HOUSE_OVERSIGHT_014972 - HOUSE_OVERSIGHT_015001

No Subject

Document HOUSE_OVERSIGHT_014972 is a set of government records from the House Oversight Committee.

This 30-page document appears to be an internal report related to global equity volatility insights, specifically concerning potential trading strategies in the US and European markets. It discusses topics such as monetary policy, equity market ranges, and dispersion in the EU bank sector, and mentions specific financial instruments and institutions. The report includes recommendations for investment strategies and risk management.

Key Highlights

- •The document discusses a potential trading strategy involving buying in-the-money down and out puts on the S&P.

- •It recommends a strategy for long EU banks dispersion.

- •Merrill Lynch and Bank of America are mentioned as organizations involved in the creation or distribution of this report.

Frequently Asked Questions

Related Links

Books for Further Reading

Perversion of Justice: The Jeffrey Epstein Story

Julie K. Brown

Investigative journalism that broke the Epstein case open

Filthy Rich: The Jeffrey Epstein Story

James Patterson

Bestselling account of Epstein's crimes and network

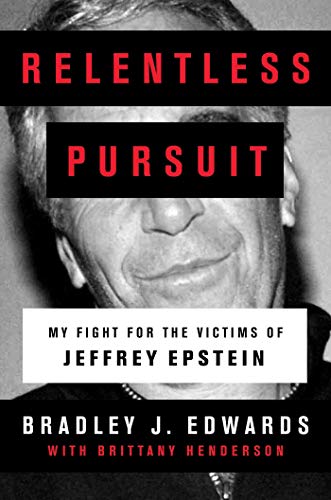

Relentless Pursuit: My Fight for the Victims of Jeffrey Epstein

Bradley J. Edwards

Victims' attorney's firsthand account

Document Information

Bates Range

HOUSE_OVERSIGHT_014972 - HOUSE_OVERSIGHT_015001

Pages

30

Source

House Oversight Committee

Date

June 20, 2017

Original Filename

GEVI 6.20.2017.pdf

File Size

2.09 MB

Document Content

Page 1 - HOUSE_OVERSIGHT_014972

Unauthorized redistribution of this report is prohibited. This report is intended for [email protected] Global Equity Volatility Insights Want a cheap call on EU equity? Monetise correlation through EU bank dispersion US Extract alpha from summer SPX range as policy and positioning “collar” equities With the Federal Reserve last week appearing more emboldened to normalize monetary policy, risk asset bears have come out in force. While we agree that a changing Fed reaction function is likely not supportive of substantial equity upside, we think the “Yellen put” still exists, albeit with a lower strike. Hence, we see monetary policy as providing a near-term “collar” (long put/short call) on a US equity market already prone to getting trapped in record-tight trading ranges. Further impetus for a summer range- trade should come from (i) fiscal policy, as gridlock caps equity upside but policy hope floors the downside, and (ii) positioning, where the risk of continued “fragility events” (potentially exacerbated by stretched quant fund/short vol positioning) meets cashed-up investors still accustomed to buying dips. As a risk-limited range trade, we like buying in-the-money down and out puts on the S&P. For example, an SPX Sep 2475 put that knocks out at 2300 (6% OTM) indicatively costs 7Obps (spot ref 2451), a 60% discount to the 2475 / 2300 put spread. Europe Long EU banks dispersion: Buy Dec17 call on a basket, sell worst-of call We recommend positioning for greater dispersion in EU bank sector returns via buying a Dec17 105% call on an equally-weighted basket of Santander, BNP, ING, Intesa and Deutsche Bank, part-financed by selling a worst-of call on the same basket for 1.8% (net) indic., as: 1) improving macro/earnings, sensitivity to rates and regulatory headwinds are likely to lead to greater differentiation within banks, 2) the entry point is attractive given historically low implied vol (13 8y+ percentile) and high implied correlation (81% bid vs latest 6M realised correl of 66%), 3) historical risk-reward at current pricing is attractive (avg. P&L of +8.4% when positive vs -1.8% when negative), and 4) the trade can be considered as a cheap call on EU equities as it has a similar payoff profile but with greater benefit relative to its cost. Asia Buy depressed China vs. US risks through corridor variance spreads As global central banks have taken on more hawkish tones, the uncertainty surrounding policy tightening will be more positive for EM volatility than for DM volatility. Additionally, our strategists have a more bearish outlook for the Chinese banking sector (which makes up a majority of the HSCEI index) amid rapidly rising leverage, complex shadow banking, and excessive home price inflation. Since we believe the global synchronized monetary tightening will impact HSCEI volatility more than SPX volatility, we recommend owning HSCEI-SPX 70/110% corridor variance at 5 vol points, a 3 vol point discount to a vanilla variance spread. The entry point is attractive as the HSCEI- SPX 18-month variance swap spread has fallen back to the lower-end of its 5-year trading range, the trade has a positive carry, and it benefits during China risk-off events. >> Employed by a non-US affiliate of MLPF&S and is not registered/qualified as a research analyst under the FINRA rules. Refer to "Other Important Disclosures" for information on certain BofA Merrill Lynch entities that take responsibility for this report in particular jurisdictions. BofA Merrill Lynch does and seeks to do business with issuers covered in its research reports. As a result, investors should be aware that the firm may have a conflict of interest that could affect the objectivity of this report. Investors should consider this report as only a single factor in making their investment decision. Refer to important disclosures on page 28 to 29. Analyst Certification on page 27. 11756528 Timestamp: 20 June 2017 01:18AM EDT Bankof America Merrill Lynch 20) une 2017 Equity Derivatives Glob. al BofA Analytics = DATA DRIVEN = Global Equity Derivatives Rsch MLPI F&S Anshul Gupta >> Equi MLI Nitin Saksena Equi MLP Willi Equi ‘y-Linked Analys UK) y-Linked Analys F&S am Chan, CFA >> y-Linked Analys Merrill Lynch (Hong Kong) Abhi Equi MLI Benj Equi MLP nandan Deb >> ‘y-Linked Analys UK) amin Bowler ‘y-Linked Analys F&S [email protected] Jason Galazidis >> Equi MLI Clov Equi MLI Chin Equi MLP Michael Youngworth Equi MLP Nikolay Angeloff Equi MLP y-Linked Analys UK) is Couasnon >> y-Linked Analys UK) tan Kotecha y-Linked Analys F&S ‘y-Linked Analys F&S y-Linked Analys F&S See Team Page for List of Analysts Table 1: 3M volatility (weekly changes) Implied Realized S&P500 9.8 (-0.2) 7.1 (-0.2) ESTX50 3.4 (0.3) 1.5 (0.2) FTSE 10.0 (-0.4) 9.7 (0.2) DAX 2.6 (0.3) 0.7 (0.5) NKY 13.8 (-0.2) 12.3 (-0.2) HSI 24 (0.1) 0.1 (0.2) KOSPI 2.2 (0.3) 0.5 (0.1) EEM US 5.6 (0.5) 11.8 (-1.1) TOP40 6.9 (1.2) 1.1 (0.3) RDX 25.9 (0.9) 20.6 (-1.1) IBOV 22,9 (-1.7) 25.5 (-0.7) ISE30 20.2 (0.4) 3.5 (0.1) Source: BofA Merrill Lynch Global Research H OUSE_OVERSIGHT_014972

Page 2 - HOUSE_OVERSIGHT_014973

BofAML GFSI™ X-Asset Risk Landscape Stress now below normal for all asset classes The indicator was little changed last week, finishing at -0.23. ¢ Stress is now in benign territory across all five asset classes: Stress in across all asset classes (except equity) declined last week. Notably, rates stress turned negative (benign territory) and stresses across all five asset classes are now negative. ¢ Stress in Equity skew rose as ESTX50 and (to a lesser extent) S&P500 skew steepened; indeed the gain in ESTX50 skew was the greatest across GFSI sub- components (Chart 2) and also historically significant (Chart 5). ¢ Commodity-related stresses fell the most across asset classes (Chart 3), led by declines in Crude and Gold vol (Chart 2}, reversing some of the gains after geopolitical tensions in the Middle East rose in recent weeks. Chart 1: Latest* stress across GFSI sub-components 2.0 420 Bo 154m = © Sf Red shaded area highlights components in fi Green shaded area highlights components in 2 1.0 so © Bearish territory “—* Skew Bullish territory ® 05 Flow a 00 - 2 05 © 40 -2.0 : mes errarg ea ar aa Basn> ee ec © oc eB raxzsese SEO SEES DEBS EBSBRSEEHSHE EES SSS SSS ESSSSESsREsesHRsEES Ww 2? D woueduwu a SS On, Px Ow Weow ~ ee» ep pk fp Bet dO oe ow a aoann wn =n a nw” a) oO wn ° HAE SES SSV2MBPBEBS A2HESEHRESL CP NDHDBKL WY EEFEEXT ES ERC SBSBEEDS O2>T8EEBe@o0s5 22a FGOrsgsseogee SONORA S ERA SSF u ze se' FF e07 ao EX xX GB TtDAHHA PG Loe st EReaertoaoer 208 DF —>SB &—Sega2eoB (oa a Cc Az n oO 2 [o) a w > Oo <x” aS$<setZnnuer>xxRPo SSnl2®SRBSBeFESpoeeeseotarexegPprEEEZSE S6S BE mesStrseBaBRELE Sf§rtaat se sa E 62 Au sr tS Seu aZto a o 8 ze a > “@ co ne) a0° zp OF 2 =u = 23s > o Bas — -- = s ro) = os > =. > o”€g uo n nw = fo} 2 = of ere ce & @ Ww Aa fou iin Ss ian (= x= z >= 8 = co oo ue a 38 6 82° = iS) a > Source: BofA Merrill Lynch Global Research. *Latest as of 16-Jun-17. Chart 2: Change** in stress across GFSI sub-components 08 12 . 2 4 Gas Risk £ NN o> Skew 6045 s5Sn = oe Flow o o © 00 T T T T a a oe oe a i i Ee Ee Be Be Be T a T 1 2 rrrrriyy oO 2.04 =] Xi N = oe F978 oO es 08 ; ; ; [a saars QOeg 3S so>e “ou a sooxek seanpevoeaars ® [a SST ESRBBSTSHBABESS ESE, ES Esa SSS ST ESEBRESELSSRESBESESS HAtxvFeaer- De sar -GdeFfefPteuwseVoeetuexy er fuser r2eFKFSGHwUEL SEG ENDNDH ESE HR BSPREZTEL HD EHR EBHEED SO ExsSBRZREBRE GS Cy 2 @ BSSz-oo0oooFtABeBALRALZTOoO SBS ESOC LR F777, Fz rsegerPBTtrFzreasgeE >< mA TT YTStOs DOG ~? ia Cem tT Sseostuv aoc aes aSr>sags CPA REE EVE © ZzSoeQc05 FP and 5SB2e2ae° PPE E AP a BER BA ° Mx nDS FER 5 E2RB 5 B =a=as2se 8 PEELS BSR EEL CEH s 25>xeFEQernVS um 2FO0nHt oGEt AAFPs RS SFtTSESHZASBAX* BPEGVEHe PSF seaQESS £ 6 WeOm ao = =Ooos Cet £828 eR 2°SFtB°-B D io) =e ro) = 6 Qo eer sun ekaoe ao 2 >t =i te > eget A28Bss = O WW a oO ee =e gan ao 8 2 = 8 foe) Source: BofA Merrill Lynch Global Research. **Latest as of 16-Jun-17. Change vs 1 week prior (9-Jun-17). The GFSI Risk Allocator (using Bull, Bear & Neutral weights of 2, 0, 1} suggested a 17.4% overweight position on 16-Jun (vs 13.0% OW as of 9-Jun}. The percentages of Bullish, Bearish and Neutral GFSI components (as used in the Risk Allocator) as of 16-Jun were 34.8%, 17.4% and 47.8% respectively. ; a ; Bankof America 2 Global Equity Volatility Insights | 20 June 2017 zi guinty yf lnsighies | 20.) Merrill Lynch HOUSE_OVERSIGHT_014973

Page 3 - HOUSE_OVERSIGHT_014974

Chart 3: Stress in commodities fell the most last week (driven by a drop Chart 4: EM and the US are the least stressed GFSI regions globally in crude oil vol) while stress in equities rose marginally (led by equity 0.02 skew) 0.05 0.02 02 0.00 — ‘ -0.05 0.0 -0.10 5% -0.15 ~ -0.20 -0.4 -0.25 06 -0.30 ~ 0.35 -0.8 -0.40 40 EM Europe Japan US Equities Credit Rates FX Commodities mLatest stress (16-Jun-17) | © Change in stress mLatest stress (16-Jun-17) © Change in stress Source: BofA Merrill Lynch Global Research. Iwk change (9-Jun-17 to 16-Jun-17). Source: BofA Merrill Lynch Global Research. 1wk change (9-Jun-17 to 16-Jun-17). Chart 5: Top 10 movers in stress (1-week abs chg %-ile vs history*) Chart 6: Global volatility & credit spread stress in the GFSI me Stress fall m Latest stress (16-Jun-17) = Change in stress gam Stress rise _ 100% 792% 3 0.01 0.01 o : 2 90% 83% 82% 82% 81% 80% 799 79% 77% 0.2 = 80% 67% -0.4 > - J 9 m GONG 1.0 ‘am 50% -1.2 irs} a cs] S 2 a Ss fom = § 2 § 5 $a Fx 5 238 1.4 6 5 8 5 632,93 & 5BPe 2 5 2 3S 8 3B 8 Q <2) > 2 oY EBVBwAA aEs = = = > = a 2 2 > & co) co) ee o) a 6 2X >2P aM FZ ope >< 2 = 8 2 Pa > mo SHU LfOsnr 5 PELOS = uw a) 5 > a= a=] — ° a a 3 a oOo se8 = = > {o) & fo) i nn 5 5 ums uw # ar = 3 a co) <x ce) = co) Source: BofA Merrill Lynch Global Research. * %-ile of weekly mave in stress vs all historical weekly Source: BofA Merrill Lynch Global Research. 1wk change (9-Jun-17 to 16-Jun-17). moves (earliest 3-Jan-00). Bar colours represent rise (red) or fall (green) in stress. 1wk change (9-Jun- 17 to 16-Jun-17). Bankof America = . dee toes z Global Equity Volatility Insights | 20 June 2017 Merrill Lynch quity plnstents | 28) a HOUSE_OVERSIGHT_014974

Sponsored

Page 4 - HOUSE_OVERSIGHT_014975

Volatility in the US Risk-limited alpha in a “collared” market: SPX ITM KO puts US equities vulnerable...to a summer range-trade The Federal Reserve last week appeared more emboldened to normalize monetary policy, not only raising interest rates by 25bps but also reiterating its intention to hike four more times by the end of 2018 and stating that it “expects to begin implementing a balance sheet normalization program this year” - all despite recent softness in inflation data. Breakeven rates of inflation narrowed following the Fed communications due to tighter monetary conditions in the face of slowing US economic data, and risk asset bears responded in force, suggesting that Janet Yellen had “broken up” with investors and that it would be prudent to sell “before it’s too late”. We agree that the changing reaction function of the Fed is likely not supportive of further substantial US equity upside and may be viewed as the Fed now providing a short call option on the S&P 500. However, in our view, it is premature to conclude from last week’s developments that the “Yellen put” is dead. We see its strike as declining but would not underestimate Yellen’s dovish inclinations in a shock or the capacity for the Fed to still remain credibly on hold as long as the US economy is not “running hot”. In short, we see monetary policy as now providing a “collar” (long put / short call} on a US equity market that has already shown a propensity over the past year for getting trapped in record tight trading ranges.' Other factors may also conspire to create a summer range-trade for US equities, namely (i) fiscal policy, where gridlock likely caps equity upside but lingering policy hope floors the downside, and (ii) positioning, where the risk of continued “fragility events” (potentially exacerbated by stretched quant fund/short vol positioning) meets cashed-up investors still accustomed to buying dips. Tug of war between fragile market/stretched positioning and cashed-up dip-buyers As we have noted recently, US equities have displayed a historically unusual tendency to jump rapidly from calm to stress and back (“fragility”), with the recent Tech sell-off and rebound the latest example. For example, in the past year, the S&P 500 has seen 5sigma declines (3 in total—Brexit, Sep-16, May-17) occur 20x more frequently than over the prior 90 years or so. The increased frequency of these “fragility events” is in part due to vol failing to remain high post a spike as equity market participants continue to aggressively “buy the dip” and in the process reset vol lower. Historically low vol alongside consistently upward trending equity markets and low cross asset correlations could be creating stretched positioning across markets. For example, upward trending equities on historically low vol may be pushing CTA equity positioning to near record levels (Chart 7). Risk parity portfolios could be increasing their leverage due to low vol as well as low cross asset correlation (Chart 8). And lastly, inverse VIX ETPs have seen increased open interest as performance has swelled on the back of continued declines in vol and attractive term structure risk premia (Chart 9). Should vol spike again alongside a reversal in equity price momentum and a rise in cross asset correlations, then unwinds from these strategies could exacerbate market fragility. However, this must be weighed against an investor base that has plenty of cash on hand (Chart 10) and their potentially fickle but still-intact tendency to view any equity market dip as an alpha opportunity. ' For example, the Dow Jones Industrial Average traded in its tightest trading range in over 110 years in Jan-17; this followed a record in the S&P 500 ending Sep-16 for the longest stretch of trading within a range of 1.77% since 1928. Bankof America 4 Global Equity Volatility Insights | 20 June 2017 Merrill Lynch HOUSE_OVERSIGHT_014975

Page 5 - HOUSE_OVERSIGHT_014976

Chart 7: A combination of upward trending global equity markets and very low volatility have conspired to push trend following (CTA) equity positioning to near record levels. Consequently, the beta of CTA strategies to global equities is also at extreme levels 1.00 0.75 0.50 0.25 0.00 -0.25 -0.50 -0.75 -1.00 wo Ww co ico} > oO fom ® wm > fom & ® = cop) Jul-15 Nov-15 Jan-16 Mar-16 Jul-16 Nov-16 Jan-17 Mar-17 May-17 wo Ww to & & 370 S=> 5S mmm MSCI World (Ratio of trend strength to volatility) (LHS) ——— BofAML Model CTA Global Equity Allocation (RHS) Source: BofA Merrill Lynch Global Research. Based on daily data form 2-Jan-2015 to 16-Jun-2017. CTA = Commodity Trading Advisor Chart 8: Owing to low cross asset vol and strong diversification, the volatility of risk-balanced multi-asset portfolios has fallen to historically low levels. Consequently, leverage levels across multi-asset & other portfolios that target fixed vol have likely hit their caps 24% 3.0X 20% 2.9X 16% 2.0X 12% 1.5x 8% 1.0x 4% 0.5x 0% 0.0x Noor tH OMOH ANNM OAK TER SNK R DHODOADBHAHAASDS LHS BAADBARBAAAASSSSSS mmm Model Risk Parity Leverage (Vol Target: 10% & Max Leverage: 3x) (RHS) Unlevered BofAML Model Risk Parity Volatility (LHS) Source: BofA Merrill Lynch Global Research. Based on daily data from 3-Jan-72 through 16-Jun-17. Equity, fixed income, and commodity components within the hypothetical risk parity investment are represented by the S&P500, 10-Year US Treasury Bonds, and the S&P GSCI Index, respectively. Risk parity allocations are determined and rebalanced monthly using prior 12-month realized volatility and correlations. It is important to note that not all CTA, risk parity, or vol control strategies operate similarly and there is model risk in estimating the exact size of these trading flows. Chart 9: The vega outstanding in inverse VIX ETNs has also reached a record high at ~$125mn vega 350 ee levered long === Levered long 300 ee |nverse === Net vega across VIX ETPs 250 200 150 100 VIX ETP open interest ($mn vega) -150 2012 2013 2014 2015 2016 2017 Source: BofA Merrill Lynch Global Research. Daily data from 13-Feb-12 through 16-Jun1 7. Chart 10: Global FMS average cash balances (%) remain elevated, suggesting dry powder for investors still conditioned to buy equity dips I 6.0% Backtest | Actual 2400 2200 5.5% \ 2000 I I ans | 1800 1600 4.5% 1400 4.0% 1200 3.5% 1000 . 800 3.0% 600 ‘01 ‘02 ‘03 '04 '05 '06 ‘07 ‘08 09 10 11 12 '13 14 15 16 “17 FMS avg cash balance (%) — S&P 500 (RHS) Source: BofA Merrill Lynch Global Fund Manager Survey, Bloomberg. As a reminder, the FMS Cash Rule works as follows: when average cash balance rises above 4.5% a contrarian buy signal is generated for equities. When the cash balance falls below 3.5% a contrarian sell signal is generated. Extract risk-limited alpha from SPX range via cheap in-the-money knockout puts As a risk-limited range trade, we like owning down-and-out puts on SPX that are already in-the-money. For example, the SPX Sep 2475 put with a 2300 knock-out (continuous observation) indicatively costs 7Obps (spot ref 2451) and offers a 60% discount to the vanilla 2475/2300 put spread, which is itself historically cheap (Chart 12). If SPX stays above the 2300 barrier at all points in time before expiry, the structure is equivalent to a 2475 put option. If the barrier is instead breached, the maximum loss will be equal to the (low) upfront premium. The 2300 barrier is about 6% out-of-the- money, hence “allows” for the elusive 5% correction not seen since Brexit (on a closing basis). However, investors can mitigate the risk of breaching the barrier by either moving it farther down (e.g., a 2245 barrier would indicatively raise the cost from 0.7% to 1%}, or by only observing it on a close-to-close basis (in turn sacrificing part of the discount). Bankof America Merrill Lynch Global Equity Volatility Insights | 20 June 2017 5 HOUSE_OVERSIGHT_014976

Page 6 - HOUSE_OVERSIGHT_014977

The trade prices attractively today due to exceptionally steep SPX put skew, which is near its highs established since 2004 (Chart 11). With steep SPX put skew, the market is implicitly pricing in a high probability that the option will knock-out during its life, i-e., that relatively large drawdowns are more likely. As detailed above, however, we see many reasons why the most likely near-term scenario for US equities is to remain range-bound. The structure is short 11% delta at inception and has the same vega sensitivity as the equivalent put spread (short 6bps). Chart 11: SPX put skew is near the all-time highs reached since 2002. Chart 12: The price of SPX put spreads is already near the lows reached Steep skew helps cheapen knockout puts as the market is implying a since 2002. In particular, the price of a 3m 50d-25d put spread is relatively high probability of the barrier being breached ~1.02%, in the 0.15 %-ile since Nov-02 7.5% 9% 7.0% 8% 6.5% 7% 6.0% 6% 5.5% 5% 5.0% 4% 4.5% 3% 4.0% 2% 3.5% 1% 3.0% 0% EE SBSB Bee eae EE Sssesssgsysgereer2rese ———SPX 3m 90-100 put skew 9 === 16-Jun-17 ——=SPX 3m 50d - 25d put spread = === 16-Jun-17 Source: BofA Merrill Lynch Global Research. Data from Jan-04 to 16-Jun-17. The 90 and 100 strikes Source: BofA Merrill Lynch Global Research. Data from Nov-02 to 16-Jun-17. are based on the SPX forward. aici Bankof America 6 Global Equity Volatility Insights | 20 June 2017 Merrill Lynch HOUSE_OVERSIGHT_014977

Sponsored

Page 7 - HOUSE_OVERSIGHT_014978

Notable trends and dislocations (US) The Fed turns more hawkish, though vol remains subdued Last week, unsurprisingly the Fed opted to hike benchmark rates another 25bps. However, the market was more focused on the FOMC’s unexpectedly hawkish message, which indicated that it is willing to normalize policy despite weaker-than-desired inflation. Qur economists now think the Fed will announce balance sheet normalization in September and will hike rates again in December. A more hawkish Fed could result in higher real rates and a stronger USD, which ultimately should benefit our Growth to Value rotation trade of long XLF calls versus short QQQ calls (see Chart 15). The S&P 500 was more-or-less flat week-over-week as it gained only 6bps. The tech selloff continued, however, and the Nasdaq-100 dropped 105bps. Similarly, the Russell 2000 also dropped 105bps. Despite concerns on the Fed, the VIX fell 0.32 vol points to 10.38, and SPX 1m ATM implied vol declined 0.3 vol points to 7.6%. Chart 13: The Nasdaq has set a new record for consecutive days without a 5% peak-to-trough drawdown 160 «2 136 140 120 100 Bo 80 60 40 Be 20 SSeS 0 16-Jun-17 14-Jul-86 27-Feb-97 21-Jun-71 22-Nov-93 20-Aug-15 19-Nov-91 3-Nov-16 29-Sep-80 29-Mar-94 5-Feb-99 4-Oct-95 8-Dec-80 14-Apr-87 3-Mar-80 14-Mar-00 22-Jul-99 21-Sep-78 19-Apr-99 28-Jan-00 15-Oct-99 Source: BofA Merrill Lynch Global Research. Data from 1-Feb-71 to 16-Jun-17. Drawdowns measured from prior peaks and using close-to-close data. Chart 14: On 16-Jun, the SPX had its 11™ consecutive session of moves not exceeding 0.5% in either direction on a close-to-close basis. This is the 4" time this year that such a streak has surpassed 10 days 50 10 40 8 30 6 20 4 10 2 0 , 0 ‘64 '65 52 17 ‘59 ‘62 '63 '67 '95 '51 ‘53 ‘66 ‘68 '72 '93 16 Max # of days without an up or down move > 0.5% (LHS) m# times SPX has gone for 10 days w/o a 0.5% move (RHS) Source: BofA Merrill Lynch Global Research, Bloomberg. Data from Jan-1928 to 16-Jun-2017. On June 9, the Nasdaq dropped nearly 2% as investors unwound crowded positions, resulting in a sudden selloff from a period of relative calm. However, despite the volatility among tech names during the first week of June, the Nasdaq (CCMP} has not seen a 5% drawdown from a prior peak (using closing data} in 150 days. This is the longest such streak in the Nasdaq’s history. Prior to today, the longest periods of similar calm occurred during July ’83 and July ’86, when the index did not record a 5% drawdown from a peak in 136 and 135 days respectively. Last week the S&P 500 recorded its 11" session without a move larger than 0.5% in either direction. As a result, 10d realized vol stood at 3.31% as of 16-Jun. This is already the fourth time this year that SPX has gone more than 10 consecutive days without a move greater than +/- 0.5%. This has historically happened only in ’64, ’65 and ’52. The longest such stretch this year lasted 15 consecutive trading sessions and ended on 16-May. For comparison, in ’64 SPX had 8 stretches without such a move with the longest stretch spanning 43 days. Bankof America Merrill Lynch Global Equity Volatility Insights | 20 June 2017 7 HOUSE_OVERSIGHT_014978

Page 8 - HOUSE_OVERSIGHT_014979

Chart 15: Buying an XLF 1m ATM call financed by selling a QQQ 1m call is Last week, we highlighted that investors who want to rotate out tel attractive way for investors to rotate out of Growth and into of Growth strategies into Value strategies should take advantage of elevated tech vol by buying XLF 1m ATM calls 43 financed by selling QQQ 1m ATM calls. After last week’s FOMC meeting, the case for such a trade grows even stronger as the 14 market thinks the Fed has become more hawkish, driving up 09 real rates and the USD. Amid this backdrop, one could see , outperformance of Value names over Growth names, which tend 07 to have higher amounts of offshore revenues that would come under pressure by a stronger dollar. ae 2013 2014 2015 2016 2017 Additionally, the trade remains attractive at current levels as pricing has only been better 1% of the time in 5 years. Today, ——+# of 1m XLF calls one 1m QQQ call buys 1.03 XLF calls could be bought for each QQQ call sold, whereas ——Current (99th %-ile) over the past 5 years, the average number of XLF calls that could be purchased was only 0.80. == Average Source: BofA Merrill Lynch Global Research. Data from 9-Jun-12 to 16-Jun-17. Table 2: Current S&P500 volatility and correlation measures relative to the prior two year of historical daily data 1-week change Over 2-year historical period 46Jun17 9Jun17 Change au Minimum 25% Median 75% © Maximum 1-month ATM implied volatility 16% 19% -0.3% 1.3% 11% 9.8% 11.7% 14.5% 31.8% 1-year ATM implied volatility 14.0% 14.0% 0.0% 17% 13.4% 15.3% 16.2% 17.3% 22.5% 1-week intraday realized volatility 18% 13% 0.5% 19.6% 5.2% 8.3% 10.6% 14.0% 53.7% 1-year minus 1-month term structure 6.5% 6.1% 04% 99.2% -12.0% 2.1% 44% 5.4% 10% 3-month 90 minus 110 skew 8.5% 8.3% 0.2% 16.1% 71% 9.4% 11.3% 11.8% 13.8% 1-year top 50 implied correlation 45 44 45.10 0.35 8.1% 42.03 49 37 54.22 57.14 65.55 3-month top 50 realized correlation 21.30 24.08 -218 16.8% 12.57 27.15 37.28 48.45 60.41 VIX 1-month ATMf implied vol 81.9% 80.0% 1.9% 39.9% 61.2% 18.2% 85.0% 95.2% 162.2% VIX 1-month 110 minus 90 skew 27.1% 26.9% 0.2% 88.6% 9.3% 18.6% 21.5% 23.8% 30.3% Source: BofA Merrill Lynch Global Research deg oes Bankof America 8 Global Equity Volatility Insights | 20 June 2017 Merrill Lynch HOUSE_OVERSIGHT_014979

Page 9 - HOUSE_OVERSIGHT_014980

Volatility in Europe Buy EU banks dispersion: (+) basket call, (-) worst-of calls Trade: Long Dec17 105% call on an equally weighted basket of SAN, BNP, ING, ISP & DBK*, short Dec17 ATM worst-of call on the same basket for 1.8% indic. (correl bid: 81%). * We pick the top 5 stocks with the largest market cap within the SX7E (EU banks sector index) corresponding to 5 different countries We have previously highlighted our preference for vol dispersion trades both in the US and the EU — with the most recent recommendation being sector dispersion opportunities within the EU. In a similar vein, we suggest positioning for greater dispersion within EU banks via buying a call on a basket of Santander, BNP Paribas, ING, Intesa and Deutsche Bank part-financed by selling a worst-of call on the same basket as: ¢ Improving macro/earnings, sensitivity to rates and regulatory headwinds likely to lead to greater differentiation within banks: An improving macro backdrop in Europe & ongoing improvement in EPS revisions (see Style Cycle) paint a bullish picture for EU banks as they are seen as leveraged macro plays within the EU. However, we believe there is a potential for greater differentiation within banks as our bank analysts have argued before (here and here} that: (i) some banks stand to benefit more than others based on their earnings power should the uptick in the earnings cycle continue, (ii) banks’ gearing to interest rate cycles, and therefore likely impact from a more hawkish ECB, varies between different banks and (iii) French and Benelux banks are likely to be most impacted under potential Basel IV regulations. + Entry point is attractive given historically low implied vols: The structure benefits from its long vol bias as average 6M implied vol on the basket of 5 European banks is historically low (13% %-ile since Jan-08, Chart 16). ¢ High implied correlation beneficial for structure’s short correlation bias: Chart 17 shows the average pairwise 6M and 3M realised correlations between the 5 EU banks, which are historically low. Despite this recent drop in realised correlations, implied correlation is priced higher, thus providing an interesting entry point for the (short-correlation) trade. Bankof America <> ; dee Ios Merrill Lynch Global Equity Volatility Insights | 20 June 2017 9 HOUSE_OVERSIGHT_014980

Sponsored

Page 10 - HOUSE_OVERSIGHT_014981

Chart 16: SAN, BNP, ING, ISP and DBK average 6M ATMf implied vol is Chart 17: Despite the recent drop in realized correlation, implied trading historically low (13" percentile since 2008) correlation is priced near the high end of the reaiised range for the basket of EU banks Basket of SAN, BNP, ING, ISP & DBK 5 100% 90% 80% 80% 70% 60% 60% 40% 13th percentile 50% 40% 20% 2 fox oO = N o st ve) © ye 30% ss 8 & &§ B & &B & & ssssssaggeyrgezees = = = FF = FF FF FF ESF Ss <© ¢ ¢ ¢ ¢ © & © G&G ©GCe Gc Ge E SSSSSBSSSSSSSSSSS 6M avg realised vol ———=6M avg implied vol = Last IV (16-Jun-17) 3M realised correl ————6M realised correl = Dec17 implied correl Source: BofA Merrill Lynch Global Research. Data: 2-Jan-08 to 16-Jun-17 Source: BofA Merrill Lynch Global Research. Data: 2-Jan-08 to 16-Jun-17 - Attractive risk-reward profile at current pricing: As highlighted in Exhibit 1, historically the trade held to expiry, at current pricing, would have generated an average P&L of 8.4% when positive and -1.8% when negative. The risk-reward looks even more attractive in extreme market outcomes as the max P&L of the trade which is greater than 75% compares to the max loss of only 5.7%. The trade also provides an effective way to gain long exposure to EU equities with limited risks, as evident from the call-like payoff in Exhibit 1 (vs the ESTX50). It is worth noting that, by construction, the maximum loss of the trade is 6.8% with the most likely loss limited to the upfront premium of 1.8%. We also note that the trade payoff profile is superior to a SX5E Dec17 ATM call when sized such that: (i) the call premium is the same as the upfront premium for the dispersion trade (=1.8%, blue line), as well as (ii) when the call premium is the same as the theoretical maximum loss for the trade (=6.8%, orange line). Exhibit 1: Hypothetical back-test of long Dec17 105% call on a basket of SAN, BNP, ING, ISP & DBK, short Dec17 ATM worst-of call on the same basket (upfront premium = 1.8%) 80% ESTX50 6M returns Trade P&L (long basket call, short worst-of} 80% P&L Q, 5 Avg P&L when positive: 8.4% 70% 60% Avg P&L when negative: -1.8% 60% 9g, 40% 50% 40% 20% 30% 20% 0% 10% 20% ty 0% H “10% | SyS5E 4.7x Dect7 ~ATM call 40% rt . SX5E returns Se 7 nN me sy BBP he BD RWBorHT Ne ts Dm -20% oO Oo 2 oO oO 2 oO fon) o ° i 7 i 7 S&S § &§ &§ & & &§ &§ &§ &§ &§ &§ &§ & & & & & -60% -40% -20% 0% 20% 40% 60% Source: BofA Merrill Lynch Global Research. Data: 3-Jan-00 to 16-Jun-17. Back-testing is hypothetical in nature & reflects application of the strategy prior to its introduction. It is not actual performance & is not intended to be indicative of future performance. The two call payoff diagrams shown in the chart correspond to SX5E Dec17 3575 strike call sized such that upfront premium = 1.8% (0.46x notional, blue line, equal to the upfront premium for the trade) and 6.8% (1.7x notional, orange line, equal to potential max loss of the trade) deg oes Bankof America 10 Global Equity Volatility Insights | 20 June 2017 Merrill Lynch HOUSE_OVERSIGHT_014981

Page 11 - HOUSE_OVERSIGHT_014982

Notable trends and dislocations (Europe) European equities ended the week lower mainly due to a tech-driven sell-off on 12-Jun during which the SX8P (European tech sector) witnessed its largest 1-day decline since the UK’s EU referendum. Nevertheless, implied vols across European indices remained mostly unchanged near 2 year lows. ¢ European intra-sector correlation continues to decline while inter-sector correl has hit a floor: The average EU intra-sector 3m correlation is near a 10- year low currently. In contrast, the average 3m inter-sector correlation reached a 10-year low in Mar-17 driven by post US election reflation trades but is now rising off its lows likely driven by an unwind of reflation trades. - §SX7E implied-realised correlation near 5-year highs: SX7E 6m implied correlation fell since Mar-17 but the implied-realised correlation spread remains in the 88" 5-year percentile driven by even lower realised correlation. * _ESTX50 3M put skew is near 5 year highs, in stark contrast to SXEP (European Oil & Gas equity) put skew which is close to 5 year lows. * The overall seasonality in ESTX50 realised volatility since 1987 has been one of relatively lower vol during the summer months vs. autumn. In particular, May stands out as the lowest vol month across most 10 year horizons, and this also appears to be the case so far this year. EU Intra-sector correl continues to decline while inter-sector correl is supported The average European intra-sector 3m correlation is near a 10-year low, partly driven by divergence within the personal & household goods, utilities, real-estate, autos and insurance sectors (Chart 18 and Table 3). Interestingly, the average 3m inter-sector correlation reached a 10-year low on 14-Mar-17 (as the 8-Nov-16 US election led to the outperformance of sectors sensitive to inflation) but inter-sector correlation now seems supported likely driven by the unwind of reflation trades (Chart 18). Bankof America <> ariective Merrill Lynch Global Equity Volatility Insights | 20 June 2017 11 HOUSE_OVERSIGHT_014982

Page 12 - HOUSE_OVERSIGHT_014983

Chart 18: European intra-sector realised correlation is near a 10-year Table 3: Personal & household goods, utilities, real-estate, autos and low, which suggests that we are currently in a stock pickers insurance are the top 5 sectors with the lowest 10-yr percentile of intra- environment sector 3m realised correlation Average SXXP 3m inter-sector correlation* ; Intra-sector 3M correl Average SXXP 3m intra-sector correlation Sectarticher -Seclorname Level Tyr vile 100% 4th 10-yr SxQP Pers. & Hous. Goods 17% percentile SX6P Utilities 24% 80% SX86P Real estate 40% SXAP Autos 41% 60% SXIP Insurance 32% SXRP Retail 19% 40% SXTP Travel 26% SXFP Financials 28% 20% . SX4P Chemicals 28% 3rd 10-yr percentile SXNP Industrials 30% 0% SXPP Basic res. 50% KC ODO DROOoOKr NN Mt tNM OOR SXDP Health care 24% See cae emaeeaaaan se i SXMP Media 27% Sfos Pos Pes Pos PW 6s SXOP Construction 39% Source: BofA Merrill Lynch Global Research. 3m correlations calculated using daily returns and SXKP Telcos 32% assuming current weights. Data from 16-Mar-07 to 16-Jun-17. *Average correlation between each of SXEP Oil & Gas 42% the 19 SXXP sector indices and the other SXXP sector indices. **Average of the 19 intra-sector SX7P Banks 41% 2 correlations (in Euro) where the 19 sector indices are the indices which make up the SXXP index. SX3P Food & bev 31% 25% Note that the average intra-sector correlation calculated using returns in local currencies is also near Sx8P Tech 35% 35% Z nd @ : ai Ugearlond2” Miynpercentiley Source: BofA Merrill Lynch Global Research. 3m correlations calculated using daily Euro returns and current weights. Data from 16-Mar-07 to 16-Jun-17. SX7E implied-realised correlation near 5 year high, driven by stock-level divergence SX7E 6m implied correlation has fallen since Mar-17 but the implied-realised correlation spread remains in the 88" 5 year percentile (Chart 19). Notably, the low SX7E 6m realised correlation in 2017 was mostly driven by company-specific rather than region- specific divergence (Chart 20). deg oes Bankof America 12 Global Equity Volatility Insights | 20 June 2017 Merrill Lynch HOUSE_OVERSIGHT_014983

Sponsored

Page 13 - HOUSE_OVERSIGHT_014984

Chart 19: The SX7E 6m implied-realised correlation spread has been high throughout 2017 and remains in the 88 5-year percentile Chart 20: The decline in SX7E 6M realised correlation appears to be mainly due to company-specific rather than region-specific divergence 6m realised correlation 6m implied correlation implied-realised spread 100% 80% 60% 40% 20% 0% -20% Jun-12 Dec-12 Jun-13 Dec-13 Jun-14 Dec-14 Jun-15 Dec-15 Jun-16 Dec-16 Source: BofA Merrill Lynch Global Research. Data: 16-Jan-12 to 16-Jun-17. Implied and realised correlations are calculated using current weights. Chart 21: ESTX50 3M put skew is near 5yr highs, in stark contrast to SXEP (European Oil & Gas equity) put skew which is close to 5yr lows 6.5% 55% 100th percentile __ 45% 3.5% 2.5% = a = 2nd percentile 1.5% Jun12 Jun13 Jun14 Jun15 Jun16 Junt7 SX5E 3M 90-100 put skew SXEP 3M 90-100 put skew Source: BofA Merrill Lynch Global Research. Data: 16-Jun-12 to 16-Jun-17. 90% 50% 40% 10% 30% 20% 50% 10% 30% 0% 12 13 14 15 16 47 Spread (rhs) Average inter-regional SX7E 6M realised correlation** SX7E 6M realised correl* Source: BofA Merrill Lynch Global Research. Data: 16-Jan-12 to 16-Jun-17. *Calculated based on current weights of French, German, Italian and Spanish banks with enough price history. **We construct theoretical portfolios consisting of SX7E names from a given country (France, Germany, Italy and Spain) and compute the average pairwise correlation of their daily returns ESTX50 put 3M 90-100 (%fwd) put skew has re-steepened to near 5 year highs following the flattening which ensued after the first round of the French presidential elections (23-Apr). The recent ESTX50 skew dynamics are in stark contrast to what has been witnessed in the SXEP (European Oil & Gas equity), where the 3M 90-100 volatility spread has been trending lower and is currently near-flattest in 5 years. Bankof America Merrill Lynch Global Equity Volatility Insights | 20 June 2017 13 HOUSE_OVERSIGHT_014984

Page 14 - HOUSE_OVERSIGHT_014985

Chart 22: May has typically been the month with the least amount of The overall seasonality in ESTX50 realised volatility since 1987 ESTX50 realised volatility. This has also been true in 2017 thus far (ESTX50 inception) has been one of relatively lower vol during - 12% uf i a the summer months vs. autumn. In particular, May stands out as = 40% | mmmn'97 to'07 the lowest vol month across most 10 year horizons, and this @ == (Overall trend (87 to '17) also appears to be the case so far this year. We note that Apr- SZ g% ——2017 YTD 17 vol stands out mainly due to the 4% ESTX50 move on the 3 Monday following the first round of the French presidential Be 5% elections. 2 B 4% = “” 2% a £ 2 0% < -2% Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec Source: BofA Merrill Lynch Global Research. Data: 1-Jan-87 to 16-Jun-17. Chart 23: ESTX50 1M 100-110 call skew is near-flattest since 2008 ESTX50 short-dated (1M) 100-110 (%fwd) call skew has 12% 7 ____§X5E 1M 100-110 (%fwd) call skew = ———Current flattened considerably since pre-French election (23-Apr) levels ; and currently stands near 9 year+ lows. Consequently, limited sie upside structures (¢@.g., call spreads) price attractively both from 8% an ATMf volatility and skew basis. 6% 4% 2% 0% -2% 08 ='09 #10 #11 #12 °#«13 0 «14 ~=«'15 «160 M7 Source: BofA Merrill Lynch Global Research. Data: 2-Jan-08 to 16-Jun-17. Table 4: Volatility measures of major equity indices in the EMEA region (data as of 16-Jun-17) Equity 3Mth ATM implied volatility 10D realised volatility {2Mth-3Mth ATM i-vol spread 3Mth 90-110 skew index Weekly Weekly Weekly Weekly Weekly Current change 2Yrpercentile Current change 2Yrpercentile Current change 2Yrpercentile Current change 2Yrpercentile return ESTX50 13.4% 0.3% 2% 9.6% 2.0% 17% 3.4% -0,2% 99% 8.4% 0.9% 72% -1.2% FTSE 10.0% 0.4% 1% 8.6% 1.1% 24% 3.6% 0.2% 100% 6.2% 0.2% 9% 0.8% DAX 12.6% 0.3% 1% 12.7% 2.9% 29% 3.9% -0,2% 100% 8.5% 0.7% 67% 0.5% CAC 13.3% 0.3% 3% 10.3% 2.0% 21% 2.6% -0.1% 100% 8.6% 1.2% 77% 0.7% SMI 11.4% 0.1% 3% 12.2% 3.3% 44% 2.4% -0.1% 96% 6.5% 0.1% 27% 1.3% RDXUSD 25.9% 0.9% 29% 16.2% -1.2% 17% 0.9% -0.4% 58% 5.2% 0.4% 27% -3.7% TOP40 16.9% 13% 17% 10.6% 0.2% 15% 1.7% -0,5% 47% 8.0% 0.4% 36% -3.0% ISE30 20.2% 0.4% 6% 10.1% -1.4% 5% 3.1% -0,3% 81% 6.9% 0.19% 74% 0.8% Source: BofA Merrill Lynch Global Research 14 — Global Equity Volatility Insights | 20 June 2017 ome orale HOUSE_OVERSIGHT_014985

Page 15 - HOUSE_OVERSIGHT_014986

European volatility: Sector snapshot Table 5: Volatility measures and indicative option prices for major European sector indices (data as of 16-Jun-17) Bearish — <<<< ---------------------eecnnnenccnnencecnennncnnnnes >>>> Bullish 3Mth ATMf implied 3Mth 90%-110% risk Equity volatility Real vol* 3Mth 95%-85% put spread 3Mth 100%-110% call spread** reversal** index _ Current Current Current price Weekly Max price Weekly Max price™* Weekly Weekly 2Yr (%of change 2Yr payout (%of change 2Yr payout (%of change 2Yr Weekly Current change %-ile Current spot) (bps) %-ile ratio spot) (bps) %-ile ratio spot) (bps) %-ile — return SX3P (Fd&Bv) 0.7% -04% 2% 0.1% 0.6% = 2% 16.4 2.1% -8 7% 48 -0.2% 5 80% 13% SX6P (Utils) 22% 0.0% 4% 0.9% 0.8% 2 4% 128 24% 5% 42 -0.3% 0 95% -0.1% SX7E (Banks) 22.7% 0.3% 2% 8.6% 9% 2 3% 54 3.6% 2 9% 28 -0.5% 0 52% — -3.0% $X7P (Banks) 85% -12% 2% 3.1% 5% -10 3% 68 3.2% =15 5% 3.2 -0.4% 10 86% —-1.9% SXAP {Auto} 67% -12% 1% 1.7% 3% -12 1% 78 3.0% -13 % 33 -0.4% 6 68% -0./% SXDP (Health) 3.0% -08% 1% 8.7% 0.9% 9 2% 115 2.5% -12 3% 40 -0.3% 4 71% 0.0% SXEP (Oil&Gas) 5.4% 0.0% 3% 1.8% 2% 0 3% 85 2.8% 2 2% 3.6 -0.2% -2 97% — -1.3% SXIP (Insur} 4.0% -09% 1% 9.4% 0% -10 1% 10.0 2.7% -11 % 37 -0.4% 6 83% 1.0% SXKP (Telecom) 54% 03% 3% 1.1% 1% 3 3% 88 2.8% 5 5% 3.6 -0.3% 3 83% —-1.3% SXNP (Indust) 63% 01% 13% 0.9% 2% 23% 8.1 2.8% 10% 36 0.0% 0 100% — -0.3% SXPP (Basic) 23.8% -0.7% 3% 7.8% 2.0% -/ 3% 5.1 3.5% 0 4% 29 -0.3% -/ 53% — -4.8% SXQP (Prsnl&HH Gds) 0.2% 0.0% 1% 7.2% 0.5% -] 2% 185 2.0% -] % 49 -0.3% 1 76% 0.3% SXRP (Retail) 3.2% 0.4% 10% 2.8% 0.9% 8 10% = 113 2.5% 14 10% 40 -0.1% -10 = 78% = -3.3% SXTP (Trvl&Lsre) 44% 0.0% 7% 1.6% 0% 7% 9.9 2./% 0 8% 37 -0.3% 1 41% 05% Source: BofA Merrill Lynch Global Research *Real vol = EWMA (Exponentially Weighted Moving Average) volatility, which measures historical price volatility but assigns greater importance to recent returns. Sigma(t)*2 = 0.94*Sigma(t- 1)*2+(1-0.94)*r(t}*2, where r(t) is the return on day t. “Indicative mid prices; strikes as % of forward ***Negative values indicate that the bullish risk reversal takes in a credit. Bankof America <> ariective Merrill Lynch Global Equity Volatility Insights | 20 June 2017 15 HOUSE_OVERSIGHT_014986

Sponsored

Page 16 - HOUSE_OVERSIGHT_014987

Volatility in Asia Long HSCEI-SPX volatility spread via corridor variance Global synchronized monetary tightening is positive for EM vol Emerging markets have been the biggest beneficiaries of the central bank-fueled abundance of liquidity. However, we think the tide may be turning as last week, the Fed, ECB, and BOE all delivered policy announcements with hawkish tones. How far they really go to tighten policy when economic data is weakening still remains unknown. However, we think the uncertainty surrounding tightening will be more positive for EM volatility than for DM volatility. Chinese banks: Rapid increase in leverage is a big concern The HSCEI currently has a 70% weight in the financial sector. Recently, BofAML analyst Winnie Wu turned very bearish on the sector as (1) leverage has rapidly increased—debt to GDP rose by 18% in 2016 and may go above 300% by 2019, (2) shadow banking has become too big, too complicated, and too levered to easily regulate—even at the highest quality bank, China Merchants, off-balance sheet wealth management products (WMP) have grown to 40% the size of on-balance sheet assets from just 18% two years ago, and (3) excessive home price inflation—low and middle-income households are late to the party and a correction in prices could have a systemic effect as property assets have been used as collateral in WMPs. SPX: The Fed is now “collaring” the market Since the global financial crisis the Fed has been well known for providing a put option by its willingness to step in during periods of market stress. However, post the Fed meeting last week, it appears the central bank has decided to cap its monetary support as some FOMC members seem worried that financial conditions are too loose. Effectively, the market is now “collared” (more so for the SPX compared to EM) as the downside is protected by the Fed put (though with a lower strike price) while the upside is capped by log-jammed fiscal policy and positioning, where the risk of quant funds selling record equity positions meets cashed-up investors still accustomed to buying- the-dip. The depressed implied China vs. US risks should reverse With the steep drop in global risk premium, the HSCEI-SPX 18-month variance swap spread has fallen back to the lower-end of its 5-year trading range. Since we believe the global synchronized monetary tightening will impact HSCE! volatility more than SPX volatility, we recommend owning HSCEI-SPX 70/110% corridor variance at 5 vol points, a 3 vol point discount to vanilla variance spreads. Investors will be exposed to the realized vol spread between HSCEI and SPX as long as HSCEI stays within 70-110% of its initial level. Pricing of corridor variance is cheaper than vanilla variance as investors can avoid paying for the rich HSCEI convexity below the 70% barrier. The trade has a positive carry and benefits during China risk-off events. Note that the potential HSCEI index enhancement will reduce the financial weightings in HSCEI from 70% to 50% and lower realized volatility by 1.8 vol points. However, the enhancement will be implemented in stages. It will probably start in Dec-17 at the earliest and will not be fully implemented by the end of 2018, in our view. Indicative pricing (As of 19-Jun-17) Buy HSCEI-SPX Dec-18 70/110% corridor variance swap: 5 vol points deg oes Bankof America 16 Global Equity Volatility Insights | 20 June 2017 Merrill Lynch HOUSE_OVERSIGHT_014987

Page 17 - HOUSE_OVERSIGHT_014988

Chart 24: The HSCEI-SPX Dec- 18 (18-month) variance swap spread is Chart 25: The long term HSCEI-SPX realized vol spread has been higher back to the lower-end of its 5-year trading range than the current implied corridor variance spread (5%) 98% of the time since 2007 20% 30% 18% 16% 25% 14% 20% 12% ; 10% 1 8% 10% 6% 5 4% a 2th 0% Mm owomomoewerer nnrnrnnwn srwm woo oOo Mm NAN MOMMA TA TOM HD OO ONN SSSSeSseSReS FFE ZBRSEES seeeeeeeeeeeebesg sd OS SO SOO eee 7 EoO>?-S 2 eH = see 7 o er =, a> S HSCEI - SPX 18-month realized vol ee ATISTIGS apnea — — Dec18 Variance Implied: 8% Source: BofA Merrill Lynch Global Research Data as of 2-Jan-12 to 16-Jun-17 weeeee Dect8 70/110% Corridor Variance Implied: 5% 18-month constant maturity variance swap spread is used as a proxy of Dec18 variance swap spread Source: BofA Merrill Lynch Global Research Data as of 2-Jul-O7 to 16-Jun-17 Chart 26: Historical payoff of buying HSCEI-SPX Dec-18 70/110% Table 6: The HSCEI-SPX Dec-18 70/110% corridor variance trade corridor variance spread; higher payoffs during 2011-2012 and 2015 has a positive carry with realized vol across most tenors higher sell-offs than the current implied corridor variance swap spread HSCEI SPX Spread 1M realized vol 12.1% 4.6% 75% 0, Ao 3M realized vol 13.7% 6.8% 6.9% 250,000 6M realized vol 14.0% 6.8% 7.2% 200,000 12M realized vol 16.6% 9.7% 6.9% 1 fe} 0, fe} 450,000 18M realized vol 20.8% 11.99% 8.8% 100,000 HSCEI - SPX Dec18 70/110% corridor variance offer: 5.0% 50,000 Source: BofA Merrill Lynch Global Research -50,000 mand toe} Lo?) Q — N oO s+ iw ico} SSS 3 53 53353553 8 == HSCEI-SPX Dec’18 70/1 10% corridor historical payoff (10k vega) Source: BofA Merrill Lynch Global Research Data as of 2-Jul-O7 to 16-Jun-17 orice a Global Equity Volatility Insights | 20 June 2017-17 HOUSE_OVERSIGHT_014988

Page 18 - HOUSE_OVERSIGHT_014989

Notable trends and dislocations (Asia) Most regions in Asia reported modest declines last week, led by Hong Kong’s HSCEI, which lost 2.0% week-over-week. Much of the decline came on Thursday following the US Fed’s decision to hike rates 25bps. Also in China, the People’s Bank of China (PBOC) injected 410bn yuan (about $60bn) into the financial system via reverse-repos, the largest cash boost since January. The central bank said the funds are meant to ease concern amid a seasonal funding squeeze. The biggest contributors to the index’s loss were financials names, including China Life Insurance (2628 HK), which fell 5.7%, Ping An Insurance Group Co of China Ltd (2318 HK}, which dropped 3.7%, Bank of China Ltd (3988 Hk), which declined 1.8%, and China Merchants Bank Co Ltd (3968 Hk), which fell 5.7%. We saw a similar decline from Hong Kong’s HSI index, which lost 1.6% percent last week. After the HSCEI and HSI, last week’s biggest losers were Korea’s KOSPI and India’s NIFTY, which each returned -0.8% week-over-week. In Japan, the Nikkei fell 0.3%. On Friday, the Bank of Japan (BoJ) left its monetary policy unchanged—it will continue to control the yield curve via its negative benchmark rate and its asset purchasing program. The final region to report a loss last week was Taiwan’s TWSE, which lost 0.4%. On the other hand, the only region to see a gain last week was Australia, which saw its ASX 200 benchmark increase 1.7% week-over-week. The biggest contributors to the gain were Commonwealth Bank of Australia (CBA AU}, which gained 3.4%, Westpac Banking Corp (WBC AU), which increased 1.9%, and CSL Ltd (CSL AU), which added 2.9%. 10 day realized vol picked up in Asia last week, up 2.0 vol points to 9.6% « Asian 3m ATM volatility declined on average 0.1 vol point to 12.3% last week, while 10 day realized vol increased on average 2.0 vol points to 9.6%. Notably, the HSI's realized vol increased 5.4 vol points, the biggest increase in the region. On the other hand, the NKY was the only index to see a decline in 10 day realized vol—it dropped 4.3 vol points week-over-week to 7.2%. ¢ On average, term structures among Asian indices steepened by 0.2 vol points to 4.2% last week. The TWSE 12M-1M term structure steepened the most, increasing 1.0 vol point to 2.9%. On the other hand, Hong Kong’s HS! saw the only flattening as its term structure flattened 0.1 vol point to 4.9%. e Asian 3M 90-110% skews widened 0.5 vol points on average to 3.8%. Taiwan’s TWSE widened the most, increasing 2.3 vol points to -0.2%. Table 7: Volatility measures of major Asian indices (data as of 16-Jun-17) 3Mth ATM Implied Volatility 10D Realized Volatility {2Mth-1Mth ATM Vol Spread 3Mth 90-110 Skew Spread Equity Market Weekly 4Yr Weekly 4Yr Weekly 4Yr Weekly 4Yr Weekly Current change percentile Current change percentile Current change percentile Current change percentile return HSI 124% 0.2% 2.1% 10.2% 54% 20.6% 49% 0.1% 97.8% 3.3% 0.9% 414% -1.6% HSCEI 15.0% 0.4% 0.0% 107% 48% 78% 5.4% 0.2% 98.1% 14% 0.5% 36.5% -2.0% NKY 13.8% 0.2% 0.1% 1.2% 43% 1.8% 5.8% 0.5% 99.9% 5.8% 0.0% 13.9% -0.3% KOSPI 200 = 12.2% 0.2% 19.7% W1% 11% 53.1% 40% 0.2% 17.0% 3.8% 0.3% 43.7% -0.8% ASX 200 11.8% 0.2% 177% 157% 51% 171% 2.1% 0.0% 59.5% 6.4% 0.1% 22.5% 1.7% NIFTY 10.7% 0.2% 2.2% 48% 1.0% 0.4% 40% 0.0% 16.1% 5.9% -0.1% 64.1% -0.8% TWSE 10.5% -0.6% 1.2% 78% 1.0% 20.3% 2.9% 1.0% 112% 0.2% 2.3% 3.9% 0.4% Source: BofA Merrill Lynch Global Research Bankof America 18 Global Equity Volatility Insights | 20 June 2017 Merrill Lynch HOUSE_OVERSIGHT_014989

Sponsored

Page 19 - HOUSE_OVERSIGHT_014990

Chart 27: Both HSCEI and NKY term structures are near record steeps; we favor calendar puts to hedge downside risks 15% 10% 5% 0% -5% 2 2 OO TT NN OO TT OO Oo Oo SSSSESSESSESESE8S8 35 ———NKY 3M-12M ATM Vol = ===HSCEI 3M-12M ATM Vol Source: BofA Merrill Lynch Global Research Data as of 2-Jan-09 to 16-Jun-17 Chart 28: The Nikkei/Topix ratio and its volatility is capped with the Bo)’s ongoing yield curve control ; O06 3 2.9 04 3 5 27 02 § g 12.5 0 > a& 12.3 02 3 > 04 2 a 12.1 9 = 18 06 & c os © 17 { o 11.5 1.2 NNN OO MO DS Tt OO ODO Oo Oo LE c<ct SBE aQoaesz oH ER WE SE SSSERSR2RFSEPES ——=NKY/TPX Ratio === 10Y JGB Yield Source: BofA Merrill Lynch Global Research Data from 2-Jan-12 to 16-Jun-17 AS51 3M ATM IV over HSCEI is at its 4-year high Table 4 lists Asian index pairs with the highest IV ratio vs their 4-year histories. For instance, the ratio of AS51 3M ATM IV over HSCEI is at its 4-year high. Calendar puts are attractively priced given the steep term structure With the continuous low realized volatility environment, both NKY and HSCEI 3-month minus 12-month term structures steepened to -3.7 vol points, which are near multi-year lows. As our Strategists think the Fed now appears concerned about surging asset prices, investors should consider downside hedges. Calendar puts, i.e. buying short-dated ATM puts and selling long-dated OTM puts, are attractively priced given the steep term structure. Currently, we still have an open trade on NKY calendar puts (buy Jul-17 19,500 puts vs sell Dec-17 17,500 puts) to hedge downside risks. The Bo)’s ongoing yield curve control has capped the Nikkel/Topix ratio and its volatility Japanese government bond (JGB) yield has been on a downward trend over the last few years and has negatively impacted bank earnings. As the Topix has higher weightings in banks than the Nikkei, the NKY/TPX ratio has been grinding higher. However, the NKY/TPX ratio appears to have flattened out since the Bo}’s commitment to maintain the 10-year JGB yield at around 0% in September 2016. With global central banks increasingly advocating tighter monetary policies, the market may start to speculate Bo)’s exit strategy and this may reverse NKY/TPX’s upward trend. With TPX vol trading below NKY vol, buying TPX calls funded by NKY calls may perform well in such a scenario. Bankof America Merrill Lynch Global Equity Volatility Insights | 20 June 2017 19 HOUSE_OVERSIGHT_014990

Page 20 - HOUSE_OVERSIGHT_014991

Chart 29: The ratio of AS51 3M ATM IV over HSCEL is at its 4-yr high Table 8: Index pairs‘ with the highest implied vol ratio vs their histories (Daily data from 1-Oct-12 through 16-Jun-17) (data as of 16-Jun-17) m= AS51 BMATM Vol «= == HSCEIATMvol = Vol ratio Index A Index B AIB Implied Ratio 4-yr A5Y% 0.90 (Implied vol} — (Implied Vol} Vol ratio —_ percentile ° ‘ 3M ATM AS5 8% HSCEI (15.0% 0.79 100% 40% 6M ATM KOSPI2 (13.2%) HSCEI (17.1% 0.77 98% 359% 2M ATM KOSPI2 (14.6%) NIFTY (14.0%) 1.04 98% ‘0 SB 30% 3M 25d-Put AS51 (13.8% HSCEI (16.3% 0.85 99% 2 2 6M 25d-Put KOSPI2 (14.4%) HSCEI (18.7% 077 98% 2 25% & 2M 25d-Put = KOSPI2 (16.0%) HSCEI (20.5% 0.78 99% E 20% 3M 25d-Call AS51 (10.9% HSCEI (15.0% 0.73 99% 15% 6M 25d-Call KOSPI2 (12.8%) NKY (14.4%) 0.89 98% 40% 2M 25d-Call KOSPI2 (14.2%) NIFTY (12.2%) 1.16 98% ° Source: BofA Merrill Lynch Global Research 5% * Index universe includes the ASX200, HSCEI, HSI, KOSPI2, NIFTY, NKY, TWSE, SPX and SX5E a a oo a a a ee mid level implied vol ise] iss} o oO D o ise] D o ise] D o ise] oO > Sao 7 SYN FT EH FEY FOS Source: BofA Merrill Lynch Global Research 20 Global Equity Volatility Insights | 20 June 2017 Bankof America Merrill Lynch HOUSE_OVERSIGHT_014991

Page 21 - HOUSE_OVERSIGHT_014992

Summary of Open Trades (19-Jun-17) Price data for open level reflects the price on open date and does not necessarily reflect the price at which the trade could be executed at the date of this report. Our trades are structured to be executed on the open date and are not necessarily appropriate to execute as formulated beyond that date. Table 9: Summary of open trades as of 19-Jun-17 Trade Description Long SX5E vs short SPX Dec18 var swap Long NKY vs short SPX Dec18 var swap Long SX5E vs short SPX Dec18 put vs put Buy a 1Y ATM worst-of call on SPX & TLT Buy SPX>UKX Jun17 ATM outperformance call, conditioned on SPX lower at maturity (q{USD) Buy UKX Jun17 6650 put, sell SPX Jun17 1850 put Buy an SX5E Sep-17 95% put conditional on EUR 10Y CMS > 1.1% or < 0.3% in Mar-17 Buy 2823 HK Jun-17 90/110 strangle Buy ESTX50 Dect? 90% put contingent on EURGBP < 0.82 by Jun? expiry Buy SPX>UKX Jun17 5% outperformance call (qUSD) Long XLF vs SX7E Juni? ATM outperf call, contingent on SX7E higher at Jun expiry (qEUR) Buy NKY Jun17 110% Call Buy TPINSU Jun17 110-125% Call Spread Buy TPNBNK Jun17 110-125% Call Spread Buy 2823 HK Junt7 90/1 10% strangle Buy HSCEI Jun17 105-120% call spread contingent on $KRW >1200 Buy NKY-SPX Dec19 70/110% corridor variance Buy NKY Jun17-Jun18 18,500 strike FVA Long Russell 2000 vs. short S&P 500 Dec-18 var spread Buy 1x Jun? 64 call on Aug17 Brent futures, sell 1x SXEP Jun17 330 call Buy SPX 6m ATM call contingent on GLD 5% higher in 3m Long NKY - SPX Dec-18 corridor var replication Buy NDX Top20 volatility dispersion Long 1.8x vega on 1y single stock vols of UK Brexit exposed names, Short 1x vega on 1y FTSE index vol SPX Sep-17 95% puts conditional on the Syr CMS rate above 2.4% at maturity Buy Buy-Rated MSCI A-shares stocks & hedge with puts Buy A-shares with highest MSCI impact & hedge with put Own Japan stock vol via gamma weighted vol dispersion Buy CNOOC Jul-17 95% puts vs. sell HSCEI 95% puts Buy CH Merchant Bk Jul-17 18.5/17 put spread vs 22 call Buy SX5E Dec17 3800 calls contingent on EURUSD > 1.1 at expiry Buy 1.5x KOSPI2 285 puts vs. short 1x $KRW 1160 call Buy EEM Aug17 39.5 put and sell EEM Aug17 37 put Buy Dec17 105% call on an equally weighted basket of SX7E, SXAP, SXPP & SXEP, sell Dec17 ATM worst-of call on the same Buy NKY Jul-17 19500 puts vs. short Dec-17 17500 puts Short GILD $55-$62.5-$67.5 put spread collar Long 1x EEM 3m 97.5% put vs. short ~0.09x units each of 3m 97.5% puts on FXI, EWY, EWZ, EPI, EWT, RSX, EZA, and EWW Buy Tencent Jul1? 250/300 strangle Buy A-shares (2823 HK) Jul17 105% call Buy 1x contract of ESTX50 Jun17 3525, sell 4x contracts of V2X Aug future Buy SX5E Dec17 3450-3700 bullish risk reversal vs short IBOXX HY TRS with equal notional sizing Open Date 5-Jul-16 5-Jul-16 5-Jul-16 18-Jul-16 17-Oct-16 17-Oct-16 14-Nov-16 21-Nov-16 2-Dec-16 ie} -Dec-16 2-Dec-16 02-Dec-16 02-Dec-16 02-Dec-16 02-Dec-16 02-Dec-16 02-Dec-16 02-Dec-16 5-Dec-16 9-Jan-17 23-Jan-17 3-Feb-17 27-Feb-17 4-Mar-17 4-Mar-17 23-Mar-17 23-Mar-17 0-Apr-17 24-Apr-17 24-Apr-17 8-May-17 8-May-17 15-May- 15-May- 15-May- 16-May- 1.5% 22-May-17 22-May-17 22-May-17 30-May-17 Open Level 6.1 vols 5.7 vols 0.00% 0.9% 2.0% 2.6% 2.1% 5.55% 1.63% 2.05% 1.20% 1.83% 3.30% 3.20% 5.90% 1.20% 1.50% 21.5% 3.9pts 00% % 4.00% 7.0% 32.3vols % 44% 44% 5.8% 0.77% 0.10% 3% 0.3% 6% 6% 0.0% 5% 0.0% 2.45% 15% 00% A1% Expected Trade Term Dec-18 expiry year Jun-17 expiry Jun- > 7 expiry Sep-17 expiry -17 expiry Dec-17 expiry -17 expiry Jun-17 expiry Jun-17 expiry 7 expiry 7 expiry 7 expiry 7 expiry Dec-19 expiry 7 expiry vun- vun- vun- vun- vun- Dec-18 expiry Jun-17 expiry Jul-17 expiry Dec-18 expiry Jan-18 expiry 4-Mar-18 Sep-17, expiry Jun-17 expiry 7 expiry Mar18 expiry Jul17 expiry Jult7 expiry Dec? expiry Jult7 expiry Aug17, expiry vun- Dec? expiry Jult7 expiry Sep-17 expiry 3m Jul-17 expiry Jul-17 expiry Jun-17 expiry Dec-17 expiry Rationale Investors should re-assess attractiveness of popular and {typically} technically motivated longer- dated RV vol trades, given environment of structurally higher political & economic risks and increasingly limited policy options Cheap equity upside in a bond / equity melt-up Risks of a hard Brexit rising and (weak) currency tailwind likely to prove short-lived; position cheaply for FTSE 100 (UKX) underperformance Remain long equities and cheapen hedges by conditioning on rates China risk premium rising but A-shares vol still at all-time lows Equity-FX correlation is not priced for a spillover of populism into the EU, which could cause EUR 0 fall against an already weakened GBP as equities fall UKX is heavily exposed to EU (50% revenues) and should underperform SPX if GBP tailwind ades. Volatility & correlation suit well for outperformance Cheapen long XLF upside to near 8y lows via selling upside on structurally challenged European banks & relatively more bearish outlook for US rates vs EU USDJPY and NKY the biggest beneficiaries of a Trump win Banks and Insurance are the most leveraged sector Banks and Insurance are the most leveraged sector China risk premium rising but A-shares vol still at all-time lows Own contrarian EM upside at low cost & limited risk QE uncertainty and USDJPY vol support NKY vs SPX realized vol What if QE hits its limit? Long NKY vol outright which is cheap to carry With fiscal stimulus and potential tax cuts, small caps revert to old normal generating higher vol on upside and downside relative to large caps Vol and price technicals are attractive. BofAML commodity strategists oil target is $70/bbl but this is already priced in SXEP levels according to BofAML Oil & Gas equity analysts Position for a near-term wobble followed by yet another equity melt up Cheaply access positive carry QE failure hedge Position for a pick-up in single stock realised vol on the 10 names (within FTSE’s top 30} where post EU referendum realised vol was the highest relative to current 1y ATMf vol. The 10 names are: Barclays, Aviva, Prudential, BT, Glencore, Tesco, CRH, BA, Standard Chartered & HSBC. Hedge portfolios against a buy-the-dip failure should a faster rate cycle ultimately jeopardize it he MSCI inclusion theme; Hedge with 2823 HK Jun17 95% put Market may trade on the MSCI inclusion theme; Hedge with 2823 HK Jun17 95% put Historically attractive to own TOPIX Top 10 corridor gamma weighted volatility dispersion Hedge a rollover in China GDP and screen for cyclicals that could face pressure Hedge a rollover in China GDP and screen for cyclicals that could face pressure Benefit from low vol, flat correl, likely hawkish ECB & (FX un-hedged) inflows into EU equities Leverage inexpensive equity vs. FX vols to own cheap tail protection Buy inexpensive EM equity puts on near-record performance gap to commodities Monetise low vol & high implied correl to position for greater sector dispersion in EU: long basket call, short worst-of call Own inexpensive NKY hedges into FOMC; Term structure is too steep is under-pricing risks Buy out-of-favour and inexpensive biotech upside by levering depressed vol & skew Market may trade on Buy EEM puts financed by a basket of EM puts to lever near record low correl Hedge a potential China tech bubble; Tencent potentially volatile after a 45% rally YTD Hedge the upside into MSCI announcement on 20-Jun Fundamental case to be long EU equities remains intact but stretched bullish positioning could lead to near-term consolidation BofAML Equity & Credit strategists highlight they favour equities over HY credit as div yields have surpassed HY credit yield & equities o er more gearing to rising PMI's, earnings and FCF Bankof America Merrill Lynch Global Equity Volatility Insights | 20 June 2017 21 HOUSE_OVERSIGHT_014992

Sponsored

Page 22 - HOUSE_OVERSIGHT_014993

Table 9: Summary of open trades as of 19-Jun-17 Open Open __ Expected Date Level Trade Term 6.9% (FB), 1.2% (AMZN), 9.4% (NFLX), 6.2% (GOOGL) Trade Description Rationale Buy 6m ATM calls on FB, AMZN, NFLX and GOOGL 30-May-17 Stock replace FANG stocks Buy a 6m outperformance call on FANG stocks vs. SPX conditional on SPX> ae . . . 30-May-17 3.4% 6m Lever extremely depressed FANG volatility and low correlation to buy upside current levels at expiry Buy HSI Sep17 90% put, sell ASX200 Sep-17 90% put 30-May-17 0.15% Sep-17 expiry HSI is unlikely to outperform if AS51 drops more than 10%; HSI vol below AS51 vol Buy 14-Sep-17 best-of 95% put on NKY/KOSPI2/HSI 05-Jun-17 0.80% Sep-17 expiry Buy best-of puts to hedge a reversal in rally with the low vol and correlation environment Buy SPX Top50 volatility dispersion 05-Jun-17 16.6% — Jun-18 expiry Position for a potential bubble in Tech Buy XLF 24 call, sell QQQ 139 call 12-Jun-17 0.01% — Jul-17 expiry Rotate out of Growth into Value Buy NKY-KOSPI2 Dec-17 90/110 strangle spreads 12-Jun-17 3.50% Dec-17 expiry We think the technically depressed NKY-KOSPI2 volatility spread will normalize Buy NKY Sep17 19000-17500 put spread 12-Jun-17 0.93% Sep-17 expiry NKY put spread may offer even better value in hedging against a "mini TARP moment" Source: BofA Merrill Lynch Global Research. Prices reflective of most recently available data which may be delayed in some cases. “Trade Value” represents current valuation of trades initiated on the “Open Date”. Bankof America 22 Global Equity Volatility Insights | 20 June 2017 Merrill Lynch HOUSE_OVERSIGHT_014993

Page 23 - HOUSE_OVERSIGHT_014994

Summary of Closed Trades (19-Jun-17) Table 10: Summary of closed trades as of 19-Jun-17 Trade Description Buy NKY Aug-16 105%-110% call spreads & sell 90% puts Replace FB long positions via Oct-16 ATM calls Replace AMZN long positions via Oct-16 ATM calls Buy AAPL Oct-16 ATM protective puts Buy 1.5x 5-Aug-16 2950-3000 strangles by selling 1x 19- Aug-16 2950-3000 strangles Sell NKY Aug16 15500 puts, Buy Sep16 15500-14500 put spreads Buy TLS 25-Aug16 95% puts Buy Newcrest 25-Aug-16 105/115% call spreads Buy CSL 25-Aug-16 95% puts Buy BHP 25-Aug-16 105/115% call spreads Buy HSCEI Aug16 9400 call, Short Oct16 10000 call Buy Tencent (700 HK} Sep16 105% call Sell 1x SX7E 1M 25d call to fully finance 1.85x SX5E 1M 25d calls Buy CMB (3968 HK} Sep16 105-115% call spread Buy ICBC (1398 HK) Sep16 105-115% call spread Buy BOC (3988 HK) Sep16 105-115% call spread Buy XLF Sep 24 strike call Buy XLU Sep 51 strike pu Buy a 6M ATM worst-of {XLF call, XLU put} Buy 0.85x SX5E Sep16 3000-3100 strangle, sell 1x SX5E Dec16 3000-3100 strangle Long 0.5x V2X Oct16 future, short 0.5x V2X Jan-17 future Sell VSTOXX Sep 21 puts VIX Sep 17/22 1x2 call ratios (short 2x} + 0.75x SPY Sep23 210 puts Buy NKY Oct 95/105 strangle outright Buy NKY Oct 95/105 strangle daily delta-hedging Long 3M 25d EFA put vs short 3M 25d UKX put Replace T long position via 3M ATM calls Replace LOW long position via 3M ATM calls Replace RTN long position via 3M ATM calls Replace CRM long position via 3M ATM calls Replace NEE long position via 3M ATM calls Overlay long WBA long position with 3M ATM calls Buy HKEx (388 HK) 1x2 105%-115% call ratio Buy NKY Oct16 17500 call, Sell 0.65x NKY Sep 17250 call Short VIX Oct 15 put vs. long VIX Nov 19/26 call spread Long 2x SPX Oct31 2125 puts vs. short 1x SPX Mar-17 1975 put DAX +2.31x Dec16/-1x Dect? put calendars Buy SX5E Dec16 2950/2750 put spread Buy 1.5x SX5E Dec16 3100 call, sell 1x SXSE Mar17 3100 call for an upfront credit of 56bps Buy a 6M ATM worst-of call on XLP & GLD Buy a 6M ATM worst-of {SPX put, GLD call} Buy GLD 124/130 Dec-16 call spread Buy GLD 116/124/130 Dec-16 call spread collar Buy TLT 123/132/137 Dec-16 call spread collar Buy Oct16 110%f calls on VIE FP, Al FP, IBE SQ, STAN LN 18-Jul- and MUV2 GY Buy an Oct16 110%F call on an equally weighted basket {quanto EUR) Buy 0.895x V2X Oct 21 puts, sell 1x VIX Oct 16 puts Sell SX7E Dec16 115 call Open Date 11-Jul- 25-Jul- 25-Jul- 25-Jul- ADD DD 25-Jul-16 25-Jul-16 18-Jul-16 18-Jul-16 18-Jul-16 18-Jul-16 1-Aug-16 15-Aug-16 25-Jul-16 5-Jul-16 5-Jul-16 5-Jul-16 25-Jul-16 25-Jul-16 25-Jul-16 15-Aug-16 11-Jul-16 30-Aug-16 15-Aug-16 ror 30-Aug- 30-Aug- 5-Jul-16 9-Jul- 9-Jul- 9-Jul- 9-Jul- 9-Jul- 9-Jul- 5-Aug-16 8-Aug- AWAD DD a a -Aug-16 6-Sep-16 30-Aug16 6-Sep-16 24-Oct-16 11-Jul- 11-Jul- 8-Nov- 8-Nov- 8-Nov- 18-Jul-16 19-Sep-16 6-Sep-16 Open Level 0.26% 5.9% 55% 4.6% 0.00% 0.24% 1.05% 2.64% 1.09% 2.22% 0.00% 1.70% 0.0% 2.32% 2.12% 2.10% 14% 1.3% 1.35% -5.07% 0.05 vols 1.20 vols $0.85 2.28% 2.28% 0.00% 2.12% 3.90% 3.16% 4.16% 2.32% 4.04% 0.60% 0.70% $0.45 0.0% 0.00% 1.48% -0.56% 1.05% 1.60% 0.9% 0.65% 0.67% 2.31% 0.81% 0.0 -0.88% Close Level 1.73% 6.1% 6.3% 1.2% -1.12% 0.28% 2.95% 1.18% 1.18% 0.77% 0.67% 2.10% 0.0% 6.12% 9.0% 6.28% 2.3% 2.6% 3.0% -5.73% -0.95 vols 1.77 vols $0.45 0.44% 0.56% 0.00% 0.04% 0.00% 0.41% 0.19% 0.08% 1.20% 0.00% 0% $0.88 -0.34% -2.60% 0.00% 1.62% 0.0% 0.0% 0.0% 1A -5.03% 3.30% 0.00% $1.3 -1.09% Close Date 25-Jul-16 1-Aug-16 1-Aug-16 1-Aug-16 5-Aug-16 Aug-16 expiry & Sep-16 expiry 15-Aug-16 15-Aug- 22-Aug- 22-Aug- 22-Aug- 22-Aug- ADA DD 25-Aug-16 30-Aug-16 30-Aug-16 30-Aug-16 6-Sep-16 6-Sep-16 6-Sep-16 Sep-16 expiry 19-Sep-16 Sep-16 expiry Sep VIX expiry 27-Sep-16 27-Sep-16 3 months 3 months 3 months 3 months 3 months 3 months 3 months 29-Sep-16 14-Oct-16 14-Oct-16 14-Oct-16 Dec-16 expiry Dec-16 expiry Dec-16 expiry 6 months 6 months Dec-16 Dec-16 Dec-16 Oct-16 expiry Oct-16 expiry Oct-16 expiry 24-Oct-16 Rationale Close position as the hurdle to surprise on the upside is high following a 5.8% NKY rally Close position as Facebook rallied on better-than expected Q2 results Close position as Amazon rallied on better-than expected Q2 results Remove protection as worries around disappointing Q4 guidance faded post earnings The BoJ, Fed & EU bank stress tests could move mkts sharply in the near term Unwinding before the Aug16 expiry; The NKY Sep put spread has carried well Telstra has announced earnings and the stock has corrected 5% over the period NCM has stayed unchanged over the period despite better than expected earnings CSL fell 5.4% over the period with weak earnings announcement BHP rose 3.6% over the period but the option remains out of the money Close position as the HSCEI rallies 5.2% and we are approaching the Aug16 expiry Tencent jumped post better than expected earnings SX7E 1M 25d call / SX5E 1M 25d call price ratio is in the 100" 2-yr percentile Close position and BofA ML turned neutral in EM in the short-term Close position and BofA ML turned neutral in EM in the short-term Close position and BofA ML turned neutral in EM in the short-term Close positions from trades that have benefited thus far from the rally in Financials and weakness in Utilities; monetize view that Fed will not hike in September Take advantage of low near term vol and a steep term structure Unwind Oct/Jan spread and maintain Nov/Jan spread given clarity around the Italian referendum date Global macro event risk likely to keep V2X supported going into Sep expiry Trade provided hedging benefits during the sudden Sep market shock & has expired Take a loss post an disappointing market reaction on the BoJ announcement Take a loss post an disappointing market reaction on the BoJ announcement Trade expired on 3-Oct Our analysts no longer expect impactful catalysts in the near term; stock replacement strategies proved useful in cushioning downside losses during the abrupt Sep-16 sell-off vs. long equity positions. HKEx failed to rally above the first call strike and expired worthless NKY Oct-16 call expired out of the money Close position as the Oct VIX future stayed well-supported as is typically the case in the weeks leading up to the US presidential election Provided hedging benefits in the sudden equity shock in early Sep-16; now being unwound to mitigate decay DAX outperformance & low short dated DAX vol make put calendars attractive A catalyst-strewn fall and a remarkably low volatility summer suggests that there could be headwinds to continued market upside on low volatility Monetise steep SX5E vol curve for tactical EU upside with an upfront credit Take a loss as safe-haven assets post a weak performance in H2-16 with fears over Trump's surprise victory easing and stock markets rallying Add exposure via inexpensive upside on single names where positioning appears particularly bearish and stocks have underperformed vs. their sectors Near term catalysts & curve differentials favour tactical long V2X, short VIX puts Close short SX7E call (part of SX5E put spread, short SX7E call trade) to limit potential risk from a “Yes” in the Italian referendum Bankof America Merrill Lynch Global Equity Volatility Insights | 20 June 2017 = 23 HOUSE_OVERSIGHT_014994

Page 24 - HOUSE_OVERSIGHT_014995