EFTA00015937 - EFTA00015940

EFTA00015937 is a letter from Akin Gump Strauss Hauer & Feld LLP, representing Deutsche Bank, to the U.S. Attorney's Office in the Southern District of New York.

The letter is a response to a grand jury subpoena issued on July 11, 2019, and details the eleventh submission of documents by Deutsche Bank related to Jeffrey Epstein. The documents include bank records and electronic communications concerning the onboarding of Epstein as a client, meetings with Epstein and his associates, the transfer of Epstein's assets from JP Morgan to Deutsche Bank, and revenue-sharing accounts.

Key Highlights

- •Deutsche Bank provided documents to the U.S. Attorney's Office in response to a subpoena.

- •The documents relate to Jeffrey Epstein's relationship with Deutsche Bank.

- •Akin Gump Strauss Hauer & Feld LLP represents Deutsche Bank.

Frequently Asked Questions

Books for Further Reading

Perversion of Justice: The Jeffrey Epstein Story

Julie K. Brown

Investigative journalism that broke the Epstein case open

Filthy Rich: The Jeffrey Epstein Story

James Patterson

Bestselling account of Epstein's crimes and network

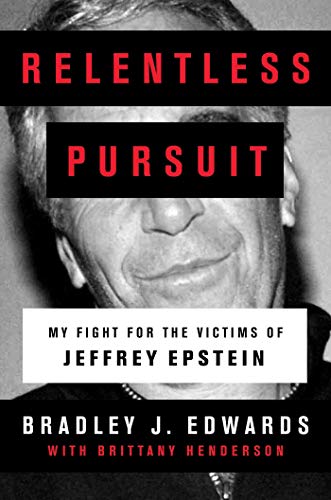

Relentless Pursuit: My Fight for the Victims of Jeffrey Epstein

Bradley J. Edwards

Victims' attorney's firsthand account

Document Information

Bates Range

EFTA00015937 - EFTA00015940

Pages

4

Document Content

Page 1 - EFTA00015937

Akin Gump STRAUSS HAUER & FELD LLP November 19, 2019 CONFIDENTIAL PURSUANT TO FED. R. CRIM. P. 6(e) VIA ELECTRONIC DELIVERY Assistant U.S. Attorney U.S. Attorney's Office Southern District of New York New York, NY 10007 Re: July 11, 2019 Subpoena to Deutsche Bank Dea On behalf of our client, Deutsche Bank AG, New York Branch and its affiliates ("Deutsche Bank" or the "Bank"), we write in further response to the grand jury subpoena dated July 11, 2019 (the "Subpoena"). This letter and the enclosed document production represent the eleventh submission in our client's rolling response to the Subpoena. Enclosed with this letter is an encrypted file labeled DB-SDNY-PROD011 containing documents responsive to items I, 4, 7, 9, 12, 19, 20, and 27 of the Subpoena. As described in the enclosed production index, labeled Appendix A, today's production contains the following categories of documents responsive to the Subpoena: • DB-SDNY-0028783 to 0031309: Bank records and electronic communications related to the following topics: o The Bank's decision to onboard the Epstein Relationship (designated as "Onboarding" in Appendix A); o In-person meetings between Bank personnel, Jeffrey Epstein, and/or his associates (designated as "Meetings" in Appendix A); o The transfer of Jeffrey Epstein's assets from JP Morgan to Deutsche Bank from 2013 through 2014 (designated as "Transfer" in Appendix A); EFTA00015937

Page 2 - EFTA00015938

November 19, 2019 Page 2 o The Bank's policies and procedures related to its Americas Reputational Risk Committee from 2013 to 2018 (designated as "ARRC" in Appendix A); o Certain revenue-sharing accounts opened by the Bank in connection with the Epstein relationship (designated as "Revenue Sharing Accounts" in Appendix A). • DB-SDNY-0031310 to 0031643: Bank records related to wire transfers from Jeffrey E stein's charitable entity, Gratitude America, Ltd., to the Foundation (designated as `4 " in Appendix A). • DB-SDNY-0031644 to 0033038: Bank records, including emails, related to lar e, routine cash withdrawals made b Jeffrey Epstein's attorney, , and accountant (designated as "Cash Transactions" in Appendix A). • DB-SDNY-0033039 to 0033067: Bank records, including emails, related to certain large wire transfers involvin Jeffrey Epstein's U.S. Virgin Islands-based attorney, (designated as "=MI" in Appendix A). • DB-SDNY-0033068 to 0033069: A Se tember 2013 email from . Tre a n's accountant, , to assistant, attaching a list of Epstein's JP Morgan accounts (designated as "JPM Accounts" in Appendix A). • DB-SDNY-0033070 to 0037559: Check images written from over twenty Epstein-affiliated accounts (designated as "Checks" in Appendix A). Today's production also encloses as Appendix B a set of five supplemental exhibits that we have prepared in response to questions raised in our prior discussions. The supplemental exhibits relate to the following issues: • Wire Transfers Related to Epstein Investments: Supplemental Exhibit A identifies wire transfers to third party bank accounts that appear to relate to investments in hedge funds and other private investment vehicles. EFTA00015938

Page 3 - EFTA00015939

November 19, 2019 Page 3 • List of Payees of LSJE, LLC Account: Supplemental Exhibit B provides background information on the recipients of payments from an Epstein- controlled account, LSJE, LLC. KYC records indicate that Epstein planned to use the LSJE account as a "[c]hecking account for the daily expenses associated with running one of Jeffrey Epstein's private homes." KYC records do not specify which private home. The transactions reflected in Exhibit B suggest that LSJE was used, at least in part, to manage Epstein's Palm Beach estate. • Butterfly Trust Account Transactions: Supplemental Exhibit C identifies all incoming and outgoing transactions involving the Butterfly Trust money market account. • Timeline of Active/Capitalized Accounts: Supplemental Exhibit D provides a timeline of the openings and closings of Epstein's capitalized Wealth Management accounts. • Payments to Certain Beneficiaries of the 2013 Butterfly Trust: Supplemental Exhibit E identifies payments to or on behalf of certain beneficiaries of the 2013 Butterfly Trust, as well as their family members. The Bank did not open an account for this entity, but received trust documents in the course of its due diligence on a separate Epstein- settled trust, "The 2017 Caterpillar Trust." The Bank previously briefed the SDNY on payments to the majority of the beneficiaries of the 2013 Butterfl Trust, with the exce tions being , an Supplemental Exhibit E contains this additional information. The decryption password for the production will be provided by separate email. As we have discussed, we continue to collect relevant information related to the Subpoena, and expect to make additional productions shortly. Because we are producing these materials pursuant to a grand jury subpoena, it is our understanding that this production will be treated as confidential consistent with Federal Rule of Criminal Procedure 6(e). Notwithstanding the confidentiality of the enclosed materials and EFTA00015939

Sponsored

Page 4 - EFTA00015940

November 19, 2019 Page 4 information, should you receive any request for disclosure of such information, pursuant to the Freedom of Information Act or otherwise, we ask to be notified in a timely fashion and given the opportunity to object to such disclosure. Further, should you determine to disclose any materials to any third party, we ask to be given reasonable advance notice in order to allow us to pursue any available remedies. In such event, we request that you contact the undersigned by email or telephone rather than rely on regular mail or facsimile transmission to provide such notice. Please advise us if you object to or disagree with the foregoing requests. For the avoidance of doubt, no response or document provided in response to the Subpoena shall be construed as a waiver of any applicable privilege or doctrine available to Deutsche Bank under state or federal law. If it were found that production of any of the enclosed materials constitutes disclosure of otherwise privileged matters, such disclosure would be inadvertent. By the production of such documents, Deutsche Bank does not intend to waive and has not waived the attorney-client privilege or any other protections. Please do not hesitate to contact us at or [email protected] if you have any questions. We look forward to continuing to work with you in a cooperative manner. i lr Sincerel Enclosures EFTA00015940

Entities Mentioned

Jeffrey Epstein

PERSON • 3 mentions

American sex offender and financier (1953–2019)

Akin Gump

ORGANIZATION

1996 single by "Weird Al" Yankovic

Butterfly

ORGANIZATION

Butterfly Trust

ORGANIZATION

Caterpillar Trust

ORGANIZATION

Deutsche

ORGANIZATION

Gratitude America

ORGANIZATION

LSJE, LLC

ORGANIZATION

STRAUSS HAUER & FELD LLP

ORGANIZATION

Wealth Management

ORGANIZATION

Investment management and financial planning service

U.S. Virgin

LOCATION

Statistics

Pages:4

Entities:11

Avg. OCR:0.9%

Sponsored