EFTA00016865 - EFTA00016875

Document EFTA00016865 is Jeffrey Epstein's Last Will and Testament, signed shortly before his death.

This 11-page document outlines the distribution of Jeffrey Epstein's assets after his death. It directs his executor to pay funeral expenses, administration costs, debts, and taxes from his estate. The remaining property is to be transferred to the trustees of The Jeffrey E. Epstein Trust One, created in 2001. The will appoints Darren K. Indyke, Joseph Pagano, and LAWRENCE NEWMAN as executors, with Jes Staley and ANDREW FARKAS as successor executors. This will has been a subject of controversy and legal challenges, especially concerning the accessibility of Epstein's assets for his victims.

Key Highlights

- •Document is Jeffrey Epstein's Last Will and Testament.

- •Darren K. Indyke, Joseph Pagano, and LAWRENCE NEWMAN are named as executors.

- •Jes Staley and ANDREW FARKAS are named as successor executors.

Frequently Asked Questions

Related Links

Books for Further Reading

Perversion of Justice: The Jeffrey Epstein Story

Julie K. Brown

Investigative journalism that broke the Epstein case open

Filthy Rich: The Jeffrey Epstein Story

James Patterson

Bestselling account of Epstein's crimes and network

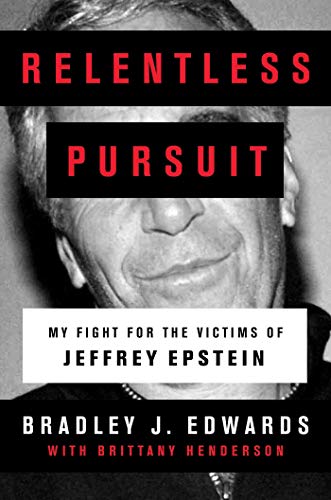

Relentless Pursuit: My Fight for the Victims of Jeffrey Epstein

Bradley J. Edwards

Victims' attorney's firsthand account

Document Information

Bates Range

EFTA00016865 - EFTA00016875

Pages

11

Document Content

Page 1 - EFTA00016865

LAST WILL AND TESTAMENT OF JEFFREY E. EPSTEIN I, JEFFREY E. EPSTEIN, of Little St. James Island, United States Virgin Islands, do make, publish and declare this to be my Will hereby revoking all prior Wills and Codicils made by me. FIRST: A. I direct my Executor to pay from my estate my funeral and burial expenses, the administration expenses of my estate and all of my debts duly proven and allowed against my estate. B. I direct my Executor to pay from my estate the federal and state transfer taxes described in Paragraph B(l) of Article SEVENTH. C. I direct my Executor to pay from my estate all expenses of storing, insuring, packing, shipping and delivering my tangible personal property. SECOND: I give all of my property, real and personal, wherever situated, after the payments and distributions provided in Article FIRST, to the then acting Trustees of The Jeffrey E. Epstein Trust One created under that certain Trust Agreement (the "Trust Agreement") dated November 8, 2001, as amended from time to time, and as amended and restated contemporaneously with the execution of this Will, and as the same may be amended from time to time, to be held in accordance with the provisions comprising the Trust Agreement at the time of my death. THIRD: A. I appoint DARREN K. INDYKE, JOSEPH PAGANO and LAWRENCE NEWMAN to be the Executors of this Will. If any one or more of my Executors fails to qualify or ceases to act, I appoint JES STALEY and ANDREW FARKAS, singly and in the order named, as successor Executors. I authorize the last acting Executor to designate his successor as Executor. B. If my estate must be administered in whole or in part in any jurisdiction other than the state of my domicile at the date of my death and if my Executor is unable or unwilling to serve in such jurisdiction, then I appoint the first successor Executor of my estate designated in Paragraph A of Article THIRD who is able and willing to serve in such jurisdiction. If no Executor or successor Executor is able and willing to serve in 2657367.1 GJ_000127 EFTA00016865

Page 2 - EFTA00016866

such jurisdiction, my Executor shall designate a successor Executor to serve in such jurisdiction. Such designation shall be made by written instrument delivered to such successor Executor. C. No bond or other security shall be required of any Executor in any jurisdiction. D. Any Executor may resign by filing a written notice of resignation with the Court having jurisdiction of the administration of my estate. All of my Executor's fees and expenses (including attorneys' fees) attributable to the appointment of a successor Executor shall be paid by my estate. E. My Executor shall not be accountable or responsible to any person interested in my estate for the manner in which my Executor in good faith exercises or declines to exercise any discretionary authority or power of my Executor. My Executor shall not be liable for any loss or depreciation in value occasioned by reason of any negligence, error or mistake of judgment in entering into any transaction, in making any sale or investment, in continuing to hold any property or by reason of any action or omission, whether by my Executor or any other fiduciary, unless my Executor has acted in bad faith. In the absence of proof by affirmative evidence to the contrary, each Executor shall be deemed to have acted within the scope of my Executor's authority, to have exercised reasonable care, diligence and prudence and to have acted impartially as to all interested persons. An Executor shall not be liable for the acts or defaults of another Executor. FOURTH: The following provisions shall apply to my estate and to my Executor, except as is otherwise specifically provided in this Will: (1) My Executor has the entire care and custody of all assets of my estate. My Executor has the power to do everything my Executor in good faith deems advisable without necessity of any judicial authorization or approval, even though but for this power it would not be authorized or appropriate for fiduciaries under any statutory or other rule of law. My Executor shall exercise my Executor's best judgment and discretion for what my Executor believes to be in the best interests of the beneficiaries hereunder. If more than two Executors are empowered to participate in the decision to exercise or not exercise any fiduciary power granted by this Will or by law, a majority of such Executors shall be empowered to make such decision. B. Except as otherwise provided herein, my Executor shall have the power: (1) to enter upon and take possession of the assets of my estate and collect the income and profits from such assets, and to invest and reinvest such assets in real, personal or mixed assets (including the common trust funds of a corporate fiduciary) or in undivided interests therein without being limited by any present or future investment laws; (2) to retain all or any part of the assets of my estate (without regard to the proportion that any one asset or class of assets may bear to the whole) in the form in which such assets were received or acquired by my Executor; 2 2657367.1 GJ_000128 EFTA00016866

Page 3 - EFTA00016867

(3) to sell or dispose of, exchange, transfer, invest or loan all or any part of the assets of my estate which may, at any time, be held by my Executor for such sums or upon such terms as to payment, security or otherwise as my Executor determines, either by public or private transactions; (4) to buy and sell options, warrants, puts, calls or other rights to purchase or sell (collectively "options") relating to any security or securities, regardless of whether such security or securities are then held by my Executor, and whether such options are purchased or sold on a national securities exchange, and to exercise with respect to such options all powers which an individual owner thereof could exercise, including, without limitation, the right to allow the same to expire; (5) with respect to oil, natural gas, minerals, and all other natural resources and rights to and interests therein (together with all equipment pertaining thereto) including, without limiting the generality of the foregoing, oil and gas royalties, leases, or other oil and gas interests of any character, whether owned in fee, as lessee, lessor, licensee, concessionaire or otherwise, or alone or jointly with others as partner, joint tenant, or joint venture in any other noncorporate manner, (a) to make oil, gas and mineral leases or subleases; (b) to pay delay rentals, lease bonuses, royalties, overriding royalties, taxes, assessments, and all other charges; (c) to sell, lease, exchange, mortgage, pledge or otherwise hypothecate any or all of such rights and interests; (d) to surrender or abandon, with or without consideration, any or all of such rights and interests; (e) to make farm-out, pooling, and unitization agreements; (f) to make reservations or impose conditions on the transfer of any such rights or interests; (g) to employ the most advantageous business form in which properly to exploit such rights and interests, whether as corporations, partnerships, limited partnerships, mining partnerships, joint ventures, co-tenancies, or otherwise exploit any and all such rights and interests; (h) to produce, process, sell or exchange all products recovered through the exploitation of such rights and interests, and to enter into contracts and agreements for or in respect of the installation or operation of absorption, reprocessing or other processing plants; (i) to carry any or all such interests in the name or names of a nominee or nominees; (j) to delegate, to the extent permitted by law, any or all of the powers set forth herein to the operator of such property; and (k) to employ personnel, rent office space, buy or lease office equipment, contract and pay for geological surveys and studies, procure appraisals, and generally to conduct and engage in any and all activities incident to the foregoing powers, with full power to borrow and pledge in order to finance such activities; together with the power to allocate between principal and income any net proceeds received as consideration, whether as royalties or otherwise, for the permanent severance from lands of oil, natural gas, minerals, and all other natural resources; (6) to hold all or any part of the assets of my estate in cash or in bank accounts without the necessity of investing the same; (7) to improve, repair, partition, plat or subdivide all or any part of the assets of my estate; 3 2657367.1 GJ_000129 EFTA00016867

Sponsored

Page 4 - EFTA00016868

(8) to litigate, defend, compromise, settle, abandon or submit to arbitration on such terms and conditions as my Executor determines any claims in favor of or against my estate or the assets of my estate; (9) to loan or borrow money in such amounts and upon such terms and conditions as my Executor determines, assume such obligations or give such guarantees as my Executor determines, for the purpose of the acquisition, improvement, protection, retention or preservation of the assets of my estate, or for the welfare of the beneficiaries of my estate; (10) to carry on for as long and in such manner as my Executor determines any business enterprise in which I owned any interest at my death, either individually, or as a partner, joint venture, stockholder or trust beneficiary; to sell such business enterprise as an ongoing business; to consolidate, merge, encumber, dissolve, liquidate or undertake any other extraordinary corporate transaction relating to such business enterprise; (11) to vote in person or by proxy any and all stock or securities and to become a party to any voting trusts, reorganization, consolidation or other capital or debt readjustment of any corporation, association, partnership, limited liability partnership, limited liability company or individual with respect to stocks, securities or debts held by my estate; (12) to enter into any good faith transactions with my Executor individually or with any corporation, partnership or other entity in which my Executor has an ownership interest; (13) to lease, mortgage, pledge, grant a security interest in or otherwise encumber all or any part of the assets of my estate for any term of years whether or not beyond the duration of my estate (including, without limitation, any such action for the benefit of any of the beneficiaries of my estate); (14) to abandon any property, real or personal, which my Executor may deem worthless or not of sufficient value to warrant keeping or protecting; to abstain from the payment of taxes, water rents or assessments and to forego making repairs, maintaining or keeping up any such property; and to permit such property to be lost by tax sale or other proceedings or to convey any such property for a nominal consideration or without consideration so as to prevent the imposition of any liability by reason of the continued ownership thereof; (15) to elect the mode of distribution of the proceeds payable to my estate from any profit-sharing plan, pension plan, employee benefit plan, individual retirement plan, insurance contract or annuity contract pursuant to the terms of such plan; (16) to allocate, in my Executors discretion, any adjustment to basis provided to my estate under the provisions of Federal and State law with respect to property comprising my estate, without any obligation to make a compensatory adjustment among the beneficiaries hereunder on account of such allocation; 4 2657367.1 G1_000130 EFTA00016868

Page 5 - EFTA00016869

(17) to conduct any audit, assessment or investigation with respect to any asset of my estate regarding compliance with any law or regulation having as its object protection of public health, natural resources or the environment ("Environmental Laws"); to pay from the assets of my estate to remedy any failure to comply with any Environmental Law (even to the exhaustion of all of the assets of my estate); and, as may be required in my Executor's judgment by any Environmental Law, to notify any governmental authority of any past, present or future non-compliance with any Environmental Law; and (18) to sell to the Trustee under the Trust Agreement any stocks, bonds, securities, real or personal property or other assets or borrow from the Trustee under the Trust Agreement even though the same person or persons occupy the office of the Executor of my estate and the Trustee under the Trust Agreement. (19) No executor shall directly or indirectly buy or sell any property for the estate from or to himself, or from or to his relative, employer, employee, partner, or other business associate. (20) No executor shall lend estate funds to himself, or to his relative, employer, employee, partner, or other business associate. C. Except as otherwise provided herein, my Executor shall have the power: (1) to employ agents, attorneys-at-law, consultants, investment advisers (to whom my Executor has discretion to delegate my Executor's investment authority and responsibility), other executors and other fiduciaries in the administration of my Executor's duties; to delegate to such persons, or to one or more of my Executors, the custody, control or management of any part of my estate as my Executor determines and to pay for such services from the assets of my estate, without obtaining judicial authorization or approval; (2) to delegate, in whole or in part, to any person or persons the authority and power to (a) sign checks, drafts or orders for the payment or withdrawal of funds, securities and other assets from any bank, brokerage, custody or other account in which funds, securities or other assets of my estate shall be deposited, (b) endorse for sale, transfer or delivery, or sell, transfer or deliver, or purchase or otherwise acquire, any and all property, stocks, stock warrants, stock rights, options, bonds or other securities whatsoever, (c) gain access to any safe deposit box or boxes in which my assets or assets of my estate may be located or which may be in the name of my Executor and remove part or all of the contents of any such safe deposit box or boxes and release and surrender the same, and (d) take any other action that my Executor may have the power to take with respect to my estate and the property thereof; no person or corporation acting in reliance on any such delegation shall be charged with notice of any revocation or change of such delegation unless such person or corporation receives actual notice thereof; 5 2657367.1 GJ 000131 EFTA00016869

Page 6 - EFTA00016870

(3) to pay any property distributable to a beneficiary under a legal disability, without liability to my Executor, by paying such property (a) to such beneficiary, (b) for the use of such beneficiary, (c) to a legal representative of such beneficiary appointed by a court or if none, to a relative for the use of such beneficiary, or (d) to a custodian for such beneficiary designated by my Executor; (4) to distribute to any of the beneficiaries of my estate in kind or in cash, or partly in kind and partly in cash, and to allocate different kinds or disproportionate shares of assets or undivided interests in assets among all of such beneficiaries; (5) to have evidence of ownership of any security maintained in the records of a Federal Reserve Bank under the Federal Reserve Book Entry System; to deposit funds in any bank or trust company; to carry in the name of my Executor or the nominee or nominees of my Executor and with or without designation of fiduciary capacity, or to hold in bearer form, securities or other property requiring or permitting of registration; and to cause any securities to be held by a depository corporation of which an Executor is a member or by an agent under a safekeeping contract; provided, however, that the books and records of my Executor shall at all times show that such investments are part of my estate; (6) to renounce and disclaim, in whole or in part, and in accordance with applicable law, any assets, interests, rights or powers (including any power of appointment) which are payable to (or exercisable by) me or my estate, which are includible in my estate or Gross Estate or over which I have any right, title, interest or power; and (7) to make, execute and deliver any and all such instruments in writing as shall be necessary or proper to carry out any power, right, duty or obligation of my Executor or any disposition whatsoever of my estate or any asset of my estate and to exercise any and all other powers incidental or necessary to carry out or to fulfill the terms, provisions and purposes of my estate. D. In connection with any insurance policy or annuity on the life of an Executor which is included in my estate, such Executor shall not participate in the decision to exercise or not exercise any fiduciary power in connection with any incidents of ownership for such policy or annuity, including, without limitation, any decision to continue, assign, terminate or convert such policy or annuity or to name the beneficiary of such policy or annuity. E. An Executor hereunder may by a written notice delivered to the other Executor (or Executors) decline to participate in the decision to exercise or not exercise any fiduciary power granted by this Will or by law. F. If an Executor is not empowered (because of a conflict of interest, declination to act or otherwise) to participate in the decision to exercise or not exercise any fiduciary power granted by this Will or by law, then the remaining Executor or 6 2657367.1 GJ_0001 32 EFTA00016870

Sponsored

Page 7 - EFTA00016871

Executors shall be empowered to make such decision. If no Executor is empowered to participate in such decision, then the first successor Executor of my estate designated in Paragraph A of Article THIRD and able and willing to act shall be empowered to make such decision. If no Executor or successor Executor is empowered to participate in such decision, my Executor may designate a successor Executor to serve as Executor of my estate who shall be empowered to make such decision but shall have no other power or authority of my Executor. Such designation shall be by written notice delivered to such successor Executor. G. (1) Except as otherwise specifically provided herein and except as provided in Paragraph G(2) of this Article, my Executor shall allocate receipts and disbursements in accordance with sound trust accounting principles and shall have discretion to allocate receipts and disbursements when the treatment is uncertain under applicable laws or generally accepted accounting principles in the judgment of my Executor. (2) Except as otherwise specifically provided in this Will, my Executor shall not treat any part of the principal amount of the proceeds of sale of any asset of my estate as income distributable to or for the benefit of any beneficiary entitled to distributions of income; provided, however, that my Executor shall treat a portion of any proceeds of sale of any financial instrument originally issued or acquired at a discount equal to the amount which (a) has previously been characterized as ordinary income for income tax purposes or (b) will be characterized as ordinary income for income tax purposes in the year of such sale, as income for trust accounting purposes. FIFTH: Where a party to any proceeding with respect to my estate has the same interest as a person under a disability, it shall not be necessary to serve legal process on the person under a disability. SIXTH: If any beneficiary under The Jeffrey E. Epstein 2001 Trust One ("the trust") shall in any way directly or indirectly (a) contest or object to the probate of my Will or to the validity of any disposition or provision of my Will or of the trust or (b) institute or prosecute, or be in any way directly or indirectly instrumental in the institution or prosecution of, any action, proceeding, contest, objection or claim for the purpose of setting aside or invalidating my Will or the trust or any disposition therein or provision thereof, then I direct that (a) any and all provisions in the trust for such beneficiary and his issue in any degree shall be null and void and (b) my estate, whether passing under my Will or the trust or pursuant to the laws of intestacy, shall be disposed of as if such beneficiary and his issue in any degree had all failed to survive me. SEVENTH: A. As used herein: (I) The term "Executor" of a person's estate means all persons or entities who occupy the office of executor, administrator, personal representative, or ancillary administrator while such persons or entities occupy such office, whether one or more persons or entities occupy such office at the same time or times, and includes any successor or successors to that office. The term "Trustee" means all persons or entities who occupy the office of Trustee under the Trust Agreement while such persons or entities occupy such office, whether one or more persons or entities occupy the office of Trustee 7 2657367.1 G.1_000133 EFTA00016871

Page 8 - EFTA00016872

at the same time or times, and includes any successor Trustee or Trustees. A reference to a person's estate or probate estate means that person's estate which is subject to probate administration. A reference to a person's Will means such person's Last Will and Testament and any Codicil or Codicils thereto. (2) The term "IRC section" means a section of the Internal Revenue Code of 1986, as amended, or the corresponding provision of any successor Internal Revenue law, as in effect as of the date of my death. (3) A reference to any tax also includes any interest or penalties thereon. A reference to a person's "Gross Estate" means such person's gross estate as finally determined for purposes of computing such person's federal estate tax. (4) Whenever the singular number is used, the same shall include the plural, and the masculine gender shall include the feminine and neuter genders. B. (1) The federal and state transfer taxes which my Executor shall be obligated to pay pursuant to Paragraph B of Article FIRST shall consist of all federal and state estate, inheritance, succession, and similar taxes (including any federal or state generation-skipping transfer tax) imposed upon my probate estate or by reason of my death in respect to all assets which pass under this Will or the Trust Agreement. Subject to Paragraph B(2) of this Article, all federal estate taxes with respect to assets not passing under this Will or the Trust Agreement (such assets are referred to as the "Apportionment Assets") and any applicable state estate taxes with respect to the Apportionment Assets shall be apportioned among all persons interested in the Apportionment Assets. My Executor shall make reasonable efforts to collect all federal estate taxes and state estate, inheritance, succession and similar taxes allocable to the Apportionment Assets from the recipients of the Apportionment Assets. Without changing the apportionment of taxes in this Paragraph B(1), my Executor has discretion, but is not required, to pay all or part of such taxes allocable to the Apportionment Assets. To the extent my Executor pays such taxes allocable to the Apportionment Assets, my Executor shall seek reimbursement for such taxes from the recipients of the Apportionment Assets. My Executor shall not be personally liable for any of such taxes if my Executor is unable, with reasonable efforts, to collect payment (or reimbursement) from any recipient of any Apportionment Assets for any or all of such taxes allocable to such assets. (2) My Executor has discretion to direct the Trustee of the Trust Agreement to pay all or any portion of the taxes which my Executor is directed or obligated to pay pursuant to Paragraph B of Article FIRST and this Paragraph B pursuant to a written direction delivered to the Trustee under the Trust Agreement. Any taxes which my Executor directs the Trustee under the Trust Agreement to pay shall be allocated and paid from the trusts under the Trust Agreement as provided under the Trust Agreement. C. Except as otherwise specifically provided in this Will, a bequest or devise to an individual who does not survive me shall lapse notwithstanding 8 2657367.1 Gl_000134 EFTA00016872

Page 9 - EFTA00016873

any law to the contrary. D. To the extent that the distribution to the Trustee under the Trust Agreement pursuant to Article SECOND shall not be effective, I give all the rest of my property, real and personal, wherever situated, after the payments and distributions provided in Article FIRST, to the person or persons named as Trustee or Trustees under the Trust Agreement, be to held in trust under this Will in accordance with the provisions comprising the Trust Agreement at the time of my death, which provisions are incorporated in this Will by reference. IN WITNESS WHEREOF, I have duly executed this Will the 2 7 4day o .21,n44.7 , 2012. REY E. The foregoing written instrument was on the date thereof, signed, published and declared by the Testator therein named as the Testator's Will in the presence of us and of each of us, who, at the Testator's request, in the Testator's presence and in the presence of each er, have s ibed our names as witnesses thereto. residing at residing at .....-affeW, C4 14, v 7, iefr Y //of 9 2657367.1 GJ_000135 EFTA00016873

Sponsored

Page 10 - EFTA00016874

We, JEFFREY E. EPSTEIN, 4 1/14 01 /Artier and, 4a AM et444. ,,,,r„ 44C the Testator and the witnesses, respectively, whose names are signed to the foregoing instrument, having been sworn, declared to the undersigned officer that the Testator, in the presence of the witnesses, signed the instrument as his Will, that he signed, and that each of the witnesses, in presence of the Testator and in the presence of each other, signed the Will as aptness fr,c STATE OF ) rav y.4ss: COUNTY OFD ) Subscribed and sworn to before me by JEFFREY E. EPSTEIN, the known to me or who has produced as identification, who is personally known to me or who has produced , a witness who is personally known to m as identification, on1/4::tailyt7 17 , 2012. Sworn to before me thisn day of January,2012 Notary P lw HARRY I BELLER Notary Public. State of New York No. 0M:463:424 Qualified in riee!zlend County hi Commission Expires Feb. 17. 20Z.7 10 Oricadne-ent—e )(-4.4.e."-ntea-n. Testator, who isp personally and bygia..../ tosho witness as identification, and e or who has produced 2657367.1 G.1_000136 EFTA00016874

Page 11 - EFTA00016875

LAST WILL AND TESTAMENT OF JEFFREY E. EPSTEIN Dated , 2012 EFTA00016875

Entities Mentioned

AF

Andrew Farkas

PERSON

American writer

DI

Darren Indyke

PERSON • 2 mentions

Jeffrey Epstein

PERSON • 4 mentions

American sex offender and financier (1953–2019)

Jes Staley

PERSON

American banker, chief executive officer of Barclays

JOSEPH PAGANO

PERSON

LN

LAWRENCE NEWMAN

PERSON

RE

REY E.

PERSON

TE

Testator

PERSON • 2 mentions

a Federal Reserve Bank

ORGANIZATION

Little St. James Island

LOCATION

Island in Franklin County, Florida, United States

Statistics

Pages:11

Entities:10

Avg. OCR:0.9%

Sponsored