YAHOO_006421

🍏 Apple’s missing profits

This is an email from The Hustle, a business and technology newsletter, to Jodi Harrison, with the subject line "🍏 Apple’s missing profits."

The email, dated November 27, 2020, discusses Apple's financial strategies and potential areas of profit loss or optimization. It mentions various companies and figures in the tech and business world. Jeffrey Epstein is also mentioned in the document.

Key Highlights

- •The email's subject pertains to Apple's profits.

- •Apple is the most frequently mentioned entity in the document.

- •Jeffrey Epstein is mentioned in the email.

Frequently Asked Questions

Document Information

Bates Range

YAHOO_006421

Pages

1

Source

DDoSecrets Yahoo Emails

Date

November 27, 2020

From

The Hustle <[email protected]>

To

Jodi Harrison <[email protected]>

Original Filename

20201127-🍏 Apple’s missing profits-4086.eml

File Size

65.20 KB

Document Content

Page 1 - YAHOO_006421

thehustle.co table {border-collapse: collapse;} table, td {mso-table-lspace: 0pt;mso-table-rspace: 0pt;} img {-ms-interpolation-mode: bicubic;} body { font-family: Helvetica, sans-serif; } body a { color: #d62829; text-decoration: none; } @media screen and (max-width:480px) { .templateColumnContainer { display: block !important; width: 100% !important; padding-left: 0 !important; padding-right: 0 !important; } } PLUS: The real origin of “Black Friday” November 27, 2020 TOGETHER WITH Still full from yesterday’s feast? Hope you left room for some Apple… because Tim Cook is in the kitchen. But first, we’re cooking up our biggest Black Friday to date. Trends is $299 $99 for 200 Hustle subscribers only. Use the code “BFHUSTLE” before we change our mind. The Big Idea Apple’s margins have been falling for years. Why? Here’s something you won’t find in a Black Friday discount bin: Apple products. To maintain its high-end appeal, the $2T tech giant is extremely careful around its pricing. Rather than deep price cuts, Apple’s Black Friday promotion this year offers gift cards as enticements. Clearly, the Cupertino colossus knows what it’s doing: it pulled in an astonishing $60B in Q3 2020 (for reference, Facebook’s full-year 2019 revenue was $70B). Apple’s margins have been sliding for years, though As highlighted by Jay Goldberg and his consulting firm D2D Advisory, Apple’s gross margins have fallen from 40.1% in 2015 to 38.2% in 2020. What’s happening? D2D offers up these potential reasons: More services revenue: Apple bundles a number of offerings under “services.” While content is likely a margin drag, Cloud Services, AppleCare, and Advertising are high margin. Increasing component costs: Over the last 5 years, Apple has upgraded its screens and radio-frequency components. D&D rejects this rationale because Apple was upgrading components even when margins were previously expanding. Wearables: Airpods -- because of their rounded case and miniaturized parts -- are likely harder to manufacture and lead to greater % of defective devices, which increases cost of goods sold (and decreases margins). Wearables could be part of a larger issue… … known as mix shift, which describes how your gross margin is affected by blending together high- and low-margin hardware. If wearables have lower margins than Macs and iPhones, that explains part of the margin decline. 2 other drivers of mix shift: China and the SE phone The recent US-China trade wars are a bit of a double whammy for Apple on the consumer side: Apple is losing share to Chinese phone manufacturers. China’s Apple’s sales are skewed toward the highest margin high-end iPhones (losing out on this business pulls margins down). Also in 2016, Apple released its entry-level iPhone SE (“foray into sub-$400 devices”). Apple said the SE boosted its margins but the move signaled that it was ready to expand its total addressable market, outside of high end. Not long after, Apple stopped disclosing iPhone unit numbers. So, there it is: mix shift seems to be eating into Apple’s profits. Now, go get those gift cards. Snippets Book Deal: Penguin Random House will acquire Simon & Schuster from ViacomCBS for $2.2B. The combined book-publishing entity will account for 1 in 3 books sold in the US. The move -- a reaction to Amazon’s dominance in the book space -- could raise antitrust concerns. Salesforce ($CRM) is in talks to acquire Slack ($WORK) … which brings together the two best stock tickers in Enterprise SaaS. Slack gained ~38% on the news (we’ll have more coverage on Monday!) AW-TF: An outage at cloud giant Amazon Web Services (AWS) took major parts of the internet offline for hours including Adobe, Roku, and The Washington Post. “Buffett had Geico, I pick Metromile”: Pay-per-mile auto insurer Metromile is going public via a SPAC with billionaires Mark Cuban and Chamath Palihapitiya backing the deal. (Read our coverage on personalized insurance). How much money we spending this year? eMarketer estimates that Black Friday and Cyber Monday will bring in $23B, up 38%+ from last year. TRENDS A Black Friday that you won’t regret Happy Black Friday… Americans’ favorite spending day of the year. Last year, Black Friday brought in $11.9B in online sales -- and with the dumpster fire that 2020 has been, who knows what this long weekend will bring in. Today, we’re giving you another option to spend your money on: Trends. Instead of spending $99 on... 28 Starbucks coffees 2-3 swiss cheese plants 930 Double Stuffed Oreos 1/20th of a Peloton 439.2 oz of Utz' Cheese Balls 91-99 useless things from the dollar store (depending on the state) … spend Black Friday investing in yourself, by gaining access to our forward-looking reports and our thriving community of 10k+ entrepreneurs -- AKA Trends. Sam let out our offer early and we were shocked to see over a thousand people roll in. But as our dearest Hustle subscribers, we’re opening up 200 more slots just for you. Use the code “BFHUSTLE” to get Trends at literally the best price it’s ever been (and likely ever will be). You essentially get 8 months free. If you miss these 200 slots, you can get in at our current price tier. As of writing this, we’re at $149 to the public. For all of you smart alecks out there, no, you can’t use these codes together. ;) Get in on the action → Startup Funding Which startups have seen the biggest valuation gain in 2020? In 2010, a startup with the not-so-great name /Dev/Payments was trying to disrupt the payments space. After a fortuitous name change to Stripe and a decade of incredible execution, that same fintech firm -- founded by brothers Patrick and John Collison -- is eyeing a new funding round that will value it at $70B-$100B. Even before any new funding, Stripe already tops the leaderboard for the biggest startup valuation “step-up” (increase) in 2020. Per private data firm Pitchbook, its $850m Series G Stripe raised in April valued it at $36B, a gain of $13.5B from its previous round. A total of ~$78B has been pumped into 2.5k+ late-state companies… ...through September of this year. Pitchbook notes that the big winners are in fintech and “lockdown-friendly” names. Here are the other top valuation step-ups so far in 2020*: (*If a startup has multiple step-ups, we highlight the most recent) Stripe (fintech): From $22.5B to $36B (+$13.5B step-up) SpaceX (space): From $35.8B to $46B (+$10.2B) Chime (fintech): From $6B to $14.5B (+$8.5B) Instacart (delivery): From $13.8B to $17.7B (+$3.9B) Hashicorp (dev tools): From $1.9B to $5.3B (+$3.4B) Doordash (delivery): From $12.7B to $16B (+$3.3B) Better (fintech): From $0.9B to $4B (+$3.1B) Robinhood (fintech): From $8.7B to $11.7B (+$3.0B) TalkDesk (SaaS): From $0.5B to $3.1B (+$2.6B) Marqeta (fintech): From $1.9B to $4.3B (+$2.4B) The big takeaway for us: it’s eminently possible to recover from a bad first name. SPONSORED Looking to protect your home? You won’t find a better deal than this one from SimpliSafe What it is: 50% off plus a free HD security camera when you buy any system. Happy Black Friday, boys and girls. What it does: Everything. We’re talkin’... Live professional alerts 24/7 HD video monitoring Protection against everything from intruders to fire, water, and natural disasters Recognize people, not pets What it doesn’t do: Cost more, since SimpliSafe cuts out the middleman and traditional markups Take up space, thanks to discreet cameras Lock you into a contract Require timely setup (it’s all wireless) Why we trust it: SimpliSafe was named Best Home Security System Overall by Business Insider… and Editor’s Choice by PCMag… and a top pick by CNEt… need we continue? Get 50% of SimpliSafe → Q&A ‘It's really important as an entrepreneur to always know your worth’ Everette Taylor is a serial entrepreneur, founding his first company at the age of 19. He’s since launched marketing firm Millisense and the GrowthHackers community while taking on the CMO roles at Sticker Mule and Skurt. Today, the 31-year-old is the CMO of Artsy, the world’s largest online art marketplace with 1m+ artworks by 1k+ artists. The Hustle’s Alex Garcia recently spoke with Taylor about his entrepreneurial journey and views on the art world. Here is an excerpt: Why have you taken on so many CMO roles? As a young entrepreneur, you don't have a lot of people to lean on or to learn from as a CEO. So, I've used marketing roles as a way to gain experience. By scaling Artsy to a multibillion-dollar company, I can apply those lessons to build my own multibillion-dollar company. I'm the youngest executive on the team and the only black executive on the team. I couldn't pass up the opportunity to learn and grow. How is Artsy changing the art landscape? A lot of people don't realize that only 2% of millionaires buy art. It's because [art is] such an opaque industry. I want to open the space up. Art pieces don't necessarily cost a million dollars. There are art pieces on Artsy right now for $200, $300, $500. Start there. What did you learn from having your company acquired? Taxes. I tell people, the first thing you should get is a dope accountant. Also, don't take the first offer… it’s probably a lowball. It's really important as an entrepreneur to always know your worth. What’s the best piece of advice you’ve received? Not directly, but when Tupac said, “All good things come to those who stay true.” I didn't really have mentors growing up, so I listened to music to get advice. And when I heard Pac say that, it really resonated and stuck with me. (Read the full Q&A here) History fun fact of the day Source: Giphy Why is it called Black Friday? According to History.com -- which GoDaddy mistakenly believes is only worth $25k as a URL (gotta be worth WAY more) -- these are the Black Friday myths and truths: First use of “Black Friday”: It was unrelated to retail. Rather, it relates to the crash of the gold market on Friday, September 24th, 1869 after 2 “ruthless Wall Street financiers” (Jay Gould, Jim Fisk) saw a gold pumping scheme unravel. Popular imagination: An accounting phrase. After a year of operating at a loss (“in the red”), retailers make back all their money and more on the Friday after Thanksgiving (“went into in the black”) True origin: “Black Friday” originated in Philadelphia during the 1950s. City police officers had to deal with “hordes of suburban shoppers and tourists flooding into the city in advance of the big Army-Navy football game.” The negative connotation of the day would not remain until the late 1980s. Retailers were able to turn the period after Thanksgiving into the 4-day shopping extravaganza it is today. SPONSORED Step up your slip-on game up with 40% off at SeaVees At The Hustle, we optimize everything. Sometimes, that’s hard -- like finding a stellar growth marketer to scale our business. Other times, it’s wayyy easy -- like buying slip-ons from SeaVees so we never have to waste our time tying our shoes again. Lucky for you, now is the perfect time to join us in laceless freedom. SeaVees is offering 40% off sitewide during their Black Friday/Cyber Monday sale (and yes, that includes shoes with laces, too). 40% off sitewide → Shower Thoughts 500 years from now, someone will uncover videos of the Macy's Thanksgiving Day parade and think we worshiped turkeys Some grandma out there actually *does* make the world’s greatest pumpkin pie and nobody knows it A potato becomes plural when mashed We’d get weird looks for eating a turkey, mashed potato, stuffing and cranberry sauce sandwich any other week of the year Thanksgiving is like the grand feast for people who are going into the battle of sales on Black Friday via Reddit SHARE THE HUSTLE Refer coworkers, get exclusive Hustle gear Step 1: Peek our sweet, sweet rewards Step 2: Copy your referral link below Step 3: Share your link across social media and beyond Step 4: Collect rewards, rinse & repeat Share The Hustle → Copy & paste your referral link to others: https://thehustle.co/?ref=bed0be7154 How did you like today’s email? hate it meh love it Today's email was brought to you by @TrungTPhan. Editing by: Zachary "Been waiting here 10 hours" Crockett, Don Weenau (Holiday Wardrobe Consultant). PODCAST JOBS ADVERTISE CONTACT US 2131 THEO DR. STE F, AUSTIN, TX 78723, UNITED STATES • 415.506.7210 Never want to hear from us again? Break our hearts and unsubscribe.

Entities Mentioned

Chamath Palihapitiya

PERSON

Sri Lankan-born Canadian-American businessman and CEO of Social Capital

JG

Jay Gould

PERSON

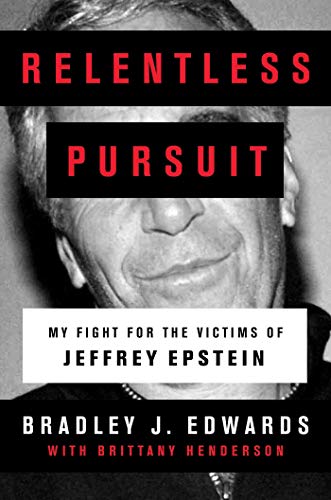

Jeffrey Epstein

PERSON • 2 mentions

American sex offender and financier (1953–2019)

JF

Jim Fisk

PERSON

JC

John Collison

PERSON

Mark Cuban

PERSON

American investor and entrepreneur (born 1958)

SC

Schuster

PERSON

Tim Cook

PERSON

American business executive

Adobe, Roku

ORGANIZATION

Advisory

ORGANIZATION

Amazon Web Services

ORGANIZATION

Apple

ORGANIZATION • 9 mentions

Apple’s Black

ORGANIZATION

Army-Navy

ORGANIZATION

Artsy

ORGANIZATION • 3 mentions

Business Insider

ORGANIZATION

Financial and business news website

Cloud Services

ORGANIZATION

Macs

ORGANIZATION

Simon &

ORGANIZATION

American publishing company

Slack

ORGANIZATION • 2 mentions

Web-based instant messaging service

ViacomCBS

ORGANIZATION

Cupertino

LOCATION

City in Santa Clara County, California, United States

Metromile

LOCATION

Philadelphia

LOCATION

1993 film by Jonathan Demme

Sticker Mule

LOCATION

United States

LOCATION • 2 mentions

Country located primarily in North America

Statistics

Pages:1

Entities:26

Avg. OCR:1.0%

Sponsored