YAHOO_000573

💳 Explaining “buy now, pay later”

This is an email from The Hustle, a business and tech newsletter, to Jodi Harrison, dated November 23, 2020.

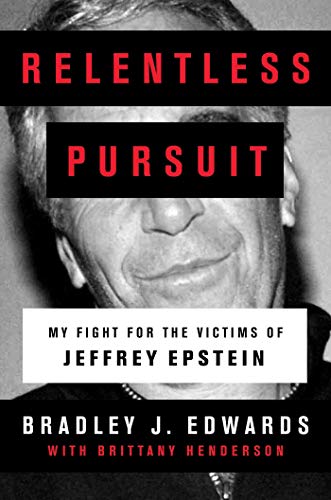

The email's subject is "Explaining 'buy now, pay later'" and discusses the 'buy now, pay later' service, mentioning companies like Affirm and Klarna, and also makes some unrelated references to Bitcoin and Jeffrey Epstein. It seems to be a fairly standard newsletter about financial technology.

Key Highlights

- •The email discusses the 'buy now, pay later' business model.

- •Affirm and Bitcoin are mentioned multiple times in the email.

- •Jeffrey Epstein is mentioned in the email, though the context is unclear.

Frequently Asked Questions

Document Information

Bates Range

YAHOO_000573

Pages

1

Source

DDoSecrets Yahoo Emails

Date

November 23, 2020

From

The Hustle <[email protected]>

To

Jodi Harrison <[email protected]>

Original Filename

20201123-💳 Explaining “buy now, pay later”-4093.eml

File Size

65.89 KB

Document Content

Page 1 - YAHOO_000573

thehustle.co table {border-collapse: collapse;} table, td {mso-table-lspace: 0pt;mso-table-rspace: 0pt;} img {-ms-interpolation-mode: bicubic;} body { font-family: Helvetica, sans-serif; } body a { color: #d62829; text-decoration: none; } @media screen and (max-width:480px) { .templateColumnContainer { display: block !important; width: 100% !important; padding-left: 0 !important; padding-right: 0 !important; } } PLUS: What’s behind Bitcoin’s recent rise? November 23, 2020 TOGETHER WITH Charli D’Amelio became the first TikTok-er to cross 100m followers. Here are the first 100m-follower people on: Instagram: Selena Gomez in 2016 Twitter: Katy Perry in 2017 YouTube: T-Series in 2019 Email newsletter: The Hustle in 2021 with your fresh referrals 😉 The Big Idea The Affirm IPO shows the opportunities and risks of ‘buy now, pay later’ The simplicity of “buy now, pay later” (BNPL) makes for an incredible business proposition. At checkout, BNPL providers offer customers an option of spreading the cost of a purchase across multiple installments -- sort of a layaway plan for the 21st century that doesn’t require credit. The business model has led to the creation of massive fintech players: Europe’s Klarna is worth $10B+. Australia’s Afterpay is worth $20B+, after IPO-ing at a valuation of only ~$100m in 2016. Now, Affirm -- America’s BNPL leader -- is prepping a $5B to $10B IPO. BNPLs have boomed during the pandemic According to Forbes, BNPL is a $24B industry that has been popular in 2020: 7% of all Americans have made a BNPL purchase this year, with particularly strong growth among high-income earners and millennials. Here’s how the transaction works for each player: Customers get to spread payments across weekly or monthly installments with little or no interest. Merchants get higher conversion rates and fewer abandoned carts. BNPL firms get paid a % of merchant revenue for facilitating the transaction. Numerous revenue stream opportunities Affirm raked in $510m in revenue in the last fiscal year -- up 93% YoY. Tech writer Byrne Hobart went deep on the company’s IPO docs to find out how this money is made: Revenue from creating loans Fees for servicing, and interest on loans Securitization (selling loans to a 3rd party) Virtual credit cards Longer term, Affirm wants to “displace” merchant marketing spend. It would do so by effectively acquiring customers through its platform for sellers in exchange for the BNPL fee. Same challenges as other consumer lenders Customers can easily overborrow (and enter debt spirals) while providers must contend with unpaid loans. According to Hobart, Affirm’s 0% loan offer appeals to people with all types of credit ratings worthiness -- not just the worst. Although not a direct comparison, Affirm’s delinquency rate (1.1%) is lower than recent credit card rates (5.7%). One specific risk for Affirm is that Peloton makes up ~28% of its revenue (though its other large customers are growing quickly). While the business proposition is simple enough, challenges still abound for Affirm and other BNPL players. Snippets Wish upon an IPO: Ecomm platform Wish is going public. Its growth has slowed in recent years but the startup received a COVID boost and now has 100m monthly active users. Hollywood antitrust? The DOJ is reviewing the sale of Hollywood Reporter to Penske Media. The deal puts 3 of the industry’s 4 trade publications under one roof. Benjamin Button enters the chat: A clinical trial of 35 adults used “oxygen therapy to reverse 2 key indicators of biological aging. A hint of oak: “A sommelier compared 11 wines from Costco, Target, Trader Joe's, and BJ's”... and Target won. Thanks… we guess: In time for Thanksgiving, Microsoft Teams is lifting the caps on video chat to 24 hours and 300 attendees (Zoom is also lifting caps). Shine Bright Like A…. Lab-grown diamonds are coming for the crown Outside of healthcare, it’s generally not good when the word “blood” becomes an adjective for your industry. For years, critics have rightfully criticized the diamond market for its awful labor practices in war-torn African countries. To address these very real ethical issues, dozens of companies have popped up to make precious gems in the lab. The appeal of lab-grown diamonds (LGDs) Chemically, physically, and optically the same as mined diamonds, LGDs have a slight time advantage. A real diamond takes billions of years to form; a lab can whip up a faux diamond in weeks. LGDs are: 30-50% cheaper More eco-friendly if made with renewable energy (there is an ongoing debate here) In 2018 the FTC ruled that LGDs didn’t legally need to be called “synthetic diamonds,” which further legitimized them in consumers’ eyes. Shifts are happening all over the biz The BBC reports that 70% of millennials would consider buying a lab- grown diamond. Bain reports that the lab-grown market grew 15-20% in 2019, while traditional diamond sales have seen a decline. Major players are taking heed: Diamond OG De Beers spun off its own LGD company. Leonardo Dicaprio (who starred in the 2006 film Blood Diamond) has invested in a separate LGD startup...talk about committing to the role. SPONSORED This new compliance software just got #1 product of the day on Product Hunt How’d Secureframe lock down the top spot on Product Hunt? With one seriously simple and powerful sales pitch: Get your company compliant in weeks, not months. Secureframe’s compliance software lets your business get enterprise ready (including SOC 2 and ISO 27001 compliant) in a fraction of the standard time. Here’s how: It monitors and collects data from 25+ difference services (including AWS, GCP, and Azure) to get a full view of your operations It automates hundreds of manual tasks, reducing wasted hours and the need for contractors It offers real-time alerts to notify you when an issue needs fixing, plus gives you detailed guidance on exactly how to correct it Because they do this all for you, your business gets -- and stays -- compliant faster and easier than ever before. Do words like “audit”, “infrastructure”, and “certification” terrify you? Then check out Secureframe and never worry again. Automate your compliance → HODL What’s behind Bitcoin’s recent rise? It could be PayPal. Whatever you think of the crypto community, one thing’s for sure: they love memes. And, if there was an appropriate meme for the moment, it would be John Wick proclaiming that he’s “back.” Bitcoin hit an all-time high of $19,783 on December 17, 2017, before falling 80%+ over the next 12 months. Now, the digital currency is back up over $18k. BTC has gained ~160% in 2020 Izabella Kaminska from the Financial Times maps out a few popular theories for why people are buying up Bitcoin: Rising inflation concerns related to massive government stimulus Growing distrust in authority Another more recent catalyst is PayPal. On October 21st, the fintech leader announced it would facilitate the buying and selling of cryptocurrency. Since then, BTC is up 40%+. PayPal brings 300m+ verified buyers into the fold An industry insider tells Kaminska that trading activity from PayPal’s crypto broker-dealer (itBit) has spiked since PayPal entered the game. Even if PayPal is creating a demand boost, it should be noted that Bitcoin is becoming more mainstream than the rah rah 2017 days: Public companies are adding Bitcoin to their balance sheets (Microstrategy, Square). Bitcoin’s current market cap (price x total supply, which has expanded since 2017) is now larger than Mastercard’s. The chief investment officer of Blackrock, the world’s largest asset manager, told CNBC that Bitcoin is “here to stay” and could potentially replace gold. We have no idea what comes next, but are pretty sure that one of these John Wick memes will be able to explain it. Small Biz OXB Studio lost 90% of its revenue overnight. Now, it’s making a comeback. In Silicon Valley lore, the garage is the go-to site of startup founding stories. If you want a curveball to this cliched tale, check out OXB Studio, the maker of sweat-proof jewelry. Co-founders Maggie Kyle (yoga teacher turned metalsmith) and Laura Treganowan (cycling instructor turned marketing guru) met in the latter’s 7am spin class. At the start of 2020, OXB had a growing wholesale operation But when the pandemic hit, the business lost 90% of its revenue. OXB was selling its minimalist necklaces, bracelets, and anklets across a network of fitness studios in Denver (where OXB is based) and nationally, in partnerships with Pure Barre. “Our ecommerce business was tiny when COVID-19 hit,” Kyle tells The Hustle. Online revenue jumped from $3k in January to $32k in April OXB -- an 18-month-old operation with 6 employees -- turned around its fortunes with a multi-pronged attack: Learning all things Shopify. Staying close to the fitness community by supporting studios (e.g.,OXB set up a program to help customers prepay for future yoga memberships). Launching an ambassador program that now boasts top athletes including Olympic gold medalist Missy Franklin. The business hit $94k in October and hopes for 2021 are high. “When I started making jewelry, I was targeting $50k a year,” says Kyle. “OXB can do 7 figures next year and we plan on scaling the business and hiring more people.” That was one fortuitous spin class. Ad of the day “A diamond is forever.” The tagline from DeBeers was created in 1947 and has been a mainstay for the UK-based diamond giant since. The phrase helped inspire the practice of gifting an engagement ring -- and it worked: in 1940, 10% of first-time brides received engagement rings; by the 1990s, 80%+ had. SPONSORED We partnered with Paycom to create this mini HR masterclass Register for it right here This 1-hour webinar condenses decades of HR knowledge from top VP’s, Founders, and Presidents into one easy-to-digest dialogue. You’ll learn from the best on how to: Pivot your HR department into digital-first leaders for your biz Use HR tech to boost your bottom line Fine-tune your employee experience to empower your workers and stop holding you back Register here → SHARE THE HUSTLE Refer coworkers, get exclusive Hustle gear Step 1: Peek our sweet, sweet rewards Step 2: Copy your referral link below Step 3: Share your link across social media and beyond Step 4: Collect rewards, rinse & repeat Share The Hustle → Copy & paste your referral link to others: https://thehustle.co/?ref=bed0be7154 How did you like today’s email? hate it meh love it Today's email was brought to you by @TrungTPhan. Editing by: Zachary "BNPL" Crockett, Maurice Chevrolet (French Automotive Liaison). PODCAST JOBS ADVERTISE CONTACT US 2131 THEO DR. STE F, AUSTIN, TX 78723, UNITED STATES • 415.506.7210 Never want to hear from us again? Break our hearts and unsubscribe.

Entities Mentioned

’K

’s Klarna

PERSON

BB

Benjamin Button

PERSON

BH

Byrne Hobart

PERSON

Jeffrey Epstein

PERSON • 2 mentions

American sex offender and financier (1953–2019)

JW

John Wick

PERSON • 2 mentions

Katy Perry

PERSON

American pop singer

KY

Kyle

PERSON • 2 mentions

LT

Laura Treganowan

PERSON

MK

Maggie Kyle

PERSON

Selena Gomez

PERSON

American singer and actress (born 1992)

ST

Studio

PERSON

Working place set aside for artist to work, the term is generally applied to workspaces used by artists creating fine art, particularly art dating from the 16th century to the present

Affirm

ORGANIZATION • 5 mentions

Affirm -- America

ORGANIZATION

Affirm IPO

ORGANIZATION

Bitcoin

ORGANIZATION • 5 mentions

Digital cash system and associated currency

CNBC

ORGANIZATION

Italian actress

Costco

ORGANIZATION

American multinational chain of membership-only stores

Financial Trust Company

ORGANIZATION

OG De Beers

ORGANIZATION

Peloton

ORGANIZATION

American exercise equipment and media company

Penske Media

ORGANIZATION

Target

ORGANIZATION • 2 mentions

Denver

LOCATION

Consolidated city-county and capital of Colorado, United States

Kaminska

LOCATION • 2 mentions

Silicon Valley

LOCATION

2014–2019 American television series

Statistics

Pages:1

Entities:25

Avg. OCR:1.0%

Sponsored