2018, were attributable to surgeries performed by these paid surgeons, according to the suit. In addition to the consulting fees and royalties being paid, surgeons also were treated to dinners at high-end restaurants, Chicago Cubs games and other perks. "As alleged, Life Spine and its senior management flagrantly ignored the law by paying surgeons millions of dollars in fees and royalties to get them to use Life Spine products during spinal surgeries," Manhattan U.S. Attorney Geoffrey S. Berman said in a release. "Kickbacks to doctors can alter or compromise their judgment about the medical care and services to provide to patients, and can increase healthcare costs." For the first two counts of violating the False Claims Act — which are against Life Spine, Butler and Greiber — the plaintiff is seeking treble damages and civil penalties to the maximum amount allowed by state law. For the third count of unjust enrichment — which is only against Life Spine — the plaintiff is seeking damages to the extent allowed by law. The plaintiff also is seeking pre- and post-judgment interest, costs and any other relief the court deems appropriate. A statement from Life Spine said that both parties are engaged in discussions and look forward to resolving the matter. EFTA00018460

Page 21 - EFTA00018461

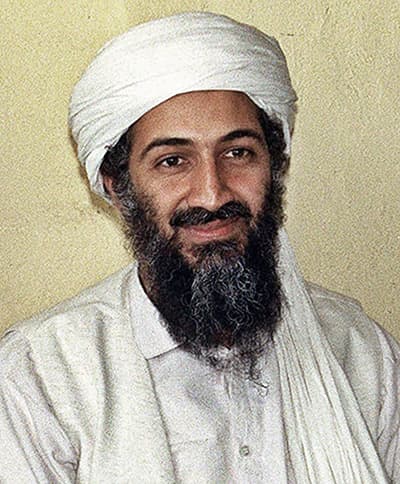

Matters of Interest The U.S. said a California cherry-picker went to Pakistan for terrorist training. Now the case has collapsed. Washington Post By Meagan Flynn 7/31/19 It was a month after 9/11, and Osama bin Laden's face flashed across the news on Naseem Khan's TV screen. The FBI was sitting in his living room in Bend, Ore., and Khan sensed an opportunity. The agents had come for an entirely different purpose and were ready to leave — until Khan pointed at the screen and said he thought he could help with something else. A few years ago, he said, he saw bin Laden's second-in-command, Ayman al- Zawahiri, one of the most wanted terrorists in the world, at a mosque in the wine-country town of Lodi, Calif. The agents perked up, intrigued by the possibility. Had they really just stumbled into a hot tip on al-Qaeda while speaking to a 28-year-old McDonald's worker and convenience store clerk? The FBI thought Khan was onto something — a possible "sleeper cell" of terrorism hidden in Lodi — and decided to dispatch him there as a confidential informant. Khan wouldn't find any associates of Zawahiri at the mosque in Lodi, and U.S. officials and terrorism experts now doubt his initial claim about Zawahiri was ever true. But Khan would find 19-year-old Hamid Hayat — who would soon become the face of homegrown terrorism in post-9/11 America. They met at the mosque, and Khan learned Hayat was taking a trip to Pakistan with family. Over and over, in recorded conversations, he returned to the same question: Would Hayat commit to attending a terrorist training camp, as he had promised? Now, a judge's order on Tuesday casts doubt on whether Hayat ever actually did. Hayat, a cherry-picker and son of an ice cream truck driver, was convicted of attending the alleged terrorist training camp and sentenced to 24 years in prison in 2006. Prosecutors, relying on Khan and Hayat's own statements, alleged that he attended the camp for three to six months sometime in 2003. The case would become one of the most high-profile examples of the government's fight against terrorism in the immediate aftermath of 9/11, especially because Hayat, after hours of interrogation by FBI agents, confessed to attending the camp. But on Tuesday, U.S. District Judge Garland E. Burrell Jr. vacated his conviction and sentence, finding that Hayat had inadequate defense during the 2006 trial while casting doubt on the facts of the case. Burrell questioned whether jurors would have convicted him had they heard evidence from witnesses in Pakistan, which the judge said likely would have "undermined" jurors' confidence in Hayat's confession alone. His attorneys have maintained the confession was coerced during an exhausting interrogation. Had the defense attorney actually interviewed any witnesses in Pakistan who spent significant time with Hayat during his trip, she would have discovered that they recalled Hayat spent most of his time playing video games and cricket and that the purpose of his visit was for his family to find him a wife, according to Burrell's order. No one identified any prolonged disappearance that would have allowed him to visit a terrorist training camp for three to six months as prosecutors alleged and Hayat said in the confession, Burrell noted. Burrell, who oversaw Hayat's original trial, found the witnesses gave consistent statements and could have provided Hayat a credible alibi. "Showing that Hayat could not have been at a jihadi training camp for the `period of months' specified in the indictment would have been completely consistent with the defense that Hayat's confession should not be EFTA00018461

Sponsored

Page 22 - EFTA00018462

credited and the government lacked other supporting evidence," a U.S. magistrate wrote in making the recommendation that Hayat's conviction be vacated. Burrell adopted most of the magistrate's findings of fact. The government has not decided yet whether to appeal the decision, a spokeswoman in the U.S. attorney's office in the Eastern District of California said in a statement, the Sacramento Bee reported. "We are in the process of reviewing the district court decision and assessing what steps, if any, should be taken and considering all our options," the statement said. Hayat, now 36, is currently being held in a federal prison in Phoenix. His attorneys are seeking his immediate release. The case against Hayat and his father, Umer, who was accused of lying to the FBI, heaped international attention on the Northern California town of Lodi. Seemingly overnight, the town went from the zinfandel capital of the world to an alleged terrorism "sleeper cell" — a claim authorities would later walk back. At the time he met Khan in August 2002, Hayat lived in his parents' garage and didn't have many friends, as the Intercept recounted in a 2016 investigation. Posing as a radical Islamist, Khan nudged Hayat into conversations that were anti-American and supportive of Islamic fundamentalist groups, and to his delight Hayat went along with it, according to recorded conversations cited in federal court documents. Hayat approved of the beheading of Wall Street Journal journalist Daniel Pearl by Pakistani militants. He told Khan he believed jihadists had attended his grandfather's religious school in Pakistan and claimed his grandfather was so politically well connected that the Pakistani president enlisted him in efforts to persuade the Taliban to turn over bin Laden after 9/11. Then came the terrorist camps. Hayat said he had seen one in an online video — and expressed interest in going himself. Khan, feeding the intel to the FBI, egged him on. But once in Pakistan, Hayat kept making excuses, according to the judge's order. When Khan told him he was being "lazy," Hayat claimed the climate had changed and it got too hot outside — the terrorist camp was canceled, he said. Khan was starting to get mad. His nudges turned to threats. "God willing, when I come to Pakistan and I see you, I'm going to ... force you to, get you from your throat and ... throw you in the madrassa," Khan said in one expletive-laden recorded conversation, as the Intercept reported. "I'm not going to go with that," Hayat said. "Oh yeah, you will go," Khan told him. "Yeah, you will go. You know what? Maybe I can't fight with you in America, but I can beat your a-- in Pakistan, so nobody's going to come to your rescue." In their last conversation, according to the Intercept, which obtained all the recordings, Hayat said he "never intended on going to a camp." Hayat denied attending a camp in his first interview with the FBI in Japan, before flying to San Francisco. He confessed during his second interview in California upon his return in June 2005. "FBI: Al Qaeda plot possibly uncovered," rang a CNN headline in June 2005, saying those involved "Trained on how to kill Americans." Months after Hayat's arrest, then-director of national intelligence, John D. Negroponte, testified in a congressional hearing that a "network of Islamic extremists in Lodi, Calif., for example, maintained connections with Pakistani militant groups, recruited United States citizens." But ultimately, no other terrorism cases arose from the investigation except for the one against Hayat. Two imams were investigated but were never criminally charged with anything. They had overstayed religious worker EFTA00018462

Page 23 - EFTA00018463

visas, authorities discovered. A retired FBI agent who watched Hayat's interrogation and the resulting confession told the Los Angeles Times it was "the sorriest interrogation, the sorriest confession, I've ever seen," believing the agents fed Hayat the details they wanted to hear and that Hayat repeated them so he could leave. He was barred from offering his testimony at trial. Burrell found that the failure to challenge the validity of the confession by presenting a false confession expert also contributed to his finding that Hayat had ineffective counsel. Khan was ultimately paid nearly $230,000 for assisting the FBI over three years. During Hayat's trial, his defense attorney questioned how one fast-food worker's implausible claim that he saw the world's most wanted terrorist in a small-town mosque could have "sparked this whole investigation with this ridiculous claim," the Times reported in 2006. Hayat's attorneys filed an appeal in 2014 and ultimately sought to interview numerous witnesses in Pakistan who could account for his whereabouts during the trip from 2003 to 2005. They appeared for sworn depositions on video in 2018. When Hayat's attorney, Dennis Riordan, asked his uncle whether he "would have known" if Hayat disappeared from their rural hamlet, Muhammad Anas said, "Naturally, I would have noticed," the Marshall Project reported then. The judge found that the witnesses "corroborated each other on some important points," regarding trips the family took throughout Pakistan and who they visited. Once or twice a month, they traveled to a hospital for his mother's medical treatment. On Tuesday, Hayat's family issued a statement applauding the judge's decision to throw out Hayat's conviction, the Sacramento Bee reported. "We have been waiting 14 long years for Hamid to be freed," the statement read. "Hamid cannot get those 14 years of his life back, but we are relieved to see the case take such a big step forward. We miss him and hope to be reunited with him soon." Fed Cuts Interest Rates for First Time Since 2008 Crisis New York Times By Jeanna Smialek 7/31/19 The Federal Reserve cut interest rates for the first time in more than a decade on Wednesday as it attempted to guard the record-long economic expansion against mounting global risks. The widely expected quarter-point move, the Fed's first since it cut rates to near zero in 2008, is meant to protect the economy against the potentially harmful effects of a growth slowdown in China and Europe and uncertainty from President Trump's trade war. "In light of the implications of global developments for the economic outlook as well as muted inflation pressures, the committee decided to lower the target range for the federal funds rate," according to the Federal Open Market Committee's policy statement. But the Fed did not indicate that this was the beginning of a rate-cutting campaign, suggesting instead that the cut was a minor adjustment intended to help the economy weather any challenges from slowing global growth and Mr. Trump's trade fights. Subscribe to With Interest EFTA00018463

Page 24 - EFTA00018464

Catch up and prep for the week ahead with this newsletter of the most important business insights, delivered Sundays. While Jerome H. Powell, the Fed chair, left the door open to additional rate moves if the economy showed signs of sputtering, he did not indicate the central bank was poised to engage in the sort of deep cutting cycle that the Fed has done in the past to avert or offset recessions. "It's not the beginning of a long series of rate cuts - I didn't say it's just one," Mr. Powell said at a news conference following the Fed's two-day policy meeting. "What we're seeing is that it's appropriate to adjust policy to a somewhat more accommodative stance over time, and that's how we're looking at it." The widely expected move from the central bank was initially greeted with a shrug in financial markets, where investors have been factoring in a rate cut for months. But the stock market turned lower after Mr. Powell began his news conference at 2:30 p.m., as investors absorbed the chair's comments as indicating the Fed was unlikely to make additional cuts anytime soon, as investors had hoped. By the end of the day, the S&P 500 was down 1.1 percent. It was the benchmark index's worst decline since May 31. The Fed dropped its target rate to a range between 2 percent to 2.25 percent. Officials also announced an early end to its efforts to shrink the Fed's balance sheet, another attempt to keep the economy moving. The central bank's holdings of government-backed bonds swelled during the financial crisis as it bought assets to try to reinvigorate growth. Policymakers have been slowly siphoning off securities to return their balance sheet to a more normal size, and that process was slated to end in September. It will now conclude Aug. 1. Why the Federal Reserve Cut Interest Rates The move is what's called an "insurance cut" — one that central bankers are making to keep growth chugging along. Both Eric Rosengren, the president of the Federal Reserve Bank of Boston, and Esther George, the president of the Federal Reserve Bank of Kansas City, voted against Wednesday's decision, preferring instead to leave rates unchanged. Those dissents marked the second and third of Jerome H. Powell's term as chair. While Fed officials said they expect economic expansion to continue and the labor market to remain strong "uncertainties about this outlook remain." Mr. Powell said the Fed's move was "intended to insure against downside risks from weak global growth and trade tensions." He said that manufacturing around the world was weakening and that Mr. Trump's trade dispute was continuing to spook American businesses. "The ongoing uncertainty is making some companies more cautious about their capital spending," he said. Officials did not indicate in their statement whether this cut would be followed by additional moves. The Fed's June economic projections suggest policymakers envision cutting rates slightly to shore up the economy, rather than beginning an easing cycle that will return rates to zero. "As the committee contemplates the future path of the target range for the federal funds rate, it will continue to monitor the implications of incoming information for the economic outlook and will act as appropriate to sustain the expansion," the Fed said in its statement, seemingly leaving its options open. Mr. Powell said the committee viewed the move as a "mid-cycle adjustment to policy," suggesting that the Fed sees this cut as more similar to two instances in the 1990s, during which the Fed moved rates down slightly to get the economy through periods of uncertainty, rather than the beginning of a rate-cutting campaign. EFTA00018464

Sponsored

Page 25 - EFTA00018465