EFTA00032225 - EFTA00032232

This document (EFTA00032225) appears to be a series of emails from August 2020, in which an individual (likely a lawyer) is contacted regarding their client's willingness to speak with someone, likely related to the Ghislaine Maxwell case.

The email chain discusses scheduling a conversation with a client who previously worked for Ghislaine Maxwell and expresses concerns about their personal safety and anonymity. The sender, Colleen Mullen, seems to be representing the client. The recipients of the emails are requesting documents and an interview with Mullen's client. The emails reference prior correspondence and documents related to Maxwell [cite: EFTA00032225].

Key Highlights

- •The document relates to potential witnesses or individuals with information related to Ghislaine Maxwell.

- •The client is concerned about their personal safety and wishes to maintain anonymity.

- •Colleen Mullen is representing a client who worked for Ghislaine Maxwell.

- •The emails request documents and an interview.

Frequently Asked Questions

Books for Further Reading

Perversion of Justice: The Jeffrey Epstein Story

Julie K. Brown

Investigative journalism that broke the Epstein case open

Filthy Rich: The Jeffrey Epstein Story

James Patterson

Bestselling account of Epstein's crimes and network

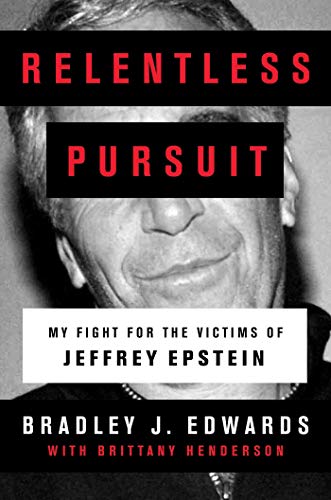

Relentless Pursuit: My Fight for the Victims of Jeffrey Epstein

Bradley J. Edwards

Victims' attorney's firsthand account

Document Information

Bates Range

EFTA00032225 - EFTA00032232

Pages

8

Document Content

Page 1 - EFTA00032225

From: ' To: Colleen Mullen Cc: Teri Gibbs Subject: RE: Follow-up Date: Thu, 20 Aug 2020 01:35:06 +0000 Inline-Images: image00 1 jpg )"H (USANYS)" Colleen, Following up on the below — please let us know? Thanks very much. From: Sent: Tuesday, August 11, 2020 18:03 To: Colleen Mullen Cc: Teri Gibbs ; Subject: RE: Follow-up Colleen, We are happy to speak with you — we had only followed up because we were under the impression she was interested in speaking with us. We certainly can discuss issues of witness safety and confidentiality, but we also are not looking to pressure anyone, at all. Please let us know if it makes sense to chat, and if so, what time ranges would work for you later this week or next. thanks, From: Colleen Mullen Sent: Monde Au ust 10, 2020 19:17 To: Cc: Teri Gibbs >; Subject: Re: Follow-up Do you have any time to speak this week? My client is deeply concerned about her personal safety and wishes to maintain her anonymity. Best, Colleen On Thu, Aug 6, 2020 at 10:26 AM ) < wrote: Colleen, We wanted to follow up on this from last month. Please let us know? (And obviously we're past late July now, but we could look at dates and times for an interview this month.) thanks, From: Sent: Wednesday, July 08, 2020 17:30 To: Colleen Mullen Cc: Teri Gibbs Subject: RE: Follow-up Colleen, Thanks very much for being in touch, and we would like to speak with As a threshold question, would it be possible for you to share with us the documents from and email correspondence with Maxwell referenced in EFTA00032225

Page 2 - EFTA00032226

your email below? And is there a good date or dates later in July that would work for a phone or videoconference interview? thanks again, From: Colleen Mullen < Sent: Monde , Jul 06, 2020 15:20 To: Cc: Teri Gibbs Sub'ect: Re: Follow-up Mr. We wanted to follow up on our prior email and offer to speak with our client, As stated earlier, worked for Ms. Maxwell (and, by extension, Jeffrey Epstein). I confirmed with our client that she is willing to speak with you and wants to fully cooperate with the criminal investigation/action pending against Ms. Maxwell. She could be a valuable witness for you. Please let us know if you would like to speak with our client. We are happy to facilitate this conversation. Best, Colleen On Wed, Jan 29, 2020 at 12:57 PM wrote: Received, thanks very much. From: Teri Gibbs Sent: Tuesday, January 28, 2020 19:08 To: Cc: >; Colleen Mullen Re: Follow-up Hi =, As we discussed last week, our client, has in her possession documents from and email correspondence with Ghislaine Maxwell. Thus far, we have received authorization to share the list of office numbers used during her employment with Ghislaine Maxwell from 2003-2007. Please see attached. Please let us know if you have any questions. Best, Teri On Wed, Jan 22, 2020 at 1:48 PM wrote: Will do, speak with you then. Thanks. From: Teri Gibbs Sent: Wednesday, January 22, 2020 16:44 To: Cc: Colleen Mullen Sect: Re: Follow-up Great. Tomorrow at 12PM PST/3PM EST works. Please call our conference line ata Best, Teri On Wed Jan M wrote: Teri, EFTA00032226

Page 3 - EFTA00032227

I can give you a call at 3:00 p.m. tomorrow (Thursday). Please let me know what number is best to reach you at, and I'll plan to call you then. thanks, From: Teri Gibbs < Sent: Tuesday. January 21. 2020 20:15 To: Cc: Colleen Mullen Subject: Re: Follow-up Wonderful,-. I am available tomorrow through Friday from 1PM-3PM EST. Please let me know what time works best for you. Best, Teri On Tue, Jan 21, 2020 at 5:06 PM wrote: >; Teri, We would be happy to set up a call to speak with you and receive the new information—please let us know a few times this week that would work for you. thanks, From: Teri Gibbs - Sent: Tuesday. January 21. 2020 18:50 To: Cc: Colleen Mullen Subject: Re: Follow-up Hi =, I am following up regardin our clients and We have more information from that may be important to your investigation. Please let us know if you would like to speak with us over the phone or set up interviews with either of them. Best regards, Teri On Mon, Jan 6, 2020 at 1:12 PM Teri Gibbs < > wrote: ME, Great. Please call our conference line at You should receive an invitation in a few moments from UberConference. You will not need a sign-in pin. Looking forward to our call on Wednesday at 12:30PM PST. Best, Teri On Mon Jan 6,2020 at 1:07 P wrote: Yes, we can do Wednesday at 12:30 p.m. PST (3:30 p.m. EST). Please let us know the best number to reach you at, and we'll call you then. From: Teri Gibbs < Sent: Monday. January 06, 2020 12:15 To: Cc: Subject: Re: Witness re Prince Andrew Colleen EFTA00032227

Sponsored

Page 4 - EFTA00032228

We have a last-minute mediation that is now scheduled for Tuesday. Are you available on Wednesday between 10-11AM PST and 12-2PM PST or Thursday at any time between 9 AM- 5PM PST? Thank you in advance for your flexibility. Best, Teri On Fri Jan 3 2020 at 6:04 PM wrote: Teri, No problem, and thanks for getting back to us. We could do a call on Tuesday the 7th at 11:00 a.m. PST (2:00 p.m. EST). Please let us know the best number to reach you at, and we'll give you a call then. thanks, From: Teri Gibbs Sent: Thursday, January 02, 2020 19:26 To: Cc: IMEMIE=It a ) Su, Re: Witness re Prince Andrew Hi Thank you for your response. I apologize for the delay. I hope you had a wonderful holiday. Attorney Lisa Bloom and I are available at the following times for a phone or video conference: • Tuesday (117) between 10AM-1PM PST • Wednesday (1/8) between 10-11AM PST and 12-2PM PST Please let me know if any of these times work for you. Best regards, Teri On Fri Dec 20 2019 at 9:55 AM wrote: Teri, Thanks for being in touch. In the first instance, before we would request an interview directly, it would be helpful for us to get a full attorney proffer from you about what the client's information is, what you expect she would convey in an interview, any relevant documentary or other corroborating materials, etc. That way we can make sure we're not re-victimizing any individual unnecessarily, and be efficient with any necessary follow-up interview of the individual him- or herself. Please let us know when a good time would be for an attorney proffer? And we can figure out scheduling. thanks very much, From: Teri Gibbs Sent: Thursday, December 19, 2019 20:0 I To: Cc: >; Subject: Witness re Prince Andrew Hi We have a client who witnessed Prince Andrew's interactions with would like to set up a phone or video interview with the appropriate party to allow our client to make a statement. Please let me know how to proceed. EFTA00032228

Page 5 - EFTA00032229

Best regards, Teri Gibbs No ice To Recipian: This email is meant for only the intended recipient of the transmission, and may be a communication privileged by law. If you received this email in CHM any review. use. dissemination. distribution. or copying or ilme.mail is strictly prohibited. Please notify us immediately of the error by return e•mad and please delete this message and any and all duplicates of this message from your system. Thank you in advance for your cooperation. IRS Circular 230 Disclosure: In order to comply with requirements imposed by the Internal Revenue Service, we inform you that any U.S. tax advice contained in this communication (including any attachments) it not intended lobe used. and cannot be used, for the purpose of (i) avoiding penalties under the Internal Revenue Code or it promoting, marketing. or recommending to another party any transaction or matter addressed herein. Notice To Recipient: This e-mail is meant for only the intended recipient of the transmission. and may be a communication privileged by law. If you received this email in error. any review, use, dissemination. distribution, or copying of this e•mad is strictly prohibited. Please notify us immediately or the error by return e-mail and please delete this message and any and all duplicates of this message from your system. Thank you in advance for your cooperation. IRS Circular 230 Disclosure: In order to comply with requirements imposed by the Internal Revenue Service. we inform you that any U.S. tax advice contained in this communication (including any attachments) is not intended to be used, and cannot be used. for the purpose of (i) avoiding penalties under the Internal Revenue Code or (ii) promoting. marketing, or recommending to another party any transaction or matter addressed herein. EFTA00032229

Page 6 - EFTA00032230

I I Notice To Recipient: This email is meant leg only the intended recipient oldie transmission. and may be a communication privileged by law. If you received this e-mail in error. any review. use. dissemination. distribution, or copying of this e-mail is strictly prohibited. Please notify us immediately of the error by return e- mail and please delete this message and any and all duplicates of this message from your system. Thank you in advance for your cooperation. IRS Circular 230 Disclosure: In order to comply with requirements imposed by the Internal Revenue Service. we inform you that any U.S. Lis advice contained in this communication (including any attachments) n not intended to be used, and cannot be used. for the purpose of avoiding penalties under the Internal Revenue Code or (ii) promoting. marketing, or recommending to another party any transaction or matter addressed herein. NoticeTo Recipient: This email is meant for only the intended recipient of the transmission, and may be a communication privileged by law. If you received this e- mail in error, any review. use. dissemination. distribution. or copying ol'this email is strictly prohibited. Please notify us immediately of the error by return email and please delete this message and any and all duplicates of this message from your system. Thank you in advance for your cooperation. IRS Circular 230 Disclosure: In order to comply with requirements imposed by the Internal Revenue Service, we inform you that any US. tax advice contained in this communication (including any attachments) is not intended to be used. and cannot be used. for the purpose of (i) avoiding penalties under the Internal Revenue Code or promoting, marketing. or recommending to another party any transaction or matter addressed herein. Notice To Recipient: This emsil is meant for only the intended recipient of the transmission, and may be a communication privileged by law. If you received this email in error, any review. use, dissemination. distribution. or copying ol'this email is strictly prohibited. Please tastily us immediately of the error by return email and please delete this message and any and all duplicates of this message from your system. Thank you in advance for your cooperation. EFTA00032230

Sponsored

Page 7 - EFTA00032231

IRS Circular 230 Disclosure: In order to comply with requirements imposed by the Internal Revenue Service, we inform you that any U.S. Lax advice contained in this conununication (including any attachments) is not intended to be used, and cannot be used, for the purpose of (i) avoiding penalties under the Internal Revalue Code or (ii) promoting, marketing, or reccaunendirig to another party any transaction or matter addressed herein. Notice To Recipient: This e-mail is meant fa only the intended recipient ol'the transmission. and may be a communication privileged by law. If you received this email in error. any review. use, dissemination. distribution, or copying of this email is strictly prohibited. Please notify us immediately ol'the erns by return e-mail and please delete this message and any and all duplicates of this message from your system. Thank you in advance for your cooperation. IRS Circular 230 Disclosure: In order to comply with 11:911FIMICIII% imposed by the Internal Revenue Service, we inform you that any U.S. tax advice contained in this communication (including any attachments) is not intended to be used. and cannot be used. for the purpose of (ilavoiihng penalties under the Internal Revenue Code or (ii) promoting, marketing, or recommending to another party any transaction or matter addressed herein. Notice To Recipient: This email is meant for only the intended recipient of the transmission, and may be a communication privileged by law. I r you received this e-mail in error, any review. use, dissemination. distribution or copying of this e-mail is strictly prohibited. Please notify us immediately ol'the error by return e-mail and please delete this message and any and all duplicates or this message from your system. Thank you in advance for your cooperation. IRS Circular 230 Disclosure: In order to comply with requirements imposed by the Internal Revenue Service, we infant you that any V.S. tax advice contained in this communication (including any attachments) is not intended to be used and cannot be used, for the purpose of (i) avoiding penalties under the Internal Revenue Code or (ii) promoting, marketing. or recommending to another party any transaction or matter addressed herein. EFTA00032231

Page 8 - EFTA00032232

Notice To Recipient: This email is meant for only the intended recipient oldie transmission. and may he a communication privileged by law. If you received this email in error, any review. use. dissemination. distribution. or copying of this email is strictly prohibited. Please notify us immediately or the error by return e-mail and please delete this message and any and all duplicates of this message from your system. Thank you in advmw for your cooperation. IRS Circular 230 Disclosure: In order to comply with requirements inipmed by the Internal Revenue Service. we inform you that any U.S. tax advice contained in this communication (including any attachments) is not intended to be used. and cannot be used. IM the purpose of (i) avoiding penalties under the Internal Revenue Code or (ii) promoting. marketing. or recommending to another party any transaction or matter addressed herein. Colleen M. Mullen, Esq. To protect the health and safety of our clients and employees, and in compliance with local orders, The Bloom Firm has closed its physical offices until further notice. We are fully operational remotely. Attorneys and staff continue to be available via videoconference, email, telephone, and fax. Please do not send mail or attempt service at our physical office. This message is for the designated recipient only and may contain privileged, proprietary, or otherwise private information. If you have received it in error, please notify the sender immediately and delete the original. Any other use of the email by you is prohibited. Colleen M. Mullen, Esq. To protect the health and safety of our clients and employees, and in compliance with local orders, The Bloom Firm has closed its physical offices until further notice. We are fully operational remotely. Attorneys and staff continue to be available via videoconference, email, telephone, and fax. Please do not send mail or attempt service at our physical office. This message is for the designated recipient only and may contain privileged, proprietary, or otherwise private information. If you have received it in error, please notify the sender immediately and delete the original. Any other use of the email by you is prohibited. EFTA00032232

Entities Mentioned

BL

Bloom

PERSON

CO

Colleen

PERSON

CM

Colleen Mullen

PERSON

Ghislaine Maxwell

PERSON • 4 mentions

British socialite and sex trafficker, daughter of Robert Maxwell, accomplice of Jeffrey Epstein

Jeffrey Epstein

PERSON • 3 mentions

American sex offender and financier (1953–2019)

Lisa Bloom

PERSON

American lawyer

MO

Monde

PERSON

Part of a crown

MU

Monde Au ust

PERSON

Prince Andrew

PERSON • 2 mentions

Third child of Queen Elizabeth II and Prince Philip, Duke of Edinburgh (born 1960)

TG

Teri Gibbs

PERSON

the Internal Revenue Service

ORGANIZATION

V.S.

LOCATION

Statistics

Pages:8

Entities:12

Avg. OCR:0.9%

Sponsored