EFTA00016542 - EFTA00016587

Document EFTA00016542 is a collection of forms and agreements related to Ghislaine Maxwell's financial accounts.

This document contains Ghislaine Maxwell's client information, including personal details, contact information, employment information related to The TerraMar Project, and net worth information. It also includes client relationship agreements and signature pages. The document provides a snapshot of Maxwell's financial standing and activities at a specific point in time.

Key Highlights

- •Ghislaine Maxwell is the primary individual associated with this document.

- •The document reveals Maxwell's net worth to be in the range of $10,000,000 and above.

- •The TerraMar Project is listed as Maxwell's employer.

Frequently Asked Questions

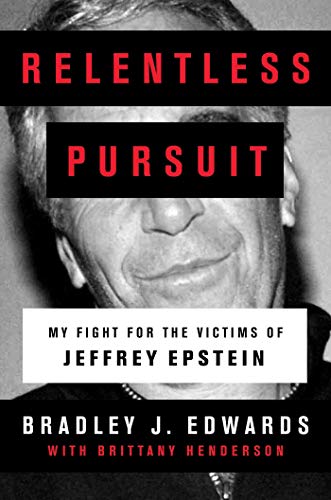

Books for Further Reading

Document Information

Bates Range

EFTA00016542 - EFTA00016587

Pages

46

Document Content

Page 1 - EFTA00016542

Signature Page Summary 93830915_0177 otozauzo tees 98EZ Le to op Ghislaine Maxwell Account Number and Description RMA Domestic - Sole Owner RMA Domestic - Sole Owner RMA Domestic - Sole Owner RMA Domestic - Sole Owner RMA Domestic - Sole Owner RMA Domestic - Sole Owner RMA Domestic - Sole Owner MIA Domestic - Sole Owner RMA Domestic - Sole Owner RMA Domestic - Sole Owner Signature Requirement Client Relationship Agreement Client Relationship Agreement Client Relationship Agreement Client Relationship Agreement Client Relationship Agreement Client Relationship Agreement Client Relationship Agreement Client Relationship Agreement Client Relationship Agreement Client Relationship Agreement Package ID: 0093830915 SDNY_GM_00274191 EFTA00016542

Page 2 - EFTA00016543

Intentionally Left Blank VIOVZIRO ZLLP 98£Z CM. SDNY_GM_00274192 EFTA00016543

Page 3 - EFTA00016544

U0112U1J0jUl 1U8II) Client Information Ghislaine Maxwell Personal Information Name Ghislaine Maxwell Citizenship United States Gender Female Date of Birth Marital Status Single Contact Information Residential Address City, State, Zip Code Home Phone E-mail Address Employment Information Employment Status Employed Occupation Other Occupation Industry Other Employer Name The TerraMar Project Business Address City, State, Zip Code New York, NY 10065 - 7007 New York, NY 10065-7007 Net Worth Information Annual Income Range from $200,000 - $499,999 Liquid Assets (cash and marketable securities) Range from $10,000,000 AND ABOVE Net Worth (excluding primary residence) Range from $10,000,000 AND ABOVE You have indicated that you do not derive a substantial amount of your income / wealth (over 50%) from a country outside of the United States. Investment Information Years you have held investment accounts 20 Equities None • Bonds None Futures None I_ Options-Buy None • Options-Sell None Knowledge of investments Percentage of total investable assets held at UBS Other d a I You have indicated you are an experienced investor] in financial markets and market investments. Less than 20% Own Home or Rent? Own Affiliations U.S. federal law requires us to obtain, leafy and record Aformahon that dentines each person or entity that opens an Account with us. When you open an Account we wdl ask for yat name, street address, date of both and a tax identification number, such as a SocaJSearnry number. We may also ask to see a drivers kense or other documents that mil goer us to identify you. ALMSe review and venfy aY of the information that you goaded to us when you opened your Account if you have changes, corrections or adcOrions, nobly yOUr Financial &rinser as soon as possil*. If you share assets with another person, the net worth figure here shows yak pawn on based upon msuuctions you Bonded Investment Information: This sec rto reflects answers you goaded related to pat investment experience. marker knowledge and other assets and is used to ensure our investment recommendations are suitable for your situation. n R 0 Affiliated with securities firms or broker/dealer? No You have indicated that you are not an employee of UBS AG, its subsidiary or affiliates. You have indicated that you are not related to an employee of UBS AG, its subsidiary or affiliates. 3 3 SDNY_GM_00274193 EFTA00016544

Sponsored

Page 4 - EFTA00016545

tiOrlaWOflij lUaiD You have indicated that you are not a control person (Policy-maker, director or 10% shareholder) of a publicly traded corporation. uoutumjui wain 4 4 SDNY_GM_00274194 EFTA00016545

Page 5 - EFTA00016546

Account Information 0 RMA Domestic Sole Owner Your Account Account Number Account Title Account Address City, State zip Cards and Checks for this account, if requested, will be mailed to this address: Primary Account Holder Disclosure of Beneficial Ownership Ghislaine Maxwell New York, NY 10065.7007 New York, NY 10065.7007 Ghislaine Maxwell 1 UBS will not disclose your name, address and security position to issuers of any securities held in your Account. Margin Yes You have agreed that the Margin Agreement in the Completing Your Account Opening Process package governs your use of margin in this account and all other accounts you have now or any accounts that you may open in the future. As described in the Margin Agreement certain securities in your Account may be loaned to UBS or to other persons or entities. Cost Basis Method First In,First Out features and Services Checking Premier- RMA / BSA VISA Credit (W/Rewards points) Account Objectives and Risk Profile Account Risk Profile Your answers to our profikng questions: Risk Tolerance Investment Objective r Risk/Return Objectives Investment Time Horizon Short-Term Liquidity Needs Sweep Account Election Primary Sweep Fund Sweep Cap Election Cap Amount Secondary Sweep Fund U.S. Senior Political Affiliation: You have indicated that no account holder, an authorized signatory, beneficial owner, trustee, power of attorney, or other individual with authority to effect transactions, or any of their immediate family members or close associates is a Current U.S. Political Official. Non-U.S. Senior Political Affiliation: You have indicated that no account holder, an authorized signatory, beneficial owner, trustee, power of attomey, or other individual with authority to effect transactions, or any of their immediate family members or close associates is a Current or Former non-U.S. Political official or non-U.S. Religious Group/Organization or Senior/Influential representative of a non-U.S. Religious Group/Organization. Aggressive/Speculative U High Risk Produce a combination of income and capital appreciation Higher Fluctuations, Higher Returns Longer than 10 years (through several market cycles). No UBS BANK USA DEPOSIT ACCOUNT Yes $250000.00 UBS AG DEPOSIT ACCOUNT a Source of Funds in the Account You have indicated the following as the source of funds for this account: Other Income Source transfer 2 2 0 Please renew the information about each °typo( accounts and notify your fmanoal advisor immeitato if you have any changes or correcoons. for more information, Please refer to the MPS Deposit Account &seep PrOglaftt audosure Statement. Please note the account risk profile and investment objective beb,vare spec& only tO this account: Othet accouna may have dfferent account risk profiles and investment °Omen. Your Account Risk Profile for this parr/cast account is defined as: Aggressive Witting to accept high risk to pampa: and hrgh vataoloty to seek high returns over time. Different accounts may have different risk peonies You, Investment Objective Produce a Combination of Income and Capital Appreciation Myestmems seeking both the gentrarton of income and growth of principal A seroorpoWKal o facia Us defined as a President or Wee President Cabinet Member, Supreme Court Ass rice. member of the Joint Chiefs Staff. Member of COngreSs Of a Parliament, Chairperson. Head or Sem( Leade of a major relogous organization. Of the like. 5 5 SDNY_GM_00274195 EFTA00016546

Page 6 - EFTA00016547

C Electronic Delivery Features Electronic Delivery of Shareholder Communications: You have elected to receive shareholder communications via electronic format in this UBS account. Please refer to Client Relationship Agreement for Terms and Conditions of this service. E•mail Address UBS Credit Card Profile (With Rewards points) Applicant GHISLAINE MAXWELL UBS Card Program UBS Visa Signature Credit Card Card Security Contact Phone Number (Applicant) C 6 6 SDNY_GM_00274196 EFTA00016547

Sponsored

Page 7 - EFTA00016548

C I RMA Domestic Sole Owner Your Account Account Number Account Title Account Address City, State zip Cards and Checks for this account, if requested, will be mailed to this address: Primary Account Holder Disclosure of Beneficial Ownership Ghislaine Maxwell New York, NY 10065.7007 New York, NY 10065.7007 Ghislaine Maxwell UBS will not disclose your name, address and security position to issuers of any securities held in your Account. -MM I Margin No If you did not choose Margin when you opened this account, you may ask to establish margin by contacting your Financial Advisor. You agree that the Margin Agreement in the Completing Your Account Opening Process package will govern your use of margin in this account and all other accounts you have now or may open in the future. Cost Basis Method First In,First Out Features and Services Premier- RMA / BSA Account Objectives and Risk Profile Account Risk Profile Your answers to our profiling questions: 6_ Risk Tolerance Investment Objective Risk/Return Objectives Investment Time Horizon Short-Term Liquidity Needs Sweep Account Election Primary Sweep Fund Sweep Cap Election Cap Amount Secondary Sweep Fund U.S. Senior Political Affiliation: You have indicated that no account holder, an authorized signatory, beneficial owner, trustee, power of attorney, or other individual with authority to effect transactions, or any of their immediate family members or close associates is a Current U.S. Political Official. Non-U.S. Senior Political Affiliation: You have indicated that no account holder, an authorized signatory, beneficial owner, trustee, power of attorney, or other individual with authority to effect transactions, or any of their immediate family members or close associates is a Current or Former non-U.S. Political official or non-U.S. Religious Group/Organization or Senior/Influential representative of a non-U.S. Religious Group/Organization. Moderate Moderately High Risk Produce a combination of income and capital appreciation Moderate Fluctuations, Moderate Returns 7. 10 years Yes UBS BANK USA DEPOSIT ACCOUNT Yes 4250000.00 UBS AG DEPOSIT ACCOUNT I J Source of Funds in the Account You have indicated the following as the source of funds for this account: Other Income Source transfer C Please review the information about each of your accounts and nobly your financial Aetna immediamly if you have any changes or corrections. For more %dome ficn, please refer to the VHS Deposit Account Sweep Program Disclosure Statement. MIS! note. the account risk profile and unestment objective below ate specific only to Nis account other accounts may have ca f !event account risk profiles and investment °biomes. You, Account Rick Profile for this particular account is defined Moderate Mang to accept some risk to pincipat an0 tolerate some volatility to seek higher returns. DMerent accounts may have different risk profiles You, Investment ObJective Produce a Combination of Income end Capital AppredatIon Investments seeking both the generation of income and growth of principal. In accounts with consenetive or moderate risk molt, Investment eligibility considerations help us identify whether you maybe etigin to invest in certain higher ask securities as a portion of your ponYolio. These investments offer ational diversification. A senia r parka! official is defined as a President or Ince President Cabinet Member, Supreme Court lusote. member of 'heroin: rhiers Staff, Member of Congress or a Parliament Chairperson. Head or Senior Leader of a major refigious organization or the eke. 7 7 SDNY_GM_00274197 EFTA00016548

Page 8 - EFTA00016549

C Electronic Delivery Features Electronic Delivery of Shareholder Communications: You have elected to receive shareholder communications via electronic format in this UBS account. Please refer to Client Relationship Agreement for Terms and Conditions of this service. Email Address C a SDNY_GM_00274198 EFTA00016549

Page 9 - EFTA00016550

C I RMA Domestic Sole Owner Your Account Account Number Account Title Account Address City, State zip Cards and Checks for this account, if requested, will be mailed to this address: Primary Account Holder Disclosure of Beneficial Ownership Ghislaine Maxwell New York, NY 10065.7007 New York, NY 10065.7007 Ghislaine Maxwell UBS will not disclose your name, address and security position to issuers of any securities held in your Account. -MM I Margin No If you did not choose Margin when you opened this account, you may ask to establish margin by contacting your Financial Advisor. You agree that the Margin Agreement in the Completing Your Account Opening Process package will govern your use of margin in this account and all other accounts you have now or may open in the future. Cost Basis Method First In,First Out Features and Services Premier- RMA / BSA Account Objectives and Risk Profile Account Risk Profile Your answers to our profiling questions: 6_ Risk Tolerance Investment Objective Risk/Return Objectives Investment Time Horizon Short-Term Liquidity Needs Sweep Account Election Primary Sweep Fund Sweep Cap Election Cap Amount Secondary Sweep Fund U.S. Senior Political Affiliation: You have indicated that no account holder, an authorized signatory, beneficial owner, trustee, power of attorney, or other individual with authority to effect transactions, or any of their immediate family members or close associates is a Current U.S. Political Official. Non-U.S. Senior Political Affiliation: You have indicated that no account holder, an authorized signatory, beneficial owner, trustee, power of attorney, or other individual with authority to effect transactions, or any of their immediate family members or close associates is a Current or Former non-U.S. Political official or non-U.S. Religious Group/Organization or Senior/Influential representative of a non-U.S. Religious Group/Organization. Moderate Moderately High Risk Produce a combination of income and capital appreciation Higher Fluctuations, Higher Returns 7. 10 years No UBS BANK USA DEPOSIT ACCOUNT Yes 4250000.00 UBS AG DEPOSIT ACCOUNT 1.1 _A -111 Source of Funds in the Account You have indicated the following as the source of funds for this account: Other Income Source transfer C Please review the information about each of your accounts and nobly your financial Aetna immediamly if you have any changes or corrections. For more %dome ficn, please refer to the VHS Deposit Account Sweep Program Disclosure Statement. MIS! note. the account risk profile and unestment objective below ate specific only to Nis account other accounts may have ca f !event account risk profiles and investment °biomes. You, Account Rick Profile for this particular account is defined Moderate Mang to accept some risk to pincipat an0 tolerate some volatility to seek higher returns. DMerent accounts may have different risk profiles You, Investment ObJective Produce a Combination of Income end Capital AppredatIon Investments seeking both the generation of income and growth of principal. In accounts with consenetive or moderate risk molt, Investment eligibility considerations help us identify whether you maybe etigin to invest in certain higher ask securities as a portion of your ponYolio. These investments offer ational diversification. A senia r parka! official is defined as a President or Ince President Cabinet Member, Supreme Court lusote. member of Melaka rhiers Staff, Member of Congress or a Parliament Chairperson. Head or Senior Leader of a major refigious organization or the eke. 9 9 SDNY_GM_00274199 EFTA00016550

Sponsored

Page 10 - EFTA00016551

C Electronic Delivery Features Electronic Delivery of Shareholder Communications: You have elected to receive shareholder communications via electronic format in this UBS account. Please refer to Client Relationship Agreement for Terms and Conditions of this service. E-mail Address C to to SDNY_GM_002742O0 EFTA00016551

Page 11 - EFTA00016552

C I RMA Domestic Sole Owner Your Account Account Number Account Title Account Address City, State zip Cards and Checks for this account, if requested, will be mailed to this address: Primary Account Holder Disclosure of Beneficial Ownership Margin Ghislaine Maxwell New York, NY 10065.7007 New York, NY 10065.7007 Ghislaine Maxwell I UBS will not disclose your name, address and security position to issuers of any securities held in your Account. No If you did not choose Margin when you opened this account, you may ask to establish margin by contacting your Financial Advisor. You agree that the Margin Agreement in the Completing Your Account Opening Process package will govern your use of margin in this account and all other accounts you have now or may open in the future. Cost Basis Method First In,First Out Features and Services Premier- RMA / BSA Account Objectives and Risk Profile Account Risk Profile Your answers to our profiling questions: 6_ Risk Tolerance Investment Objective F Risk/Return Objectives Investment Time Horizon Short-Term Liquidity Needs Sweep Account Election Primary Sweep Fund Sweep Cap Election Cap Amount Secondary Sweep Fund U.S. Senior Political Affiliation: You have indicated that no account holder, an authorized signatory, beneficial owner, trustee, power of attorney, or other individual with authority to effect transactions, or any of their immediate family members or close associates is a Current U.S. Political Official. Non-U.S. Senior Political Affiliation: You have indicated that no account holder, an authorized signatory, beneficial owner, trustee, power of attorney, or other individual with authority to effect transactions, or any of their immediate family members or dose associates is a Current or Former non-U.S. Political official or non-U.S. Religious Group/Organization or Senior/Influential representative of a non-U.S. Religious Group/Organization. Moderate Moderately High Risk Produce a combination of income and capital appreciation Moderate Fluctuations, Moderate Returns 7 - 10 years No UBS BANK USA DEPOSIT ACCOUNT Yes $250000.00 UBS AG DEPOSIT ACCOUNT I S a S "MI 1 Source of Funds in the Account You have indicated the following as the source of funds for this account: Other Income Source transfer C Please resew theinformation about each of your accounts and notify your financial ArMsonmmediarely if you have any changes or corrections. For more information, phase refer to the U8S Deposit Account Seep Program Disclosure Statement. Please note the account risk profile and investment objettive bdow are specific only to this account: other ocean may have different account risk profiles and investment objectives. Your Account Risk Pfeifle for this par:taller account is defined as: Moderate Wiling to accept some Ask to principal and tolerate some volatally to seek higher terms. Different accounts may hate diferenr risk profiles Your Investment Objective Produce a Combination of Income and Capita/ Appreciation In hesIments seeking both the generation of income and growth of prinopat In accounts mouth conseivafive or moderate risk profifes, investment eligibility considerations halo us identify whether you may be slOble to invest in refrain higher tisk set-unties as a portion of your portfolio. These investments offer additional olversificaben. A senior pobricatofficial defined as a President or Vice President Cabinet Member, Supreme Cam Justice, member of the Joint chiefs Staff, Member of Congress or a Parliament. Chauenutt, Heathy Senior Leader of a major religious organization ante like. i II SDNY_GM_00274201 EFTA00016552

Page 12 - EFTA00016553

C Electronic Delivery Features Electronic Delivery of Shareholder Communications: You have elected to receive shareholder communications via electronic format in this UBS account. Please refer to Client Relationship Agreement for Terms and Conditions of this service. E-mail Address C 12 12 SDNY_GM_00274202 EFTA00016553

Sponsored

Page 13 - EFTA00016554

C I RMA Domestic Sole Owner Your Account Account Number Account Title Account Address City, State zip Cards and Checks for this account, if requested, will be mailed to this address: Primary Account Holder Disclosure of Beneficial Ownership Margin Ghislaine Maxwell New York, NY 10065.7007 New York, NY 10065.7007 Ghislaine Maxwell I UBS will not disclose your name, address and security position to issuers of any securities held in your Account. No If you did not choose Margin when you opened this account, you may ask to establish margin by contacting your Financial Advisor. You agree that the Margin Agreement in the Completing Your Account Opening Process package will govern your use of margin in this account and all other accounts you have now or may open in the future. Cost Basis Method First In,First Out Features and Services Premier- RMA / BSA Account Objectives and Risk Profile Account Risk Profile Your answers to our profiling questions: 6_ Risk Tolerance Investment Objective F Risk/Return Objectives Investment Time Horizon Short-Term Liquidity Needs Sweep Account Election Primary Sweep Fund Sweep Cap Election Cap Amount Secondary Sweep Fund U.S. Senior Political Affiliation: You have indicated that no account holder, an authorized signatory, beneficial owner, trustee, power of attorney, or other individual with authority to effect transactions, or any of their immediate family members or close associates is a Current U.S. Political Official. Non-U.S. Senior Political Affiliation: You have indicated that no account holder, an authorized signatory, beneficial owner, trustee, power of attorney, or other individual with authority to effect transactions, or any of their immediate family members or dose associates is a Current or Former non-U.S. Political official or non-U.S. Religious Group/Organization or Senior/Influential representative of a non-U.S. Religious Group/Organization. Moderate Moderately High Risk Produce a combination of income and capital appreciation Moderate Fluctuations, Moderate Returns 7 - 10 years No UBS BANK USA DEPOSIT ACCOUNT Yes $250000.00 UBS AG DEPOSIT ACCOUNT I S a S "MI 1 Source of Funds in the Account You have indicated the following as the source of funds for this account: Other Income Source transfer C Please resew theinformation about each of your accounts and notify your financial ArMsonmmediarely if you have any changes or corrections. For more information, phase refer to the U8S Deposit Account Seep Program Disclosure Statement. Please note the account risk profile and investment objettive bdow are specific only to this account: other ocean may have different account risk profiles and investment objectives. Your Account Risk Pfeifle for this par:taller account is defined as: Moderate Wiling to accept some Ask to principal and tolerate some volatally to seek higher terms. Different accounts may hate diferenr risk profiles Your Investment Objective Produce a Combination of Income and Capita/ Appreciation In hesIments seeking both the generation of income and growth of prinopat In accounts mouth conseivafive or moderate risk profifes, investment eligibility considerations halo us identify whether you may be slOble to invest in refrain higher tisk set-unties as a portion of your portfolio. These investments offer additional olversificaben. A senior pobricatofficial defined as a President or Vice President Cabinet Member, Supreme Cam Justice, member of the Joint (Nets Staff, Member of Congress or a Parliament. Chauenutt, Heathy Senior Leader of a major religious organization ante like. 13 13 SDNY_GM_00274203 EFTA00016554

Page 14 - EFTA00016555

C Electronic Delivery Features Electronic Delivery of Shareholder Communications: You have elected to receive shareholder communications via electronic format in this UBS account. Please refer to Client Relationship Agreement for Terms and Conditions of this service. E-mail Address C 14 14 SDNY_GM_00274204 EFTA00016555

Page 15 - EFTA00016556

C I RMA Domestic Sole Owner Your Account Account Number Account Title Account Address City, State zip Cards and Checks for this account, if requested, will be mailed to this address: Primary Account Holder Disclosure of Beneficial Ownership Margin Ghislaine Maxwell New York, NY 10065.7007 New York, NY 10065.7007 Ghislaine Maxwell I UBS will not disclose your name, address and security position to issuers of any securities held in your Account. No If you did not choose Margin when you opened this account, you may ask to establish margin by contacting your Financial Advisor. You agree that the Margin Agreement in the Completing Your Account Opening Process package will govern your use of margin in this account and all other accounts you have now or may open in the future. Cost Basis Method First In,First Out Features and Services Premier- RMA / BSA Account Objectives and Risk Profile Account Risk Profile Your answers to our profiling questions: 6_ Risk Tolerance Investment Objective F Risk/Return Objectives Investment Time Horizon Short-Term Liquidity Needs Sweep Account Election Primary Sweep Fund Sweep Cap Election Cap Amount Secondary Sweep Fund U.S. Senior Political Affiliation: You have indicated that no account holder, an authorized signatory, beneficial owner, trustee, power of attorney, or other individual with authority to effect transactions, or any of their immediate family members or close associates is a Current U.S. Political Official. Non-U.S. Senior Political Affiliation: You have indicated that no account holder, an authorized signatory, beneficial owner, trustee, power of attorney, or other individual with authority to effect transactions, or any of their immediate family members or dose associates is a Current or Former non-U.S. Political official or non-U.S. Religious Group/Organization or Senior/Influential representative of a non-U.S. Religious Group/Organization. Moderate Moderately High Risk Produce a combination of income and capital appreciation Higher Fluctuations, Higher Returns 7 - 10 years No UBS BANK USA DEPOSIT ACCOUNT Yes 5250000.00 UBS AG DEPOSIT ACCOUNT I Source of Funds in the Account You have indicated the following as the source of funds for this account: Other Income Source transfer C Please resew theinformation about each of your accounts and notify your financial ArMsonmmediarely if you have any changes or corrections. For more information, phase refer to the U8S Deposit Account Seep Program Disclosure Statement. Please note the account risk profile and investment objettive bdow are specific only to this account: other ocean may have different account risk profiles and investment objectives. Your Account Risk Pfeifle for this par:taller account is defined as: Moderate Wiling to accept some Ask to principal and tolerate some volatally to seek higher terms. Different accounts may hate diferenr risk profiles Your Investment Objective Produce a Combination of Income and Capita/ Appreciation In hesIments seeking both the generation of income and growth of prinopat In accounts mouth conseivafive or moderate risk profifes, investment eligibility considerations halo us identify whether you may be slOble to invest in refrain higher tisk set-unties as a portion of your portfolio. These investments offer additional olversificaben. A senior pobricatofficial defined as a President or Vice President Cabinet Member, Supreme Cam Justice, member of the Joint (Nets Staff, Member of Congress or a Parliament. Chauenutt, Heathy Senior Leader of a major religious organization ante like. 15 15 SDNY_GM_00274205 EFTA00016556

Sponsored

Page 16 - EFTA00016557

C Electronic Delivery Features Electronic Delivery of Shareholder Communications: You have elected to receive shareholder communications via electronic format in this UBS account. Please refer to Client Relationship Agreement for Terms and Conditions of this service. E-mail Address C 16 16 SDNY_GM_002742O6 EFTA00016557

Page 17 - EFTA00016558

C I RMA Domestic Sole Owner Your Account Account Number Account Title Account Address City, State zip Cards and Checks for this account, if requested, will be mailed to this address: Primary Account Holder Disclosure of Beneficial Ownership Margin Ghislaine Maxwell New York, NY 10065.7007 New York, NY 10065.7007 Ghislaine Maxwell I UBS will not disclose your name, address and security position to issuers of any securities held in your Account. No If you did not choose Margin when you opened this account, you may ask to establish margin by contacting your Financial Advisor. You agree that the Margin Agreement in the Completing Your Account Opening Process package will govern your use of margin in this account and all other accounts you have now or may open in the future. Cost Basis Method First In,First Out Features and Services Premier- RMA / BSA Account Objectives and Risk Profile Account Risk Profile Your answers to our profiling questions: 6_ Risk Tolerance Investment Objective F Risk/Return Objectives Investment Time Horizon Short-Term Liquidity Needs Sweep Account Election Primary Sweep Fund Sweep Cap Election Cap Amount Secondary Sweep Fund U.S. Senior Political Affiliation: You have indicated that no account holder, an authorized signatory, beneficial owner, trustee, power of attorney, or other individual with authority to effect transactions, or any of their immediate family members or close associates is a Current U.S. Political Official. Non-U.S. Senior Political Affiliation: You have indicated that no account holder, an authorized signatory, beneficial owner, trustee, power of attorney, or other individual with authority to effect transactions, or any of their immediate family members or dose associates is a Current or Former non-U.S. Political official or non-U.S. Religious Group/Organization or Senior/Influential representative of a non-U.S. Religious Group/Organization. Moderate Moderately High Risk Produce a combination of income and capital appreciation Moderate Fluctuations, Moderate Returns 7 - 10 years No UBS BANK USA DEPOSIT ACCOUNT Yes $250000.00 UBS AG DEPOSIT ACCOUNT I S a S "MI 1 Source of Funds in the Account You have indicated the following as the source of funds for this account: Other Income Source transfer C Please resew theinformation about each of your accounts and notify your financial ArMsonmmediarely if you have any changes or corrections. For more information, phase refer to the U8S Deposit Account Seep Program Disclosure Statement. Please note the account risk profile and investment objettive bdow are specific only to this account: other ocean may have different account risk profiles and investment objectives. Your Account Risk Pfeifle for this par:taller account is defined as: Moderate Wiling to accept some Ask to principal and tolerate some volatally to seek higher terms. Different accounts may hate diferenr risk profiles Your Investment Objective Produce a Combination of Income and Capita/ Appreciation In hesIments seeking both the generation of income and growth of prinopat In accounts mouth conseivafive or moderate risk profifes, investment eligibility considerations halo us identify whether you may be slOble to invest in refrain higher tisk set-unties as a portion of your portfolio. These investments offer additional olversificaben. A senior pobricatofficial defined as a President or Vice President Cabinet Member, Supreme Cam Justice, member of the Joint (Nets Staff, Member of Congress or a Parliament. Chauenutt, Heathy Senior Leader of a major religious organization ante like. 17 17 SDNY_GM_00274207 EFTA00016558

Page 18 - EFTA00016559

C Electronic Delivery Features Electronic Delivery of Shareholder Communications: You have elected to receive shareholder communications via electronic format in this UBS account. Please refer to Client Relationship Agreement for Terms and Conditions of this service. E-mail Address C 18 18 SDNY_GM_002742O8 EFTA00016559

Sponsored

Page 19 - EFTA00016560

C I RMA Domestic Sole Owner Your Account Account Number Account Title Account Address City, State zip Cards and Checks for this account, if requested, will be mailed to this address: Primary Account Holder Disclosure of Beneficial Ownership Margin Ghislaine Maxwell New York, NY 10065.7007 New York, NY 10065.7007 Ghislaine Maxwell I UBS will not disclose your name, address and security position to issuers of any securities held in your Account. No If you did not choose Margin when you opened this account, you may ask to establish margin by contacting your Financial Advisor. You agree that the Margin Agreement in the Completing Your Account Opening Process package will govern your use of margin in this account and all other accounts you have now or may open in the future. Cost Basis Method First In,First Out Features and Services Premier- RMA / BSA Account Objectives and Risk Profile Account Risk Profile Your answers to our profiling questions: 6_ Risk Tolerance Investment Objective F Risk/Return Objectives Investment Time Horizon Short-Term Liquidity Needs Sweep Account Election Primary Sweep Fund Sweep Cap Election Cap Amount Secondary Sweep Fund U.S. Senior Political Affiliation: You have indicated that no account holder, an authorized signatory, beneficial owner, trustee, power of attorney, or other individual with authority to effect transactions, or any of their immediate family members or close associates is a Current U.S. Political Official. Non-U.S. Senior Political Affiliation: You have indicated that no account holder, an authorized signatory, beneficial owner, trustee, power of attorney, or other individual with authority to effect transactions, or any of their immediate family members or dose associates is a Current or Former non-U.S. Political official or non-U.S. Religious Group/Organization or Senior/Influential representative of a non-U.S. Religious Group/Organization. Moderate Moderately High Risk Produce a combination of income and capital appreciation Moderate Fluctuations, Moderate Returns 7 - 10 years No UBS BANK USA DEPOSIT ACCOUNT Yes $250000.00 UBS AG DEPOSIT ACCOUNT I S a S "MI 1 Source of Funds in the Account You have indicated the following as the source of funds for this account: Other Income Source transfer C Please resew theinformation about each of your accounts and notify your financial ArMsonmmediarely if you have any changes or corrections. For more information, phase refer to the U8S Deposit Account Seep Program Disclosure Statement. Please note the account risk profile and investment objettive bdow are specific only to this account: other ocean may have different account risk profiles and investment objectives. Your Account Risk Pfeifle for this par:taller account is defined as: Moderate Wiling to accept some Ask to principal and tolerate some vat/ally to seek higher terms. Different accounts may hate diferenr risk profiles Your Investment Objective Produce a Combination of Income and Capita/ Appreciation In hesIments seeking both the generation of income and growth of prinopat In accounts mouth conseivafive or moderate risk profifes, investment eligibility considerations halo us identify whether you may be slOble to invest in refrain higher tisk set-unties as a portion of your portfolio. These investments offer additional olversificaben. A senior pobricatofficial defined as a President or Vice President Cabinet Member, Supreme Cam Justice, member of the Joint (Nets Staff, Member of Congress or a Parliament. Chauenutt, Heathy Senior Leader of a major religious organization ante like. 19 19 SDNY_GM_00274209 EFTA00016560

Page 20 - EFTA00016561

C Electronic Delivery Features Electronic Delivery of Shareholder Communications: You have elected to receive shareholder communications via electronic format in this UBS account. Please refer to Client Relationship Agreement for Terms and Conditions of this service. E-mail Address C 20 20 SDNY_GM_00274210 EFTA00016561

Page 21 - EFTA00016562

C I RMA Domestic Sole Owner Your Account Account Number Account Title Account Address City, State zip Cards and Checks for this account, if requested, will be mailed to this address: Primary Account Holder Disclosure of Beneficial Ownership Ghislaine Maxwell New York. NY 10065.7007 New York, NY 10065.7007 Ghislaine Maxwell UBS will not disclose your name, address and security position to issuers of any securities held in your Account. Margin No If you did not choose Margin when you opened this account, you may ask to establish margin by contacting your Financial Advisor. You agree that the Margin Agreement in the Completing Your Account Opening Process package will govern your use of margin in this account and all other accounts you have now or may open in the future. Cost Basis Method First In,Fur t Features and Services Premier- RMA/ BSA Account Objectives and Risk Profile Account Risk Profile Your answers to our profiling questions: Risk Tolerance Investment Objective r Risk/Return Objectives Investment Time Horizon Short-Term Liquidity Needs Sweep Account Election Primary Sweep Fund Sweep Cap Election Cap Amount Secondary Sweep Fund U.S. Senior Political Affiliation: You have indicated that no account holder, an authorized signatory, beneficial owner, trustee, power of attorney, or other individual with authority to effect transactions, or any of their immediate family members or close associates is a Current U.S. Political Official. Non-U.S. Senior Political Affiliation: You have indicated that no account holder, an authorized signatory, beneficial owner, trustee, power of attorney, or other individual with authority to effect transactions, or any of their immediate family members or close associates is a Current or Former non-U.S. Political official or non-U.S. Religious Group/Organization or Senior/Influential representative of a non-U.S. Religious Group/Organization. Moderate I Moderately High Risk Produce a combination of income and capital appreciation Higher Fluctuations, Higher Returns 7. 10 years No UBS BANK USA DEPOSIT ACCOUNT Yes $250000.00 UBS AG DEPOSIT ACCOUNT I _A 1 Source of Funds in the Account You have indicated the following as the source of funds for this account: Other Income Source transfer C Please review the information about each of your accounts and nue& pour financial Advises immediately if you have any changes or corrections for more informabon please refer to the 085 Deposit Account Sweep Program Disclosure Statement Please note the account risk profile and investment objective balmy are specific only to this account: other accounts may have different account risk profiles and investment objeCtiVel YON' Account RIO Profile for this particular account is defined Moderate. Waling to accept some risk to principal and tolerate some volatiW4' to seek higher returns. Different accounts may have different risk profiles YCvt !nutriment Oblealve Produce a Combination of income and Capital Appreciation investments seeking both the generation of income and grimy!), of pnnopat In accounts with =se/vat'se or moderate risk mit, Investment efigibility considerations help us identify whether you may be et.g.bVi to in certain higher nsk secunties as a porno° of your ponfoho. These investments offer additional thersificanbn. A senior political official is defined as a President or Vice Prestdenk Cabinet Member, Supreme Corm Justice, member of the Joint Chefs Staff Member of Congress or a Parliament, Chayperson, Head or Senior Leader of a major religious organization. or the like. 21 21 SDNY_GM_00274211 EFTA00016562

Sponsored

Page 22 - EFTA00016563

C Electronic Delivery Features Electronic Delivery of Shareholder Communications: You have elected to receive shareholder communications via electronic format in this UBS account. Please refer to Client Relationship Agreement for Terms and Conditions of this service. E-mail Address C 22 22 SDNY_GM_00274212 EFTA00016563

Page 23 - EFTA00016564

C I RMA Domestic Sole Owner Your Account Account Number Account Title Account Address City, State zip Cards and Checks for this account, if requested, will be mailed to this address: Primary Account Holder Disclosure of Beneficial Ownership Ghislaine Maxwell New York. NY 10065.7007 New York, NY 10065.7007 Ghislaine Maxwell UBS will not disclose your name, address and security position to issuers of any securities held in your Account. Margin No If you did not choose Margin when you opened this account, you may ask to establish margin by contacting your Financial Advisor. You agree that the Margin Agreement in the Completing Your Account Opening Process package will govern your use of margin in this account and all other accounts you have now or may open in the future. Cost Basis Method First In,Fur t Features and Services Premier- RMA/ BSA Account Objectives and Risk Profile Account Risk Profile Your answers to our profiling questions: Risk Tolerance Investment Objective r Risk/Return Objectives Investment Time Horizon Short-Term Liquidity Needs Sweep Account Election Primary Sweep Fund Sweep Cap Election Cap Amount Secondary Sweep Fund U.S. Senior Political Affiliation: You have indicated that no account holder, an authorized signatory, beneficial owner, trustee, power of attorney, or other individual with authority to effect transactions, or any of their immediate family members or close associates is a Current U.S. Political Official. Non-U.S. Senior Political Affiliation: You have indicated that no account holder, an authorized signatory, beneficial owner, trustee, power of attorney, or other individual with authority to effect transactions, or any of their immediate family members or close associates is a Current or Former non-U.S. Political official or non-U.S. Religious Group/Organization or Senior/Influential representative of a non-U.S. Religious Group/Organization. Moderate I Moderately High Risk Produce a combination of income and capital appreciation Moderate Fluctuations, Moderate Returns 7. 10 years No UBS BANK USA DEPOSIT ACCOUNT Yes $250000.00 UBS AG DEPOSIT ACCOUNT I a 1 Source of Funds in the Account You have indicated the following as the source of funds for this account: Other Income Source transfer C Please review the information about each of your accounts and nue& pour financial Advises immediately if you have any changes or corrections for more informabon, please refer to the 085 Deposit Account Sweep Program Disclosure Statement Please note the account risk profile and investment objective balmy are specific only to this account: other accounts may have different account risk profiles and investment objeCtiVel YON' Account RIO Profile for this particular account is defined Moderate. Waling to accept some risk to principal and tolerate some volatiW4' to seek higher returns. Different accounts may have different risk profiles YCvt !nutriment Oblealve Produce a Combination of income and Capital Appreciation investments seeking both the generation of income and grimy!), of pnnopal. In accounts with =se/vat'se or moderate risk mit, Investment efigibility considerations help us identify whether you may be et.g.bVi to 'meson certain higher nsk secunties as a porno° of your partake. These investments offer additional thersificanbn. A senior poleical official is defined as a President or Vice Preside)* Cabinet Member, Supreme Corm Justice, member of the Joint Chefs Staff Member of Congress or a Parliament, Chayperson, Head or Senior Leader of a major religious organization. or the like. 23 23 SDNY_GM_00274213 EFTA00016564

Page 24 - EFTA00016565

C Electronic Delivery Features Electronic Delivery of Shareholder Communications: You have elected to receive shareholder communications via electronic format in this UBS account. Please refer to Client Relationship Agreement for Terms and Conditions of this service. E-mail Address C 24 24 SDNY_GM_00274214 EFTA00016565

Sponsored

Page 25 - EFTA00016566

de 0177 2398 4795 02/122014 UBS Client Relationship Agreement Introduction At UBS, we understand that we succeed only when our clients succeed. With that in mind, we provide a customized approach to wealth management, built on your personal relationship with your Financial Advisor and shaped by an understanding of your needs and aspirations. Known as the Client Relationship Agreement, this document outlines the terms and conditions of your relationship with us. By maintaining your Accounts at UBS, you agree to these terms and conditions and the other agreements and disclosures we refer to here. If signatures are required, please return the signed signature page in the enclosed envelope. To confirm that our records are complete, we will send you a record of the information you give us after you open a new Account. Please review the Client Information and Account Information pages of the Completing Your Account Opening Process package and notify us promptly if there are any updates or corrections. Please note: this Client Relationship Agreement applies to all of your accounts at UBS, including any Accounts you may already have with us and Accounts you may open in the future. You will not receive another copy of the Client Relationship Agreement or the Agreements and Disclosures unless there are updates and amendments, or if we require your signature on this Agreement when you open Accounts in another capacity. Some of the information in this document and the other agreements and disclosures we send you may not apply to you now. Please retain these documents for future reference because they contain important information if you decide to add services or open new Accounts. The terms and conditions in this Client Relationship Agreement apply to all Accounts you open with UBS Financial Services Inc. or UBS Financial Services Incorporated of Puerto Rico or any other introducing broker-dealer that has a clearing agreement with UBS Financial Services Inc. In addition, we will send you other agreements and disclosures for the UBS accounts and services you choose when you open your account, as well as features you may add in the future. We refer to all these documents, including any amendments, as the Agreements and Disclosures booklet. Your acceptance of your initial Client Relationship Agreement will serve as your agreement to the terms and conditions governing any new Accounts, features or services. Deposits of cash or securities and your continued use of your UBS Accounts constitute your agreement to all of the terms and conditions applicable to your Accounts. If you do not agree to the terms and conditions, you may cancel a feature or service or close your account. As a UBS client, you may decide to open additional Accounts or take advantage of services and account features in the future. With some exceptions, you will be able to do so without signing additional documents or agreements. Upon approval of your accounts and services, we will confirm your requests in writing and provide any relevant agreements and disclosures you have not already received. Any authorization of features and services you give us will remain in effect until a reasonable time after you notify us to terminate the feature or service. It is important to note that when we act as your broker-dealer, we do not enter into a fiduciary relationship with you, regardless of the fee structure you select. Except in special circumstances, we are not held to the same legal standards that apply when we have a fiduciary relationship with you, as we do when providing investment advisory services. We will effect transactions for your brokerage Accounts only as instructed by you, and neither UBS Financial Services Inc. nor your Financial Advisor will have any discretion over your Accounts. 'Accounts' refers to all securities accounts, brokerage accounts, margin accounts, deposit accounts or other accounts you open with us now or in the future. We refer to the Client Relationship Agreement together with all other agreements and disclosures that we make available to you, and any amendments, as our "Agreement" with you. We also refer to the "Completing Your Account Opening Process" package, which includes Signature Pages, optional forms and other required documents. If a Signature Page is included, please have all named account holders sign the Signature Page and return it to us in the enclosed envelope. This column contains important definitions applicable to our Agreement with you. 'You," "your and "yours" refer to you as a client of UBS. "UBS," "we," "us," "our" and "ours" refer to UBS Financial Services Inc. and unless we indicate otherwise, its successor firms, subsidiaries, correspondents and Affiliates, including its parent company, UBS AG. 'Affiliates" refers to UBS Financial Services Incorporated of Puerto Rico (which clears through UBS Financial Services Inc.), UBS Bank USA, UBS Credit Corp., UBS Trust Company, N.A. and their insurance agency affiliates and subsidiaries and all other subsidiaries and affiliates. UBS Client Relationship Agreement SDNY_GM_00274215 25 EFTA00016566

Page 26 - EFTA00016567

UBS Client Relationship Agreement Representations By signing a Client Relationship Agreement, you make the following representations: co You are at least 18 years old or have reached the age of majority according to the laws of the state in which you reside and the laws of the State of New York. co You have notified us if you, your spouse or any beneficial owner of the Account(s) are or become employed by any of the following: a member firm of FINRA or other exchange (including broker/dealer subsidiary of a bank, insurance company or other financial institution), or securities or commodities exchange or self-regulatory organization or any of their affiliated organizations or UBS's independent auditor. You agree to notify us promptly of any changes. ao No one other than you, and the individuals identified to UBS in connection with the opening of the Account, has or will have an interest in your Account unless you notify us in writing and UBS Financial Services Inc. agrees to continue to carry the Account. co All of the personal and financial information you have supplied to UBS is true and accurate, and you will notify UBS promptly of any material changes, particularly the information regarding your residence, financial situation, investment objectives or tax status. co You understand that UBS provides financial and investment services only and does not provide legal or tax advice. co You represent that you have fulfilled and will continue to fulfill all tax related and reporting obligations associated with any assets in your UBS accounts. co If you are acting as executor, trustee, conservator, guardian or custodian: — You understand that you are a fiduciary on behalf of the beneficial owners of the Account and that you have a duty to use the services and features provided through the Account for the benefit of the beneficial owners of the Account and not for your own benefit. — You acknowledge that you will make an independent determination that any activity in the Account is suitable and appropriate for the beneficial owners and that the compensation we receive is reasonable. — You understand and agree that this determination is solely your responsibility and not ours. Fees and charges As a client of UBS, you agree to pay all fees and charges relating to your accounts for any transactions or services you receive from us, such as annual service fees, brokerage fees for securities transactions, fees for specific services you request and fees or charges by a third party that we incur in the course of providing services to you. All fees and charges are subject to change at any time. Fees and charges will be charged to your accounts and may be satisfied, along with any other amounts you owe us, from free credit balances, margin and other assets in any of your accounts. We may sell assets in your Account to satisfy debit balances for any amounts due, including those resulting from unpaid fees and charges. Please review and verify the information about you and your Accounts in the "Completing Your Account Opening Process" package. if you have questions, changes or corrections, call your Financial Advisor. Please refer to the Fees and Charges section of the Agreements and Disclosures booklet or more information about fees and charges. if you have questions, please contact your Financial Advisor. PlOZ/ZUZ0 96LP B6EZ LL ID 09 26 SDNY_GM_00274216 EFTA00016567

Page 27 - EFTA00016568

de 0177 2399 4797 02/12/2014 Individual Retirement Accounts The Agreements and Disclosures booklet contains the UBS IRA Custodial Agreements and the IRA Disclosure Statements that apply to any Traditional, Roth, SEP or SIMPLE Individual Retirement Accounts (IRAs) you open with us now or in the future. If we make changes to the UBS IRA Custodial Agreement and the IRA Disclosure Statement we will send you updated documents, and you agree to be subject to those updated terms and conditions. According to the UBS IRA Custodial Agreements, UBS Financial Services Inc. is named as the custodian of your IRA when we accept the Account. At your death, the beneficiary or beneficiaries whose name(s) are shown on the Account Information pages of the Completing Your New Account Process package will become entitled to your IRA. Beneficiaries must be named in writing. Your written designation may apply to future accounts, and in that case, we will confirm your designation in the Completing Your Account Opening Process package. If you do not designate beneficiaries, or your beneficiary designation does not effectively dispose of the assets, your beneficiary with respect to the IRA or any part of the IRA not effectively disposed of, will be your surviving spouse, or your estate if you do not have a surviving spouse. You may be charged a Custodial Account fee in connection with this IRA. If this IRA account is funded via transfer from a non-UBS account, you represent that all transfers to this account originate from a same name inherited IRA of the same type indicated on this IRA Account Application (e.g., Traditional IRA, Roth IRA) and/or a direct rollover from a qualified plan which named you as beneficiary. Accounts with Cash Management Features The Agreements and Disclosures booklet contains the terms and conditions that apply to the cash management features you may select. All requests to enroll in cash management features are subject to approval. We consider your continued use of your Account as your acceptance of the applicable terms and conditions. There are important differences in the cash management features and other services that are available to U.S. residents through UBS accounts and those that are available to clients who reside outside the U.S. For example, we have different sweep programs for uninvested cash and different Card programs for these accounts. This agreement and the Agreements and Disclosures booklet describe which programs apply to which types of accounts. Verbal Authorization to Upgrade or Add Cash Management Features to an Account For any account you have with us now or may open in the future, we may accept verbal requests to upgrade or add cash management features to your Account. Generally, we permit any authorized person to provide verbal instructions to upgrade or add services to your Account unless you instruct us otherwise. In some circumstances, we may ask you or another person who is named on the account to sign additional documents or provide additional information for those additional features. We will provide you updated terms and conditions for the services you request if we have not already sent them to you or another owner of the Account. We consider your use of the Account as your acceptance of the applicable terms and conditions. Our Sweep Options and Your Sweep Election As a service to you, we offer options for the automatic investment or deposit of available cash balances ("sweep") in your Accounts. Current Sweep Options include the UBS Bank Sweep Programs and the Sweep Funds. The available Sweep Options and their features, and the eligibility of an Account for a specific Sweep Option varies by the type of Account you open, the services you select, the type of entity you are and your country of residence. We may change or discontinue our sweep service at any time, including adding or discontinuing specific Sweep Options. We may establish criteria for Sweep Options offered to different clients, including, but not limited to, establishing minimum asset requirements for clients to qualify for specific Sweep Options. You authorize and direct us to deposit or invest your available cash balances on each business day in your Sweep Option and to withdraw your funds from, or liquidate your The features and fees of your IRA are fully described in the Agreements and Disclosures booklet. Please note: UBS does not extend margin for Individual Retirement Accounts. Employers with a SEP IRA or SIMPLE IRA plan for their businesses must sign a separate plan document. We accept any approved plan documents, known as prototypes, whether they were produced by UBS, an IRS model or a document from another provider. If you would like to use a UBS prototype, please ask for a copy of the SEP IRA Plan or SIMPLE IRA Plan prototype document from your UBS Financial Advisor. UBS offers a variety of accounts with cash management features, including the Resource Management Account® (RMA), Business Services Account 85A® (BSA) and International Resource Management Account® (IRMA®). Cash management features available for eligible accounts include: oo Check writing oo Debit cards oo Credit cards oo Rewards programs oo Bill Payment oo Electronic Funds Transfer oo Margin bans Sweep Options' refers to the options made available by UBS for the automatic investment or deposit ('sweep') of available cash balances in your Account Sweep Options include the LIBS Bank Sweep Programs, the Sweep Funds, the Puerto Rico Short Term Investment Fund, the International Deposit Account Sweep Program and any other sweep investments we may make available from time to time for eligible Accounts. UBS Client Relationship Agreement SDNY_GM_00274217 27 EFTA00016568

Sponsored

Page 28 - EFTA00016569

UBS Client Relationship Agreement shares in your Sweep Option, as described in this section and in the General Terms and Conditions in the Agreements and Disclosures booklet, and any amendments. Please refer to the UBS Bank Sweep Programs Disclosure Statement for a description of the eligibility requirements for the UBS Bank Sweep Programs. If your Account is not eligible for the UBS Bank Sweep Programs, you may select an available Sweep Fund as the Sweep Option for your Account. For Accounts eligible for one of the UBS Bank Sweep Programs, unless you are eligible for and select an available tax-advantaged Sweep Fund, your Sweep Option will be one of the UBS Bank Sweep Programs. In general, most clients with a Resource Management Account® (RMA®), Individual Retirement Account (IRA), Basic Investment Account, Business Services Account® (BSA®), Coverdell Education Savings Account and certain Investment Advisory Accounts will be eligible for one of the UBS Bank Sweep Programs. Eligibility is based primarily upon the type of client. Most non-business clients and employee benefit plans qualified under Section 401(a) or Section 403(bX7) of the Internal Revenue Code of 1986, as amended, or under any other employee retirement or welfare plan subject to the Employee Retirement Income Security Act of 1974, as amended (ERISA) (Plans) are eligible for the Deposit Program. In cases where a participant in a Plan has established a Securities Account for purposes of participation in the Plan (each a Plan Participant), the Plan Participant will be eligible for the Deposit Program. Most business clients are eligible for the Business Program. The UBS Bank Sweep Programs Through each of the UBS Bank Sweep Programs, available cash balances in each eligible Account are automatically deposited into deposit accounts at Bank USA up to the Bank USA Sweep Cap. Available cash balances in excess of the Bank USA Sweep Cap will be automatically swept without limit to your Secondary Sweep Option. Unless you select an available Sweep Fund, the Secondary Sweep Option for eligible Accounts other than Investment Advisory Accounts is deposit accounts at AG Stamford Branch. Investment Advisory Accounts will not sweep to the AG Stamford Branch; instead the Secondary Sweep Option for Investment Advisory Accounts will be an available Sweep Fund. Funds in deposit accounts at AG Stamford Branch are not eligible for FDIC Insurance or protection by SIPC. Sweep Funds are not FDIC-insured, not guaranteed by a bank, are sold by prospectus only and may lose value. Deposits held at Bank USA through the Business Program are subject to monthly withdrawal limits, as described in the UBS Bank Sweep Programs Disclosure Statement. If your withdrawals in a month reach the limit, all funds on deposit through the Business Program will be withdrawn from Bank USA and transferred into your Secondary Sweep Option and available cash balances will sweep to your Secondary Sweep Option for the remainder of the month. These funds, up to the Bank USA Sweep Cap, will be transferred back to Bank USA on the first business day of the following month. FDIC Insurance Coverage and Limitations: If you have more than one Account that sweeps to Bank USA, the amount deposited at Bank USA may exceed the amount covered by FDIC insurance (currently $250,000 per insurable capacity). You are responsible for monitoring the total amount of deposits that you have with Bank USA to determine the extent of FDIC deposit insurance coverage available to you. Please refer to the UBS Bank Sweep Programs Disclosure Statement for more detailed information regarding the UBS Bank Sweep Programs and FDIC insurance. Alternatives to the UBS Bank Sweep Programs With the exception of tax-advantaged Accounts and Basic Investment Accounts, if you are eligible to participate in one of the UBS Bank Sweep Programs, but do not wish to have your available cash balances deposited with Bank USA, you may elect at any time to have "Sweep Funds' refers to one or more of the UBS money market funds made available as a Sweep Option. Sweep Funds are described in the respective prospectuses for the UBS RMA Funds, UBS Cash fund, UBS Retirement Money Market Funds, UBS Liquid Assets Fund, UBS Cash Reserves Fund and the UBS Select Capital Money Market Funds. The 'UBS Bank Sweep Programs' collectively refers to the UBS Deposit Account Sweep Program (the "Deposit Program") and the UBS Business Account Sweep Program (the "Business Program") as more fully described in the UBS Bank Sweep Programs Disclosure Statement. UBS Bank USA (Member FDIC) ("Bank USA"),is an FDIC-member bank affiliate of UBS. UBS AG, Stamford Branch ("AG Stamford Branch") is a US branch of UBS AG, a Swiss Bank that is the parent of UBS Financial Services Inc. and UBS Financial Services Incorporated of Puerto Rico. For clients other than Plans and Plan participants, the "Bank USA Sweep Cap" is $250,000 per Securities Account owner. For Plans and Plan participants, the Bank USA Sweep Cap is $250,000 per Securities Account. Please refer to the UBS Bank Sweep Programs Disclosure Statement for important information about how the UBS Bank Sweep Programs work, how the Bank Sweep Cap is determined, eligibility, interest rates, withdrawal limits, FDIC insurance and your relationship with UBS, Bank USA and AG Stamford Branch. You should review the Disclosure carefully. n DZ/ZI/ZO 86/ 9 66EZ ZZ IC 01, 28 SDNY_GM_00274218 EFTA00016569

Page 29 - EFTA00016570

de 0177 2400 4799 02/12/2014 your available cash balances swept without limit to a tax-advantaged Sweep Fund or, for Puerto Rico residents only, the Puerto Rico Short Term Investment Fund, Inc. The following tax-advantaged Sweep Funds currently are available: CO UBS RMA Tax-Free Fund Inc. CO UBS RMA California Municipal Money Fund CO UBS RMA New York Municipal Money Fund to The Puerto Rico Short Term Investment Fund, Inc. to UBS Select Tax-Free Capital Fund (subject to minimum asset requirements) State-specific municipal funds are intended for residents of those states only. The Puerto Rico Short Term Investment Fund, Inc. is offered exclusively to Puerto Rico residents as defined in the fund's prospectus. The Puerto Rico Short Term Investment Fund is not a money market fund registered under the U.S. Investment Company Ad of 1940, does not comply with rules applicable to U.S. registered funds, presents a higher degree of risk than those funds, and is for Puerto Rico residents holding accounts with UBS Financial Services Incorporated of Puerto Rico only. The Puerto Rico Short Term Investment Fund and the Sweep Funds are sold by prospectus only, and are not FDIC-insured, not guaranteed by a bank, and may lose value. If your Account is tax-advantaged, or is a Basic Investment Account, whether tax-advantaged or not, you are not eligible to select a tax-advantaged Sweep Fund as a Sweep Option. Tax-advantaged Accounts include, but are not limited to, Accounts of Plans, Plan Participants and IRAs. If your tax-advantaged Account or Basic Investment Account is not an Investment Advisory Account, and you choose not to participate in a Bank Sweep Program, available cash balances will remain in your Account and will not earn interest. If your tax-advantaged Account or Basic Investment Account is an Investment Advisory Account, available cash balances must be swept through a Bank Sweep Program. Changing Your Sweep Option You may change your sweep election to an available alternative Sweep Option at any time. By instructing us to change your sweep election, you are authorizing and directing us to redeem your Sweep Fund shares, or withdraw funds from one of the UBS Bank Sweep Programs, and transfer the funds to your new Sweep Option. You may change your sweep election by contacting your Financial Advisor. For additional information regarding program availability and Account eligibility, please refer to the UBS Bank Sweep Programs Disclosure Statement and the UBS International Deposit Account Sweep Program Disclosure in the Agreements and Disclosures booklet, and to the prospectuses for the Sweep Funds and the Puerto Rico Short Term Investment Fund. Institutional Sweep Funds and Automatic Exchanges We may offer Institutional Sweep Funds as Sweep Options or Secondary Sweep Options for clients (except for Plans and IRAs in investment advisory programs) who meet certain minimum asset thresholds. Current eligibility criteria may be obtained from your Financial Advisor. UBS may change the eligibility criteria at any time in its discretion without notice to you. Institutional Sweep Funds will generally offer a higher yield than other Sweep Funds, though there is no guarantee that the yield will be, or will remain, higher. Clients other than Plans and Plan Participants Your eligibility for the Institutional Sweep Funds will be determined at the end of each month, based on the value of your Marketing Relationship assets as determined in the sole discretion of UBS. If the value of your Marketing Relationship assets reaches the minimum asset threshold at any time other than the end of the month, you will not be eligible for an Institutional Sweep Fund. Plans and Plan Participants A Plan's eligibility for the Institutional Sweep Funds will be determined at the end of each month, based on the value of the Plan's QP Relationship assets, as determined in the sole 'Secondary Sweep Option' refers to deposit accounts at AG Stamford Branch or one of the available Sweep Funds. "Investment Advisory Account' refers to an Account enrolled in any of the following investment advisory programs: Managed Accounts Consulting Program, Portfolio Management Program, ACCESS, Managed Portfolio Program, UBS Strategic Wealth Portfolio, UBS Strategic Advisor, and Private Wealth Solutions and such other programs as UBS may add from time to time. Please refer to the section 'International Accounts' for information about the sweep option for the International RMA. "Institutional Sweep Funds' refers to one or more of the UBS money market funds made available by UBS to clients who meet certain minimum asset thresholds. 'QP Relationship assets' is defined in the UBS Bank Sweep Programs Disclosure Statement. UBS Client Relationship Agreement SDNY_GM_00274219 29 EFTA00016570

Page 30 - EFTA00016571

UBS Client Relationship Agreement discretion of UBS. A Plan Participant's eligibility for the Institutional Sweep Funds will be determined at the end of each month, based on the greater of the value of the Plan's QP Relationship assets and the Plan Participant's Marketing Relationship assets, both as determined in the sole discretion of UBS. If the value of a Plan's QP Relationship assets or a Plan Participant's Marketing Relationship assets reaches the minimum asset threshold at any time other than the end of the month, the Plan or Plan Participant will not be eligible for an Institutional Sweep Fund. If you are eligible for an Institutional Sweep Fund as either your Sweep Fund or your Secondary Sweep Option for one of the Bank Sweep Programs, we will liquidate your shares in your current Sweep Fund or your Secondary Sweep Option, as applicable, and purchase shares in the Institutional Sweep Fund with the same investment objectives without direction from you. Thereafter, your Sweep Fund or Secondary Sweep Option, as applicable, will be the Institutional Sweep Fund. Once an Account's Sweep Option or Secondary Sweep Option, as applicable, is an Institutional Sweep Fund and a first purchase has been made into the Fund, that Institutional Sweep Fund will remain the Account's Sweep Option or Secondary Sweep Option even if the Account's Marketing Relationship assets cease to meet the minimum asset thresholds for that Institutional Sweep Fund. QP Relationship assets as a means to determine eligibility will not be available until on or about Dec 2, 2013. Check Writing Many UBS accounts incorporate a check writing feature. If you choose this feature for your account, you authorize us and our Check Provider to honor checks that bear your signature(s) and unsigned drafts that are presented on the basis of separate written authorization from you to the payee. These checks may be used only in conjunction with your accounts and only up to the account's 'Withdrawal Limit' as defined in the General Terms and Conditions in the Agreements and Disclosures booklet. We will deduct funds from your Accounts and reimburse the Check Provider in federal funds when checks or drafts are presented to the Check Provider. We may delay or deny payment if there are insufficient available assets in your Account to cover payment on the day you write the check or authorize the draft through the day on which we deduct funds from your accounts to pay the check or draft. Bill Payment and Electronic Funds Transfer Services Many UBS accounts incorporate the Bill Payment and Electronic Funds Transfer services. If you enroll in these services, you authorize UBS and its processing bank to effect the types of transactions described in the Bill Payment and Electronic Funds Transfer Service Agreement. This service agreement also applies to other electronic transfers to or from your Accounts, including transfers made with UBS CashConnect feature and certain payments made through the Automated Clearing House ("ACH") system, even if you do not enroll in this service. "Check Provider' is the provider and processor we have appointed to handle payment of your checks and drafts. We reserve the right to change check providers from time to time. The Bill Payment and Electronic Funds Transfer Service Agreement is located in the Agreements and Disclosures booklet. Bill payments are only available to payees located in the U.S. Transfers through the ACH system are only available to and from accounts at financial institutions and banks within the U.S. 30 SDNY_GM_00274220 EFTA00016571

Sponsored

Page 31 - EFTA00016572

de 0177 2401 ali01 02/12/2014 UBS Visa Debit Card for RMA or BSA Brokerage accounts with cash management features include the UBS Visa Debit Card (Card). If you choose this feature either verbally or in writing, you will be issued one or more Card(s) by the Card Issuer. UBS or the Card Issuer will complete any transactions you initiate using the Card(s). The Card Issuer will approve transactions up to your account's "Withdrawal Limit," as described in the Agreements and Disclosures booklet. You agree to maintain sufficient available assets in your account to make payment in full, and transactions may be denied if there are insufficient assets in your account to make full payment for any Card transactions as they are processed. As your Card cash withdrawals are processed, we will deduct funds from your Account to reimburse the Card Issuer. Once each calendar month, we will deduct from your Account the amount of purchases made with the Card that have been received by the Card Issuer but not yet deducted from your Account. The Card Issuer may suspend or cancel Cards if there are insufficient assets to cover transactions. Your use of the Card constitutes your agreement to the terms and conditions in the UBS Visa Debit Card Cardholder Agreement, which is included in the Agreements and Disclosures booklet. 1.185 Credit Card for RMA or BSA You may apply for a UBS Visa Signature credit card or UBS Preferred Visa Signature credit card (Credit Card) either verbally or in writing. If your application is approved by the Card Issuer, you will be issued one or more Credit Cards. We will bill transactions made with your Credit Card separately from your eligible brokerage account. You may pay your Credit Card balance automatically each month from your eligible brokerage account, or you may pay the bill from other sources or allow a balance to revolve. The Credit Card terms and conditions describes rates, fees and other costs for the Credit Card. The Card Issuer will issue and manage your Credit Card according to Utah law and the UBS Credit Card Cardholder agreement (Credit Card Agreement). The Card Issuer will include the Credit Card Agreement with your Credit Card. Your use of the Credit Card constitutes your agreement to the terms and conditions in the Credit Card Agreement, which may change occasionally. The Credit Card is not subject to the General Terms and Conditions of this UBS Client Relationship Agreement. To fulfill your application for a Credit Card, we will share the personal information the Card Issuer requires to open your Credit Card Account, and we share your personal information such as application data, approval status and transaction information on a regular basis to update your UBS monthly account statement and our records. When you request a Credit Card, the Card Issuer will obtain a credit report as part of your application and after it establishes your Credit Card account to administer your Credit Card account and report its credit experience with you to others. At your request, the Card Issuer will provide the name and address of each consumer reporting agency from which it obtained a report about you. After your Credit Card account is open, you will have the opportunity to select how the Card Issuer can use or share information about you for marketing or Credit Card account maintenance purposes. Any disputes you may have with the Card Issuer will be resolved by binding Arbitration. For more information regarding Arbitration please consult the UBS Credit Card Agreement. By requesting Credit Card, you agree with the following statements: oo I (we) am at least 18 years old and a permanent resident of the United States. oo I (we) have reviewed and agree to the Important Information about the UBS Credit Card Account Terms and Conditions that was provided with this Client Relationship Agreement. oo All information provided to UBS and the Card Issuer was truthful and complete. "Card Issuer" means UBS Bank UM its successors and assigns, or the issuer of UBS Cards we appoint in our sole discretion. Your LIBS Visa Debit Card(s) will be mailed to you under separate cover after your Account has been approved. Your LIBS Credit Card(s), if approved for issuance by the Card Issuer, will be mailed to you under separate cover after your Account has been approved. Express Delivery. If you are approved for an account and your card was requested next day delivery, your card will be sent the next day after your account is opened if the request is made before 3:00 p.m. Eastern time of that day. A signature is required for Express Delivery. The information contained in these disclosures is accurate as of 04/04/2012 and may change after this date. The UBS Credit Card is not available with the International RMA. The Credit Card terms and conditions describe the fees for the UBS Credit Card. UBS Client Relationship Agreement SDNY_GM_00274221 31 EFTA00016572

Page 32 - EFTA00016573