EFTA00037015 - EFTA00037044

Document EFTA00037015 is a literary option agreement between BRAWN FILMS LLC and an unnamed author for the book "Silenced no Mare."

This document outlines the terms and conditions under which BRAWN FILMS LLC is granted an exclusive and irrevocable option to acquire the rights to the book "Silenced no Mare" for potential audio-visual productions. It details the conditions precedent that must be met for the agreement to be effective, including approval of the chain-of-title, receipt of fully-executed originals of the agreement, a release from the author's publisher, and required documentation for compliance with statutes/regulations. The agreement covers all aspects of the book, including titles, themes, plots, characters, and translations.

Key Highlights

- •The document is a literary option agreement related to the book "Silenced no Mare."

- •BRAWN FILMS LLC is acquiring the option to produce audio-visual projects based on the book.

- •Several organizations are mentioned, including the Copyright Office, Authors, and Productions.

- •The agreement includes conditions precedent that must be satisfied for it to be effective.

Frequently Asked Questions

Books for Further Reading

Perversion of Justice: The Jeffrey Epstein Story

Julie K. Brown

Investigative journalism that broke the Epstein case open

Filthy Rich: The Jeffrey Epstein Story

James Patterson

Bestselling account of Epstein's crimes and network

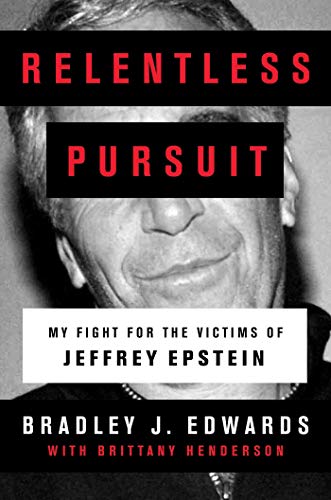

Relentless Pursuit: My Fight for the Victims of Jeffrey Epstein

Bradley J. Edwards

Victims' attorney's firsthand account

Document Information

Bates Range

EFTA00037015 - EFTA00037044

Pages

30

Document Content

Page 1 - EFTA00037015

CONFIDENTIAL LITERARY OPTION/PURCHASE AGREEMENT This literary option agreement (the "Agreement") is made and entered into by and between the Parties as of (*) (*), 2021, and shall be binding on the Parties. For good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the Parties agree as follows: 1. Parties BRAWN FILMS LLC ("Company"); and ("Author" and collectively with Company, the "Parties" and individually, each a "Party"). 2. Condition Precedent The grants made by Author to Company shall be effective immediately, subject to payment of the Option Price (as defined below), but Company shall have no obligations under this Agreement unless and until the following conditions precedent have been satisfied (hereinafter, the "Conditions Precedent"): (a) Company has approved the chain-of-title regarding the Property in a form and substance acceptable to Company; (14 Company has received fully-executed originals of this Agreement, together with all exhibits and documents attached hereto, in form and substance satisfactory to Company, including, but not limited to, the Short Form Option; (c) Company has received a release fully executed by Author's publisher; and (d) Company has received all required documentation from Author in connection with compliance with all statues/regulations (if and as applicable). 3. Option Author grants Company the exclusive, irrevocable option to acquire all necessary rights of the book entitled "Silenced no Mare" (the "Book"), including without limitation its titles, themes, plots, contents, character, illustrations, artwork, stories, elements, translations, adaptations and versions of any of all the foregoing, written and/or created by Author (collectively, the "Property') in connection with the development and production of potential audio-visual projects based on the Property (hereinafter, the "Productions"). All references in this document to the "Agreement" shall be deemed to refer to the long form option agreement to be executed by the Parties with the subject detailed above. 4. Initial Option Period In consideration of Company's agreement to pay Owner the sum of Seven Thousand US Dollars (USD $7,000) (hereinafter, the "Initial Option Price"), payable upon Company's receipt of the documents mentioned in the Conditions Precedent in section 2, Owner grants to Company the exclusive and irrevocable option (hereinafter, the "Option") to acquire the Granted Rights (as defined below) for a period commencing upon the execution date of this Agreement and continuing for eighteen (18) months thereafter (hereinafter, the "Initial Option Period"). The Initial Option Price shall be fully applicable against the Series Purchase Price and/or the Film Purchase Price, as applicable. 1 %MS.:not/ft, Mort\ Simon/ •iniee.trissre Nom easionnt.viao EFTA00037015

Page 2 - EFTA00037016

5. Extended Option Period Company shall have the right, but not the obligation, to extend the Initial Option Period for an additional and consecutive eighteen (18) months period (the "Extended Option Period" and collectively with the Initial Option Period, the "Option Period") by written notice to Author and payment to Author of the additional amount of Seven Thousand US Dollars (USD 57,000) prior to the expiration of the Initial Option Period. 6. Option Period Activities Company shall have the right throughout the Option Period to engage in all customary development and pre-production activities in connection with the Property and Author shall not exercise or otherwise use (or permit others to use) any of the Granted Rights (as defined below) during such Option Period. 7. Extension for Claims/Force Majeure Notwithstanding anything to the contrary in this Agreement, the Option Period shall be automatically suspended and extended by written notice to Author for any period during which: (I) a bona fide third party claim with respect to the Property (which claim would, in Company's good-faith opinion, materially and adversely affect Company's rights in connection with the Property and/or Company's ability to develop and/or produce the Productions) has been asserted and remains unresolved (whether or not taken to the level of formal litigation); (ii) Company's development and/or production activities in connection with the Productions based on the Property is/are materially interrupted or postponed due to the occurrence of any event of force majeure, including, but not limited to guild, union strike, fire, war or governmental action, pandemics, epidemics and/or quarantines; and/or (iii) Author is in breach of this Agreement. In the event the Initial Option Period or the Extended Option Period otherwise would expire on a Saturday, Sunday or national holiday, said period shall be extended without notice until the end of the next following business day. 8. Exercise of the Option The Option may be exercised at any time during the Option Period by written notice to Author, with prompt payment to follow of the Series Purchase Price and/or the Film Purchase Price (defined below in section 10). Commencement of principal photography of the first Production during the Option Period shall be deemed exercise of the Option (subject to the payment of the Series Purchase Price and/or the Film Purchase Price within fifteen (15) business days following such commencement of principal photography, provided, however, that production of a non- broadcast presentation or mini-pilot that is twelve (12) minutes or less in running-time, which is not publicly or commercially exhibited, shall be considered allowable development of the Property during the Option Period and shall not constitute a Production or automatically trigger the payment of the Series Purchase Price and/or the Film Purchase Price. 9. Non-Exercise of Option If the Option is not timely exercised during the Option Period pursuant to the terms of this Agreement, then all right, title, and interest in and to the Property granted to Company shall revert to Author upon the expiration of the Option Period (as the same may be suspended and/or extended in accordance with section I8.a) below). However, all additions to, extrapolations of and other 2 WIYIYISIc.X.0.000c.4151motOrl vettrissw 0,0m evittrekvI /co EFTA00037016

Page 3 - EFTA00037017

changes in the Property, written or made by, for or with the authorization of Company, including, but not limited to, all screenplays, teleplays, and presentation and other development materials (collectively, "Company Materials"), shall remain the sole and exclusive property of Company in perpetuity, throughout the universe. 10. Purchase Price a) In the event Company decides to acquire the feature film adaptation rights regarding the Property, the exercise of the Option shall imply payment by Company to Author of a purchase price equal to two-point five percent (2.5%) of the below-the-line production budget, with a minimum amount (floor) of Eighty Thousand US Dollars (USD $80,000) and a maximum amount (ceiling) of Three Hundred Thousand US Dollars (USD $300,000) (the "Film Purchase Price"). b) In the event Company decides to acquire the episodic audio- visual rights regarding the Property, the exercise of the Option shall imply a payment, by Company to Author, of a purchase price equal to Ten Thousand US Dollars (USD $10,000) per episode produced (the "Series Purchase Price"). 11. Derivative Works Bonus a) In the event Company develop and produces subsequent productions, Company shall pay Author a bump equal to two- point five percent (2.5%) of the Film Purchase Price or the Series Purchase Price, as applicable. b) In the event Company develops and produces prequels, sequels remakes, spin-offs and any other audio-visual derivative work based on the Property, Company shall pay Author five percent (5%) of the Series Purchase Price or Film Purchase Price, as applicable. 12. Payment Terms All payments are made by Company and within thirty (30) days of receipt of Author's invoice. 13. Granted Rights a) Upon exercise of the Option and payment of the Series Purchase Price and/or the Film Purchase Price, Author shall be deemed to have exclusively assigned and granted to Company, and Company shall own solely, exclusively, and irrevocably, without restriction or reservation, all rights, title, and interest (hereinafter, the "Granted Rights") of every kind and nature throughout the universe, in perpetuity, in all media, now known and hereafter devised, in and to the Property and all portions thereof (except for any Reserved Rights set forth in section 14 below), in all languages and all versions (including, without limitation, digitized versions), including, without limitation, all production, distribution, exhibition, exploitation, advertising, marketing, and publicity rights and all other rights in and to the Property, as follows: (i) Upon payment of the Film Purchase Price, animated and/or live action motion picture rights (whether theatrical, non-theatrical or DTC streaming) (ii) Upon payment of the Series Purchase Price, animated and/or live action audiovisual episodic series and/or podcast. Both (i) and (ii), inclusive of all necessary elements thereof, 3 %WHS.:at...O Mor111. knead*, vettrissw w,". evittrekvI /co EFTA00037017

Sponsored

Page 4 - EFTA00037018

live television rights, sequel, prequel, remake rights and spin- off rights, and all allied, ancillary, and subsidiary rights (including, without limitation, all interactive, video, and computer games, interactive media, multi-media, Internet and wireless content, merchandising, commercial, and promotional tie-up, musk publishing, recording, soundtrack album and audiodiscs), and publication rights (not to exceed the lesser of ten percent (10%) of the text from the Book or seven thousand five hundred (7,500) words in length in the aggregate) for purposes of advertising, publicizing, or promoting any of the foregoing rights (i.e., not for sale to the public) and print publication rights to publish or cause to be published souvenir booklets and "making-or and "coffee- table type books relating to the Productions and other works produced hereunder (provided that such publication(s) shall not contain synopses of or excerpts from the Property in excess of the lesser of ten percent (10%) of the text from the Book or seven thousand five hundred (7,500) words in the aggregate) and all versions thereof (including, without limitation, digitized versions) in all languages, and any Author trademarks, trade names, logos, designs, and trade dress associated therewith or embodied therein or related thereto, and all copyrights in the rights therein and renewals and extensions of copyright thereof. Company shall have the right to own, register and use the title of the Book as a trademark or service mark in connection with all the goods and services contemplated by the Granted Rights granted under this Agreement. b) Author is aware and hereby acknowledges that new rights to the Property may come into being and/or be recognized in the future, under the law and/or in equity (collectively, the "New Exploitation Rights"), and Author intend to and hereby grant and convey to Company any and all such New Exploitation Rights to the Property subject to the Reserved Rights. Company and Author are also aware and do hereby acknowledge that new (or changed) technology, uses, media, formats, modes of transmission, and methods of distribution, dissemination, exhibition, or performance (collectively, the "New Exploitation Methods") are being, and will inevitably continue to be, developed in the future, which would offer new opportunities for exploiting the Property. Author hereby agrees to execute any document Company deems in its interest to confirm the existence of the preceding and to effectuate its purpose to convey such rights to Company, including, without limitation, the New Exploitation Rights and any and all rights to the New Exploitation Methods. c) Company shall own all rights in and to the copyrights of all of the foregoing and all rights to advertise, broadcast, exhibit, and otherwise exploit any productions produced hereunder and all rights therein and portions thereof in all languages. d) Company shall have, in Company's sole discretion, the right to 4 WIYIYISIc.X.0.000c.4151motOrniee.trissre 0,0m Vita etrI. EFTA00037018

Page 5 - EFTA00037019

add to, delete from, modify, and, adapt the Property in the exercise of the Granted Rights, including, but not limited to, changing the title, making musical or non-musical versions of the Property, and adding, deleting, changing, or creating new characters, plots, themes, situations, etc., as well as create new characters, plots, themes, situations, etc. based on the Property. Author hereby waives the benefits of any provision of law known as "droit moral", "moral rights" or any similar laws, regulations, or decisions in any country of the world with respect to the Productions and agree not to institute, support, maintain, or authorize any action or lawsuit on the ground that any motion pictures, sound records, or other items produced hereunder in any way constitute an infringement of any of Author's "droit moral" or "moral rights" or a defamation or mutilation of any part thereof or contain unauthorized variations, alterations, modifications, changes, or translations. In addition, Company shall have the right to manufacture, sell, furnish, supply, and distribute products, by-products, services, facilities, merchandise, and commodities of every nature and description now known or hereafter devised, including, but not limited to, still photography, drawings, posters, artwork, toys, games, items of wearing apparel, foods, beverages, and similar items, which make reference to or are based upon or adapted from the Property or any part thereof, and the right to make trade deals and commercial tie-ups of all kinds involving the Property or any part thereof, including, but not limited to, the characters. Company shall have the right to use any of the rights set forth in this section in connection with the promotion, publication, and advertisement of any production based on the Property, or the exploitation thereof and in connection with any commercial tie-up, or the manufacture, advertising, distribution, and/or sale of any products, commodities, or services in connection therewith. 14. Reserved Rights The following rights are reserved to Author for Author's use and disposition (hereinafter the "Reserved Rights"): a) Publication Rights. "Publication Rights" shall mean the right to publish and distribute in all languages 0 printedversions of the Property owned or controlled by Author in book form, whether hardcover or softcover, and in magazine or other periodicals, whether in installments or otherwise; and (h7 electronic book versions of the verbatim text of the Property in a manner designed only to be read without any moving visual imagery and/or interactive and/or multimedia elements. Company shall have the right, for advertising and exploiting purposesgranted to Company under this Agreement: N to produce and publish (with or without illustrations by photographs, drawings, or cartoons) synopses, excerpts, summaries, resumes, on a "not for salt basis not to exceed ten percent (10%) of the text from the Books or seven thousand five hundred (7,500) words in total, whichever is less; (4 to publish in any medium and form "making of' and "behind-the-scenes" type books with respect to motion pictures exmsas.vwh vettrissw Nom gertbrekvittla EFTA00037019

Page 6 - EFTA00037020

and audio-visual programs and any other productions produced hereunder based upon the Property; and (iii) to publish in any medium and form the screenplays and teleplays of motion pictures and audio-visual programs based upon the Property. Notwithstanding anything to the contrary contained herein, the right to crnte a "novelization" of the Production's screenplay/teleplay shall be "frozen" so that neither Author nor Company may exploit such rights without the prior written consent of the other party. b) Electronic Display Rights. The right to publish and distribute the Property or adaptations thereof (including any photographs and illustrations contained in the Property) in whole or in part by any electronic means of storage, retrieval, distribution, or transmission that makes the Property in its printed form available in non-moving visual (but not audio) non-dramatic form for reading; subject, however to Company's right to all times to exercise its electronic display rights for advertising and promotional purposes. c) Author- Written Prequel/Sequel. The "Author- Written Prequel/Sequel" is a literary property written by Author using one or more of the characters appearing in the Property, participating in different events from those found in the Book, and whose plot is substantially different from that of the Book. Author shall have the right to exercise publication rights, i.e., in book or magazine form as set forth above in sections 15.a) and b), at any time. Author agrees not to exercise, offer or permit any other person or entity to exercise any rights (including, but not limited to, motion picture, television or other audiovisual rights) equivalent to the Granted Rights in or to any Author-Written Prequel/Sequel earlier than three (3) years after the first general release of the last episode of the series based on the Books (or, if not a series, then three (3) years after the first general release of the first Production based on the Books). After the expiration of said restricted period, Company shall have the right to first negotiate with respect to said Author-Written Prequel/Sequel rights and last refusal rights with respect thereto, in accordance with the provisions of section 16 below. Company shall not, however, be obligated to exercise or waive such right to negotiate prior to having an opportunity to review a completed manuscript for such Author-Written Prequel/Sequel. Author acknowledges that any disposition of rights in an Author-Written Prequel/Sequel pursuant to section 16 made to any person or company other than Company shall be limited to new characters and material not previously contained in the Books. d) It is expressly agreed that Author's Reserved Rights under this section 14 relate only to material written by Author, and not to any screenplay, teleplay, music, lyrics, original character aspects (enhanced or changed by Company) or sequels written or authorized by Company, even though the same may contain characters of other elements contained in the Property. 6 WIYIYISIc.X.0.000a111.1cnotOrl vettrissw Nom evittrekvI /co EFTA00037020

Sponsored

Page 7 - EFTA00037021

Notwithstanding anything to the contrary contained in this section 14, it is specifically agreed that included among the rights granted to Company under this Agreement and not reserved to Author is their sole, exclusive and irrevocable right to use and exploit the Property, the Productions and any other work hereunder using the Property, in whole or in part, in or in connection with any amusement/ theme park and the advertising, promotion and exploitation thereof. 15. Right of First Negotiation/Last Refusal Subject at all times to the holdback provisions set forth in section 14: a) First Negotiation. If Author desires to dispose of or exercise any Reserved Rights (hereinafter, the "Offered Right(s)"), then Author shall give notice to Company of such desire. Commencing upon Company's receipt of such written notice, there shall be a period of not less than thirty (30) days in which Author and Company may negotiate in good faith for such Offered Right. If by the end of such negotiation period no agreement has been reached or if at any time during such negotiation period Company gives Author a written notice that Company declines to negotiate for such Offered Right, then Author shall be free to negotiate elsewhere with respect to such Offered Right, subject to Company's right of last refusal set forth in section b) below. b) Right of Last Refusal. i. Reconsideration Period. If, with respect to the Offered Right, Company declines to negotiate, or there is no agreement pursuant to Company's right of first negotiation as set forth above in section a), and, with respect to the Offered Right, Author makes and/or receives any bona fide offer that Author proposes to accept, which is equal to or less favorable to Author than the last offer made by Company as part of Company's first negotiation right set forth above, Author shall give notice to Company of such offer specifying the particulars thereof, including any Offered Rights that are the subject of such offer, the name and address of the offeror, the proposed financial terms, and all other material terms of such offer. During the period of ten (10) business days after receipt of said notice (hereinafter, the "Reconsideration Period"), Company shall have the exclusive option to license or acquire, as the case may be, the particular Offered Right(s) referred to in such offer, upon the same financial terms and other terms set forth in such notice (hereinafter, the "Company's Purchase Option"), provided that, in no event shall Company be required to meet any term or condition that cannot be met as easily by Company as by any other offeror (such as the required employment of a particular performer or director whose services are exclusive to such offeror). ii. Company Purchase Option. If Company elects to exercise Company's Purchase Option, Company shall notify Author in writing of the exercise thereof within the 7 WIYIYISIc.X.0.000c.4151motOrl vettrissw 0,0m evittrekvI rw EFTA00037021

Page 8 - EFTA00037022

Reconsideration Period; Company and Author shall then promptly execute written agreements subject to good faith negotiations conveying to Company such Offered Right(s). If Company does not elect to exercise Company's Purchase Option, Author shall be free to accept said bona fide offer (but only upon the terms and conditions specified in such bona fide offer); provided, however, if any such proposed offer is not confirmed in writing within sixty (60) days following the expiration of the Reconsideration Period, Company's Purchase Option shall revive and shall apply to such proposed offer again and to each and every further offer or offers at any time received by Author relating to the particular Offered Right(s). Company's Purchase Option shall continue in full force and effect, upon all of the terms and conditions of section 15, so long as Author retains any right, title, or interest in or to the particular Offered Right(s). 16. Screen Credit Provided the Productions are produced based upon the Property (or, in the case of an Author- Written Prequel/Subsequent Production, based on original elements of the Property), Author shall receive the following credits (as applicable): a) Snurre Material fredit for Production. Author shall receive an appropriate on-screen credit on a separate card on the Productions substantially in the form of "Based upon the book "Silenced No More" by or similar. If other material is incorporated into the Production's screenplay or teleplay, then Company may, in its sole discretion, also accord credit with respect to such material. b) Creative Consultant Credit. If Company develops and produces a Production and Author provides creative consultant services, Author shall receive an on-screen creative consultant c) General. Except as expressly provided above, all aspects of Authors credits shall be at Company's sole discretion. No casual or inadvertent failure by Company and no failure by any third party to comply with the credit provisions of this Agreement shall be deemed a breach of this Agreement, but in the event of any failure by Company to accord such credit(s), then upon written notice of same by Author to Company, Company shall take reasonable good faith steps to cure such failure on a prospective basis (but in no event shall be under any obligation to recall or reprint any existing copies or materials). 17. Name and Likeness. Publicity Company shall have the perpetual, irrevocable and nonexclusive right to use, and authorize others to use Author's name, likeness and approved biography for advertising, publicity and promotional purposes, in connection with the Productions and any other production or work based upon the Property, all ancillary and subsidiary rights therein and thereto, and any other use of the Property authorized under this Agreement, provided, that Author shall be depicted as directly endorsing any product, commodity or service (other than the applicable production or work) without 8 01twisiexte w intelsicnotow vettnosvy Nom egstre.t.vzoco EFTA00037022

Page 9 - EFTA00037023

Author's prior written consent, as applicable. 18. Reversion/Preemption All right, title, and interest in and to the Property (and only to the Property) shall revert to Author under the following circumstances: a) If the Option is not timely exercised pursuant to the terms of this Agreement, all right, title, and interest in and to the Property granted to Company hereunder shall revert to Author (other than any original copyrightable material created by or for Company, including, without limitation, new characters, new elements, screenplays, designs, storyboards, and music and lyrics created in connection with the Productions, ownership of which shall remain vested solely in Company's name) upon the expiration of the Option Period (as the same may be suspended and extended) provided Author has notified Company of such failure in writing and Company has failed to cure such failure by payment within ten (10) business days of receipt of notice. b) If Company exercises the Option, but has not commenced production on a feature, pilot, or series if no pilot (or any other initial production, e.g., an MOW, DTV, feature), by the date (hereinafter, "Early Termination Date") that is seven (7) years following exercise of the Option (subject to extension for material delays due directly to force majeure events, principal cast or director unavailability, and any other event outside of Company's control), then Author shall have the right to give Company written notice requesting a reversion of the Property (hereinafter, the "Reversion Notice") on or after the Early Termination Date (subject to subparagraph d) below) and Company shall have the right to preempt such reversion by commencing production of the first Production within twenty (20) business daysof Company's receipt of the Reversion Notice from Author; in which event, the Reversion Notice shall be deemed rescinded and shall not be operative in any way. c) If Company produces a pilot but fails to produce a Production (e.g., audio-visual series, motion picture, DTV or MOW, or feature) by the date that is seven (7) years following the later of (i) the Option exercise date or (ii) completion of principal photography of the Production or pilot (subject to extension for material delays due directly to force majeure events, principal cast or director unavailability, and any other event outside of Company's control), then Author shall have the right to give Company a Reversion Notice (as defined below), subject to subparagraph d. below. Company shall have the right to preempt such reversion within fifteen (15) business days of Company's receipt of the Reversion Notice (as defined below) by either of the following methods: (1) commencing production of the Production, or (2) paying Author an extension price (hereinafter, the "Extension Price") of US Dollars two thousand (USD 2,000, in which case Author shall not have the right to send an additional reversion notice for two (2) years from the date of such payment by Company. If Company preempts in accordance with the previous sentence, the Reversion Notice 9 WItwisiox no ma 'Ares emote*, ilettelowe 0,0m evitrell:4 EFTA00037023

Sponsored

Page 10 - EFTA00037024

shall be deemed rescinded and shall not be operative in any way. d) If the rights revert to Author pursuant to the terms hereof, other than pursuant to section 18.a): L Author shall reimburse Company, pursuant to the provisions of this subparagraph: (1) for any and all costs paid and/or incurred by Company in connection with the Production, induding, without limitation, the Series Purchase Price and/or the Film Purchase Price paid to Author and other costs paid or incurred by Company in connection with the development of the Property; (2) interest computed thereon from the date of Company's payment(s) thereof, calculated at the rate of one percent (1%) over the prime commercial rate from time to time in effect as announced by Company's primary lending institution. All of the foregoing costs, plus the interest thereon, are collectively referred to herein as the "Reversion Amount'. Pursuant to the provisions of this subparagraph, Author is responsible for the hill and complete reimbursement to Company of the Reversion Amount, and the full payment by Author of the Reversion Amount is a condition precedent to the reversion of the Property (i.e., until Company has been fully paid the Reversion Amount, all right, title, and interest in and to the Property shall remain with Company). Author shall reimburse the Reversion Amount to Company out of the first monies received by Author (or Author's successor, assignee, licensee, or other transferee (collectively "assignee")) in consideration of the sale, transfer, assignment, license, or other disposition or production, distribution, or other exploitation of the Granted Rights. If such first monies are insufficient to fully reimburse Company for the Reversion Amount, Author shall pay Company the remaining portion of the Reversion Amount within ten (10) business days after Author's receipt of the Reversion Amount from the assignee. In the event Author does not pay the remaining portion of the Reversion Amount within such ten (10) business day period, Company shall have the right to recoup the remaining portion of the Reversion Amount from any and all monies then or thereafter due or payable to Author under any and all agreements between Company and Author. Such reimbursement of the Reversion Amount shall be made promptly after Author's or any such assignee's receipt of such first monies, but in no event later than the commencement of principal photography or voice recording of any motion picture, television production, or other production based on or derived from any portion of the Granted Rights. Author shall remain primarily liable for the reimbursement to Company of the Reversion Amount until full payment has been made. Notwithstanding any reversion pursuant to this section, Company, shall retain the right to advertise, broadcast, distribute and otherwise exploit the 10 WIYIYISIc.X.0.000c.4151motOrl vettrissw 0,0m evittrekvI /co EFTA00037024

Page 11 - EFTA00037025

pilot (and any other material produced prior to such reversion) in any and all media now known or hereafter known or devised throughout the universe in perpetuity. ii. Upon exercise of the Option and payment of the Series Purchase Price and/or the Film Purchase Price, Author grants to Company as security for the hill repayment of the Reversion Amount, a lien upon, and first priority security interest in, the Granted Rights and the proceeds of all exploitation of the Granted Rights or any portion thereof in all media, whether now known or hereafter devised. Promptly upon Company's request, Author shall execute such security agreements, financing statements and other documents as Company deems reasonably necessary to create and perfect such security interest. If Author fails to do so, Company may execute such documents, as Author's attorney-in-fact, which appointment shall be irrevocable and coupled with an interest. After all amounts due to Company have been paid in full, upon Authors request, Company will execute such documents as Author deem reasonably necessary to terminate such security interest. iii. Reversion is also subject to Authors indemnification of Company in writing from all liability in connection with any further development, production, distribution, and/or exploitation of the applicable new production, such written indemnification to be in a form reasonably satisfactory to Company and entered into by, as Company reasonably approves, Author or a third party. h'. Provided the Reversion Amount is fully reimbursed to Company and subject to Company's security interest provided for herein, all rights relating to the Property that are acquired by Company under this Agreement (other than any original material created by or for Company, including, without limitation, new characters, new elements, screenplays, designs, storyboards, and music and lyrics created in connection with the Productions, ownership of which shall remain vested solely in Company's name) shall revert to Author free and clear of any obligation to Company, provided that Author execute, as a condition precedent to such reversion, a project termination agreement. e) Reversion is also subject to Author's indemnification of Company in writing from all liability in connection with any further development, production, distribution, and/or exploitation of the applicable new production, such written indemnification to be in a form reasonably satisfactory to Company and entered into by, as Company reasonably approves, Author or a third party. f) Notwithstanding any reversion pursuant to this section, Company, shall retain the right to advertise, broadcast, distribute and otherwise exploit the pilot (and any other 11 WIYIYISIc.X.0.000a111.1cnotOrl.syttrissre Nom evierrekviao EFTA00037025

Page 12 - EFTA00037026

material produced prior to such reversion) in any and all media now known or hereafter known or devised throughout the universe in perpetuity. 19. Creative Consultation Author shall be given a meaningful opportunity to review and consult on the most relevant creative elements of the development materials and the Productions. 20. Ownership Company shall be the sole owner of all finished Productions and of all related materials, and shall be free to exploit and distribute the Productions and the created audio-visual formats (the "Formats") in all media, in perpetuity, subject to the revenue share detailed below. 21. Holdback In the event Company does not acquire the adaptation rights to develop and produce the episodic series or the feature film, and should such adaptation rights are assigned to a third party, the resulting audiovisual work shall not be premiered before a period of five (5) years from the execution of the Option elapses and never before two (2) years elapse from the premiere of the series or film (if such rights are acquired), as applicable. 22. Contingent Compensation Author shall be entitled to five percent (5%) of Company's MAGR from the exploitation of the Productions (the "Contingent Compensation"). MAGR is defined in Exhibit A. 23. Premiers In the event Company organizes a premier screening event of a Production, then Company shall invite and Steve Ross plus one guest each, to the premier of the Productions, if. 24. Representations and Warranties Author represents and warrants, as follows: a) Power and Authority. Author has the unrestricted right, power, and authority to enter into this Agreement and to sell and assign to Company the Granted Rights, and the consent of no other person or entity is necessary in order for Author to enter into and fully perform this Agreement; b) Sole Author. Author is the sole writer of the Property (and any revisions made by Author thereto) and Author is the sole and exclusive owner of all of the Granted Rights (including, without limitation, all copyrights and extensions and renewals of copyright) and owns all necessary rights therein to grant all of the Granted Rights to Company without payment of any additional sums therefor by Company or any successor, licensee, or assignee; c) Granted Rights Unencumbered. Author has not granted or assigned or otherwise transferred any of the Granted Rights to any third party(ies), and will not do so during the Option Period or thereafter if the Option is exercised, Author has not done or authorized to be done any act or thing whereby the Granted Rights have been encumbered or materially impaired, and will not do so during the Option Period or thereafter if the Option is exercised; d) No Impairment of Rights. There are no and shall be no outstanding options with respect to all or a portion of any of the Granted Rights, and there are no and- to the best of Author's knowledge- shall be no claims, demands, liens, litigation, or other proceedings or encumbrances, pending, threatened, or 12 WIYIYISIc.X.0.000c.4151motOrl .0ettrissre 0,0m Vita etrI. /co EFTA00037026

Sponsored

Page 13 - EFTA00037027

suspected, that could in any way impair, limit, or diminish any of the Granted Rights, or which, if sustained, would be a material breach to Author's warranties, representations, and/or agreements contained in this Agreement. No attempt hereafter will be made by Author or with Author's authorization to encumber, diminish or impair any of the Granted Rights and all appropriate protection of the Granted Rights will continue to be maintained by Author; e) Originality. The Property shall be wholly original by Author except for pre-existing sources, research or materials in the public domain or material added, changed, or altered by Company, and no incident, element, or part of the Property is taken or copied from any other work or source; f) Title. The title of the Property may be legally and exclusively used by Company in any manner whatsoever, including without limitation, as the title of any motion picture, audio-visual program or other work based upon the Property; g) No Infringement. To the best of Author's knowledge in the exercise of reasonable prudence, the Property does not and shall not infringe any copyright of any person or entity and does not violate the right of privacy or publicity or any other personal or property right of, or constitute a libel or slander against, any person or entity; h) No Disability. Author is not subject to any conflicting obligations or any disability that will or might prevent or materially interfere with the execution and performance of this Agreement by Author; 0 Copyright. The Property enjoys and will enjoy statutory copyright protection in the U.S., and all countries adhering to the Berne and/or Universal Copyright Convention, and no part of the Property will be in the public domain; j) Prior Exploitation. As of the date of this Agreement, neither the Property nor any part thereof has been performed or otherwise exploited in any audio-visual form or manner whatsoever; k) Plugola/Pavola. Author acknowledges that it is a crime under Section 507 of the Federal Communications Act for any person in connection with the production or preparation of any Production intended for broadcasting to accept or pay any money or provide any service or other valuable consideration for the inclusion of any matter as a part of any such Production without disclosing the same to the employer of the person to whom such payment is made or to the person for whom such Production is being produced, and that it is Company's policy not to permit any employee to accept or pay any such consideration. Author has not paid or accepted, shall not pay or accept, and has no knowledge of the payment or acceptance of any money, service, or other valuable consideration for the inclusion of any plug, reference, product identification, or any other matter in the Property and/or Productions and further agrees to promptly deliver to, upon Company's request, such affidavits and/or statements as Company may require with 13 WIYIYISIc.X.0.000c.4151motOrl vettrissw OotimeweevekvIeco EFTA00037027

Page 14 - EFTA00037028

respect to Section 508 of the Federal Communications Act, as amended; and, I) Author's Representations. All of the representations and warranties of Author set forth in the Agreement are true and correct and will be true and correct as of completion of all of Author's services in connection with the Productions as contemplated herein. 25. Indemnification Author agrees to indemnify, and hold harmless Company, its successors, licensees and assigns, and the officers, parents, affiliates, directors, shareholders, agents, representatives, and employees of each of the foregoing, and any other person(s) or entity(ies), in whole or in part, owning, financing, producing, or otherwise exploiting the Productions and/or any other motion picture or other work based on the Property, and each of them, from and against any and all claims, liabilities, losses, damages, costs, expenses (including, but not limited to, reasonable outside attorneys and reasonable outside accountants' fees and court costs, whether or not in connection with litigation) and judgments (collectively "Claims") brought or incurred by third parties arising out of Author's breach of this Agreement. 26. Confidentiality Author shall not individually, or through any publicity representative or otherwise, circulate, publish or otherwise disseminate any news story, article, book or other publicity relating to the subject matter of this Agreement, Company, the Productions or the Granted Rights to Company in connection with the Productions, unless first approved in writing by Company. Author shall not acquire any right under this Agreement to use, and shall not use or permit the use of, the name or any fanciful characters or designs, logos or trademarks of Company or that of its successors or assigns, or of any telecaster or other exhibitor of the Productions, or the parent, subsidiary or affiliated entities of each of the foregoing. Author also shall not disclose to any third party any information to which either of them has had or will have access concerning any of the Productions and/or any of Company's, or its related companies, operations or programming or other services or the terms and conditions of this Agreement, except as expressly permitted by Company in writing, or as required by law or the valid order of a court of competent jurisdiction, in which event Author shall so notify Company and shall seek confidential treatment of such information (if available). Without limiting the foregoing, Author shall not (nor shall Author authorize others to) disclose to any party any information obtained or learned as a result of any of their involvement with the Productions, including without limitation any information concerning or relating to the Productions, the performers, participants, the events contained in the Productions, the outcome of the Productions or any of the other narrative details of the Productions, unless and solely to the extent such information becomes available to the public through no breach (whether direct or indirect) of this paragraph by Author. The foregoing shall not be deemed to prohibit Author from: (a) providing the financial terms 14 WIYIYISIc.X.0.000c.4151.notOrl vettrissw 0,0m evittrekvI EFTA00037028

Page 15 - EFTA00037029

of this Agreement solely for "quote purposes to other third parties who wish to engage Author (unless any such financial terms are expressly referred to herein as "non-precedentie or "non- quotable); and (b) issuing personal publicity which includes incidental references to the Productions and Author's involvement therein, provided the same occurs after the initial press release for the Productions has been issued by Company and does not mention the Productions, Company or any other person or entity involved therewith in an unfavorable or derogatory manner. For the avoidance of doubt, Authors confidentiality obligations and publicity restrictions hereunder shall apply to any and all media whatsoever, including, without limitation, any social networking site; micro-blogging service; user-generated or user-uploaded content website; online forum, discussion thread or comment section; personal website or blog; user modified website ("wiki"); and any other website, service, platform, program, application or other form or method of communication, whether now known or hereafter devised. For example, Author may not make disclosures prohibited hereunder via Facebook, Twitter, YouTube, or any other similar website or service, whether existing now or in the future. 27. Notices If to Author: gli. If to Company: Cowan DeBaets Abrahams & Sheppard LLP, 41 Madison Avenue, 38th Floor, New York NY 10010. 28. No Obligation to Sell, Produce or Release Notwithstanding any other provision of this Agreement to the contrary, Company will not be obligated to: exercise the Option or any extensions thereof; develop, produce, release, broadcast, distribute, or otherwise exploit any audio-visual or podcast under this Agreement or continue any such development, production, release, broadcast, distribution, or exploitation, if commenced; sell any or all of the rights granted herein to any Company or otherwise exercise any of the rights granted to Company under this Agreement. If any of the rights granted to Company herein are sold to a third party, Company shall have no obligation to ensure that any such third party exercises the Option or any extensions thereof; develops, produces, releases, broadcasts, distributes, or otherwise exploits any audio-visual or podcast under this Agreement or continues any such development, production, release, broadcast, distribution, or exploitation, if commenced. Other than as specifically set forth in this Agreement, Company shall not be obligated to make any so-called residual, rerun, foreign use, or theatrical use payments with respect to any motion picture produced pursuant to the rights granted to Company herein. The compensation payable to Author herein is an all-inclusive flat fee and shall constitute full and sufficient consideration for any and all uses of the Productions, and all elements thereof, in any and all media, whether now known or hereafter developed, throughout the universe, in all languages, in perpetuity, in all versions (including without limitation digitized versions), and for any and all 15 YnS SW Mor1Wleva0 .6) MatWry Nom ewe.. °knew.. Commented (GUI: Please complete. Gentile, Lucia 2021-12-13 10:4800 EFTA00037029

Sponsored

Page 16 - EFTA00037030

purposes, including, without limitation, all replays, broadcasts in any foreign area, theatrical exhibitions and exhibitions in any supplemental market. 29. No Partnership/Joint Venture Nothing herein contained will constitute a partnership between, or joint venture of, the parties to this Agreement or establish either party as the agent of the other. No Party hereto will hold itself out contrary to the terms of this section, and no Party will become liable for the representation, warranty, act, or omission of any other contrary to the provisions hereof. 30. Remedies a) Author's Remedies / No Injunctive Relief:Author acknowledges that, in the event of any breach of this Agreement by Company or any third party, the damage, if any, caused to Author thereby will not be irreparable or otherwise sufficient to entitle Author to seek injunctive or other equitable relief. Author acknowledges that its rights and remedies in any such event will be strictly limited to the right, if any, to recover damages in an action at law, and Author shall not have the right to terminate this Agreement or any of Company's rights hereunder, neither the right to enjoin the distribution, publication, or other use of the Granted Rights or the exercise of any right in and/or to the Productions, nor the right to enjoin the production, exhibition or other exploitation of any motion picture produced pursuant to the Granted Rights, any element thereof, any subsidiary or allied rights with respect thereto, or any other results and proceeds of Authors services hereunder, nor will Author have the right to terminate their respective services or obligations hereunder by reason of such breach. Without limiting the foregoing or Company's other rights under this Agreement or at law or in equity, under no circumstances will any act or omission of Company which would otherwise constitute a breach or alleged breach of this Agreement be deemed such unless Author notify Company in writing setting forth in detail the basis for such breach or alleged breach and Company fails to commence reasonable efforts to cure such breach or alleged breach within thirty (30) days of Company's receipt of such notice. b) Company Remedies: The rights and services which are the subject matter of this Agreement are of a special, unique, extraordinary and intellectual character which gives them a peculiar value, the loss of which cannot be reasonably or adequately compensated in damages in an action at law and which would cause Company great irreparable injury and damage. Accordingly, Company shall be entitled to seek injunctive relief, to preserve its rights and interest in and to such rights and services. This provision shall not, however, be construed as a waiver of any rights Company may have for damages or otherwise arising from any breach of this Agreement. At all times, Company shall have all rights and remedies which it has at law or in equity pursuant hereto or otherwise, all of which rights and remedies shall be construed as cumulative. 16 exmwv.ewh ilettelowe 0,0m evittrekvI /co EFTA00037030

Page 17 - EFTA00037031

31. Copyright a) Protection of Copyright L Author shall ensure that the Property will be protected by copyright and will be registered in the United States Copyright Office in Washington, D.C. for copyright protection, following initial publication in the United States. In connection therewith, Author agrees and acknowledges that (1/ the Property is a work of authorship protected under Title 17 of the United States Code and is intended to constitute, and does constitute, intellectual property' within the meaning of sections 101(52)( E) and 365(n) of Title 11 of the United States Code (the "Bankruptcy Code"), and (2) the rights of Company hereunder are "rights to intellectual property" within the meaning of such sections. ii. Author shall take all reasonable steps at Authors expense to protect all copyrights pertaining to the Property from infringement, and Author agrees that it will institute such action and proceedings as may be reasonable to prevent any unauthorized use, reproduction, exhibition or exploitation by third parties of the Property or any part thereof which may be in contravention of the rights granted to Company hereunder. Company shall provide Author copies of all documents executed pursuant hereto. iii. If Author elect not to take any action in the event of an infringement of copyright or of the Granted Rights, Author shall so notify Company promptly, in writing, and Company shall have the right, but not the obligation, to take such action as Company shall deem reasonable in the circumstances, at Authors sole cost and expense. Author appoints Company as its attorney-in-fact (which power is coupled with an interest) to act in its name for the purpose of permitting Company to prevent any unauthorized use, reproduction, exhibition or exploitation of the Property or any part thereof. iv. Author further agrees that it shall not take any steps to prevent, challenge or otherwise hinder Company from registering any and all of Company's interest in the Productions with the United States Copyright Office in accordance with this Agreement. b) Copyright Termination i. If at any time after Company's exercise of the Option, Author or any party succeeding to Authors termination interest or otherwise claiming through Author or any other party so empowered by law is deemed to have any right to terminate any or all of the rights granted to Company hereunder (the "subject rights") pursuant to Section 203 or 304 of Title 17 of the U.S. Code (the "Copyright Act") or any other laws of the United States, or any of its subdivisions, or of any foreign country, nothing in this Agreement shall be deemed to preclude Author from freely exercising said right to terminate. Any exercise or further grant of the subject rights 17 WIYIYISIc.X.0.000c.4151motOrl vettrissw w,". evnevekvIeco EFTA00037031

Page 18 - EFTA00037032

so terminated shall be subject to the terms and conditions of this paragraph. Any such right to terminate the subject rights shall in no event apply to any rights granted to Company hereunder other than those rights arising under the Copyright Act or any comparable act of a foreign country. If the parties do not reach an agreement with respect to a reacquisition of the subject rights prior to the effective date of such termination, Company shall have a right of first negotiation and last refusal with respect to the subject rights as follows: If at any time, Author proposes to accept or make a bona fide offer to produce, license, transfer or exploit ("Exploit") any of the subject rights, Author shall first offer to negotiate to grant such rights to Company by giving Company written notice of the rights which Author desires to Exploit and the terms and conditions of any proposed transaction. Within ten (10) days after the receipt of such notice, Company may notify Author whether or not Company desires to negotiate, failing which Company shall be deemed to have elected not to negotiate. If Company notifies Author within such ten (10) day period that it elects to negotiate, then the parties shall negotiate in good faith regarding the subject rights for a period of thirty days thereafter. If Company agrees to negotiate, but such negotiations do not result in an agreement between the parties within such thirty (30) day period, then Author thereafter may negotiate with any third party with respect to the subject rights; provided, that Company may meet any bona fide third party offer which Author are willing to accept (or which is proposed by Author to any third party) ("Third Party Offer"). Author shall give Company written notice of the Third Party Offer, specifying its particulars, including, but not limited to, the identity of the offeror or offeree, the price and other terms, and Company shall have the exclusive right for ten days after its receipt of such notice to acquire the subject rights upon the terms and conditions in Author's notice; provided, that Company shall not be required to meet any term of condition of the proposed transaction which may not be as easily met by Company as by any other party. If Company exercises its right within such ten (10) day period, then Company shall be deemed to have acquired the subject rights and Author shall execute and deliver such additional documentation as Company may reasonably request to further evidence such acquisition. If Company fails to exercise its rights, Author may make or accept the Third Party Offer; provided, that if the transaction contemplated by such Third Party Offer is not consummated upon the terms and conditions in Author's notice within sixty (60) days after the expiration of such ten (10) day period, or if such transaction is so consummated but the subject rights return to Author for any reason, then Company's rights hereunder shall revive and apply to each 18 WIYIYISIc.X.0.000c.4151.notOrl vettrissw OotimewstrekvIeco EFTA00037032

Sponsored

Page 19 - EFTA00037033

further Third Party Offer regarding the subject rights. ii. Author agrees to use commercially reasonable good faith efforts to prevent the Property from becoming public domain material to the extent possible; (to the extent required by law) to cause to be affixed to each copy of the Property or any part thereof published or offered by sale by or with the authority of Author, notice of copyright complying in all respects with the U.S. copyright law and with the Universal Copyright Convention; and to register the Property wherever necessary for such protection. If the Property or any part thereof is unpublished at the time any motion picture or sound record produced hereunder is published or released, it is expressly agreed that any statutory copyright secured by Company in its own name hereunder, covering such motion picture or sound record, shall extend to any and all copyrightable component parts of such motion picture or sound record, and shall be held by Company and that Company may, if it so elects, obtain separate statutory copyright protection for the Property or any part thereof in the name of Company, or otherwise, as it may elect. iii. Author recognizes that a material part of the consideration motivating Company to enter into this Agreement is that Company shall enjoy all rights granted to Company for the full term of any and all of said copyrights (including, without limitation, all extensions of such copyrights, and to the full extent for or at any time hereafter permitted by law, the renewal term of all United States copyrights involved). If any United States statutory copyright in the Property or any part thereof was existing prior to January 1, 1978 and is in its initial term as of the date hereof, Author agrees to make application for, and secure a renewal of, each and even/such United States copyright involved, prior to the expiration of each such copyright, or, if Author is not entitled to renew any such copyright, Author will use its best efforts to cause the person entitled to do so to make application for, and secure a renewal of, such copyright; and in either event Author will promptly notify Company in writing that such renewal copyright has been applied for and has been secured. Promptly after each such copyright has been renewed, Author shall, without payment of any further consideration by Company, execute and deliver to Company, or cause to be executed and delivered to Company, such further instrument or instruments as shall be necessary or proper to vest in Company all of the rights herein granted for the full period of such renewal copyright, upon and subject to all of the identical terms, conditions, limitations, representations, covenants and warranties herein contained, except for the monetary consideration herein specified. Regardless of the execution and delivery of any such instrument, all such rights shall be deemed to have 19 WIYIYIHeXt0.000a111.1cnotOrnanjilosvy Nom ewe.. etriao EFTA00037033

Page 20 - EFTA00037034

been acquired by Company under such renewal copyright upon and subject to all of the terms, conditions, limitations, representations, covenants and warranties herein contained simultaneously with the effective date of renewal of such copyright. 32. Legal Clearance Upon Company's request, Author shall cooperate with Company or any attorneys for Company or any insurance company providing errors and omissions insurance for the Productions, in connection with the legal clearance of such Productions 33. Public Domain Material/Member of the Public Nothing contained in herein: (a) shall at any time limit Company's right to utilize freely, in any work or production, any story, idea, plot, theme, sequence, scene, episode, incident, name, characterization or dialogue or other material which may be in the public domain, whether included in the Property or derived from some other source; or (b) shall be construed to be prejudicial to or operate in derogation of or prejudicial to any rights, licenses, privileges or property which Company may enjoy or be entitled to as a member of the public, as if this Agreement were not in existence. Company may exercise any such rights, licenses, privileges or property at any time and in any manner, whether or not competitive with the activities of Author. This section shall not affect the scope or validity of Author's representations, warranties or indemnities in this Agreement. 34. Applicable Law This Agreement shall be construed and enforced in accordance with the internal laws of the state of New York. The Parties agree to submit to the exclusive jurisdiction and venue of the federal and state courts of the State of New York located in the City of Manhattan, which the Parties acknowledge and agree are convenient forums to litigate any such action. The Parties waive any right to transfer such action to any other court and expressly consent to the permanent jurisdiction of such courts with respect to the resolution of any disputes under this Agreement and agree to be bound by the judgment rendered by such courts. 35. Additional Documents a) Without limiting Authors obligations or Company's rights under this Agreement, Author shall execute, acknowledge, verify, and deliver to Company or cause to be executed, acknowledged, verified and delivered to Company any and all further assignments, instruments and documents pertaining to the Granted Rights, consistent herewith, which Company may request and deem necessary to effectuate the purposes and intent of this Agreement and in the form Company may prescribe, after opportunity to review; provided, however, that Author's failure or refusal to do so shall not affect any of Company's rights in the Property, or any of Author's representations or warranties with respect thereto. Without limiting the generality of the foregoing, Author agrees to timely obtain or cause to be obtained renewals of all copyrights in and to the Property. If Author fail or refuse to do so after a reasonable opportunity to review and negotiate such instruments or documents not to exceed five (5) business days (or three (3] business days in exigent circumstances as 20 1YIYISic.X.0 Mor111. knot. •iniee.trissre Nom wort etrI. EFTA00037034

Page 21 - EFTA00037035

determined by Company in good faith), Author hereby appoints Company (which such appointment is coupled with an interest and hence irrevocable) as Author's attorney-in-fact to execute any such instruments and documents in Author's name and on Author's behalf and to institute and prosecute such proceedings as Company may deem expedient to secure, protect, or enforce the rights Company is acquiring hereunder. Company shall have the right to place the same of record in the U.S. Copyright Office and elsewhere as Company may determine. Company may sue in its own name or may use the names of Author or may join Author as party plaintiff or defendant in any such suit or proceeding. Company shall provide copies of all final documents to Author executed on Author's behalf under this section following Authors request therefor provided, however, inadvertent failure to so provide such documents shall not be a breach hereof. Notwithstanding the failure or omission of any party to this Agreement to execute and/or deliver such additional instruments, it is agreed that upon the exercise of the Option, all rights agreed to be transferred to Company pursuant to this Agreement shall be deemed vested forever in Company, effective as of the date of the exercise of the Option, which rights shall be irrevocable under any and all circumstances, subject to reversion provided for in section 18. b) Concurrently with the execution of this Agreement, Author shall execute the short-form assignment (hereinafter, the "Assignment") attached to and incorporated in this Agreement. If Company shall exercise the Option and pay the Series Purchase Price and/or the Film Purchase Price, Author's signature on the Assignment shall be deemed to be effective and the Assignment shall constitute a valid and binding agreement and assignment and shall be deemed to have been executed, and shall be dated and deemed to be effective, as of the date of exercise of the Option. Company is authorized and empowered to date the Assignment accordingly. If Company fails to exercise the Option, then Author's signature on the Assignment shall be void and of no further force and effect whatsoever, and Company shall not be deemed to have acquired any rights in the Property other than the Option provided for in this Agreement. c) Concurrently with the execution of this Agreement, Author shall execute and deliver to Company the short-form option agreement (hereinafter, the "Option Agreement") which is attached to and incorporated in this Agreement. Company may record the executed short-form Option Agreement at any time, and may record the executed Assignment (but only after exercise of the Option and payment of the Series Purchase Price and/or the Film Purchase Price) with the U.S. Copyright Office and with the copyright office or comparable registry of any country. 36. Assignment Company may transfer and assign this Agreement or all or any of 21 VitY131...C.0.0 rt\Sleva0.6) vettrissw Nom guestrekvittla EFTA00037035

Sponsored

Page 22 - EFTA00037036

its rights or privileges hereunder, and/or delegate all or any of its obligations hereunder, to any person or entity. In the event of such assignment or delegation, Company shall remain secondarily liable hereunder (unless such assignment or delegation is to a so-called "major' or "mini-major motion picture distributor or television network, any similarly financially responsible party, or any party which substantially controls, is substantially controlled by or is under common control with Company or which through merger, consolidation or acquisition succeeds to substantially all of the assets of Company, and such assignee/delegee assumes in writing all of Company's obligations hereunder, in which event Company shall be released and discharged from all of its obligations hereunder and Author shall look solely to such assignee or delegee, as the case may be, for performance thereof). Author may not assign this Agreement or any rights hereunder, in whole or in part, except with Company's prior written approval, and any such purported assignment shall be deemed null and void. This Agreement shall be binding upon the parties hereto and their successors and permitted assigns, and shall inure to the benefit of Company's successors, licensees and assigns. 37. Miscellaneous Nothing herein shall be construed to require the commission of any act contrary to law. In the event of any conflict between any provision of this Agreement and any present or future statute, law or regulation, the latter shall prevail and the affected provision of this Agreement shall be modified only to the extent necessary to bring it within legal requirements, such provision shall be deemed stricken from this Agreement to the extent required to bring it within the legal requirements and the remaining terms of this Agreement shall continue in hill force and effect. No waiver by either Party of any failure by the other to perform hereunder shall be deemed a waiver of any preceding or succeeding breach of the same or any other obligation. Company may deduct and withhold from Author's compensation all amounts required to be deducted or withheld under any present or future statute, law, ordinance, regulation, order, writ, judgment or decree. 38. Entire Agreement This Agreement (including exhibits and all accompanying documents) contains the entire understanding between the Parties regarding this subject matter, supersedes any prior or contemporaneous understandings or agreements between the Parties with respect to Property, whether written or oral, and constitutes a valid and binding agreement. No officer, employee or representative of Company has any authority to make any representation or promise in connection with this Agreement or the subject matter of this Agreement that is not contained in this Agreement and Author has not executed this Agreement in reliance upon any such representation or promise. Any modification or amendment of this Agreement must be in writing and signed by both Parties. 39. Counterparts This Agreement may be executed in any number of counterparts ['including, without limitation, in facsimile, PDF or other electronic 22 exmsastvwh ilettelowe 0,0m evittrekvI /co EFTA00037036

Page 23 - EFTA00037037

form), all which taken together shall be deemed an original and constitute one single agreement between the Parties. ACCEPTED AND AGREED TO: BRAVEN FILMS LLC By: Name: Title: WIYIYIHeXt0.000a111.1cnotOrnanjilosvy Nom ewe.. etriao ACCEPTED AND AGREED TO: By: Name: 23 EFTA00037037

Page 24 - EFTA00037038

EXHIBIT A DEFINITION OF MODIFIED ADJUSTED GROSS RECEIPTS (MAGR) a) "Gross Receipts" means all non-returnable, non-refundable revenues actually received and earned by Company (and which are convertible to U.S. currency) in the United States from all sources worldwide in connection with Ancillary Use(s) (as defined below) of the Series (herein, "Project"), if any, including (if and when earned) non-returnable, non-refundable advances specifically related to the Project that otherwise qualify as Gross Receipts, but excluding all: (i) revenues received, earned, allocated, or recorded from distribution, availability, or other exploitation of the Project on Network Services, including, but not limited to, advertising revenue and subscriber fees; (ii) revenues received, earned, allocated, or recorded from distribution, availability, or other exploitation of a Project cycle or episode on Third-Party Network Services (such a cycle, or the cycle of which such episode is a part, the "Applicable Cycle"), (x) which distribution, availability, or exploitation occurs before the end of the six months following the Applicable Cycle's last episode's Premiere during such Applicable Cycle's Premiere ("Premiere" means the first distribution, availability, or other exploitation on any Network Service(s) and/or Third-Party Network Service(s)) (such end date, the "Tail End Date") or (y) which revenues constitute advertising revenue; (iii) Network trademark license fees, Network brand fees, promotional fees, and/or marketing/advertising monies, in each case paid in connection with the Project and/or any Ancillary Uses; (iv) amounts paid or payable to Company to finance development, production, or distribution costs or expenses, or as advances for such amounts, or as reimbursement of such costs or expenses; (v) tax benefits related to the Project, including, but not limited to, tax or other governmental credits or incentives ("Tax Credits") and any foreign tax credits; and (vi) amounts paid or payable to Company in connection with Company furnishing, supplying, rendering, procuring, arranging for, or making available any materials, equipment, facilities, or services in connection with the Project and/or any Ancillary Uses thereof. With respect to revenues received pursuant to agreements that cover other projects in addition to the Project, which revenues would otherwise constitute Gross Receipts: Company will allocate to Gross Receipts a portion (determined in Company's sole good-faith discretion) of such revenues. Participant acknowledges that the foregoing allocation requires the application of subjective factors, and Participant therefore waives any remedy Participant may have at law or equity with respect to Company's allocation of revenues made in accordance with this Paragraph. b) "Modified Adjusted Gross Receipts" means Gross Receipts less the following items on a continuing basis in the following order: (a) a 15% distribution fee; (b) distribution costs and expenses incurred in connection with distribution and other exploitation of any Ancillary Uses (including, but not limited to, any and all development, production, manufacturing, publishing, publicity, advertising, marketing, promotion, delivery, and guild residual/reuse costs associated with such Ancillary Use, but less all Tax Credits received and credited against such costs and expenses (which Tax Credits are not excluded from Costs deducted pursuant to clause (f) below)) ("Expenses"); (c) the contingent portion of any agency package commission payable on account of any Ancillary Use (defined below); (d) any and all third-party participations payable by Company in connection with the Project, other than those payable to net profit participants; (e) interest on the Costs (as defined below) at an annual percentage rate equal to 2% over and above the rate announced from time to time by J.P. Morgan Chase as its prime rate on unsecured loans ("Interest"); and (f) any and all costs incurred in connection with the development, production, and delivery of the Project (as defined in the Agreement) (including, but not limited to, any amounts payable to Participant) (collectively, "Production Costs"), but less all Tax Credits received and credited against such costs, plus an overhead charge of 15% of the Production Costs and Interest ("Overhead") (Overhead and Production Costs, together "Costs"). 24 exmwv.ewh, OotimewstrekvIeco EFTA00037038

Sponsored

Page 25 - EFTA00037039

c) "Ancillary Use(s)" means all distribution, availability, and/or exploitation of the Project, if any, in any manner or media now known or hereafter devised (including, but not limited to, DTO (as defined below)), throughout the universe, in perpetuity, other than (i) on Network Services, (ii) on Third-Party Network Services (x) before the Tail End Date or (y) to the extent revenues therefrom constitute advertising revenue, and (iii) the use or licensing of elements or characters from the Project which were not created by Participant and/or on which Participant did not perform services. "DT0" means the method commonly referred to as download-to-own (DTO) or electronic-sell-through (EST), i.e., permanent download, or the method commonly referred to as download-to-rent (DTR), in each case directly to the consumer through retail digital-distribution services (e.g., 'Tunes or Amazon Video), including (notwithstanding clause (i) of the foregoing sentence) any such services that constitute Network Services, for a discrete charge paid by such consumer for such episode (or "season" or other bundle of episodes). d) "Network Services" means all ViacomCBS Media Networks ("Network") branded and/or affiliated worldwide content distribution services, blocks, and feeds made available on any platform (including television, online, players, areas, applications, etc.) and in any manner (including linear, on-demand, non-permanent download, etc.), by any means of transmission (induding cable, satellite, telecom, intemet, wireless, cellular, etc.), and/or on any device (including television, computer, tablet, mobile, etc.), whether now known or hereafter devised. e) "Third-Party Network Services" means all third-party content distribution services to which Network makes available the Project, which services: make content available to their customers for exhibition on one or more platforms (including television, online, players, areas, applications, etc.) and in any manner (including linear, on-demand, nonpermanent download, etc.), by any means of transmission (including cable, satellite, telecom, intemet, wireless, cellular, etc.), and/or on any device (including television, computer, tablet, mobile, etc.), whether now known or hereafter devised; and charge their customers a subscription or other regular fee for the services and/or sell or display advertising in connection with making content available to customers. Third- Party Network Services do not include services or portions of services that charge a per-item transactional fee for the exhibition of one episode, series or project. f) Interest will be charged only on the unrecouped Costs (i.e., (1) the aggregate of all amounts chargeable to Costs, minus (2) the aggregate of Gross Receipts, in each case on a continuing and cumulative basis) as of the midpoint and end-point of the applicable semi-annual accounting period. g) Notwithstanding anything to the contrary contained in this Exhibit or in the Agreement: no exploitation of any subsequent production(s) based on the Project (each such subsequent production a "Derivative Production") (as contrasted with exploitation of the Project) will constitute an Ancillary Use unless the Agreement specifically so provides; if the Agreement does specifically so provide, then, nonetheless if Participant is engaged to render services and/or is entitled to receive contingent compensation in connection with a given Derivative Production then revenue from such Derivative Production will not be included in the calculation of Participant's Modified Adjusted Gross Receipts participation set forth in the Agreement. h) The Parties acknowledge that, for purposes of the foregoing sentence, such subsequent productions that are a result of the sale, licensing, or other exploitation of the Project format ("Format Licensing") do constitute Derivative Productions, but because Format Licensing is an exploitation of the Project (and not of a Derivative Production), revenue from Format Licensing itself does not constitute Derivative Production revenue; however, license fees and (provided Participant is not otherwise receiving any contingent participation from such Format Licensing) 25 %WHS.:rift. MorASIcnot0•11 rarttrWay Nom earyttrekviao EFTA00037039

Page 26 - EFTA00037040